Consumer Services

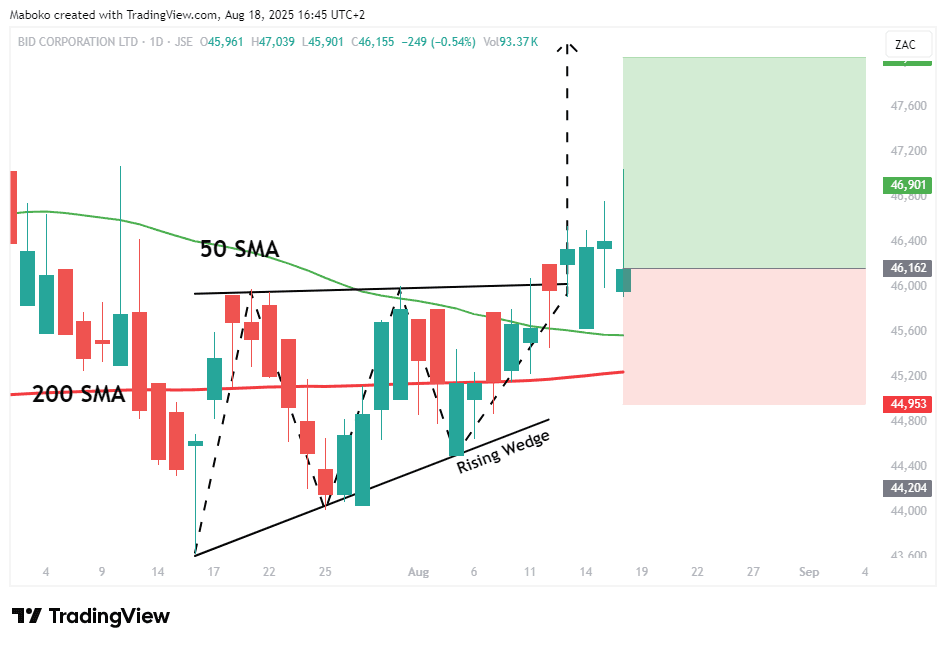

Bid Corporation Ltd (BID): BID Corporation Limited is in the business of offering comprehensive foodservice solutions. It operates in Australasia, the United Kingdom, Europe and emerging markets.

A rising wedge pattern has been confirmed with a close above R460. As confluence, the price is trading above both the 50-day and 200-day simple moving averages (SMAs), reinforcing the case for trend continuation.

A potential Buy/Long idea can be initiated, with the target set at R480.37 and the stop loss set at R449.53.

Consumer Services

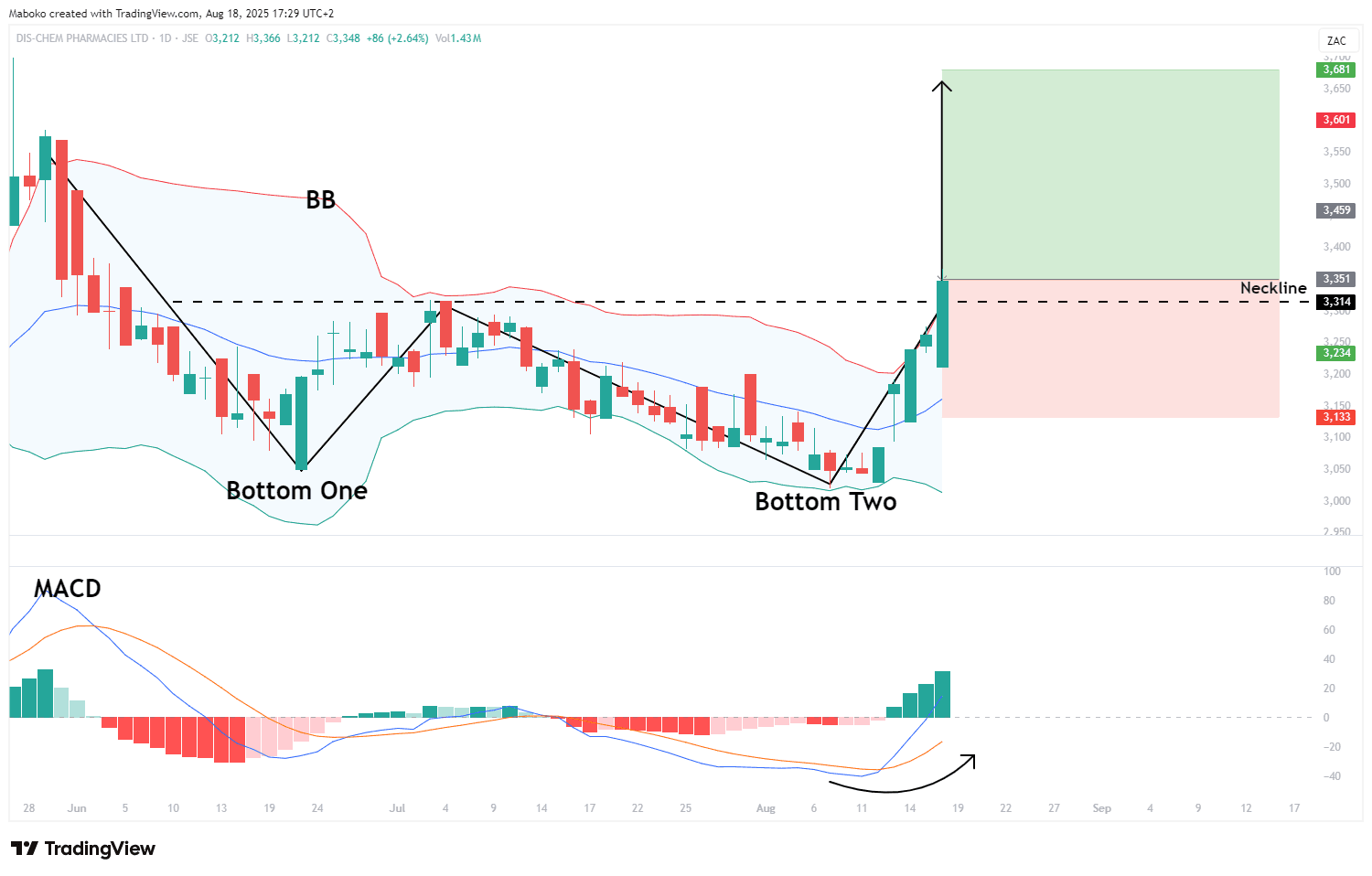

Dis-Chem Pharmacies Ltd (DCP): Dis-Chem Pharmacies Ltd. manufactures and retails pharmaceutical products. It also operates as a wholesaler through CJ Wholesale.

An inverted head and shoulders pattern has been confirmed with a close above the neckline at R33.14. As confluence, the share price also closed above the expanding upper Bollinger Band, signalling strong upward momentum, while the moving average convergence divergence’s (MACD’s) bullish crossover further supports the upward trend.

A potential Buy/Long idea can be initiated, with the target set at R36.81 and the stop loss set at R31.33.

Consumer Goods

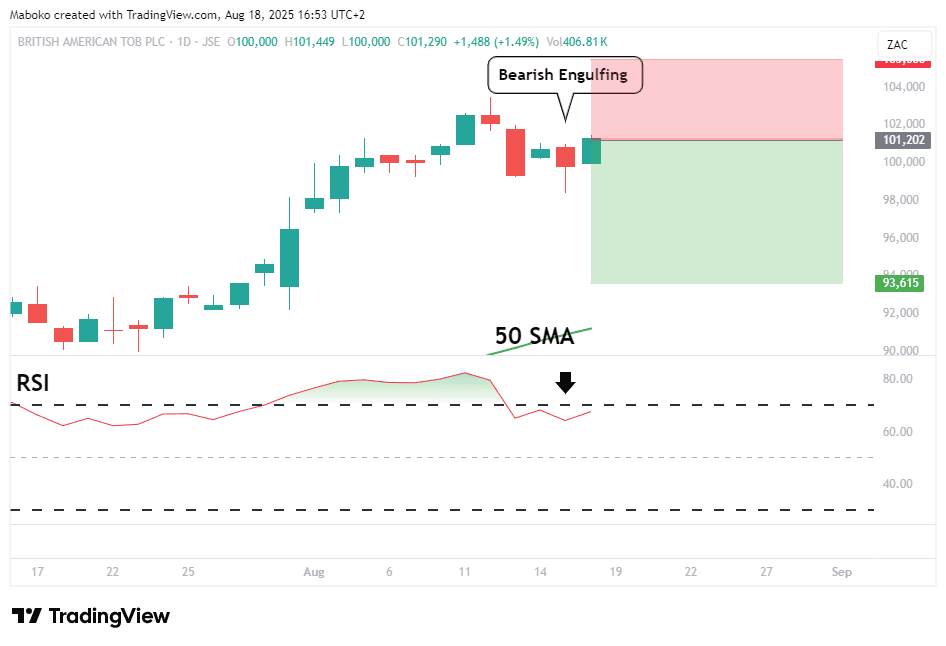

British American Tobacco plc (BTI): British American Tobacco plc is a holding company that manufactures and distributes tobacco products. Its brands include Kent, Dunhill, Lucky Strike, and Pall Mall. The company operates in the United States, Asia-Pacific and Middle East, Americas, Sub-Saharan Africa, Europe, and North Africa (ENA).

The share price has been in a strong upward trend. Recently, the relative strength indicator (RSI) exited overbought territory and a bearish engulfing candlestick formed, signalling a potential pullback. The price is now likely to test the 50-day SMA or revisit the previous high at R934.54 as support.

A speculative Sell/Short idea can be initiated, with the target set at R936.15 and the stop loss set at R1055.

Materials

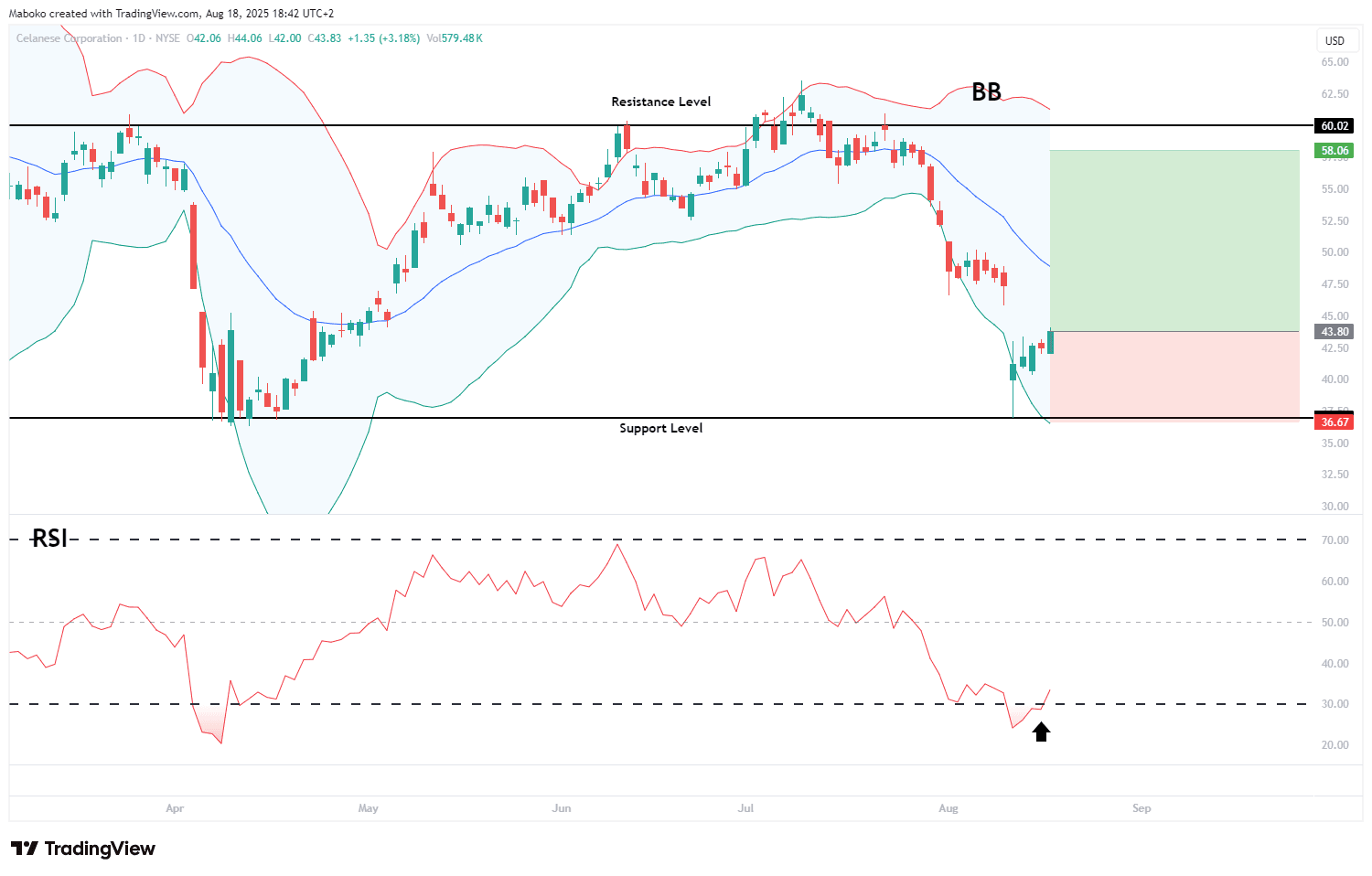

Celanese Corp (CE): Celanese is in the business of technology and speciality materials.

The stock price has been consolidating between resistance at $60 and support at $37, with a recent test of support followed by a rebound higher. The price also touched the lower bound of the Bollinger Band, while the relative strength indicator (RSI) moved out of oversold territory, both suggesting support for potential upward momentum.

A potential Buy/Long idea can be initiated, with the target set at $58.06 and the stop loss set at $36.67.

Communication Services

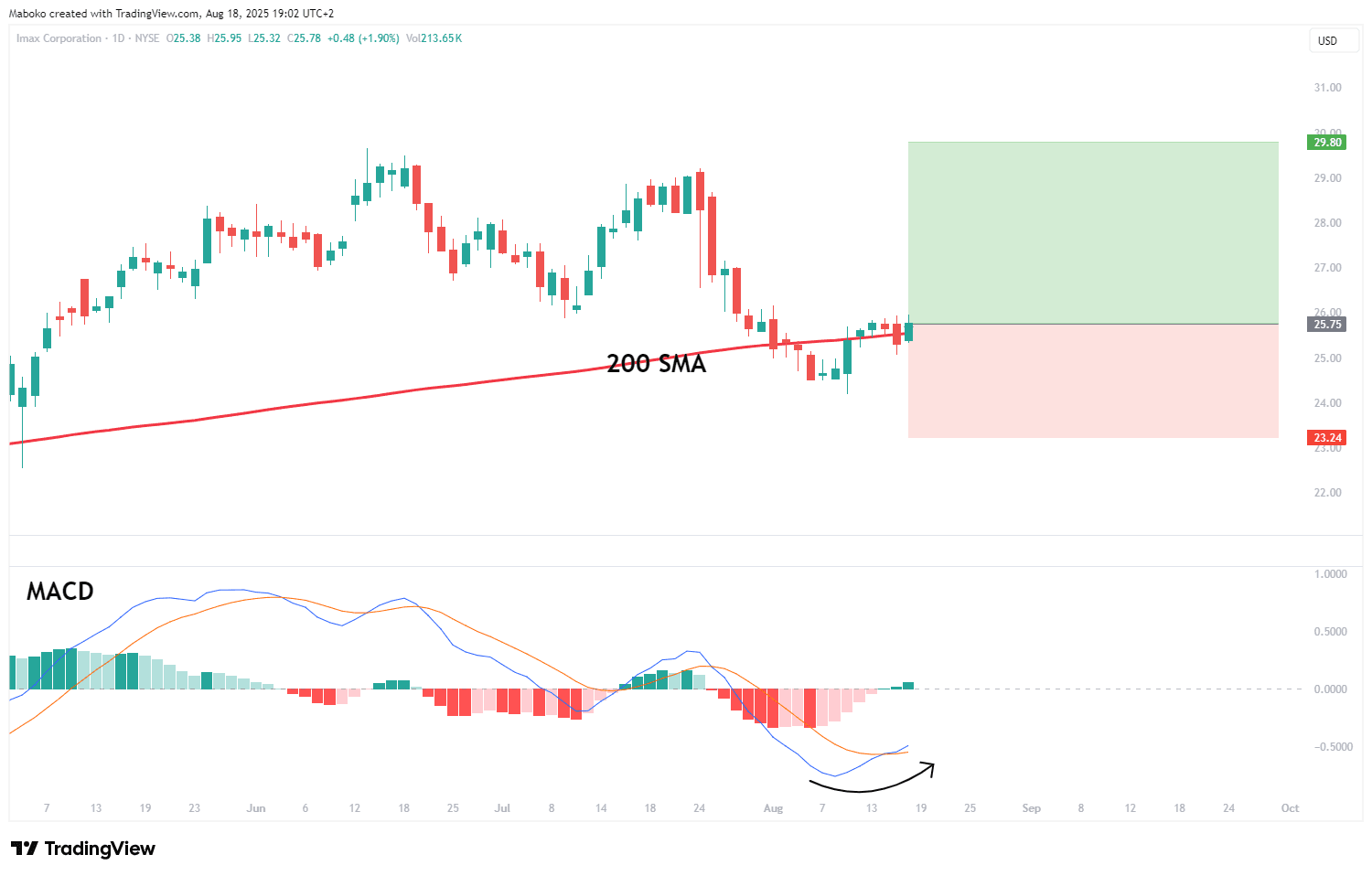

IMAX Corp (IMAX): IMAX is an entertainment technology company in the motion picture technologies and presentations business.

The stock price recently tested the 200-day simple moving average (SMA) as a dynamic support level and closed above it, indicating that bulls remain in control of the trend. Adding to this outlook, the moving average convergence divergence (MACD) has made a bullish crossover, reinforcing the case for upward momentum.

A potential Buy/Long idea can be initiated, with the target set at $29.80 and the stop loss set at $23.24.

Information Technology

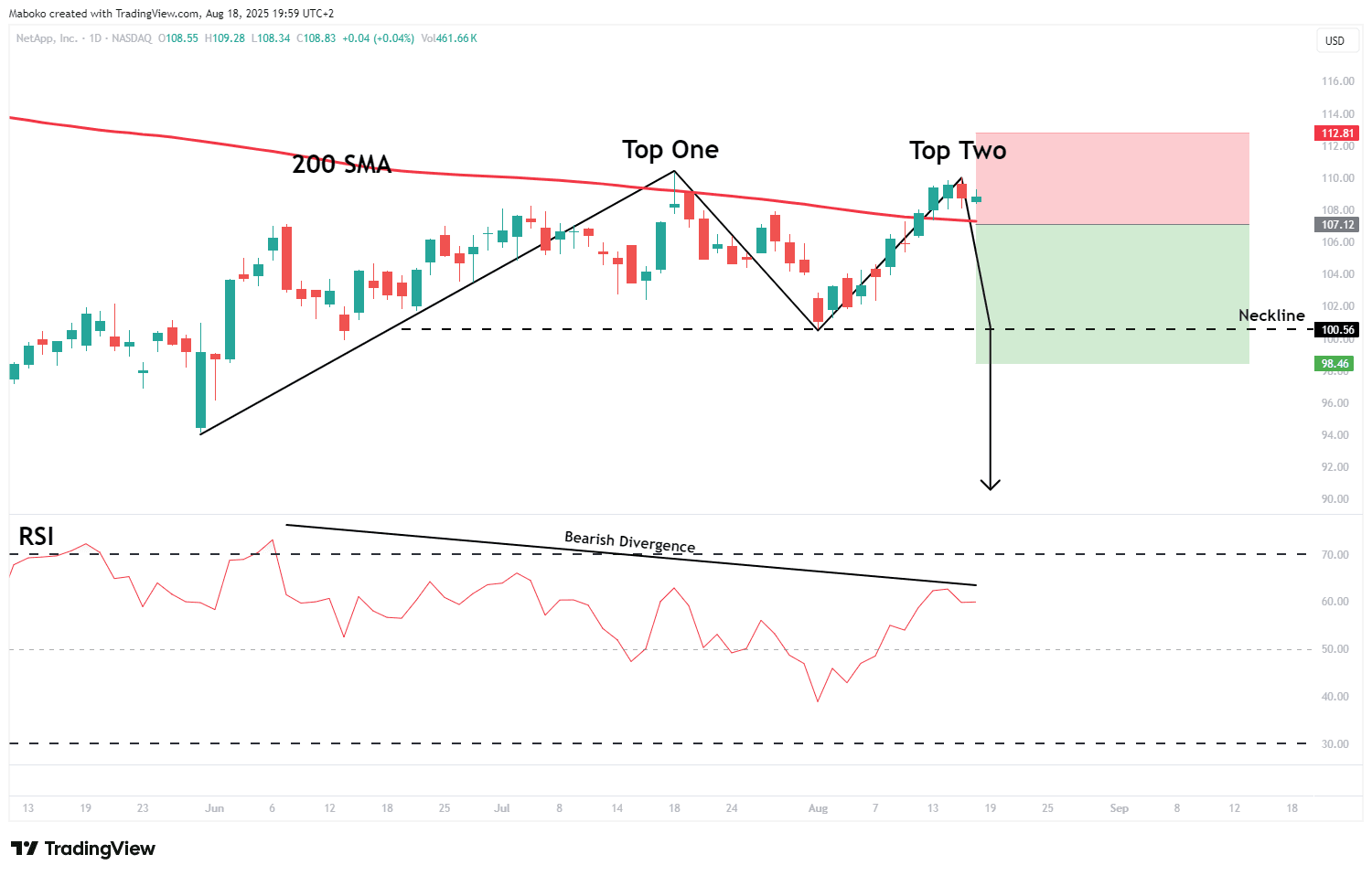

NetApp, Inc (NTAP): NetApp is in the business of software, systems, and services to manage and share data on-premises. The firm also offers private and public clouds worldwide.

A double top pattern is unfolding as the price tests the 200-day SMA, which is acting as dynamic resistance. A close below this level would confirm further downside, supported by an RSI bearish divergence that signals weakening upward momentum.

A speculative Sell/Short idea can be initiated, with the target set at $98.46 and the stop loss set at $112.81.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi