Industrials

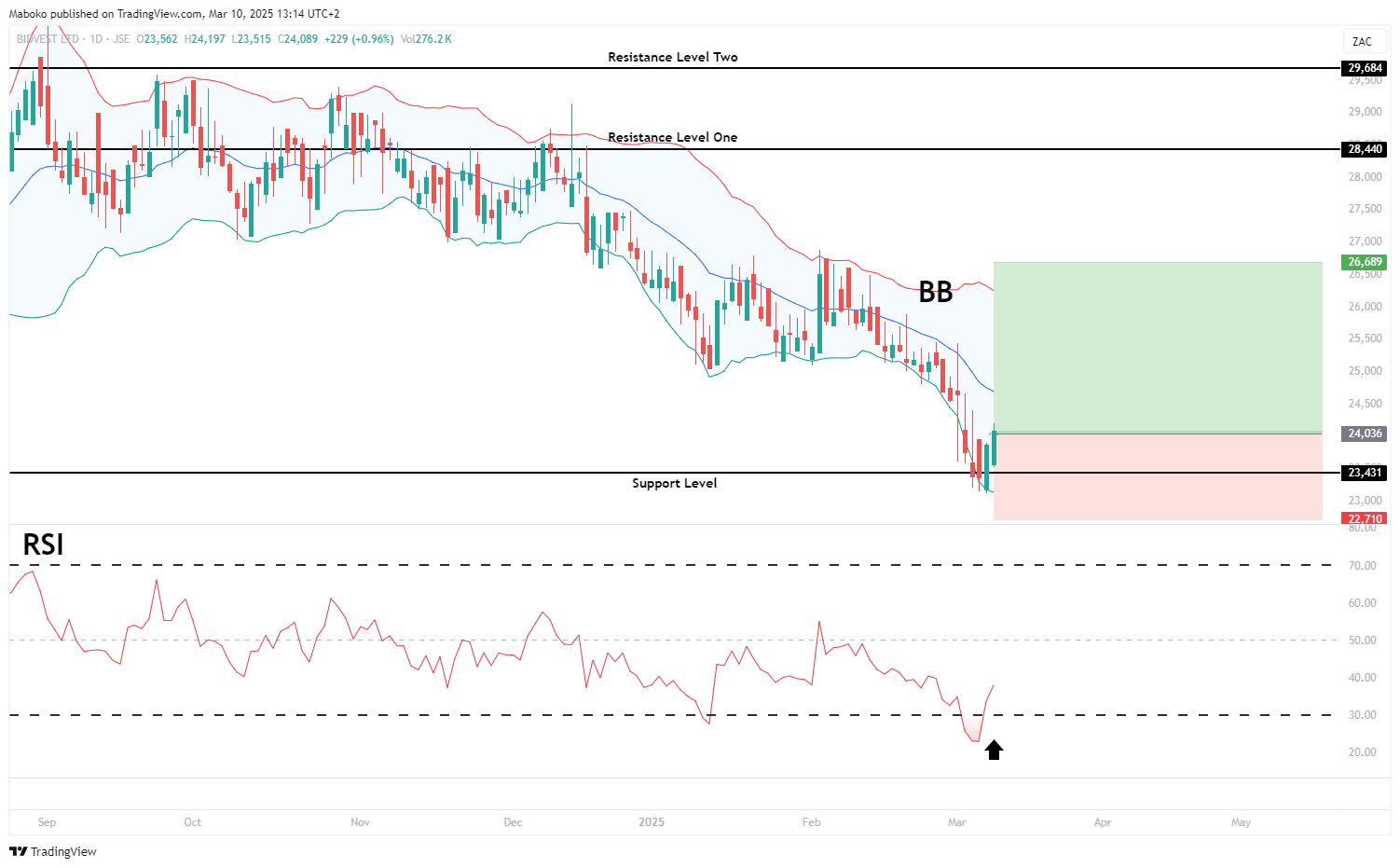

Bidvest Group Ltd (BVT): Bidvest Group Ltd. is an investment holding company with subsidiaries in the services, trading, and distribution industries. It operates through commercial products, the automotive industry, financial services, freight, branded products, and properties.

Since February 2023, the share price has been consolidating between a support level at R234 and a resistance level at R296. The price is currently testing the support level, with the relative strength indicator (RSI) crossing above the oversold region, indicating potential upward momentum. Additionally, the price has tested the lower boundary of the Bollinger Band (BB), suggesting a possible reversal to the upside.

A potential Buy/Long idea can be initiated, with the target set at R266.89 and the stop loss set at R227.10.

Financials

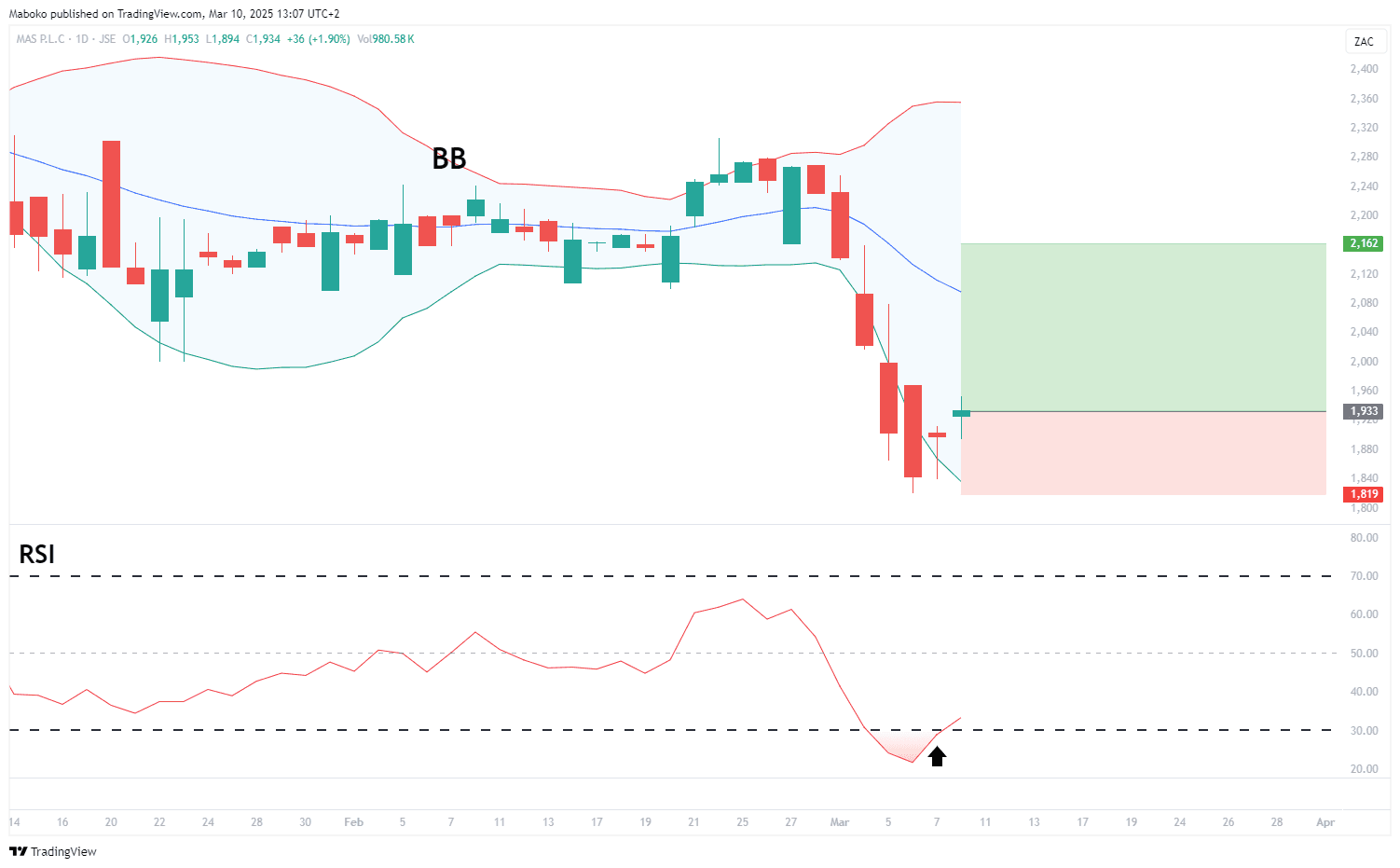

MAS Plc (MSP): MAS Plc engages in real estate investment, acquisition, and development.

The share price has closed below the lower BB for five consecutive days, indicating strong downward momentum. However, the RSI is in the oversold region. A breakout above this level could signal a potential shift towards upward momentum.

A potential Buy/Long idea can be initiated, with the target set at R21.62 and the stop loss set at R18.19.

Financials

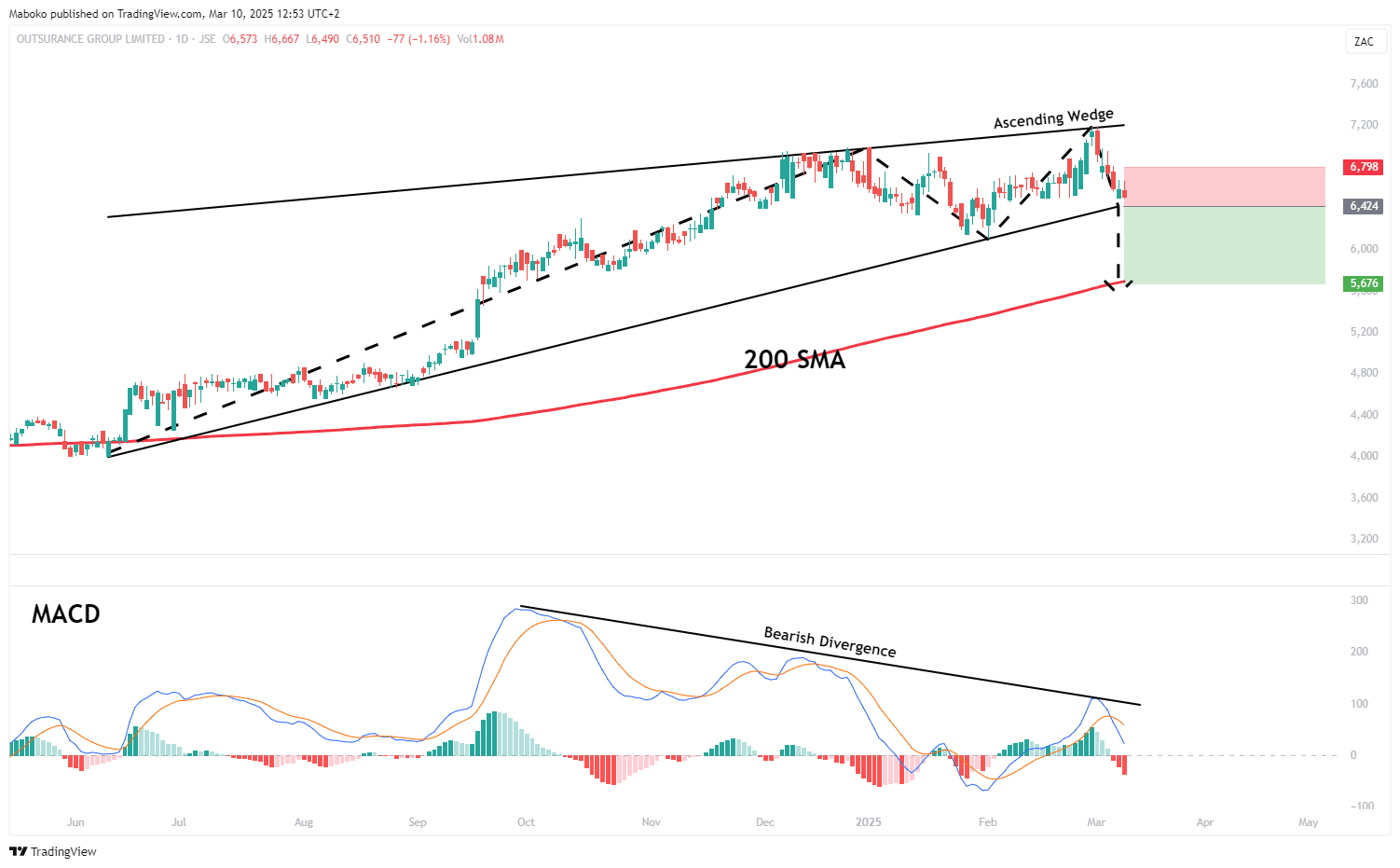

Outsurance Group Limited (OUT): OUTsurance Group Ltd. is a financial services investment group. Its portfolio comprises insurance products such as life cover, medical aid schemes, and car, individual and business insurance. It operates in South Africa, Australia, New Zealand and Namibia.

The share price is trading within an ascending wedge pattern and is approaching the lower boundary. A close below the pattern at R64.24 would signal a potential trend reversal. As confluence, the moving average convergence divergence (MACD) has formed a bearish divergence, indicating weakening upward momentum and favouring a downward move.

A speculative Sell/Short idea can be initiated, with the target set at R56.76 and the stop loss set at R67.98.

Information Technology

Broadcom Inc. (AVGO): Broadcom is a global technology company, which designs, develops, and supplies semiconductors and infrastructure software solutions. It operates through the semiconductor solutions and infrastructure software divisions.

The share price has tested the ascending trendline and the 200-day simple moving average (SMA) at the $180 level, acting as a key support area. However, the moving average convergence divergence (MACD) is yet to confirm a bullish crossover, which would signal upward momentum.

A potential Buy/Long idea can be initiated, with the target set at $242.53 and the stop loss set at $171.19.

Industrials

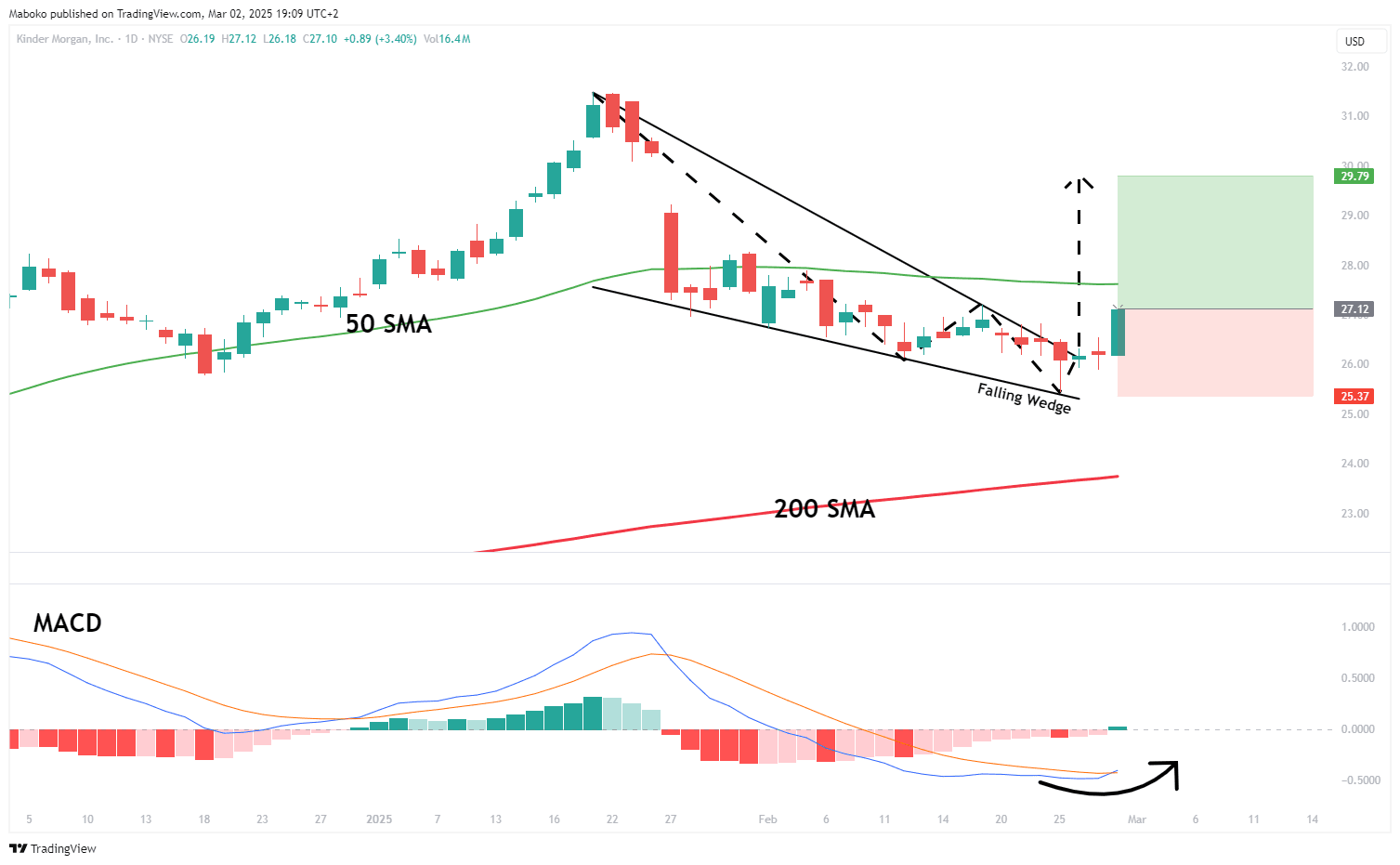

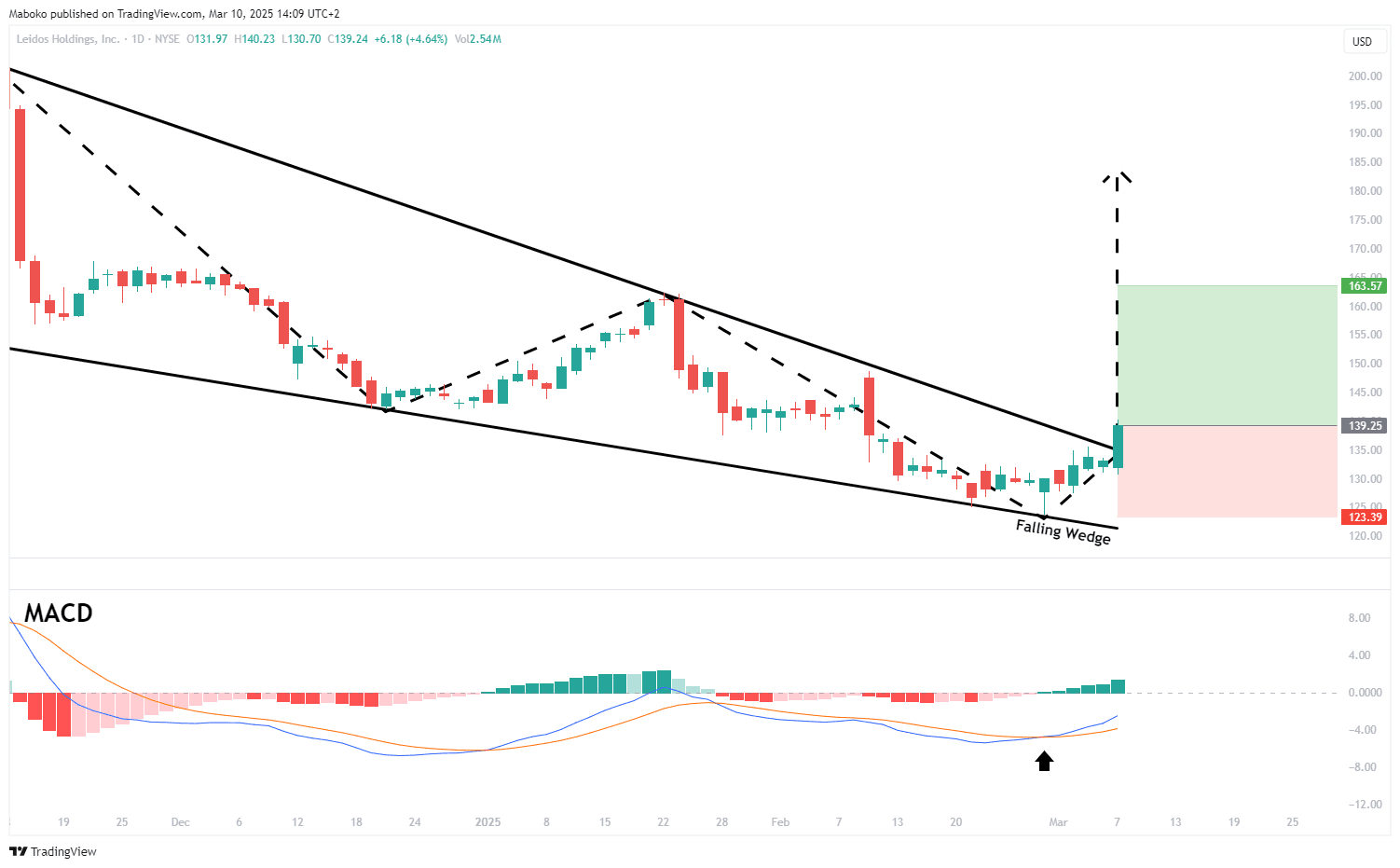

Leidos Holdings, Inc. (LDOS): Leidos Holdings provides services and solutions in the defense, intelligence, civil, and health markets.

The price broke above the upper boundary of the falling wedge pattern, confirming a potential trend reversal. As confluence, the MACD has signalled a bullish crossover, supporting upward momentum.

A potential Buy/Long idea can be initiated, with the target set at $163.57 and the stop loss set at $123.39.

Information Technology

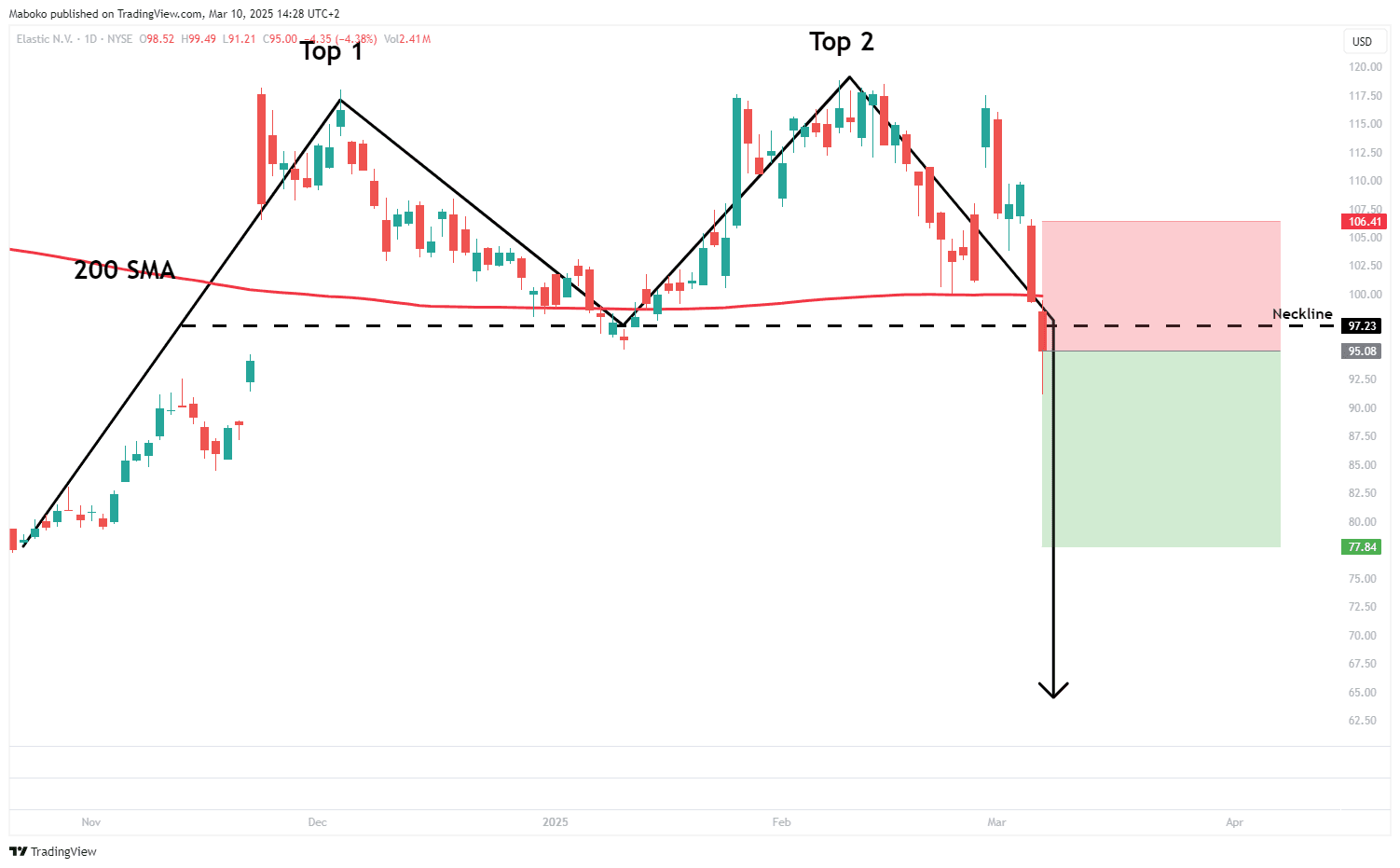

Elastic NV (ESTC): Elastic NV is a data analytics company that offers open-source search and analytics engine services.

A double top pattern has been confirmed, with the price closing below the neckline at $97, signalling a potential trend reversal. Additionally, the share closed below the 200-day SMA, reinforcing the bearish outlook.

A speculative Sell/Short idea can be initiated, with the target set at $77.84 and the stop loss set at $106.41.

Disclaimer:

*Any opinions, views, analysis or other information provided in this article is provided by BCS Markets SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BCS Markets SA does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions and all decisions are made at your own risk. BCS Markets SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss including without limitation any loss of profit which may arise directly or indirectly from use of the market commentary. The content contained within the article is subject to change at any time without notice. BCS Markets SA is an authorised financial services provider FSP No. 51404.

** This article was prepared by BROKSTOCK analyst Maboko Seabi