Consumer Services

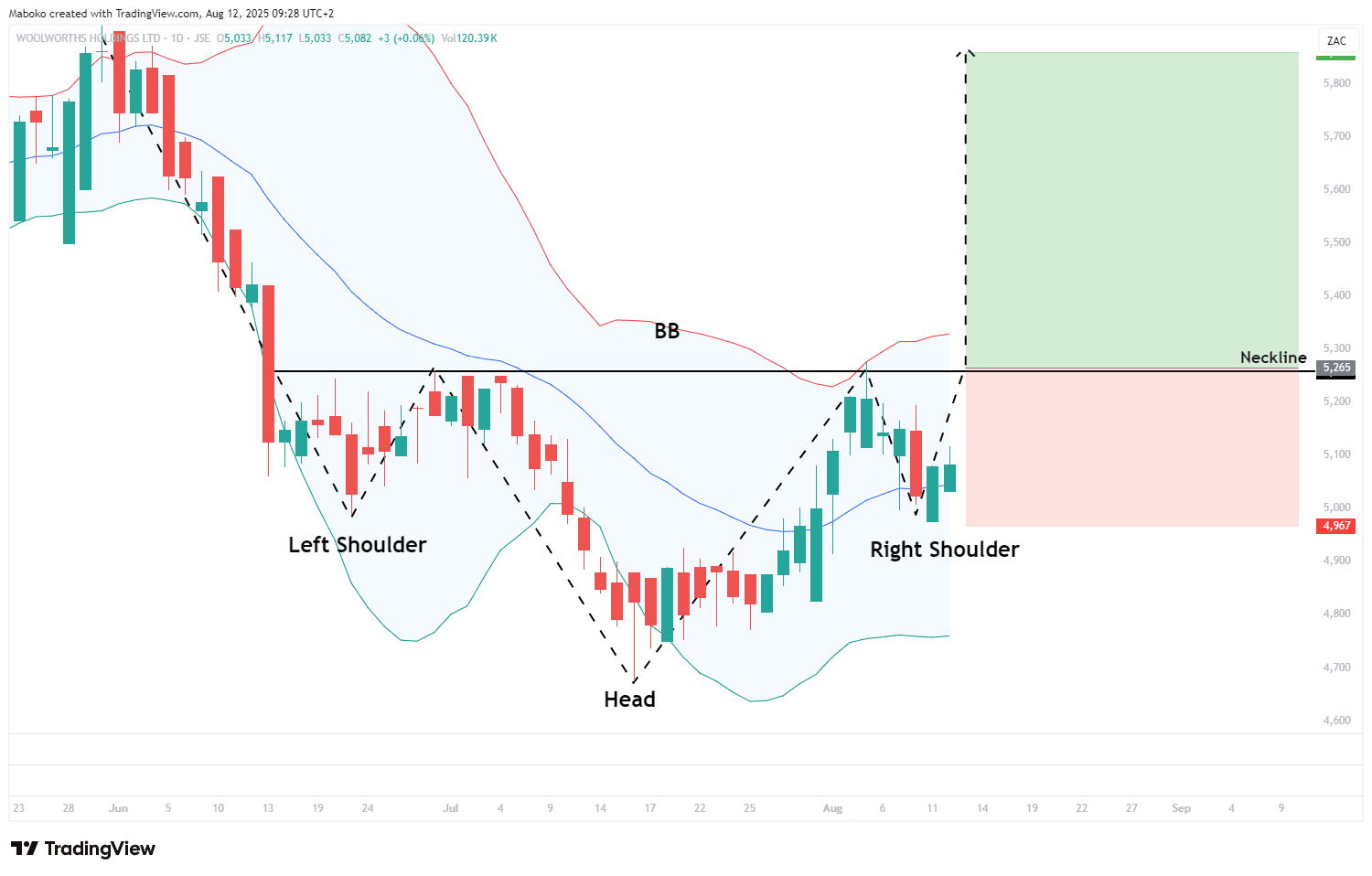

Woolworths Holdings Ltd. (WHL): Woolworths Holdings Ltd. is an investment company that provides retail and financial services. It operates through fashion, beauty, home, food, financial services, logistics, David Jones and the Country Road Group.

An inverted head and shoulders pattern is developing, with the left shoulder currently forming. The neckline sits at R52.50, and a close above this level would confirm a potential trend reversal. As confluence, a close above the upper Bollinger Band would signal strong upward momentum.

A potential Buy/Long idea can be initiated, with the target set at R58.60 and the stop loss set at R49.67.

Basic Materials

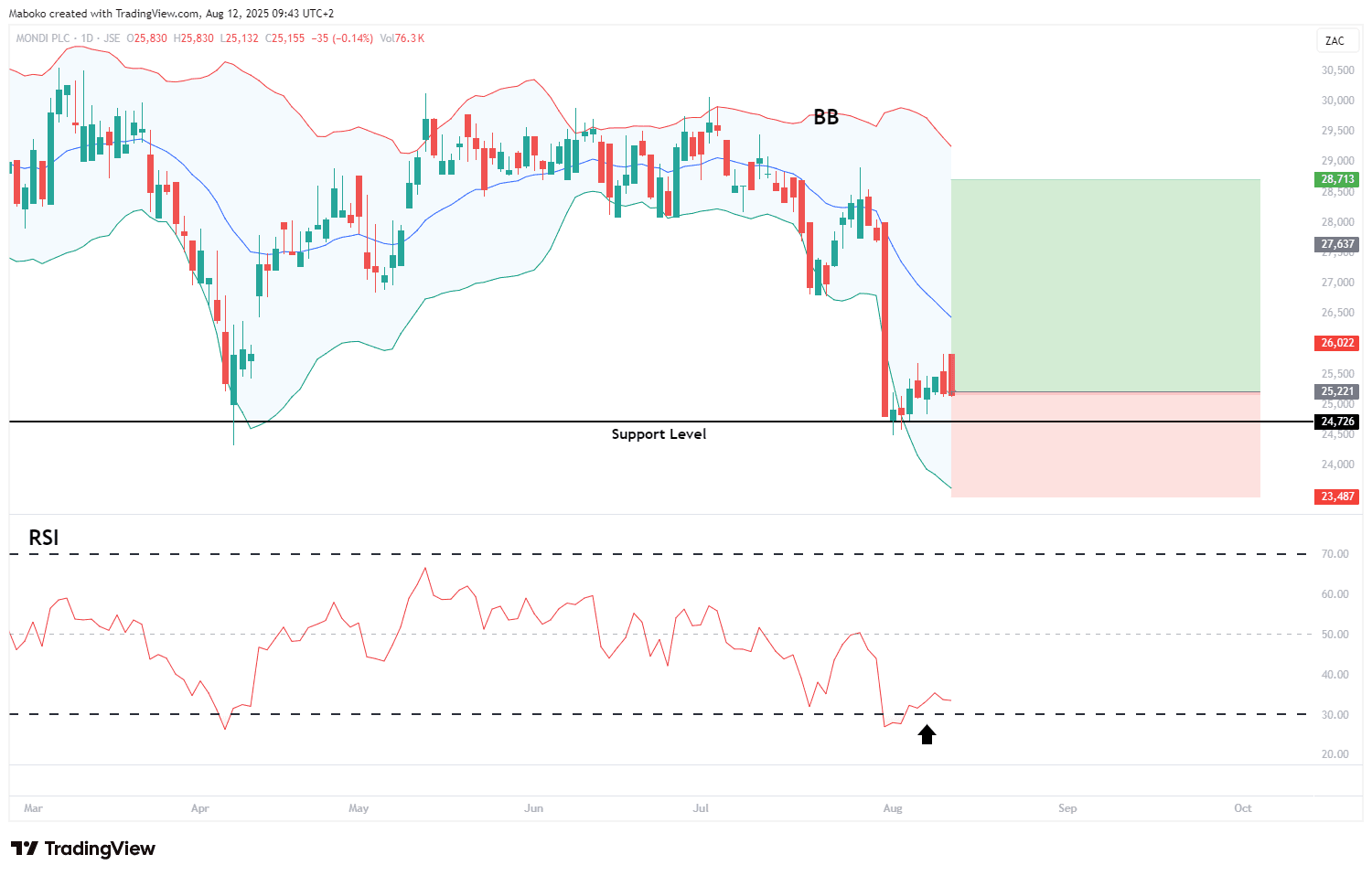

Mondi Plc (MNP): Mondi Plc is a holding company that manufactures and distributes corrugated and flexible packaging, and uncoated fine paper.

A falling wedge pattern has been confirmed with a bullish close above the upper trendline at R107.80. The moving average convergence divergence (MACD) has made a bullish crossover, suggesting upward momentum is in play, while the recent test of the lower Bollinger Band adds confluence for a potential sustained move higher.

A potential Buy/Long idea can be initiated, with the target set at R287.13 and the stop loss set at R234.87.

Consumer Services

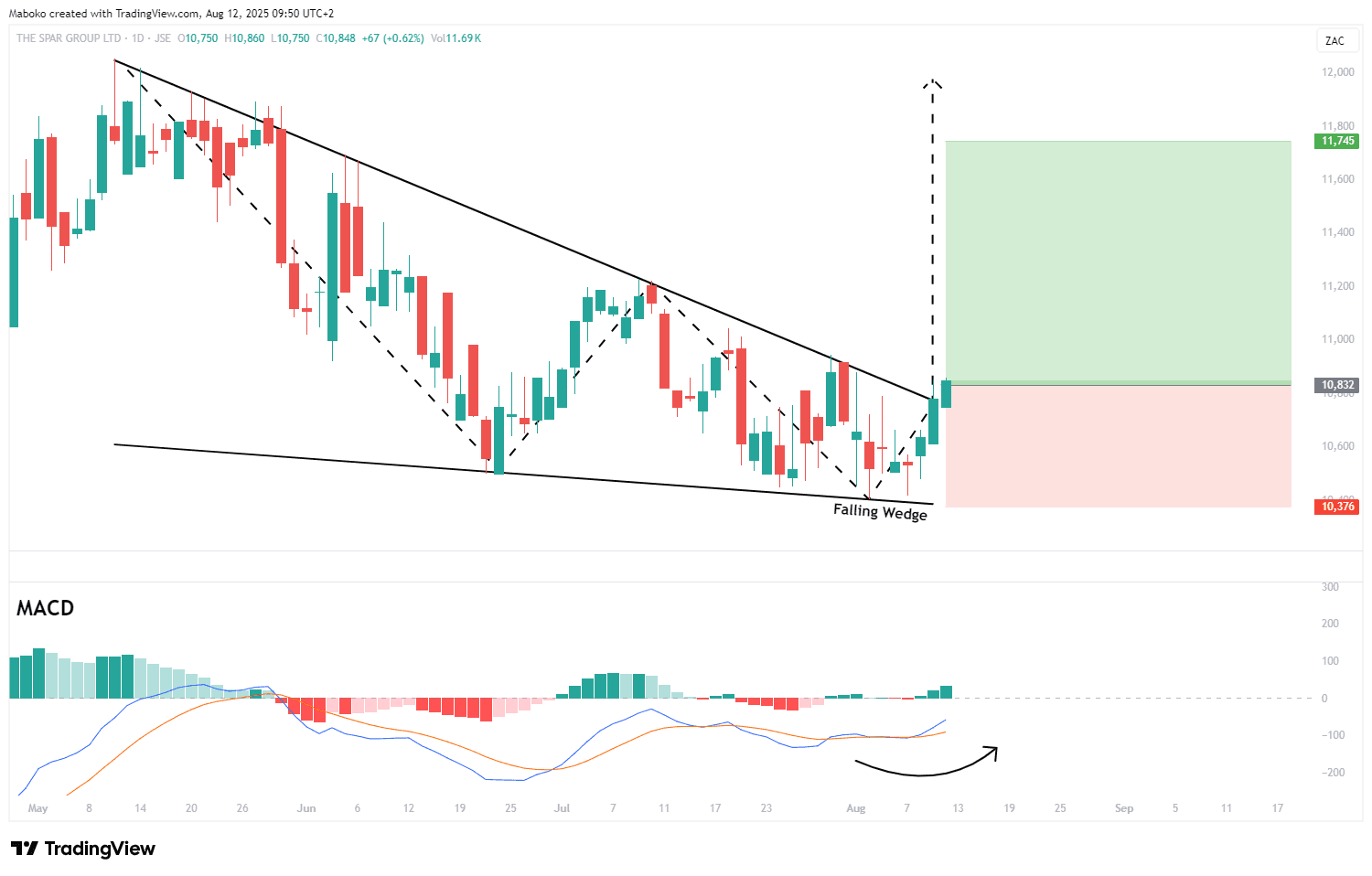

Spar Group Ltd (SPP): Spar Group Ltd. provides wholesale and distribution of goods and services to SPAR, SUPERSPAR, TOPS, SaveMor, Build It, and Pharmacy.

A falling wedge pattern has been confirmed, with a bullish close above the upper trendline at R107.80. The MACD has also made a bullish crossover, suggesting upward momentum is in play.

A potential Buy/Long idea can be initiated, with the target set at R117.45 and the stop loss set at R103.76.

Consumer Staples

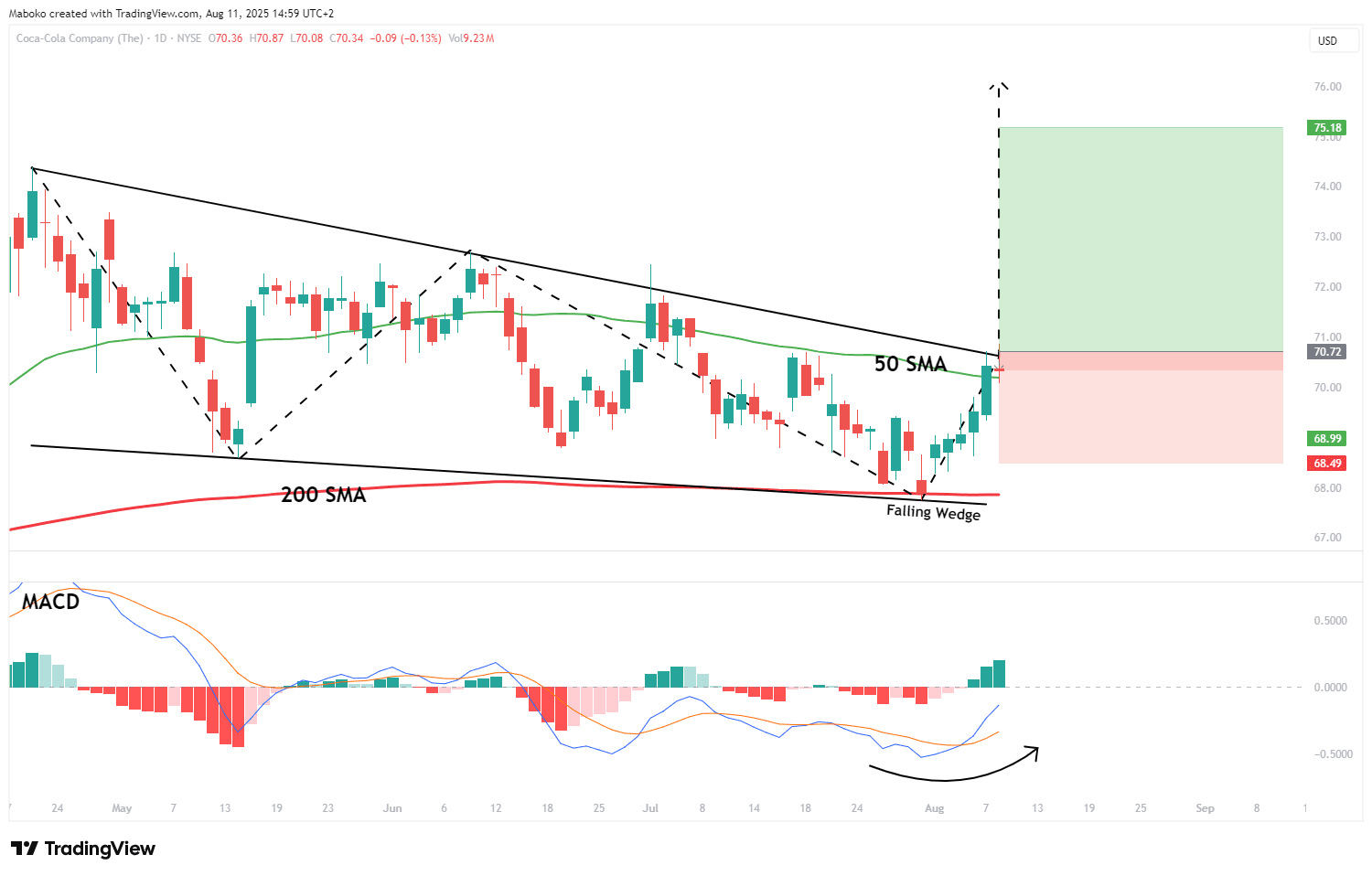

The Coca-Cola Co. (KO): Coca-Cola is in the manufacturing and marketing of non-alcoholic beverages.

The price recently tested the 200-day simple moving average (SMA) as a dynamic support level before rebounding higher and closing above the 50-day SMA, suggesting a bullish continuation. A falling wedge pattern is close to confirming a bullish breakout, while the MACD’s (moving average convergence divergence’s) bullish crossover further supports the case for upward momentum.

A potential Buy/Long idea can be initiated, with the target set at $75.18 and the stop loss set at $68.49.

Industrials

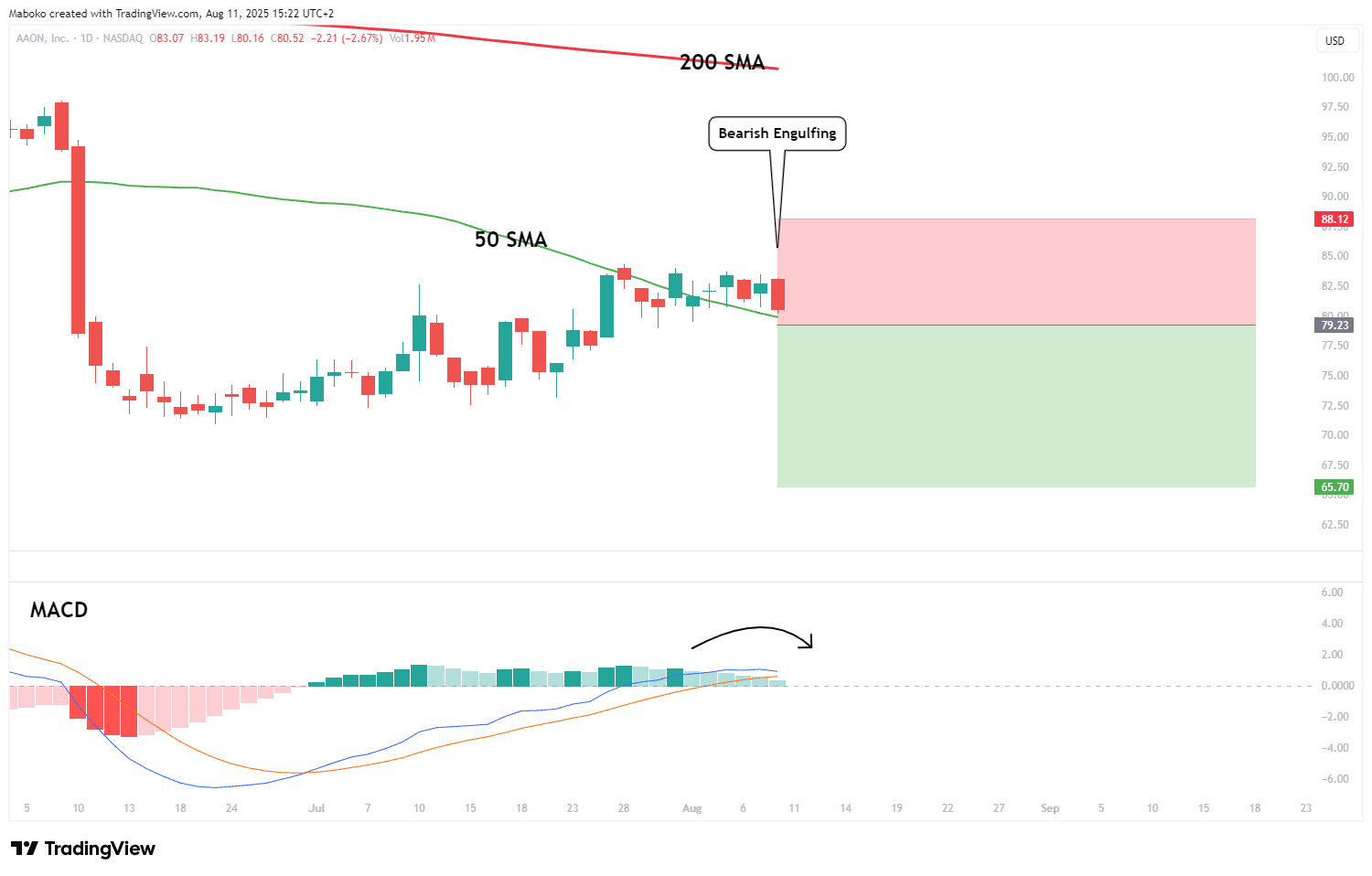

AAON, Inc. (AAON): AAON is in the business of engineering, manufacturing, marketing, and selling air conditioning and heating equipment.

The price has been in a bearish trend, currently trading above the 50-day SMA but below the 200-day SMA, indicating that downside pressure remains in play. A recent bearish engulfing candlestick signals strong potential for further decline, while the MACD’s imminent bearish crossover reinforces the likelihood of downward momentum.

A speculative Sell/Short idea can be initiated when the price closes below the 50-day SMA at $79.50, with the target set at $65.70 and the stop loss set at $88.12.

Communication Services

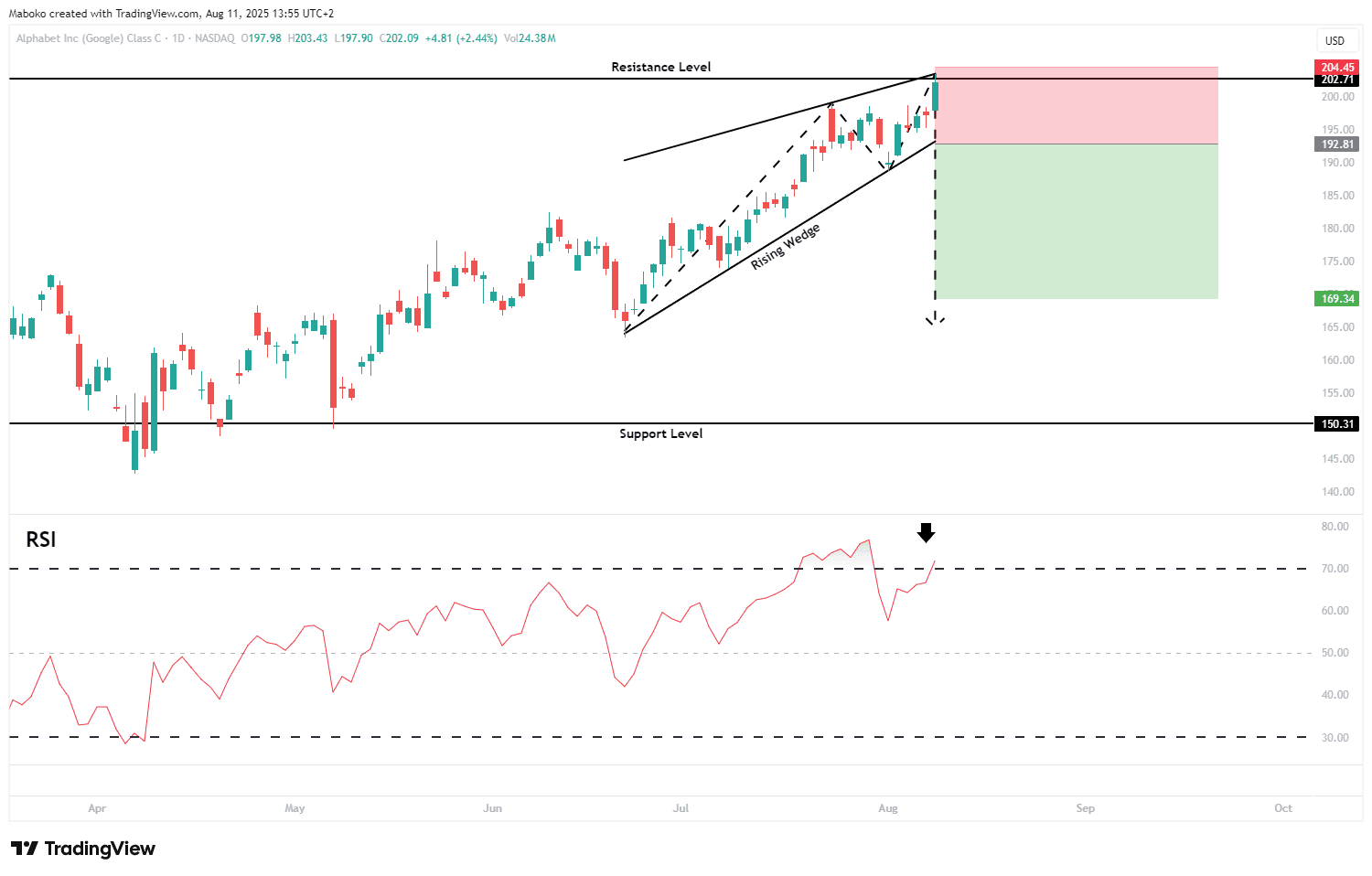

Alphabet, Inc. (GOOGL): Alphabet, Inc. is a holding company in software, healthcare, transportation, and other technologies. It operates through Google Services and Google Cloud.

The stock price is currently trading within a range, testing the resistance level at $202.71. A rising wedge pattern has formed, and a close below the lower trendline at $192.80 would confirm a bearish reversal. As confluence, the relative strength indicator (RSI) is in overbought territory, signalling potential downward momentum.

A speculative Sell/Short idea can be initiated, with the target set at $169.34 and the stop loss set at $204.45.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi