Basic Materials

Anglo American Plc (AGL): Anglo American Plc is a mining company that explores and mines precious base metals and ferrous metals, including copper, platinum group metals (PGMs), iron ore, coal, nickel, and manganese. The company operates through De Beers.

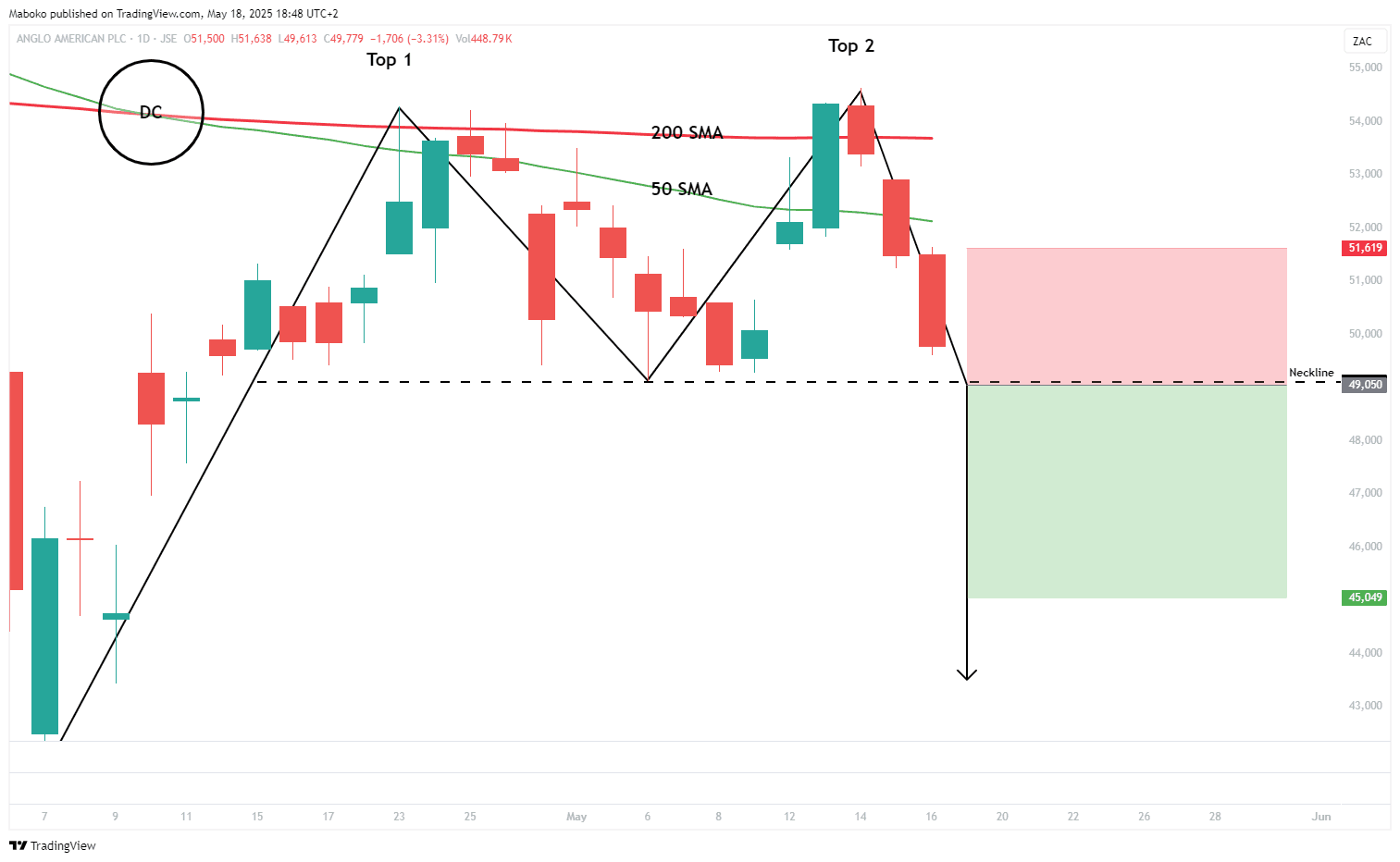

A double top pattern is forming, with both peaks near the R540 region and the neckline at R490, indicating a potential reversal from the recent uptrend. This bearish setup is supported by confluence from the 200-day simple moving average (SMA), which is acting as dynamic resistance. Additionally, a death cross has occurred, where the 50-day SMA has crossed below the 200-day SMA, further reinforcing the downward momentum and signalling that bears may be gaining control.

A speculative Sell/Short idea can be initiated once the price closes below R490.50, with the target set at R450.49 and the stop loss set at R516.19.

Consumer Goods

British American Tobacco Plc (BTI): British American Tobacco Plc is a holding company that manufactures and distributes tobacco products. Its brands include Kent, Dunhill, Lucky Strike, and Pall Mall. The company operates in the United States, Asia-Pacific, the Middle East, the Americas, Sub-Saharan Africa, Europe, and North Africa (ENA).

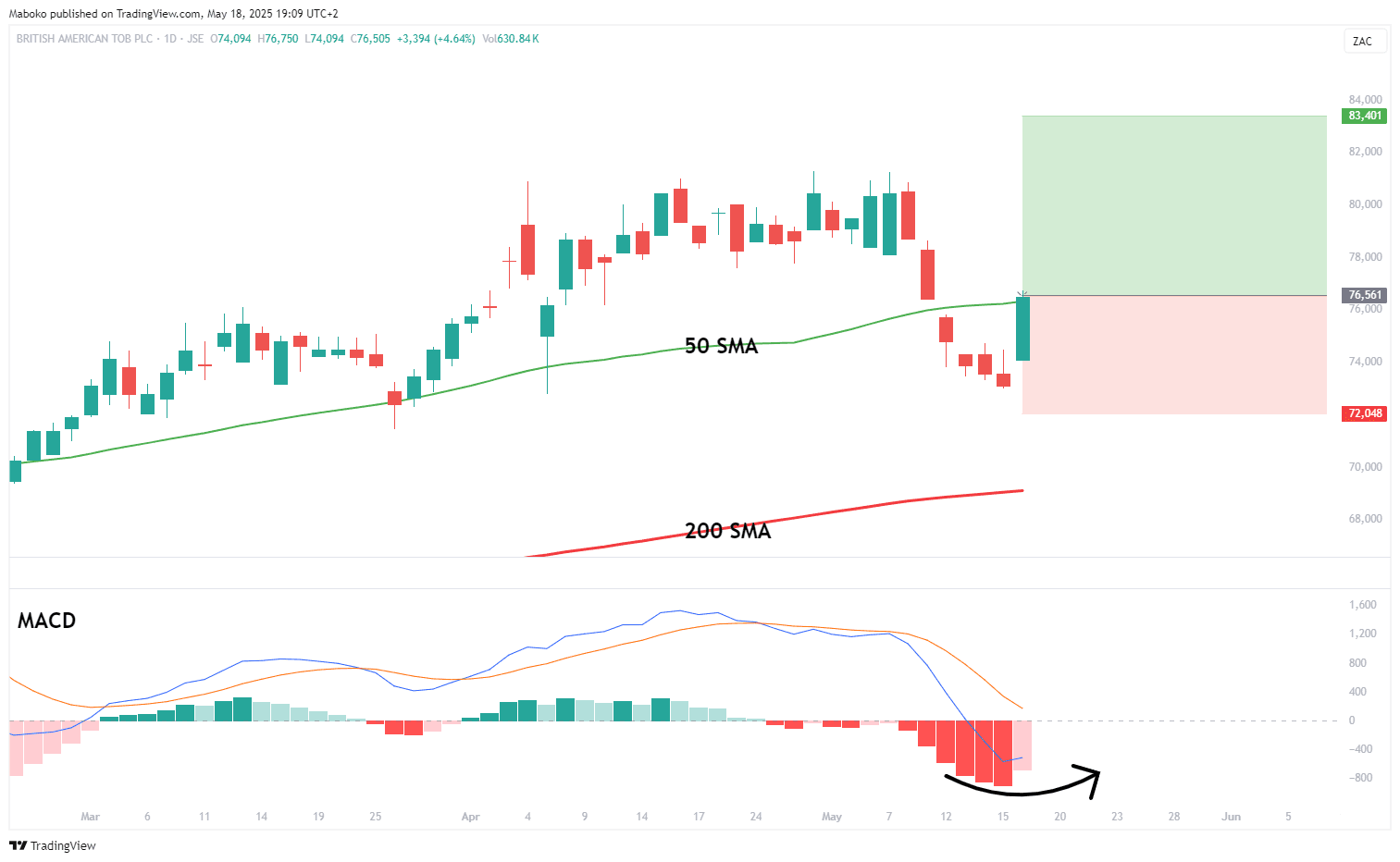

On Friday, the share price closed above the 50-day SMA, reinforcing the potential for upward trend continuation, especially with the price already trading well above the 200-day SMA, which signals strong bullish momentum. While the moving average convergence divergence (MACD) has not yet confirmed a bullish crossover, it appears poised to do so, which would potentially validate the strengthening upward momentum.

A potential Buy/Long idea can be initiated, with the target set at R834.01 and the stop loss set at R720.48.

Consumer Goods

Astral Foods Ltd. (ARL): Astral Foods Ltd. produces and sells animal feed, broiler genetics, day-old chicks, and hatching eggs. It also focuses on breeder, broiler production, and further processing operations, and distributes various key poultry brands.

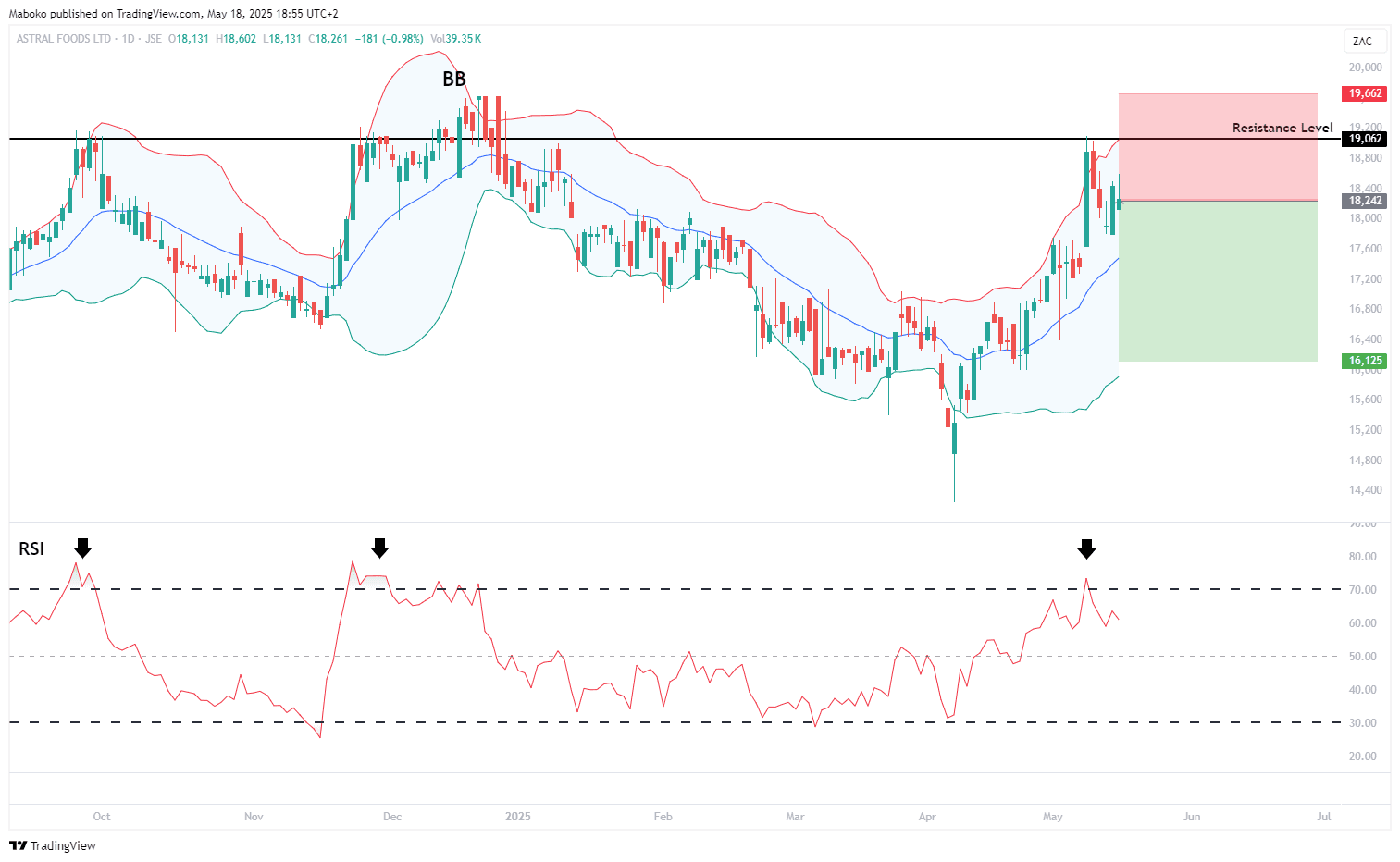

The share price has tested the major resistance level at R190, a level it has consistently failed to break above since September 2024. Notably, recent attempts have seen the price closing above the upper band of the Bollinger Bands, indicating overextension. As confluence, the relative strength indicator (RSI) is approaching overbought territory, signalling that bullish momentum may be fading and a potential pullback or reversal could follow.

A speculative Sell/Short idea can be initiated with the target set at R161.25 and the stop loss set at R196.62.

Health Care

Eli Lilly & Co. (LLY): Eli Lilly is in the discovery, development, manufacture, and sale of pharmaceutical products.

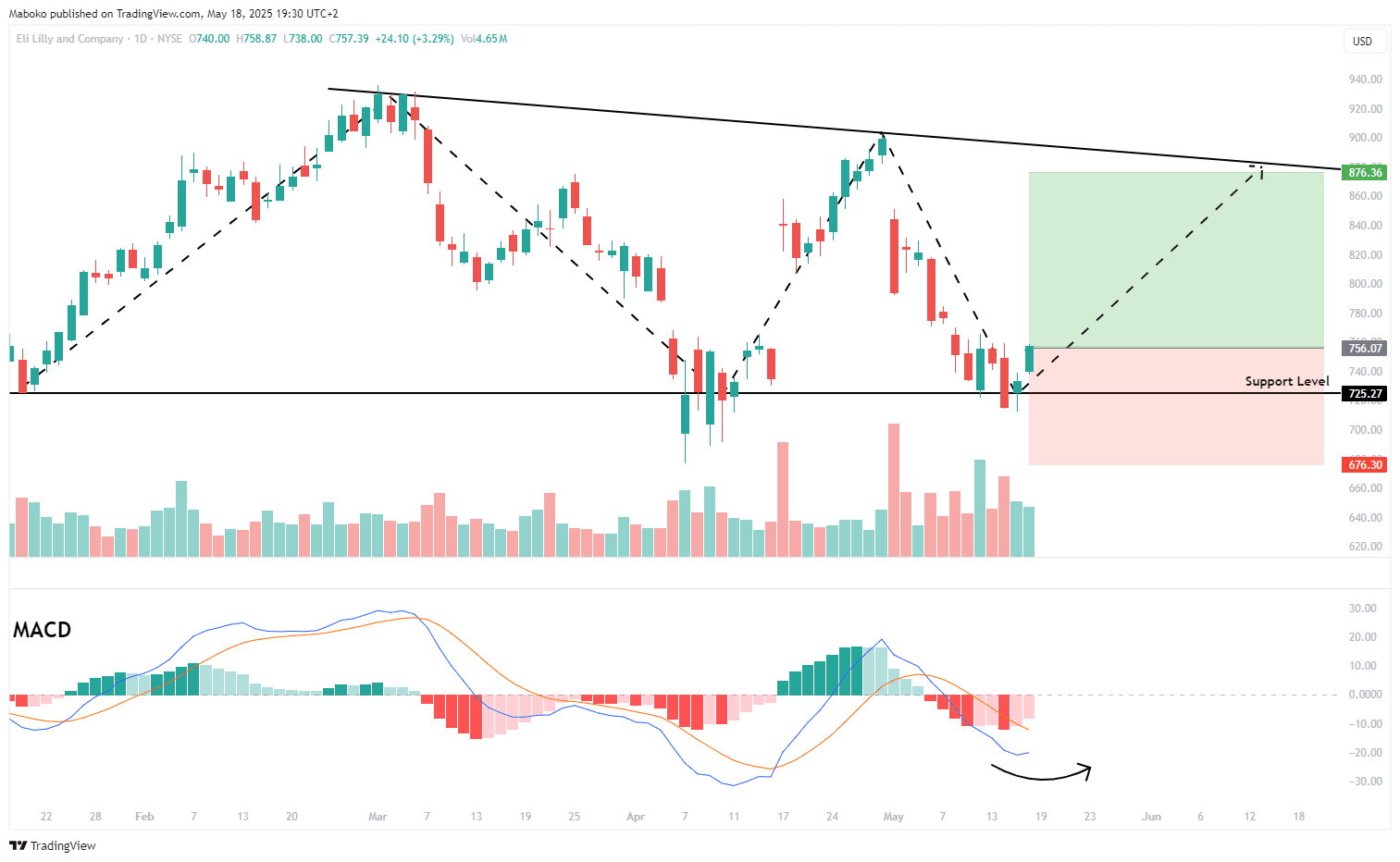

The price recently tested a major support level around the $725 region and is moving higher to retest the descending trendline, which has been defined by a series of lower highs. The moving average convergence divergence (MACD) is poised for a bullish crossover, signalling a potential shift in momentum to the upside and increasing the likelihood of a breakout from the downtrend.

A potential Buy/Long idea can be initiated, with the target set at $876.36 and the stop loss set at $676.30.

Financials

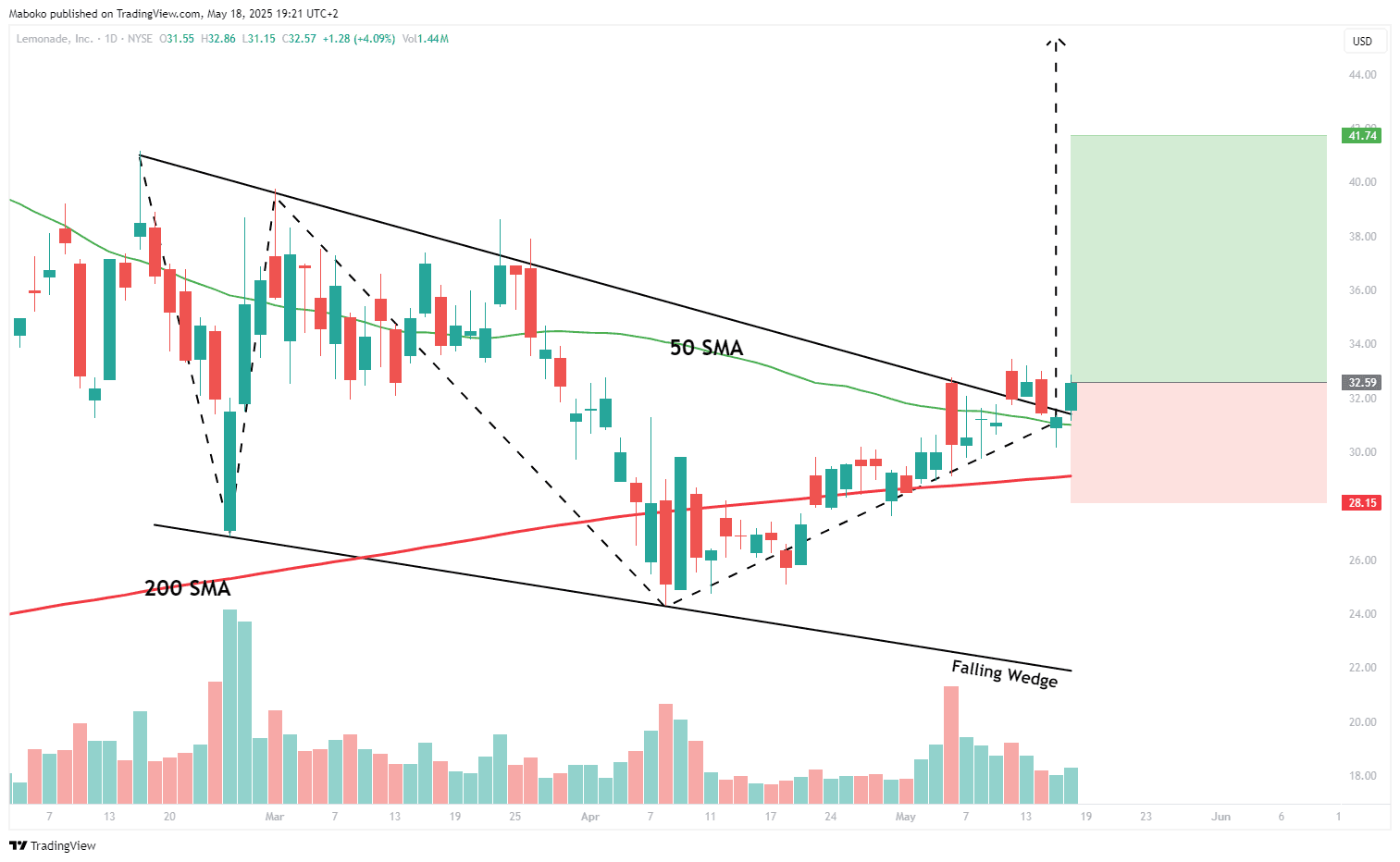

Lemonade, Inc. (LMND): Lemonade is a holding company that provides renters', homeowners', and pet insurance.

A falling wedge trading pattern has been confirmed with a breakout at $32, indicating a potential reversal from the prior downtrend. As confluence, the share price has closed above the 50-day simple moving average (SMA), reinforcing the likelihood of a bullish trend continuation as momentum shifts in favour of the bulls.

A potential Buy/Long idea can be initiated, with the target set at $41.74 and the stop loss set at $28.15.

Consumer Discretionary

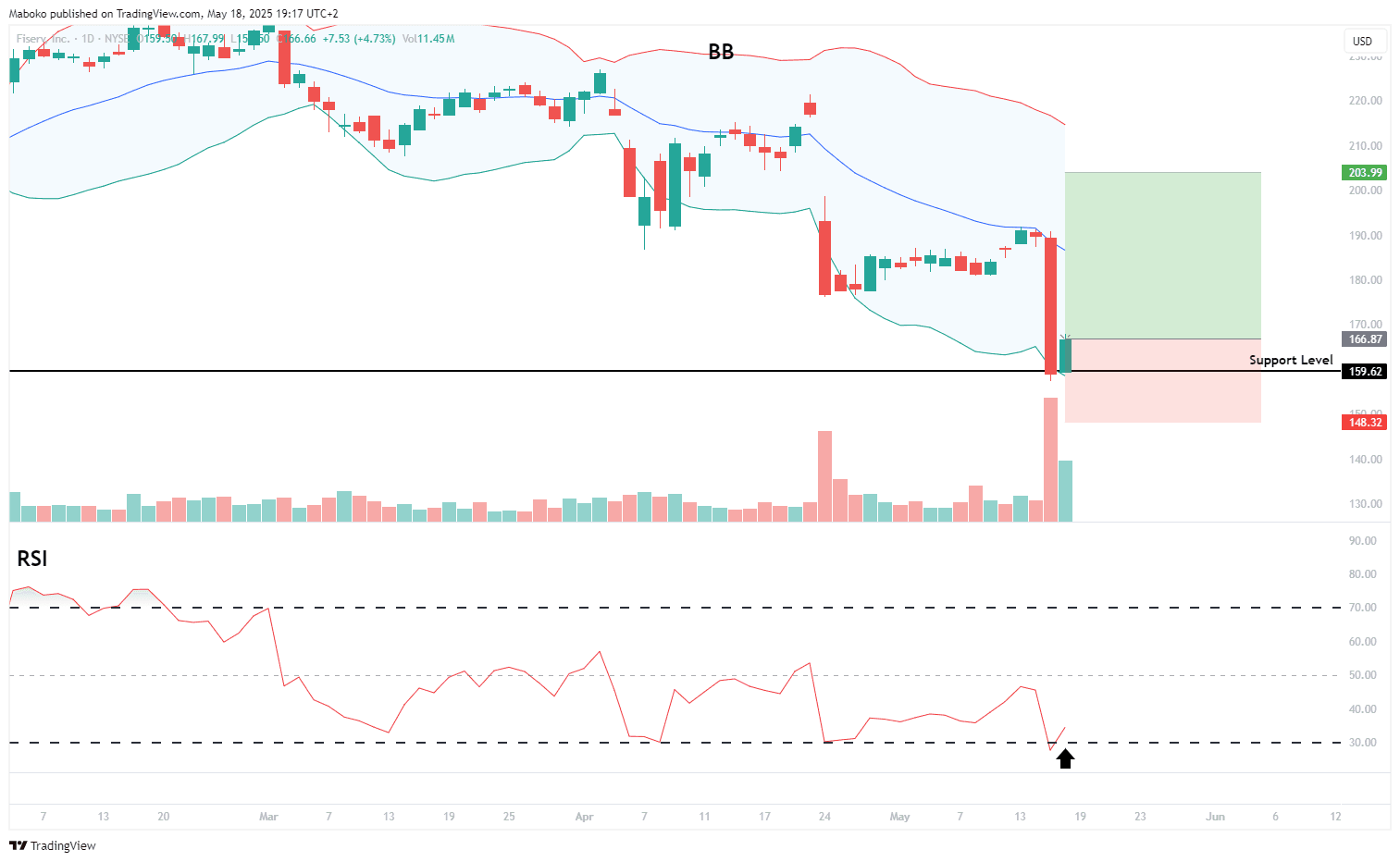

Fiserv, Inc. (FI): Fiserv is in the financial services technology business.

On Friday, the price tested the support level around the $160 region while touching the lower band of the Bollinger Bands – a setup that often suggests a potential reversal. As confluence, the relative strength indicator (RSI) is in oversold territory, signalling that selling pressure may be exhausted and upward momentum could be imminent. This combination of technical indicators supports the case for a short-term bullish rebound.

A potential Buy/Long idea can be initiated, with the target set at $203.99 and the stop loss set at $148.32.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi