Basic Materials

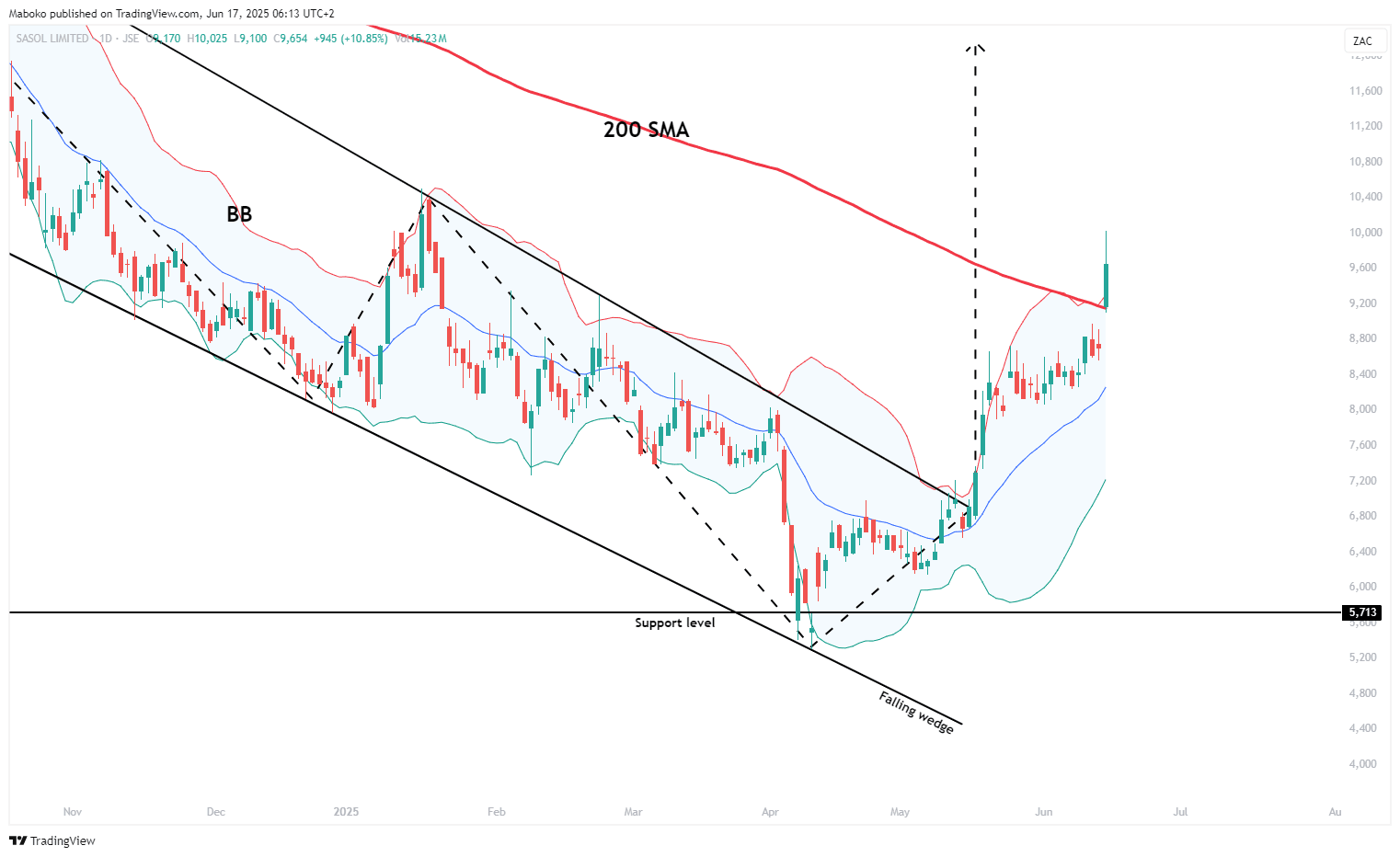

Sasol Ltd. (SOL): Sasol Ltd. is a chemical and energy company that sources, produces, and markets chemical and energy products.

The share price has closed above the 200-day simple moving average (SMA), signalling that bulls have regained control of the trend. This move follows a successful test of the COVID-19 support level and a breakout above the falling wedge pattern, both classic reversal signals. The strong bullish momentum is further supported by Friday’s close above the upper Bollinger Bands, suggesting a potential continuation of the upward breakout.

A potential Buy/Long idea can be initiated, with the target set at R122.51 and the stop loss set at R87.13.

Financials

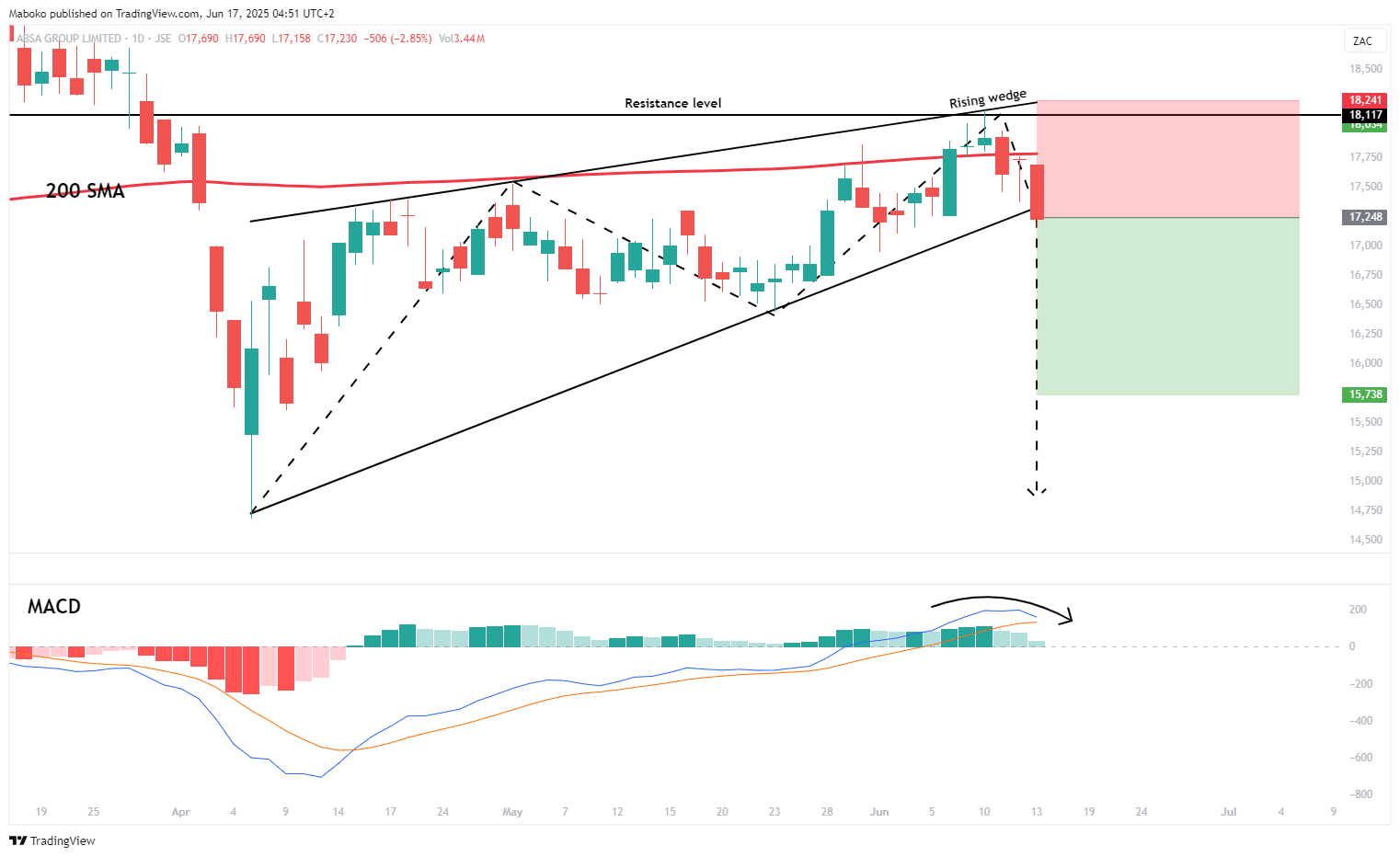

Absa Group Ltd. (ABG): Absa Group Ltd. offers financial services. It operates through product solutions, everyday banking, and corporate and investment banking.

A rising wedge trading pattern has been confirmed with a breakout below the lower boundary at R172.48, aligning with a close beneath the 200-day simple moving average, both signalling a shift toward a bearish trend. The price also recently tested and failed to break above the R181 resistance level, reinforcing downside pressure. As confluence, the moving average convergence divergence (MACD) is poised for a bearish cross-under, indicating that momentum is tilting further in favour of the bears.

A speculative Sell/Short idea can be initiated, with the target set at R157.38 and the stop loss set at R182.41.

Basic Materials

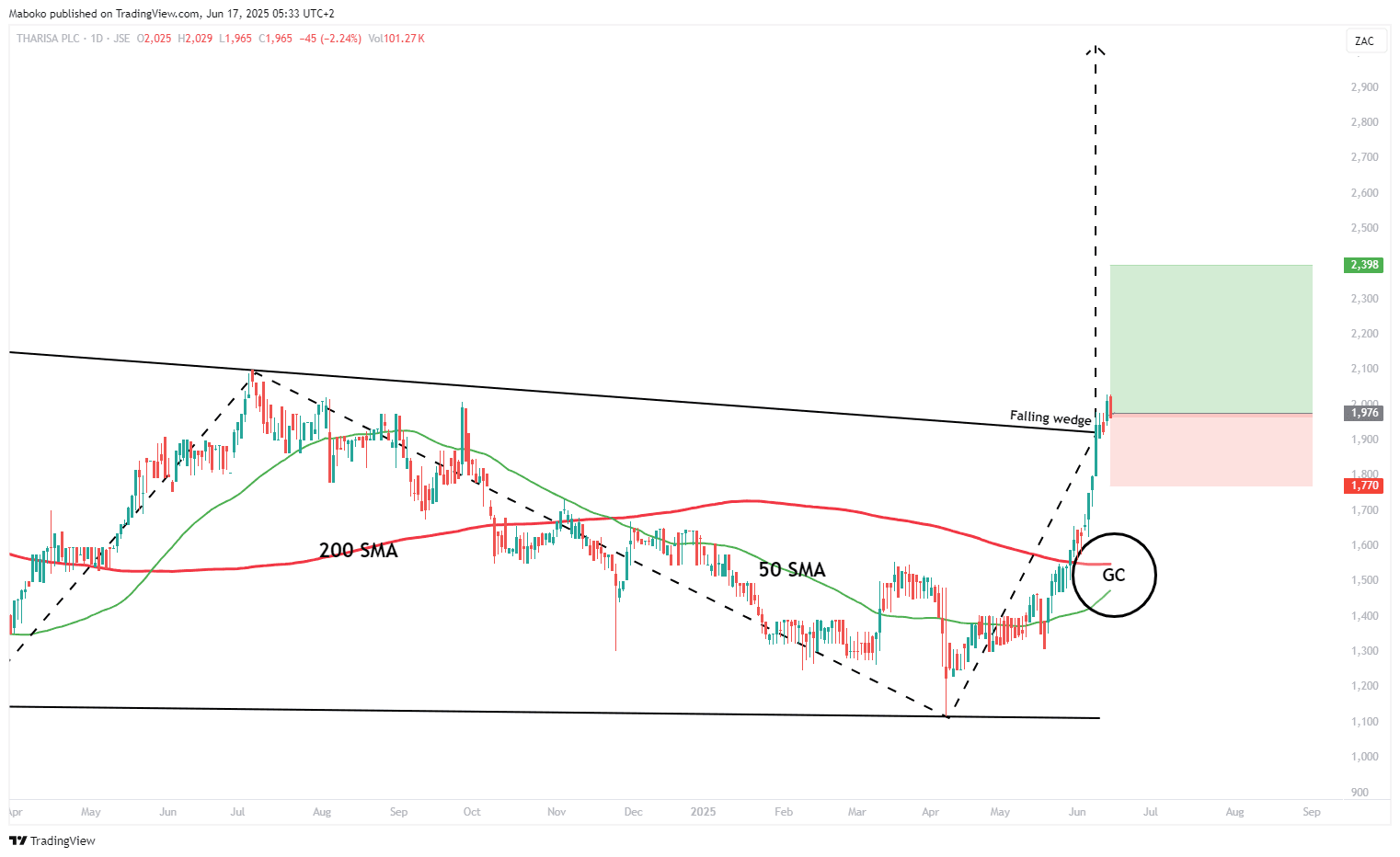

Tharisa Plc (THA): Tharisa Plc is a mining company with controlling interests in platinum group metals (PGMs) and chrome mining, processing operations, sales and logistics operations.

A falling wedge trading pattern has been confirmed with a breakout above the upper boundary at R19.40, signalling a potential bullish reversal. This breakout is further supported by the formation of a golden cross, where the 50-day simple moving average crosses above the 200-day SMA, indicating a shift in trend direction and strengthening the case for continued upward momentum.

A potential Buy/Long idea can be initiated, with the target set at R23.98 and the stop loss set at R17.70.

Information Technology

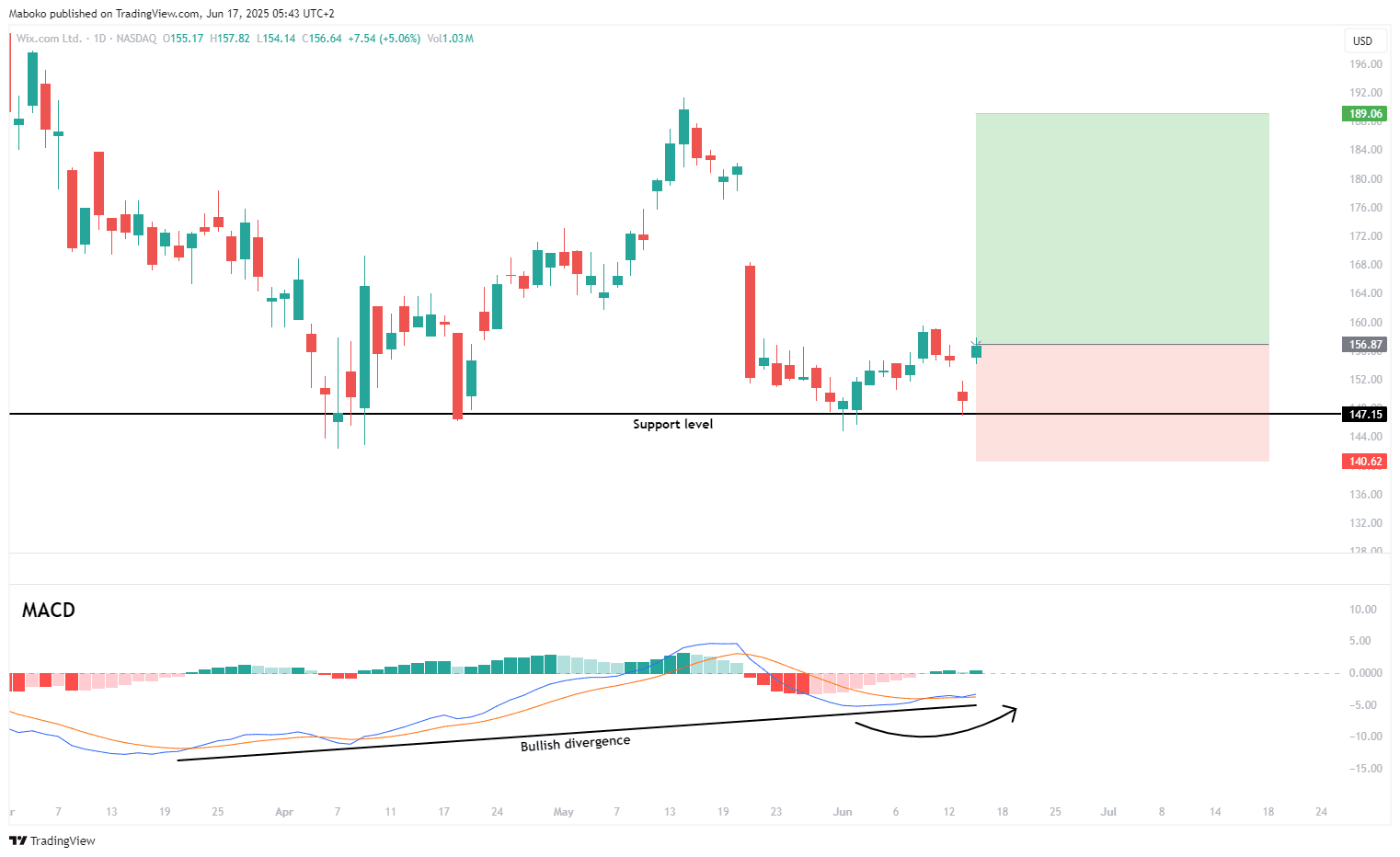

Wix.com Ltd. (WIX): Wix is in the business of cloud-based website design and development platforms. It offers web templates, editors, builders, search engine optimisation tools, logo making, web hosting, and email marketing services.

The price has tested the key support level at $147, and a potential double bottom pattern is unfolding, which would signal a bullish reversal if the price maintains its upward direction. As confluence, the moving average convergence divergence (MACD) has shown a bullish divergence across both support tests, indicating fading downward momentum and increasing probability of a trend shift in favour of the bulls.

A potential Buy/Long idea can be initiated, with the target set at $189.06 and the stop loss set at $140.62.

Information Technology

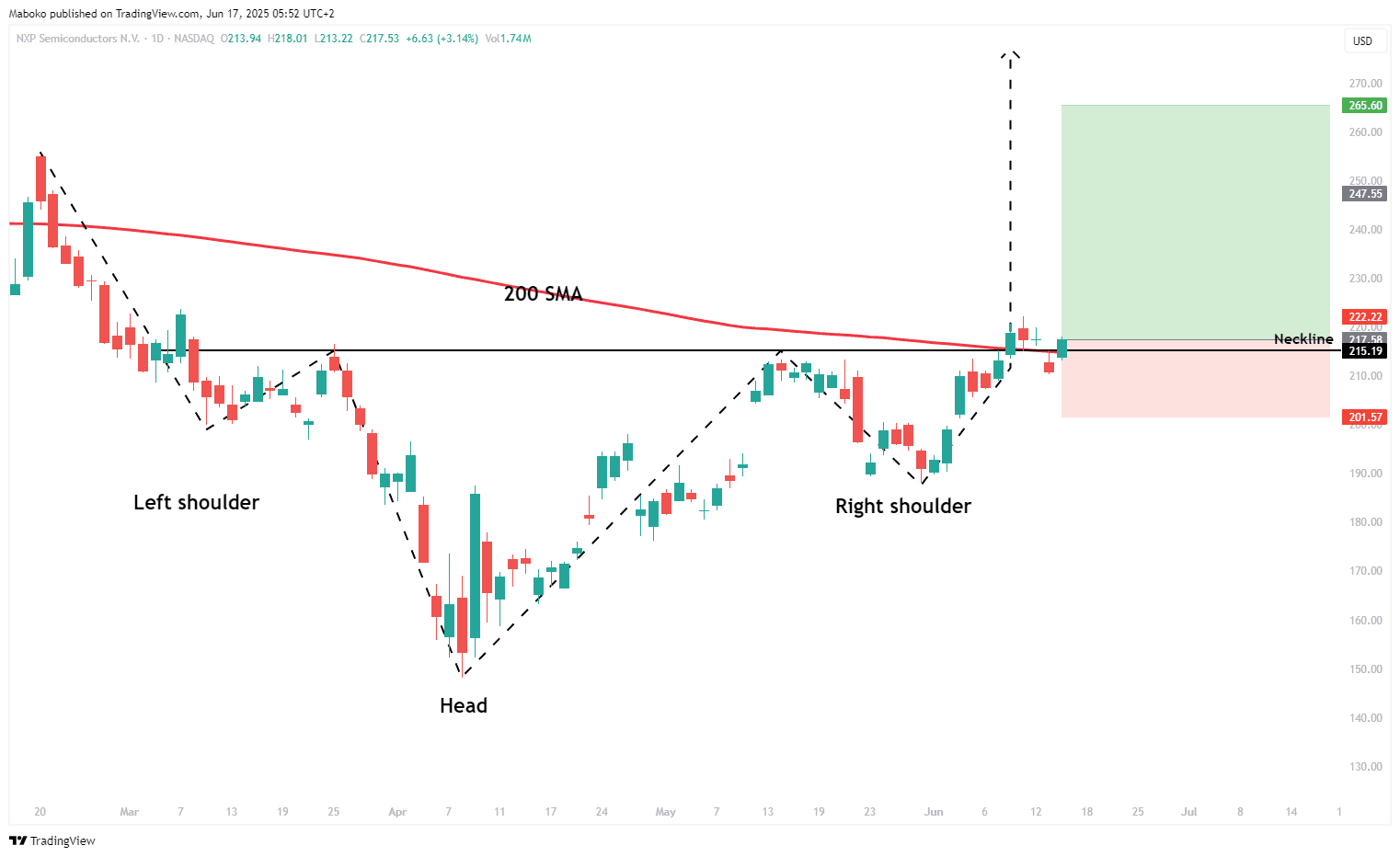

NXP Semiconductors NV (NXPI): NXP Semiconductors is a holding company that provides semiconductor solutions.

An inverse head and shoulders pattern has been confirmed with a breakout and close above the neckline at $215, signalling a bullish reversal. This move is further reinforced by the price closing above the 200-day simple moving average (SMA), suggesting that the longer-term trend has shifted in favour of the bulls.

A potential Buy/Long idea can be initiated, with the target set at $265.60 and the stop loss set at $201.57.

Technology

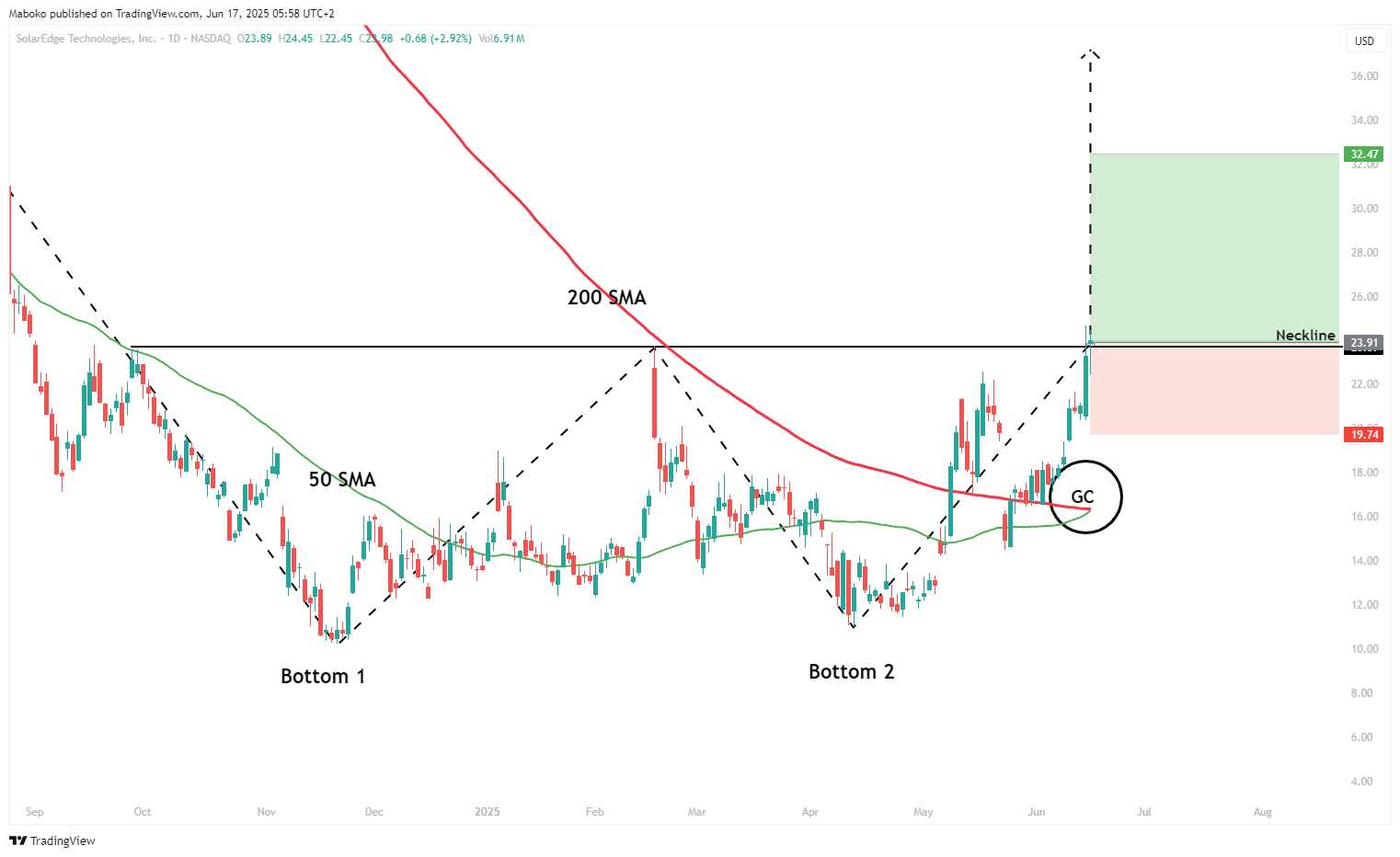

SolarEdge Technologies, Inc. (SEDG): SolarEdge Technologies develops energy technology, which provides inverter solutions.

A double bottom trading pattern has unfolded, confirmed by a close above the neckline at $23.70, indicating a potential trend reversal to the upside. This bullish signal is further strengthened by the occurrence of a golden cross, where the 50-day SMA has crossed above the 200-day SMA, suggesting a shift in long-term momentum in favour of the bulls.

A potential Buy/Long idea can be initiated, with the target set at $32.47 and the stop loss set at $19.74.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi