JSE & NYSE Shares Analysis | 1 - 5 July

JSE SHARES

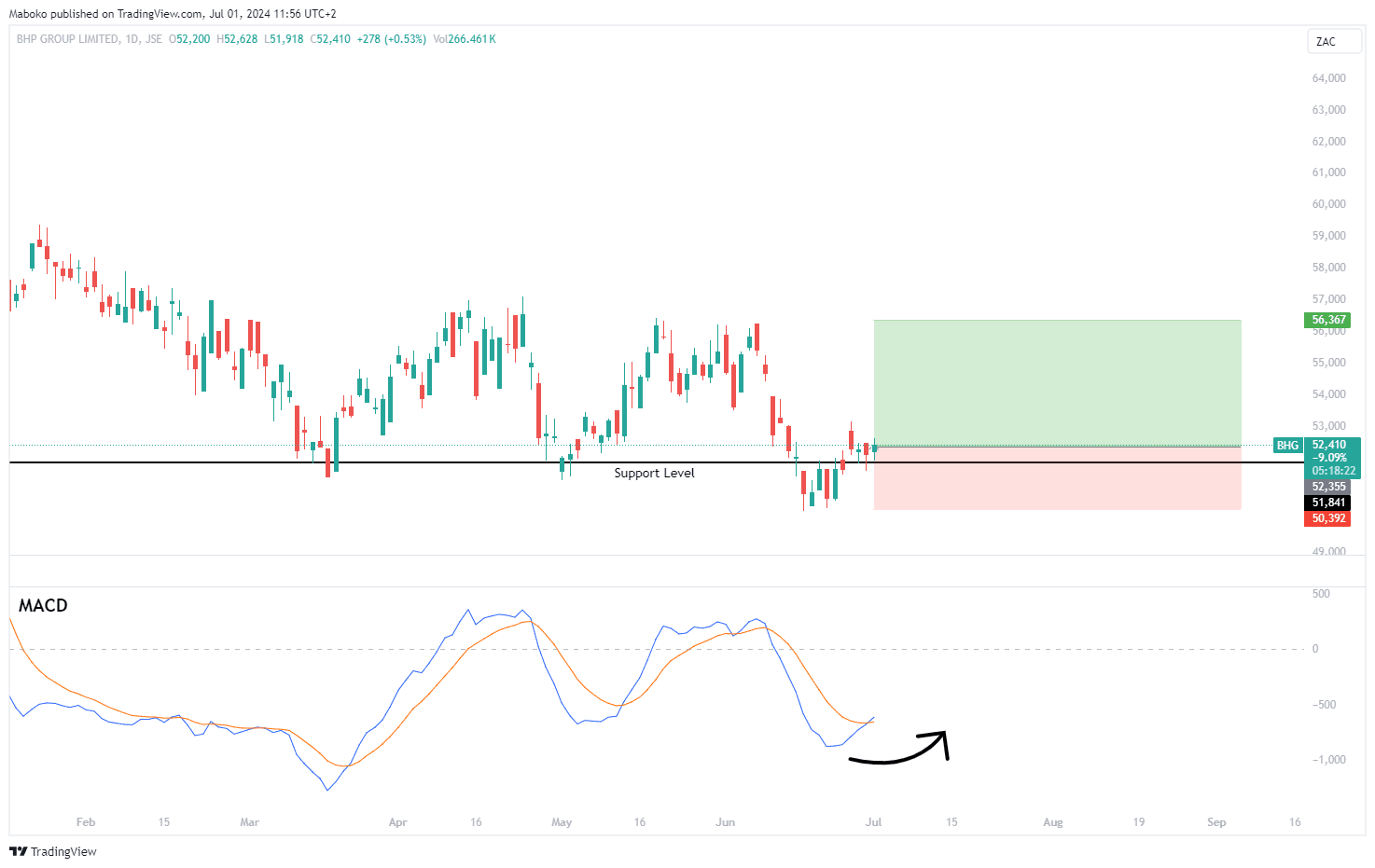

BHP Group Ltd (BHG): BHP Group Ltd. is in the business of exploration, development, production and processing of iron ore, metallurgical coal, and copper.

The share price has tested the support level at R524.00 region. The Moving Average Convergence Divergence (MACD) is yet to confirm a bullish crossover, suggesting the momentum to the upside.

A potential buy/long idea can be initiated with a take profit (TP) set at R563.67 and the stop loss (SL) set at R503.92.

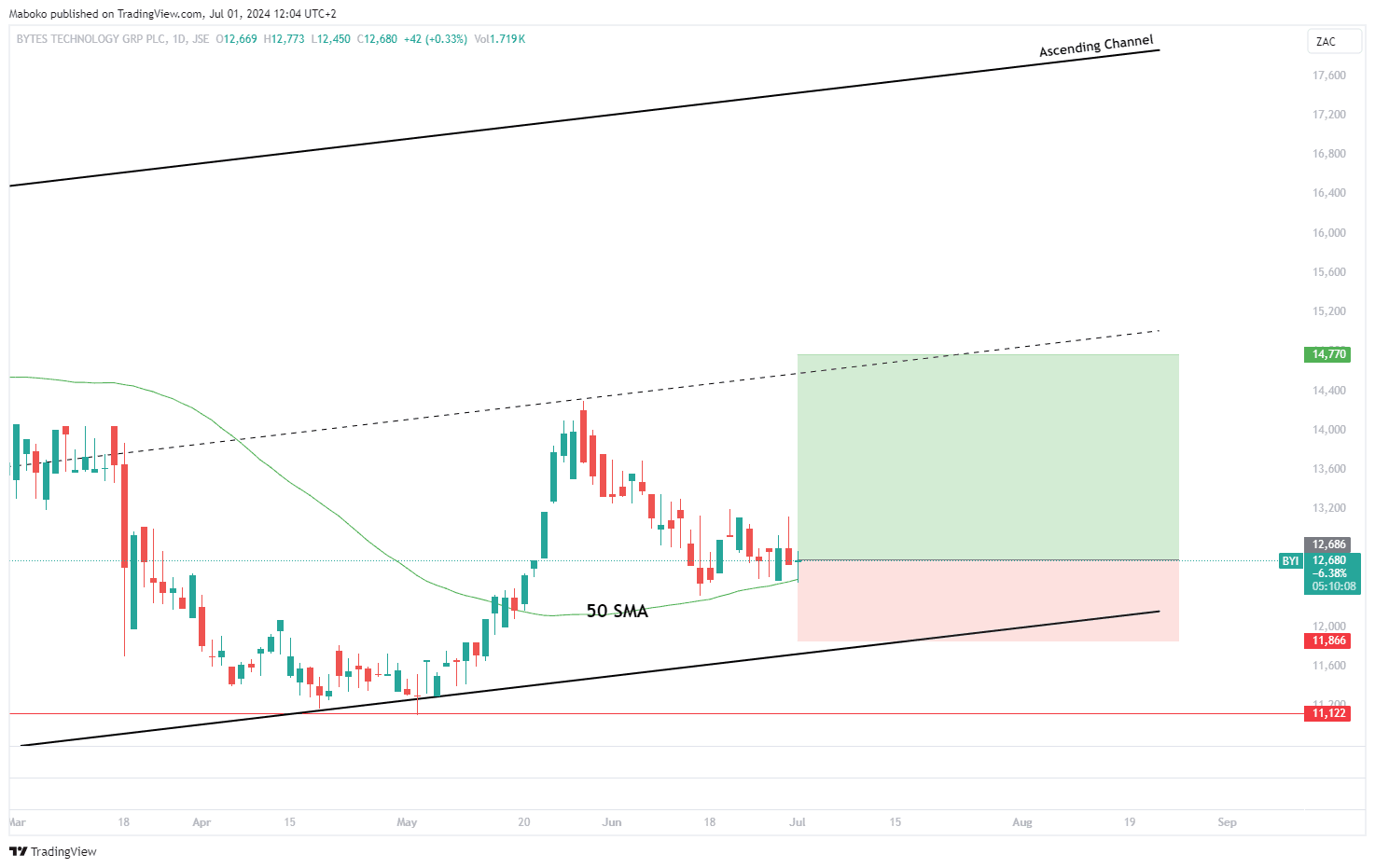

Bytes Technology Group plc (BYI): Bytes Technology Group Plc provides IT software offering and solutions with a focus on cloud and security products.

The share price has been trading in an ascending channel, after testing the lower bound of the channel at the R111.00 region. The price crossed above the 50-day Simple Moving Average (SMA), and the price has historically shown a continuation of movement in this direction.

A potential buy/long idea can be initiated with a take profit (TP) set at R147.70 and the stop loss (SL) set at R118.66.

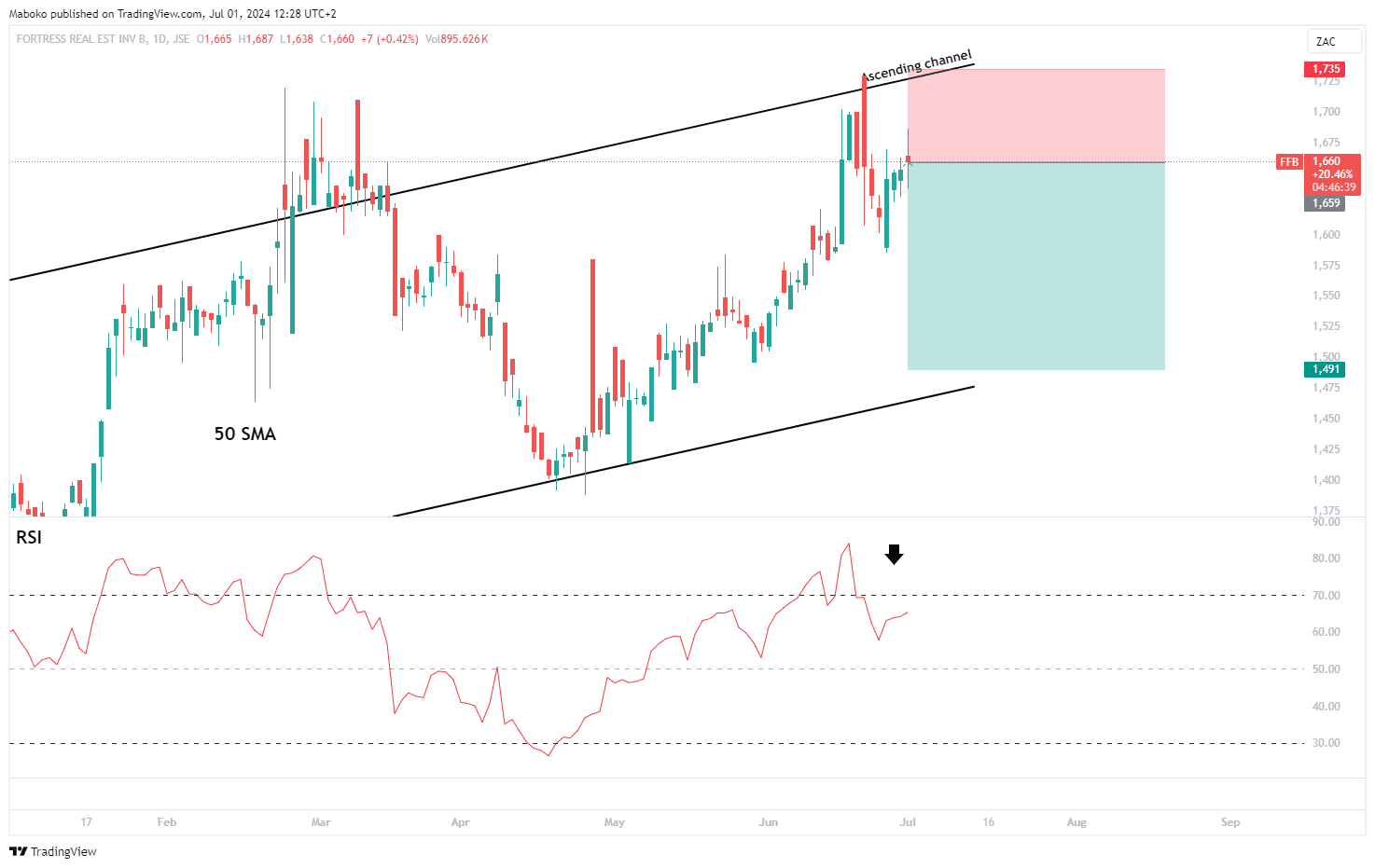

Fortress Real Estate Investments Ltd (FFB): Fortress Real Estate Investments Ltd. is in the business of development of logistic warehousing, retail centres and strategic offshore investments.

The share price is trading in an ascending channel, having tested the higher bound of the channel at the R17.00 region. The Relative Strength Indicator (RSI) has reached the overbought region and crossunder, suggesting the momentum to the upside will cool off, and favouring the downward momentum.

US STOCKS

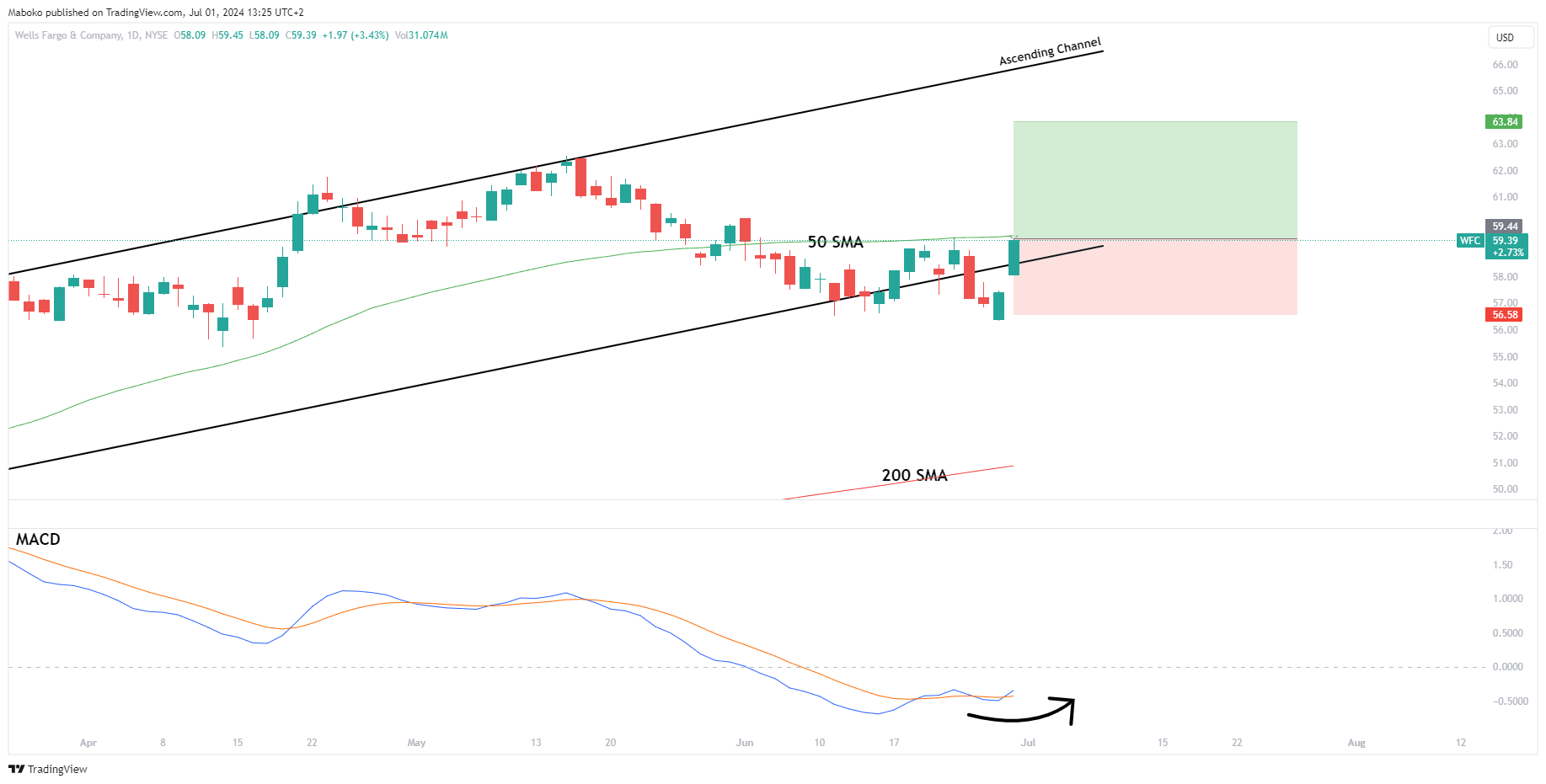

Wells Fargo & Co. (WFC): Wells Fargo & Co. is a diversified, community-based financial services company. It is in the business of banking, insurance, investments, mortgage products and services, and consumer and commercial finance.

The share price is trading in an ascending channel, the price tested the lower bound of the channel. Additionally, the price is trading well above the 200-day Simple moving average (SMA),signalling that the bulls are in charge of the trend. The Moving Average Convergence and Divergence (MACD) has made a bullish crossover, suggesting momentum to the upside is applicable.

A Buy/Long idea can be initiated with a target set at $63.84 and the stop loss set at $56.58.

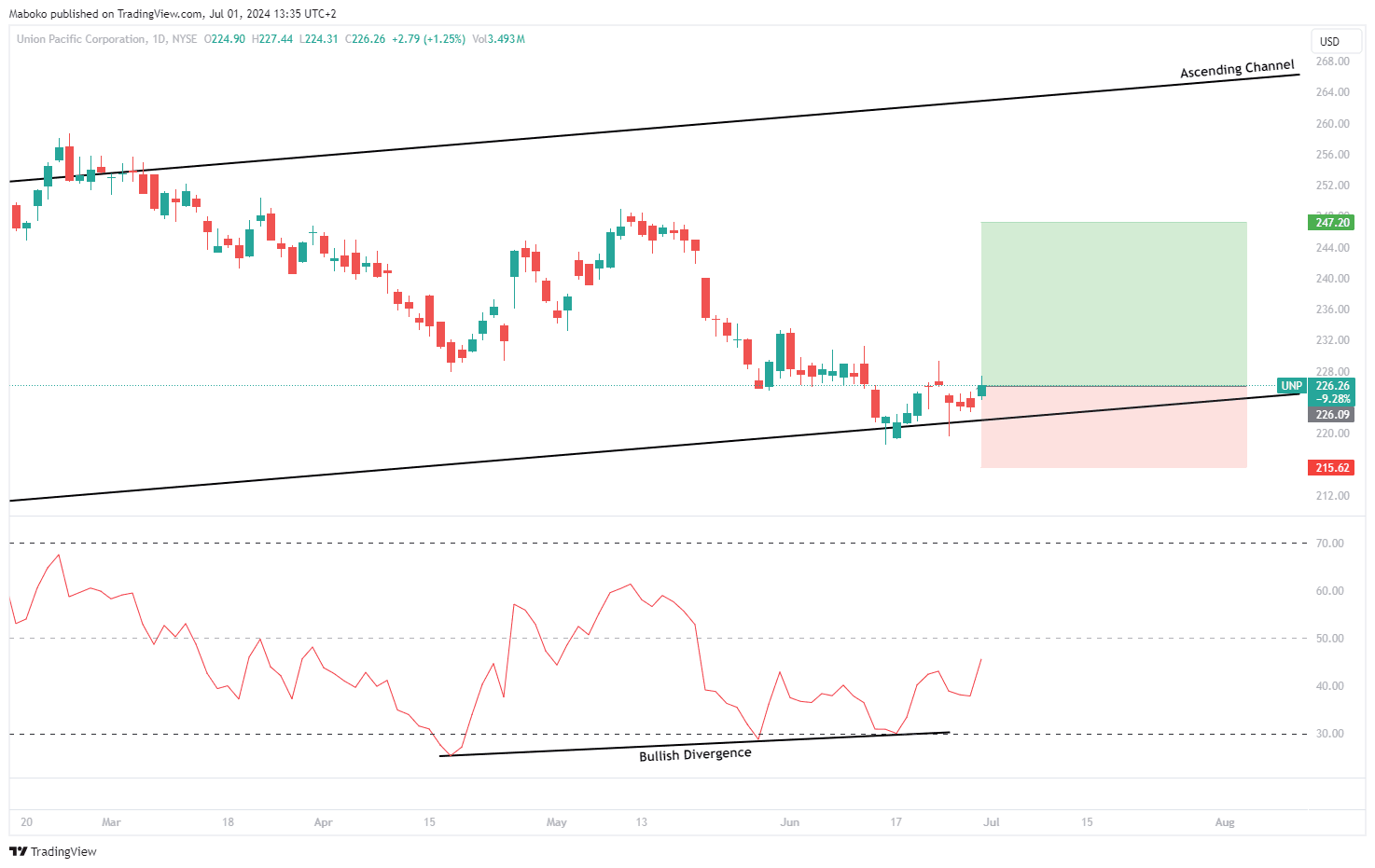

Union Pacific Corp. (UNP): Union Pacific Corp. is in the business of railroad and freight transportation services.

The share has been trading in an ascending channel, which has recently tested the lower bound of the channel at regions of $221.00. The Relative Strength Indicator (RSI) has made a bullish divergence, suggesting the momentum to the downside is fading and favouring upward momentum.

A Buy/Long idea can be initiated with a target set at $247.20 and the stop loss set at $215.62.

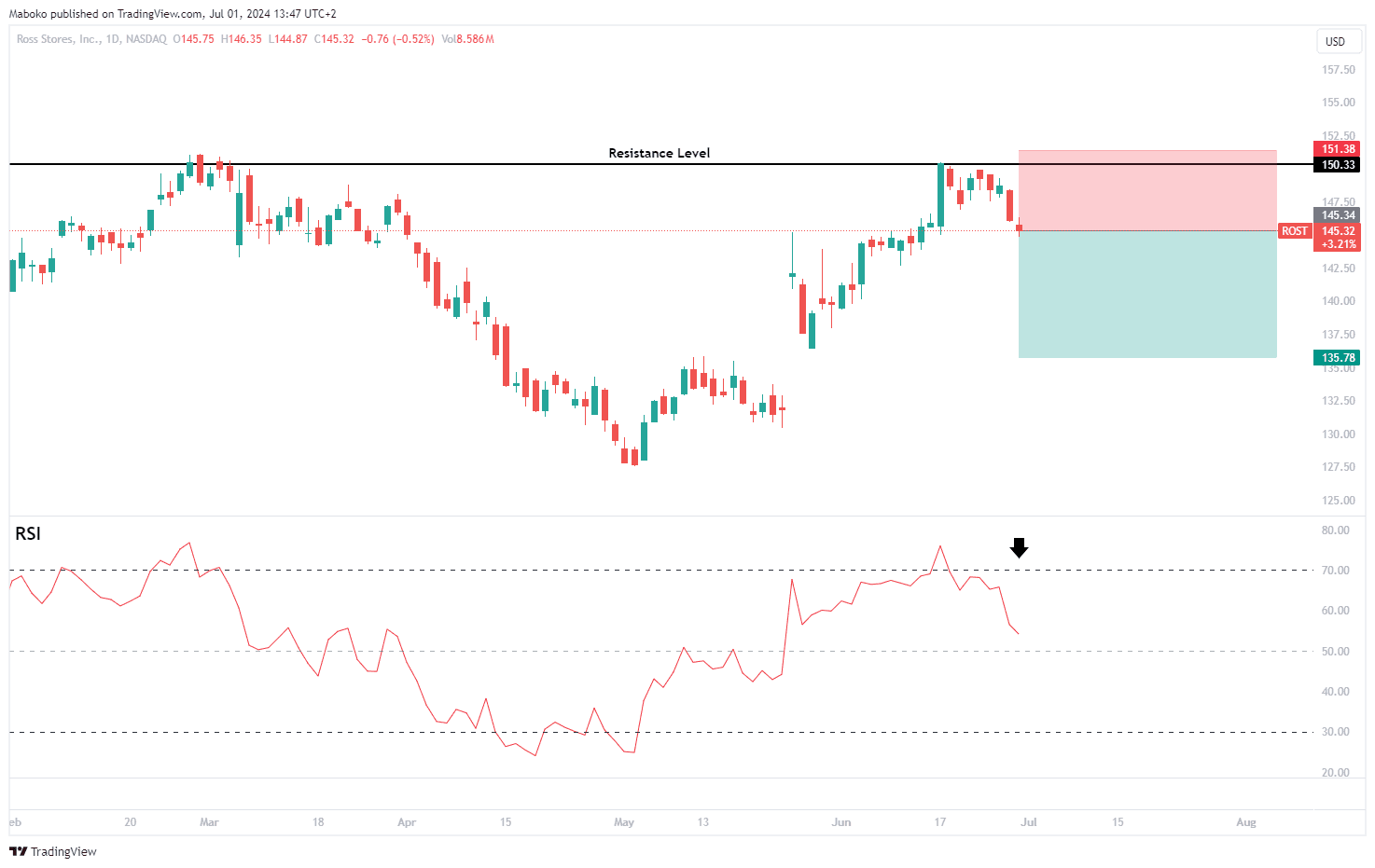

Ross Stores, Inc. (ROST): Ross Stores, Inc. is in the operation of off-price retail apparel and home accessories stores.

The share price has tested the high of February 2024, which reached a record high of $151.12, recently the share tested the high and retraced from the high. The Relative Strength Indicator (RSI) has crossed under the overbought territory, suggesting the momentum to the downside is favoured.

A speculative sell/short idea can be initiated with a target set at $135.78 and the stop loss set at $151.38.

Disclaimer: Any opinions, views, analysis or other information provided in this article is provided by BCS Markets SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BCS Markets SA does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions and all decisions are made at your own risk. BCS Markets SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss including without limitation any loss of profit which may arise directly or indirectly from use of the market commentary. The content contained within the article is subject to change at any time without notice. BCS Markets SA is an authorized financial services provider FSP No. 51404.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.