Financials

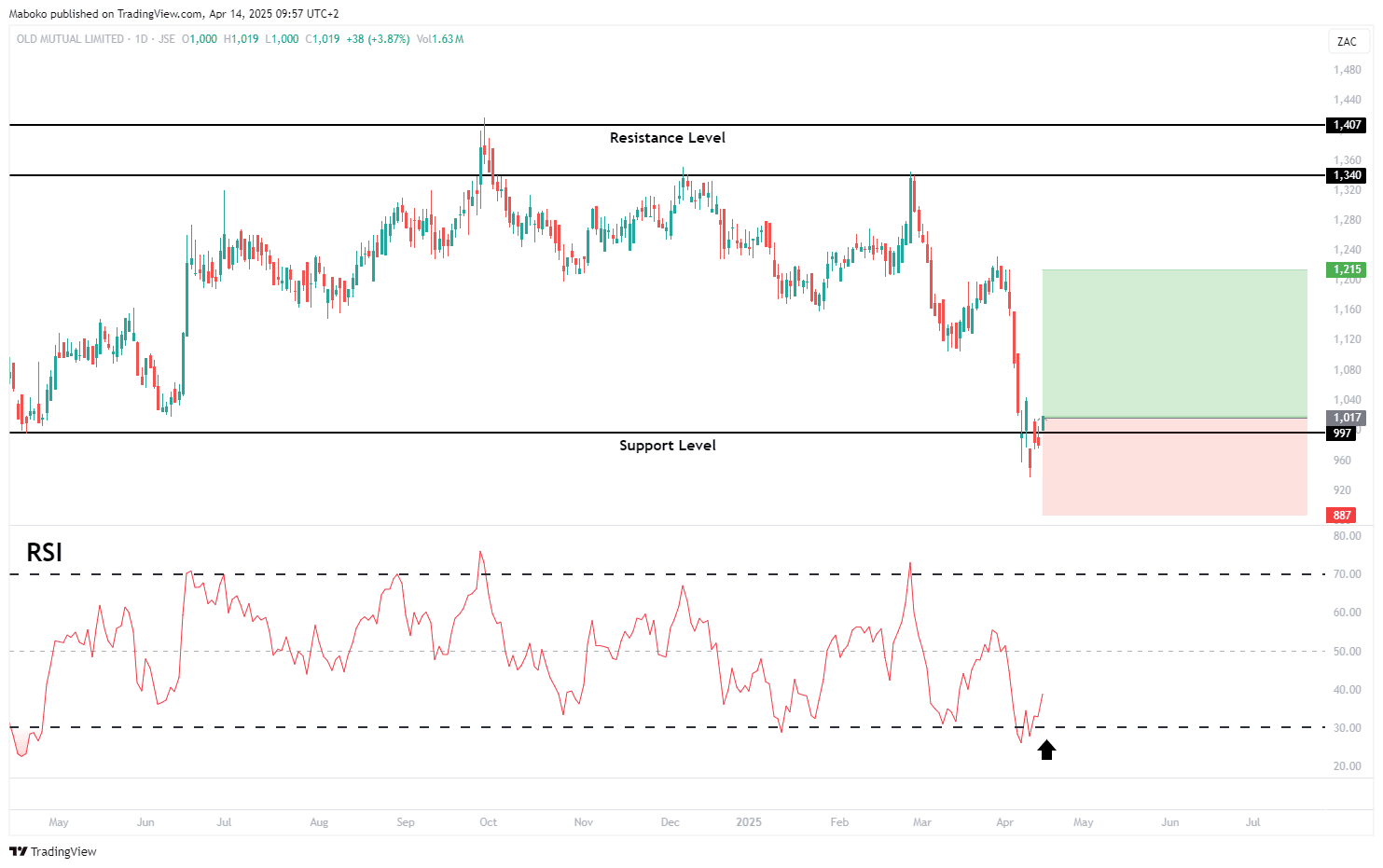

Old Mutual Ltd. (OMU): Old Mutual Ltd. is in the business of investment, savings, insurance, and banking services. It operates through personal finance and wealth management, Old Mutual Investments, Old Mutual Corporate, and Old Mutual Insure

The share price has tested a major support level around R10. The relative strength indicator (RSI) has exited the oversold territory, indicating a shift in momentum to the upside. The price now appears to be targeting the next resistance level around R14.

A potential Buy/Long idea can be initiated with the target set at R12.15 and the stop loss set at R8.87.

Health Care

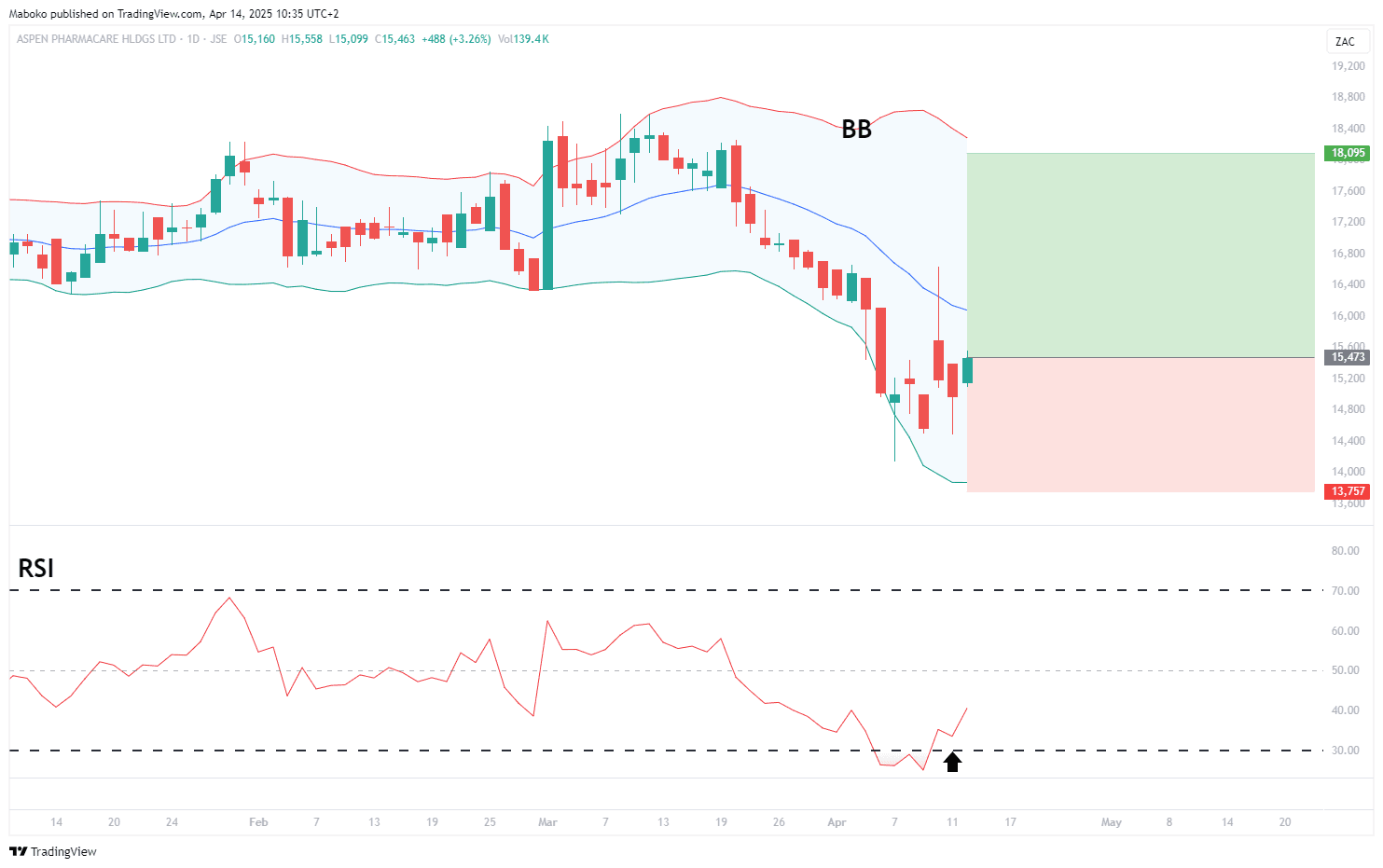

Aspen Pharmacare Holdings Ltd. (APN): Aspen Pharmacare Holdings Ltd. manufactures and supplies branded and generic pharmaceutical products. It operates through commercial pharmaceuticals and manufacturing.

The share price experienced a sharp decline over the past month and recently tested the lower Bollinger Band (BB), indicating that a bullish reversal may be imminent. As confluence, the relative strength indicator (RSI) has exited the oversold territory, reinforcing the potential for upward momentum.

A potential Buy/Long idea can be initiated with the target set at R180.95 and the stop loss set at R137.57.

Financials

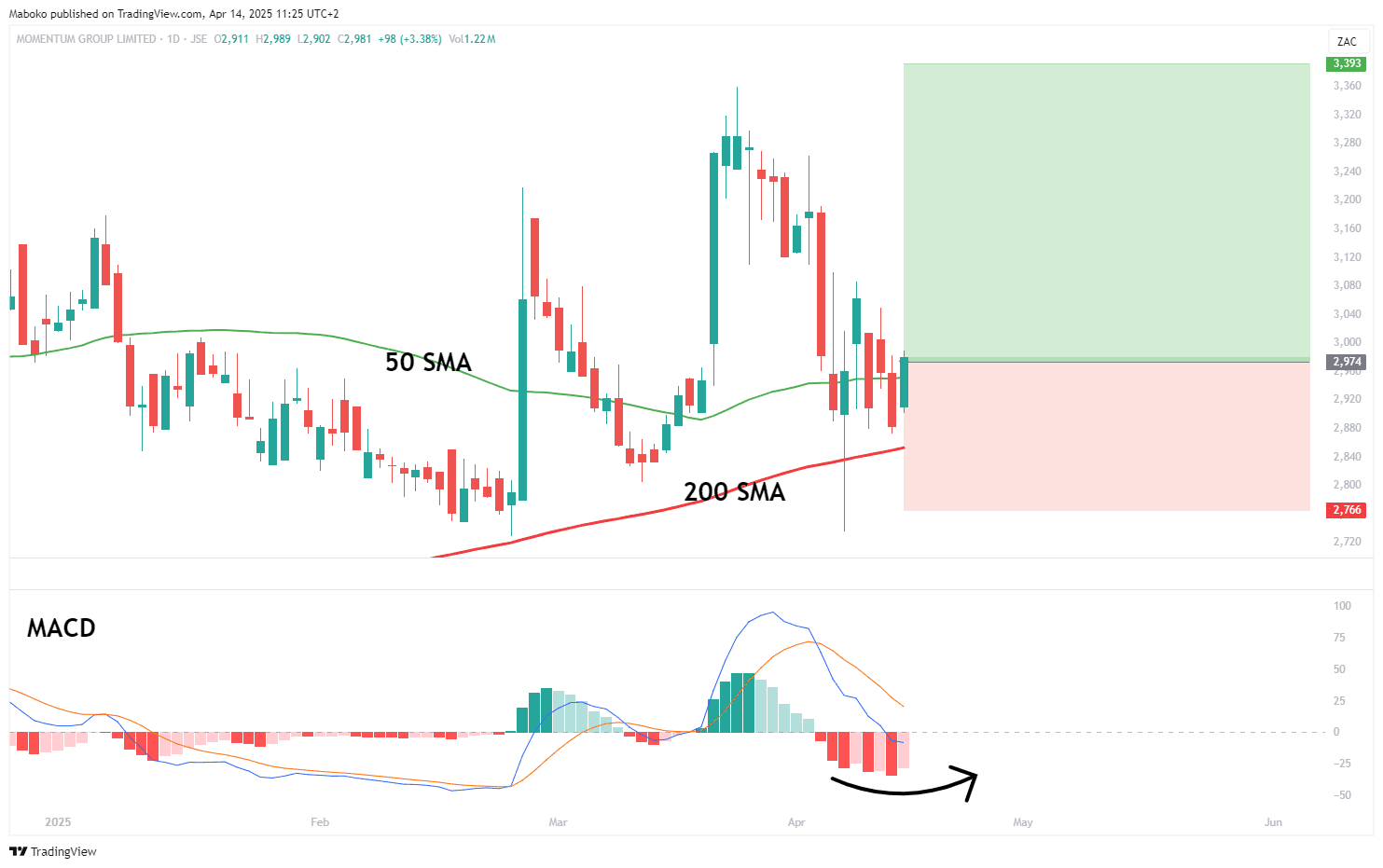

Momentum Group Ltd. (MTM): Momentum offers insurance, asset management, and financial services.

The share price recently tested both the 50-day and 200-day simple moving averages (SMAs) and closed above them, an encouraging sign that typically supports the continuation of an upward trend. As confluence, the MACD is on the verge of a bullish crossover, reinforcing the likelihood of sustained upward momentum.

A potential Buy/Long idea can be initiated with the target set at R33.93 and the stop loss set at R27.66.

Information Technology

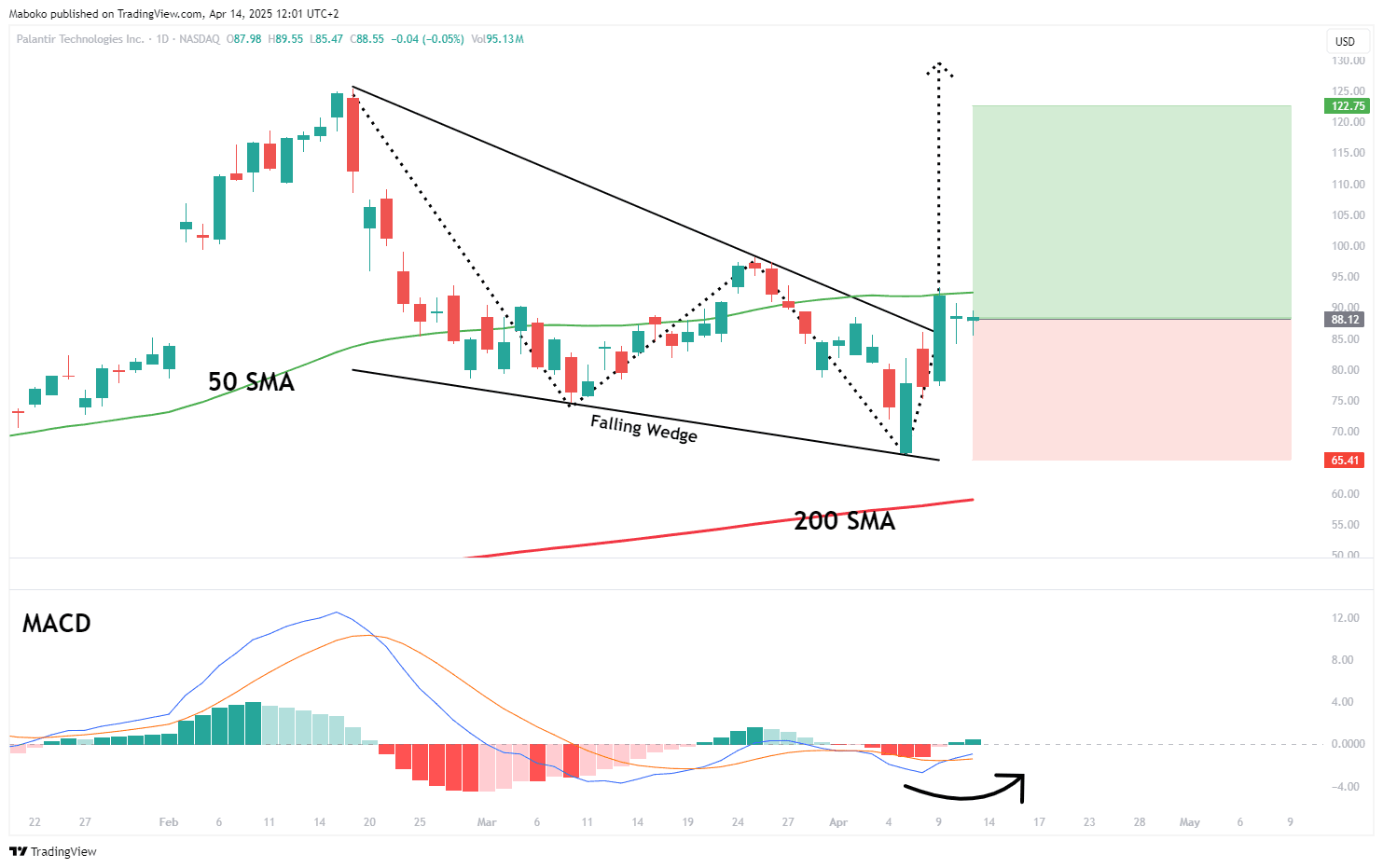

Palantir Technologies, Inc. (PLTR): Palantir builds and deploys software platforms that serve as central operating systems for its customers.

A bullish breakout from a falling wedge pattern has occurred, indicating a potential trend reversal. The share is trading above the 200-day simple moving average (SMA), signalling long-term bullish sentiment. A close above the 50-day SMA would confirm trend continuation. As confluence, the moving average convergence divergence (MACD) has formed a bullish crossover, reinforcing upward momentum.

A potential Buy/Long idea can be initiated with the target set at $122.75 and the stop loss set at $65.14.

Information Technology

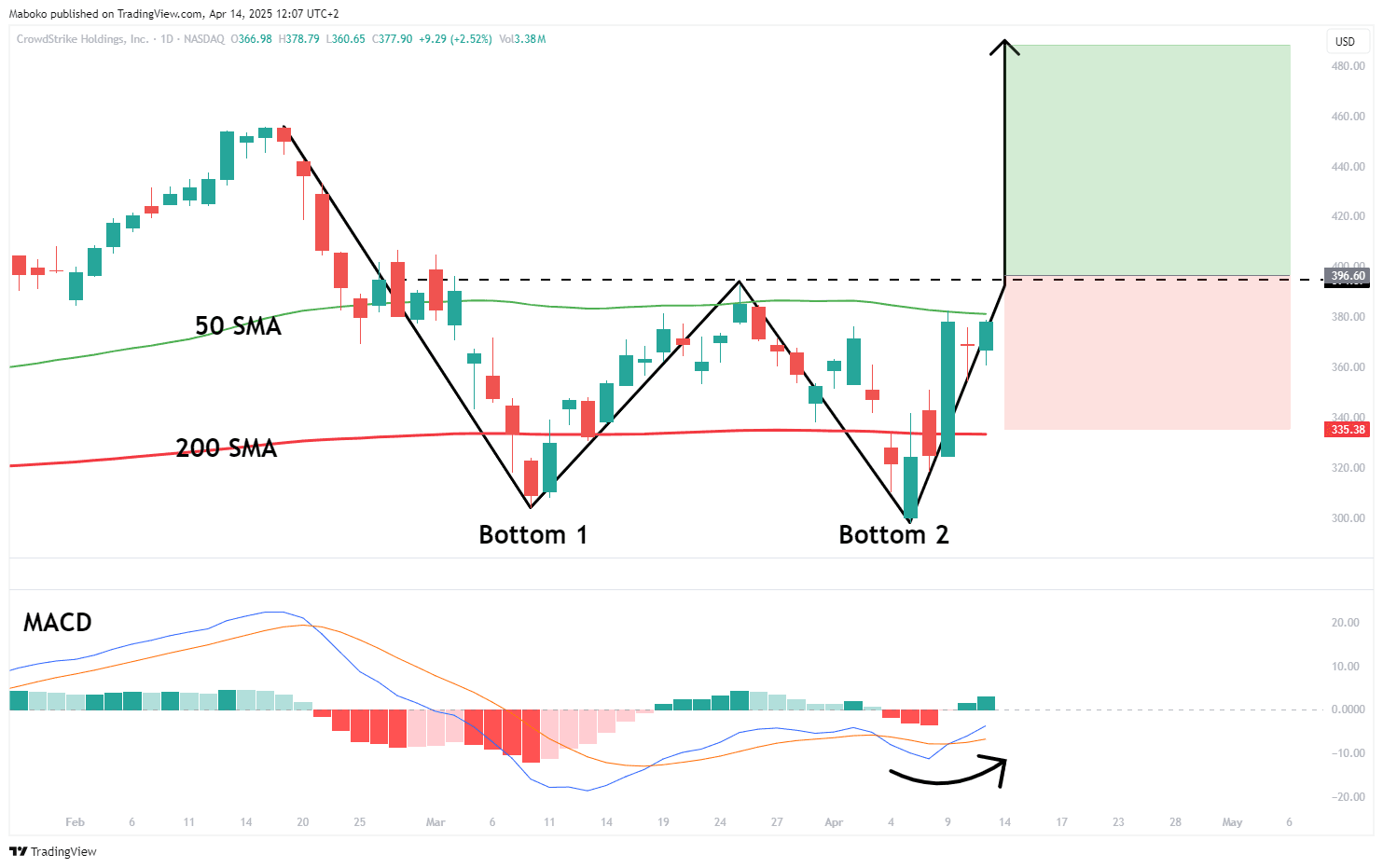

CrowdStrike Holdings, Inc. (CRWD): CrowdStrike provides cybersecurity products and services to stop breaches.

A potential double bottom pattern is forming, with troughs around $305 and a neckline at $394.57. Both lows have tested the 200-day SMA, acting as dynamic support. A close above the 50-day SMA would confirm bullish trend continuation, while a breakout above the neckline would strengthen the case for further upside.

A potential Buy/Long idea can be initiated with the target set at $488.24 and the stop loss set at $335.38.

Health Care

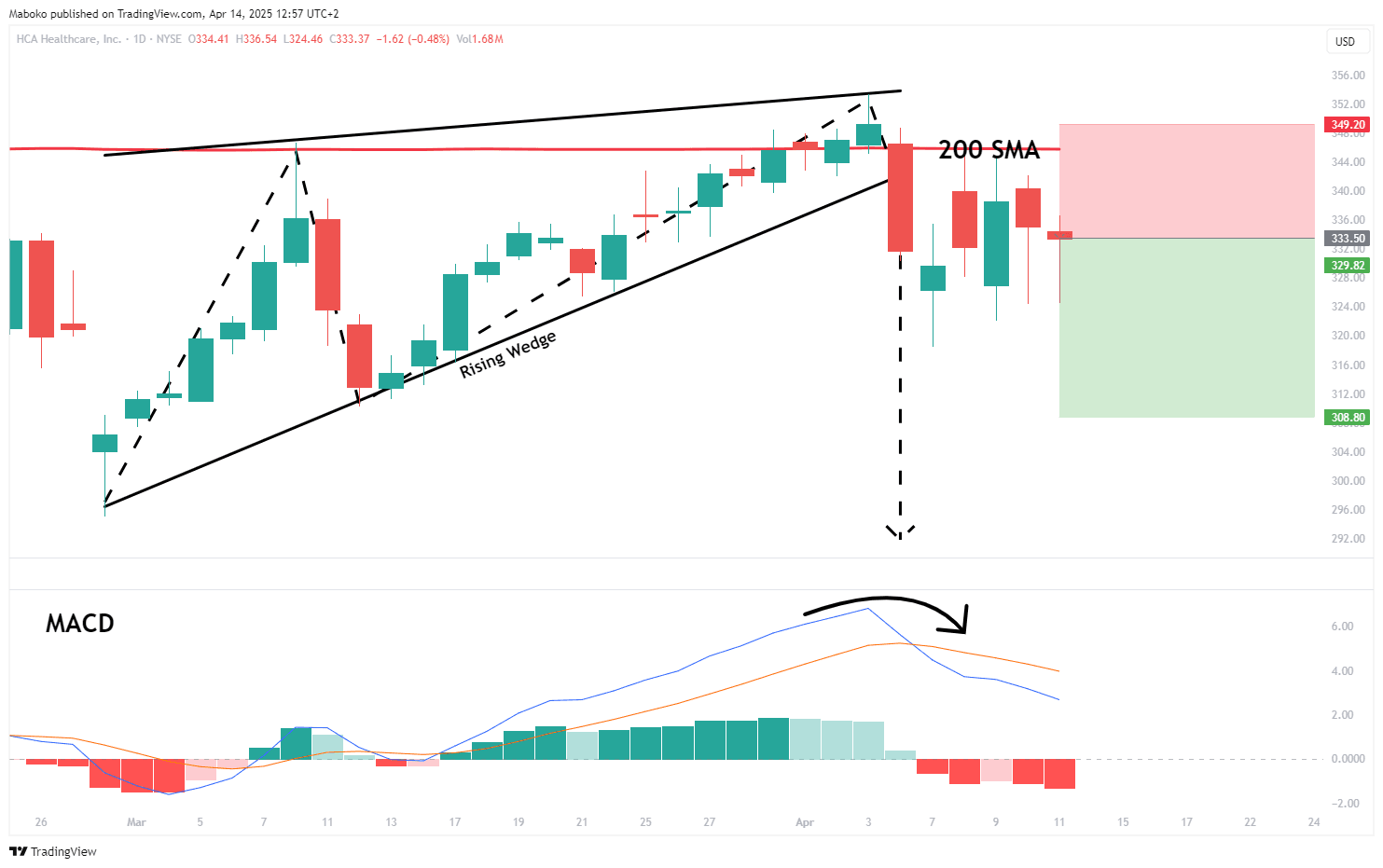

HCA Healthcare, Inc. (HCA): HCA Healthcare is a healthcare services company that operates hospitals, freestanding surgery centres, emergency care facilities, urgent care facilities, and walk-in clinics.

The price is trading below the 200-day SMA, reinforcing a bearish outlook. A confirmed breakout below the rising wedge pattern, alongside a bearish MACD crossunder, signals that downward momentum is gaining strength.

A speculative Sell/Short idea can be initiated with the target set at $308.80 and the stop loss set at $349.20.

Disclaimer:

*Any opinions, views, analysis or other information provided in this article is provided by BCS Markets SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BCS Markets SA does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions and all decisions are made at your own risk. BCS Markets SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss including without limitation any loss of profit which may arise directly or indirectly from use of the market commentary. The content contained within the article is subject to change at any time without notice. BCS Markets SA is an authorised financial services provider FSP No. 51404.

** This article was prepared by BROKSTOCK analyst Maboko Seabi