Basic Materials

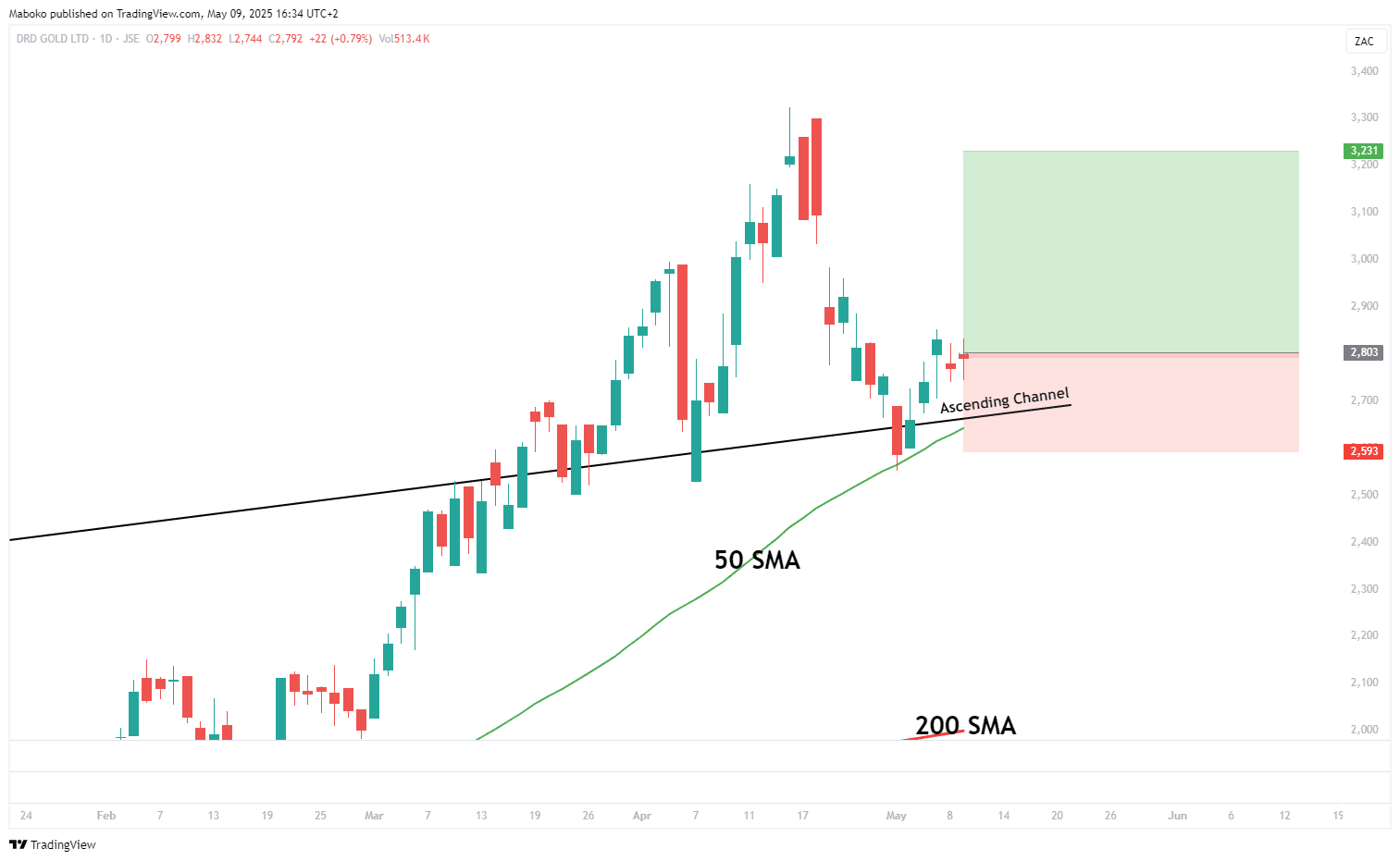

DRDGOLD Ltd. (DRD): DRDGOLD Ltd. is in the retreatment of surface gold in Johannesburg. It extracts and processes gold.

The share price has broken out of the ascending channel and has since pulled back to retest the former resistance, now acting as support. This retest coincides with the 50-day simple moving average (SMA), providing confluence and suggesting a potential upward trend continuation.

A potential Buy/Long idea can be initiated, with the target set at R32.31 and the stop loss set at R25.93.

Industrials

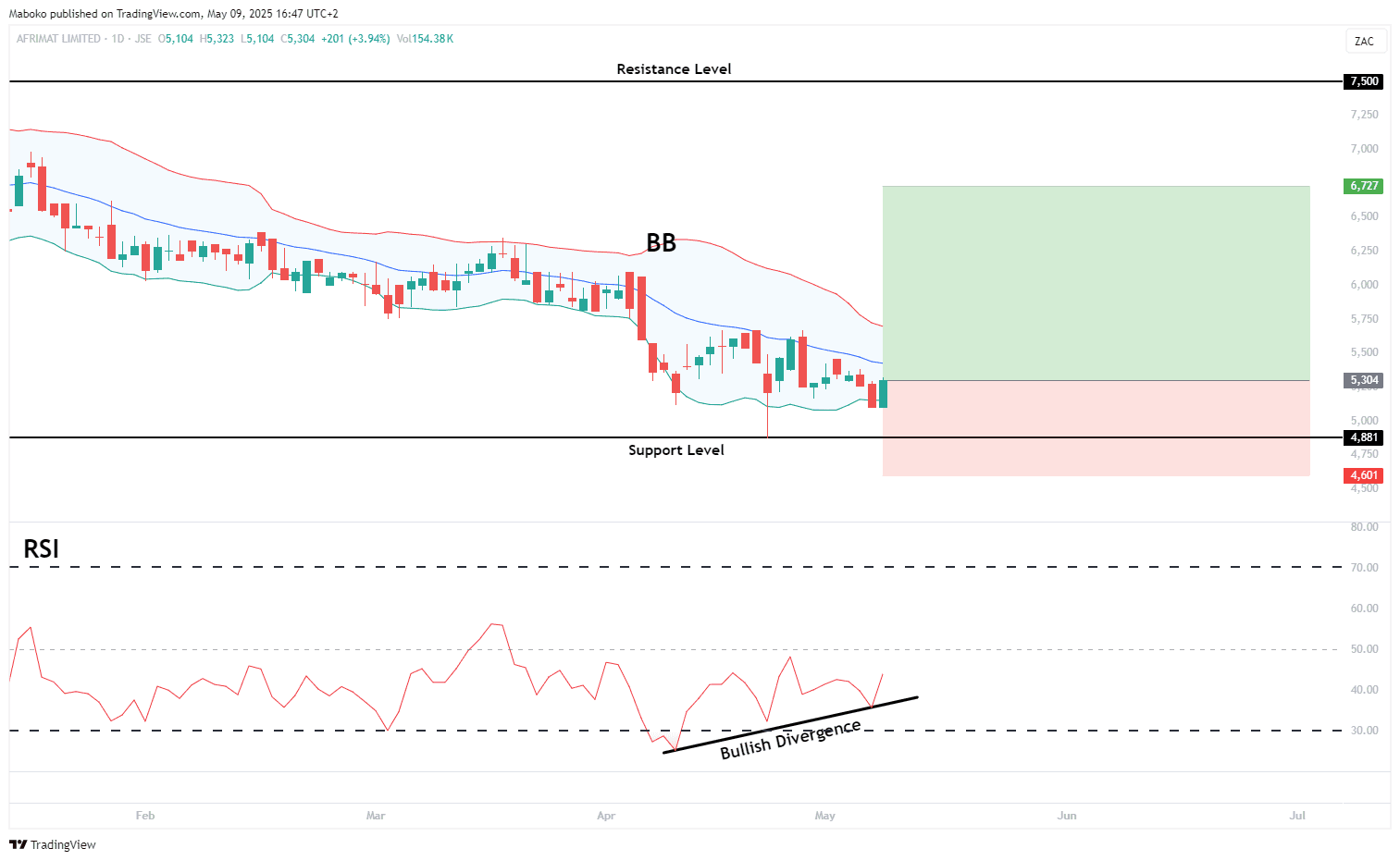

Afrimat Ltd. (AFT): Afrimat Ltd. is in the business of open-pit mining, processing, and supplying industrial minerals and materials. It operates through construction materials, industrial minerals, bulk commodities, future materials and metals.

The share price has been trading in a consolidation range since May 2021, with support at R48.81 and resistance at R75. A bullish divergence on the relative strength indicator (RSI) has emerged, signalling fading downward momentum and a potential shift towards the upper end of the range.

A potential Buy/Long idea can be initiated, with the target set at R67.27 and the stop loss set at R46.

Basic Materials

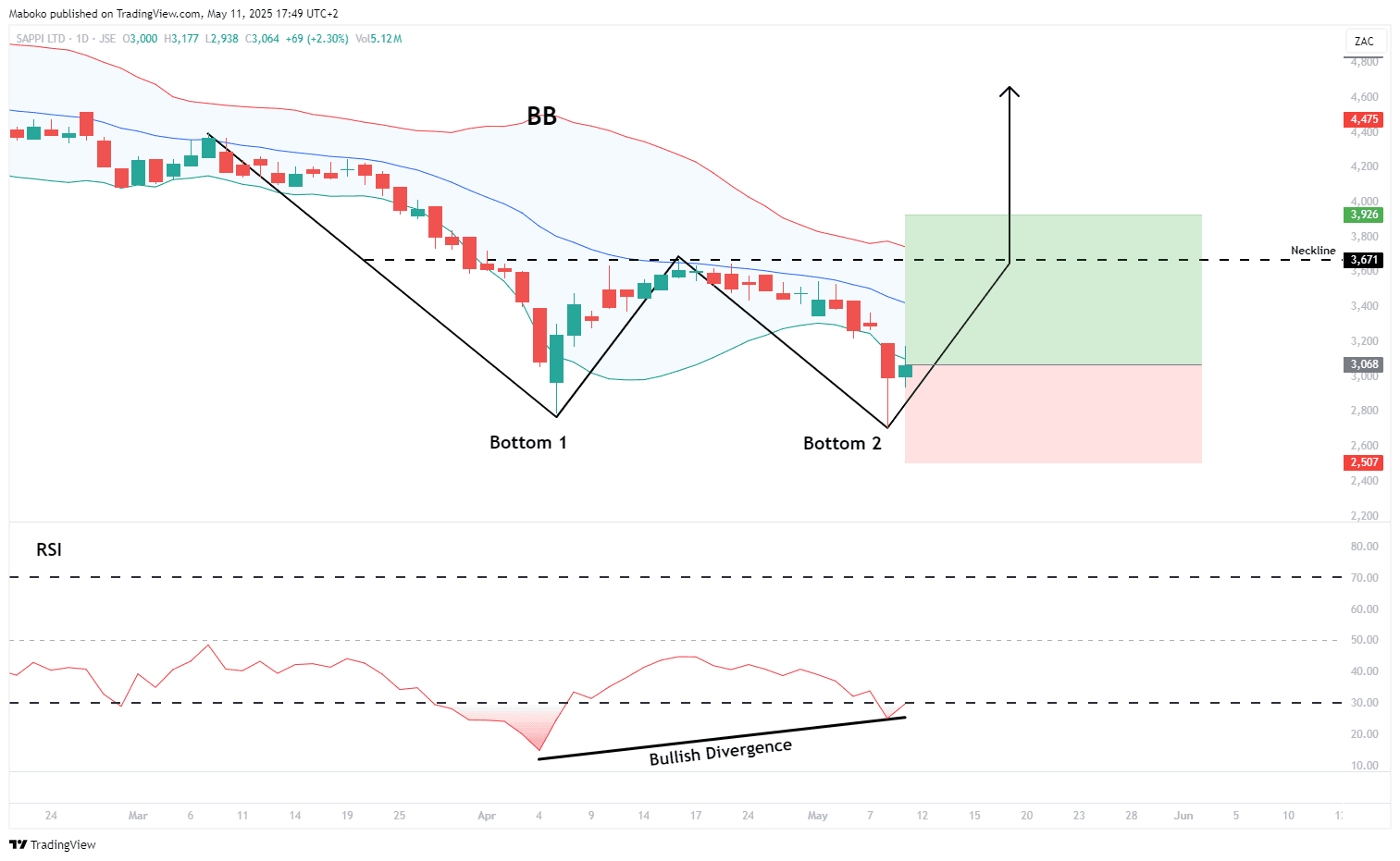

Sappi Ltd. (SAP): Sappi Ltd. is a holding company that provides wood-fibre-based solutions. Its products include dissolving pulp, speciality and packaging papers, printing and writing papers, and forestry.

A potential double bottom pattern is forming, supported by bullish divergence observed at both troughs. However, the price recently broke below the lower band of the Bollinger Bands (BB), indicating weak momentum and suggesting the breakout may lack conviction.

A speculative Sell/Short idea can be initiated with the target set at R39.26 and the stop loss set at R256.07.

Consumer Discretionary

Tesla, Inc. (TSLA): Tesla, Inc. designs, develops, manufactures, and sells electric vehicles, energy generation, and storage systems.

The stock has formed a double bottom pattern, with troughs around $213 and a neckline at $292.20, which the price closed above on Friday, confirming a bullish breakout. As confluence, both troughs coincided with tests of the lower Bollinger Band, indicating weakening downward pressure. The relative strength indicator (RSI) is rising and may soon enter overbought territory, supporting continued upward momentum in the near term.

A potential Buy/Long idea can be initiated, with the target set at $347 and the stop loss set at $269.28.

Information Technology

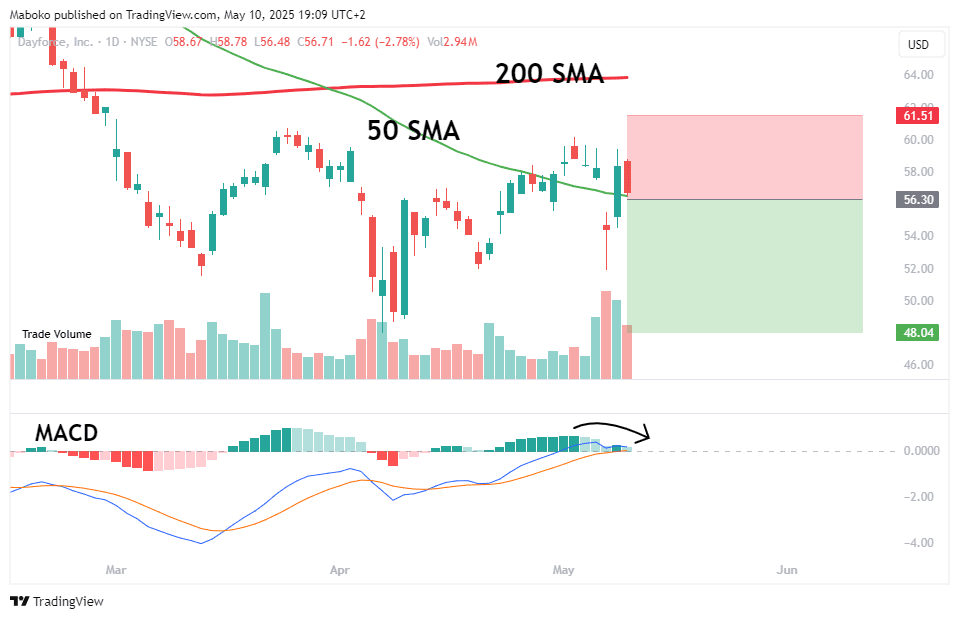

Dayforce, Inc. (DAY): Dayforce develops human capital management software. It offers Dayforce, Powerpay, and Bureau products and services. The company provides human resources (HR), payroll, benefits, workforce management, and talent management functionality.

The stock price is currently testing the 50-day simple moving average (SMA), following the recent formation of a death cross, where the 50-day SMA crossed below the 200-day SMA, indicating a bearish long-term signal. The moving average convergence divergence (MACD) has confirmed this sentiment with a bearish cross under, reinforcing the likelihood of continued downward momentum. Additionally, rising trading volume suggests increasing selling pressure and market conviction behind the move.

A speculative Sell/Short idea can be initiated with the target set at $48.04 and the stop loss set at $61.51.

Energy

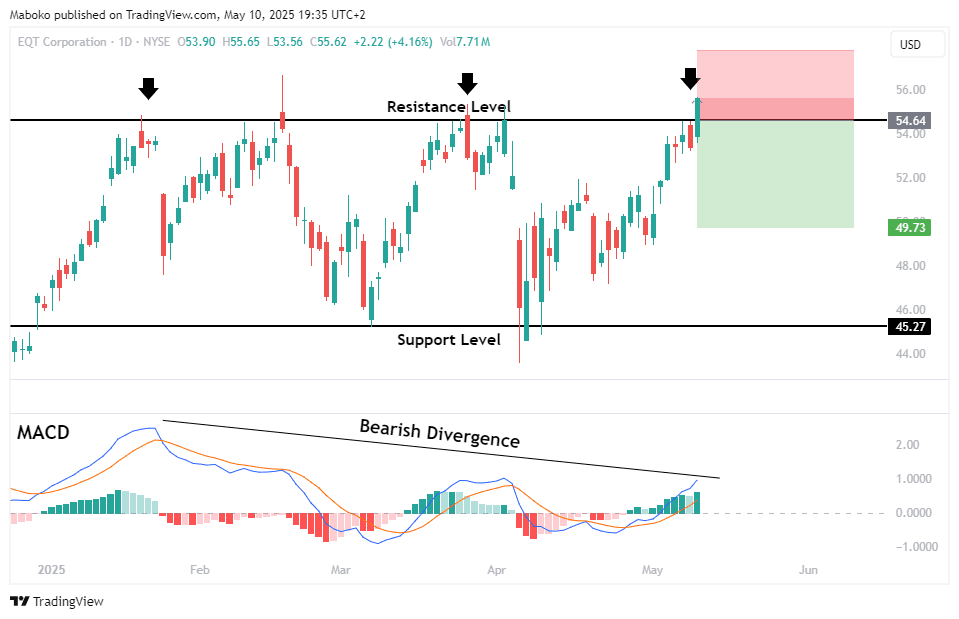

EQT Corp. (EQT): EQT is a production company that supplies, transmits, and distributes natural gas.

The stock price is currently trading within a consolidation range, having recently tested the resistance level at $54.64. There is potential for the price to move lower toward the support level at $45.27. As confluence, the MACD has formed a bearish divergence, indicating fading upward momentum and supporting the case for a possible move to the downside.

A speculative Sell/Short idea can be initiated with the target set at $57.81 and the stop loss set at $49.73.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi