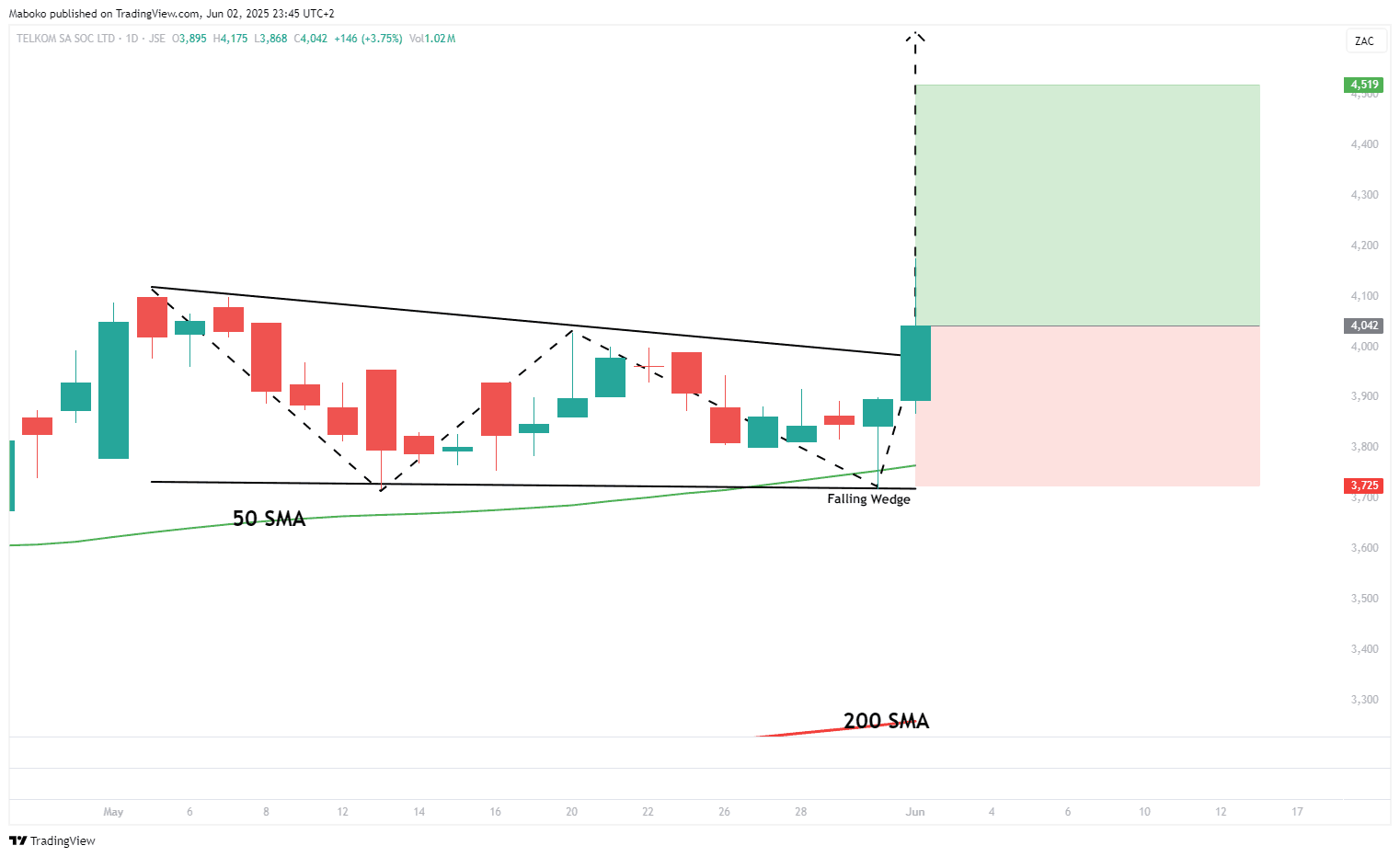

Telecommunications

Telkom SA SOC Ltd. (TKG): Telkom SA SOC Ltd. is in the business of data, integrated voice, fixed-line, mobile, data centre solutions, and information technology. It operates through Openserve, Telkom Consumer, BCX, and Gyro.

The share price has confirmed a bullish breakout from a falling wedge pattern, with the breakout occurring above the upper boundary at R40. This move followed a successful test of the 50-day simple moving average (SMA), indicating a potential continuation of the upward trend. As further confirmation, the share remains well above the 200-day SMA, suggesting that bullish sentiment continues to dominate the broader trend.

A potential Buy/Long idea can be initiated, with the target set at R45.19 and the stop loss set at R37.25.

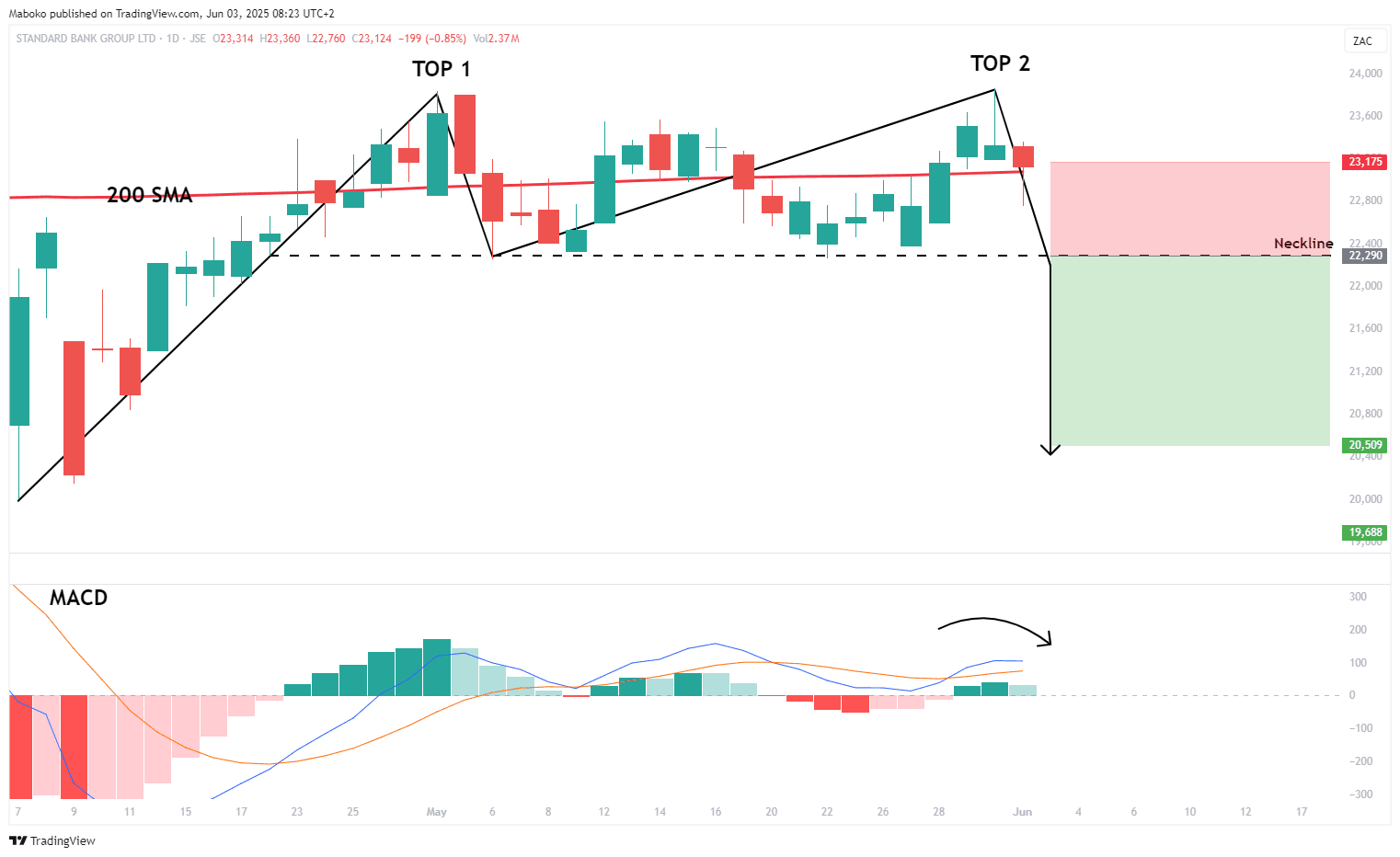

Financials

Standard Bank Group Ltd. (SBK): Standard Bank Group Ltd. is a holding company that provides integrated financial and related solutions.

A double top pattern is unfolding, with both peaks forming around the R238 level and the neckline established at R222.90. The 200-day SMA has acted as dynamic resistance during both peaks, reinforcing the bearish setup. However, downside momentum is not yet confirmed, as the moving average convergence divergence (MACD) has yet to cross under, suggesting caution until a clear signal validates the potential trend reversal.

A speculative Sell/Short idea can be initiated once the price closes below the neckline and a MACD bearish crossover occurs, with the target set at R205.09 and the stop loss set at R231.75.

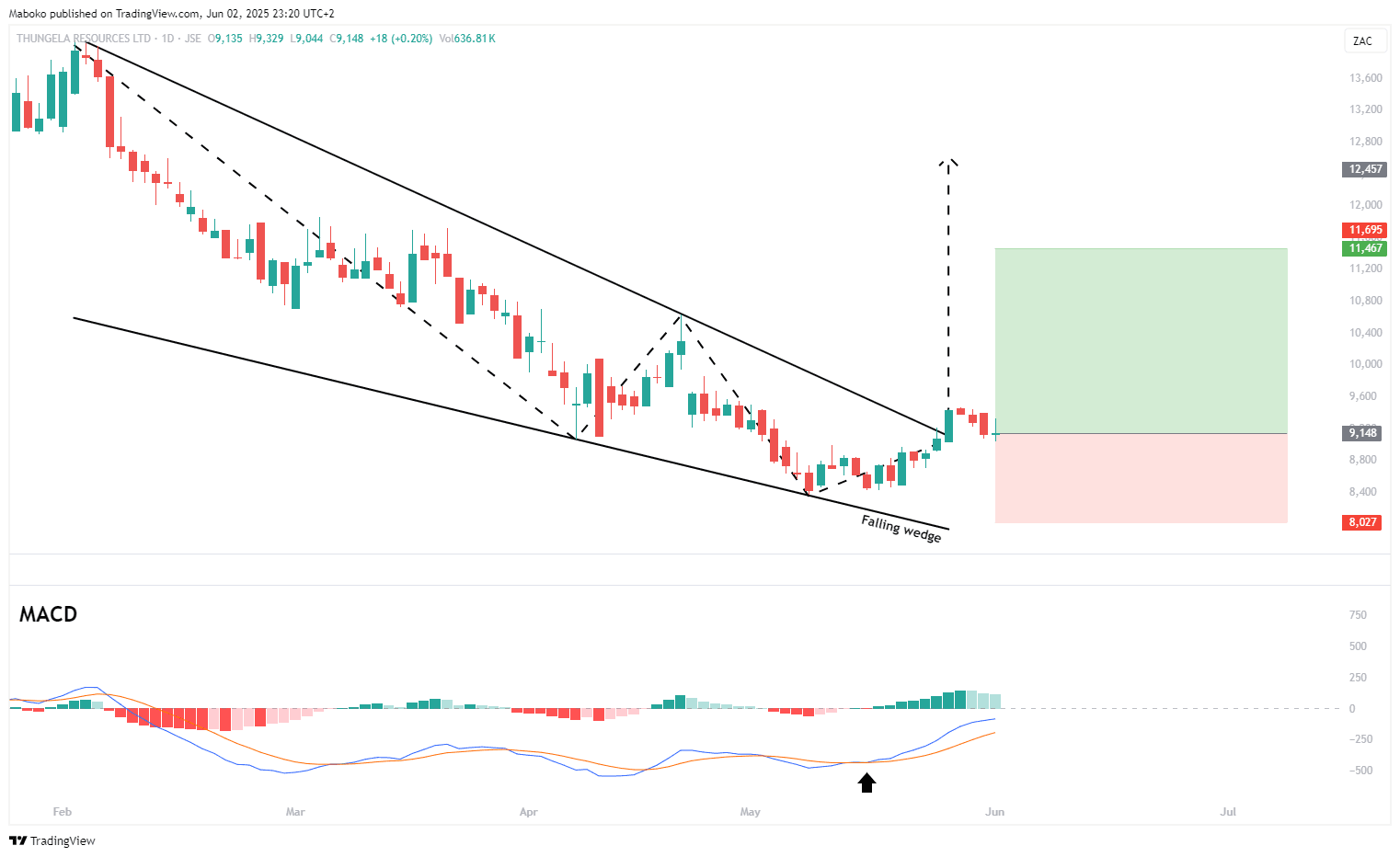

Basic Materials

Thungela Resources Ltd. (TGA): Thungela Resources Ltd. is in the production and marketing of thermal coal reserves. It operates in South Africa and Australia.

A falling wedge trading pattern has unfolded, with the share price breaking out above the upper boundary at R91.50, a classic bullish signal. The MACD is in positive territory and still trending upward, indicating that bullish momentum is intact and further upside may be on the cards. This breakout suggests a potential shift from consolidation to trend continuation.

A potential Buy/Long idea can be initiated, with the target set at R114.67 and the stop loss set at R80.27.

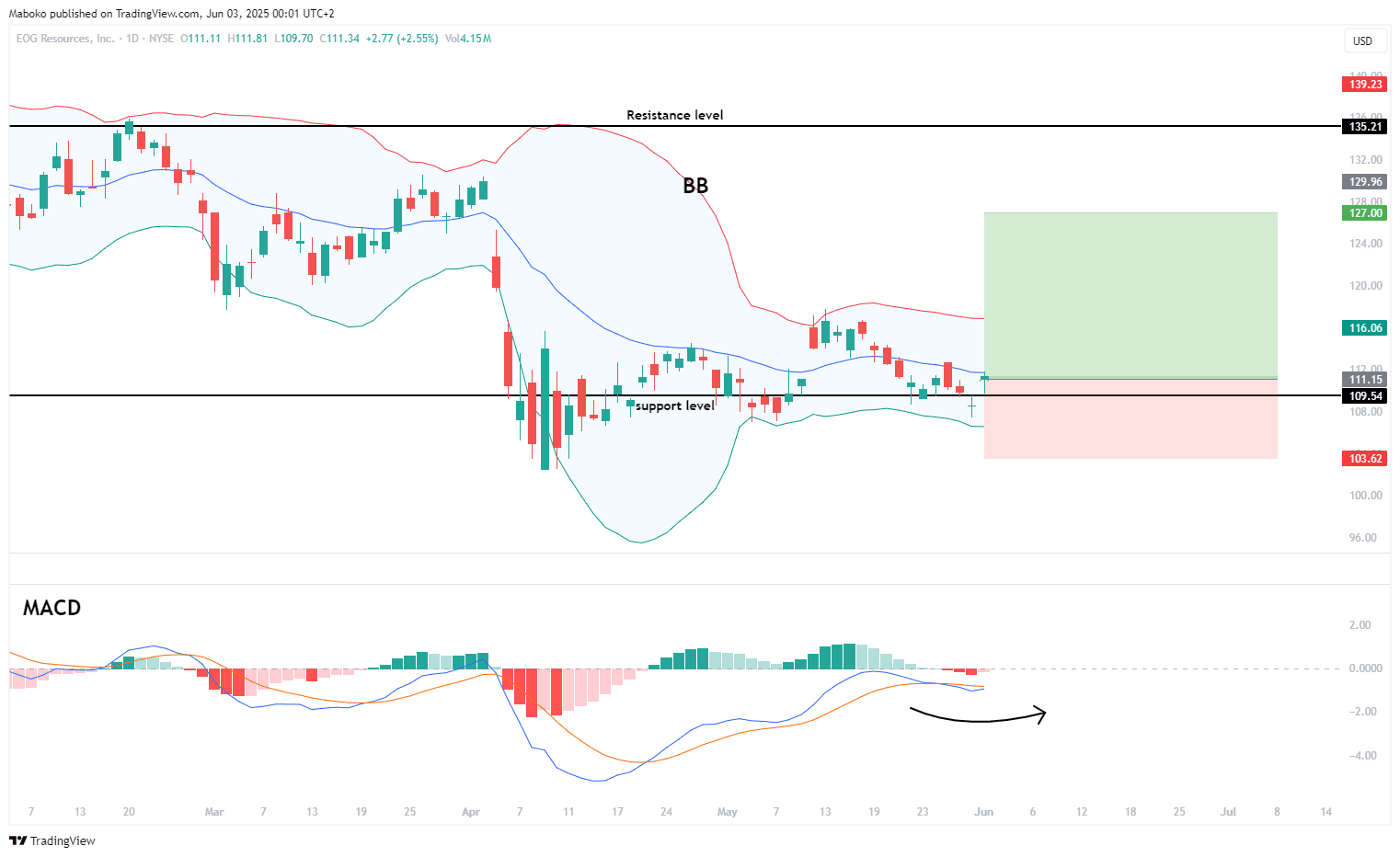

Energy

EOG Resources, Inc. (EOG): EOG is in the exploration, development, production, and marketing of crude oil and natural gas.

The share has been trading in a sideways consolidation range since 2022, bounded by resistance at $135.21 and support at $109.54. Recently, the price tested the support zone while simultaneously touching the lower band of the Bollinger Bands, indicating potential exhaustion of selling pressure. As confluence, the moving average convergence divergence (MACD) has formed a bullish crossover, signalling a possible shift in momentum, favouring the upside and a potential move back toward the upper end of the range.

A potential Buy/Long idea can be initiated, with the target set at $127 and the stop loss set at $103.62.

Consumer Discretionary

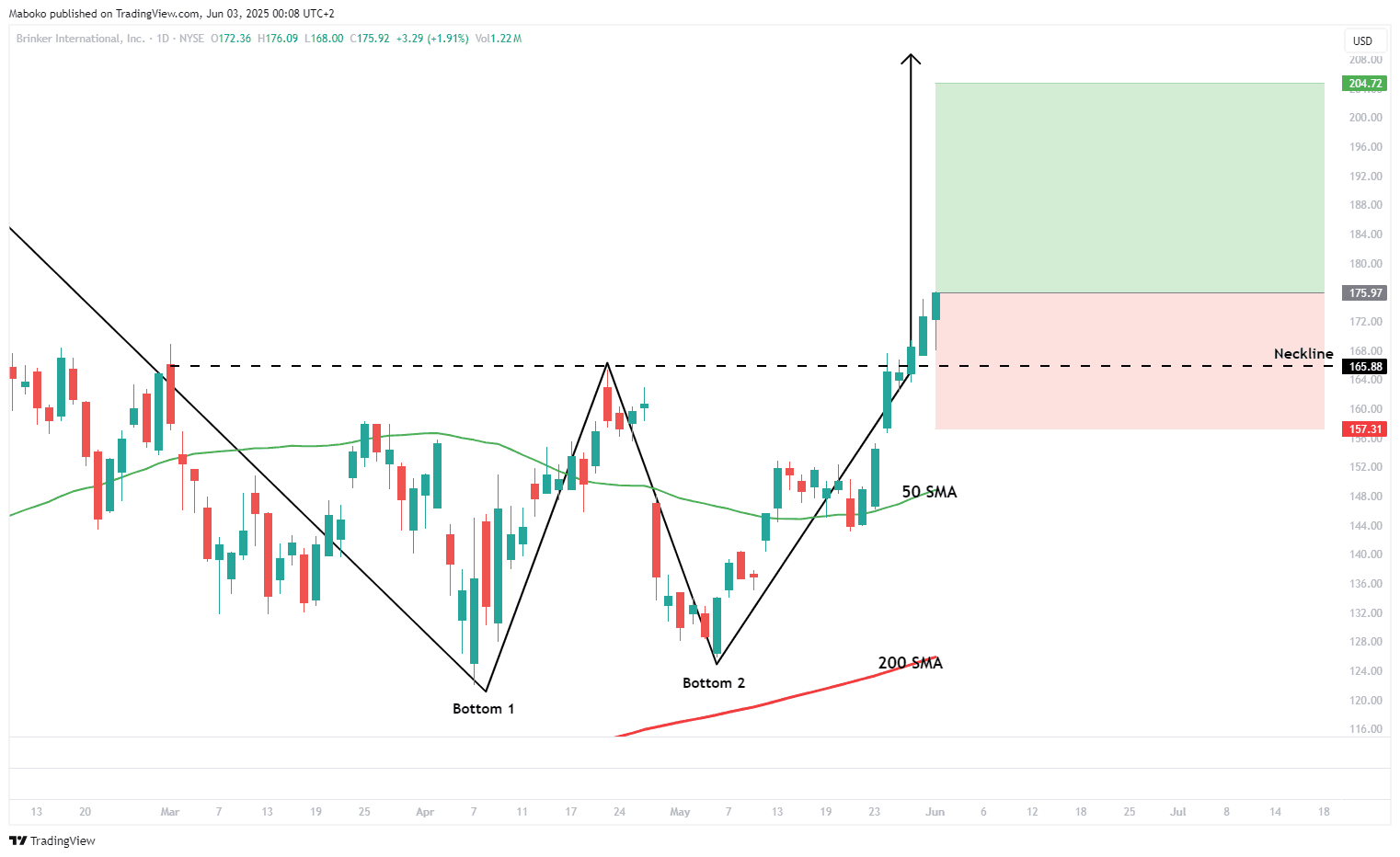

Brinker International, Inc. (EAT): Brinker owns, develops, and franchises Chili's Grill and Bar and Maggiano's Little Italy restaurant brands.

A double bottom pattern has unfolded, with the price successfully breaking above the neckline at the $165 region after forming two troughs around $125. This breakout confirms a bullish reversal pattern. As confluence, the share is trading well above the 200-day simple moving average (SMA), reinforcing the view that bulls remain in control of the broader trend and that upward momentum may continue.

A potential Buy/Long idea can be initiated, with the target set at $204.72 and the stop loss set at $157.31.

Information Technology

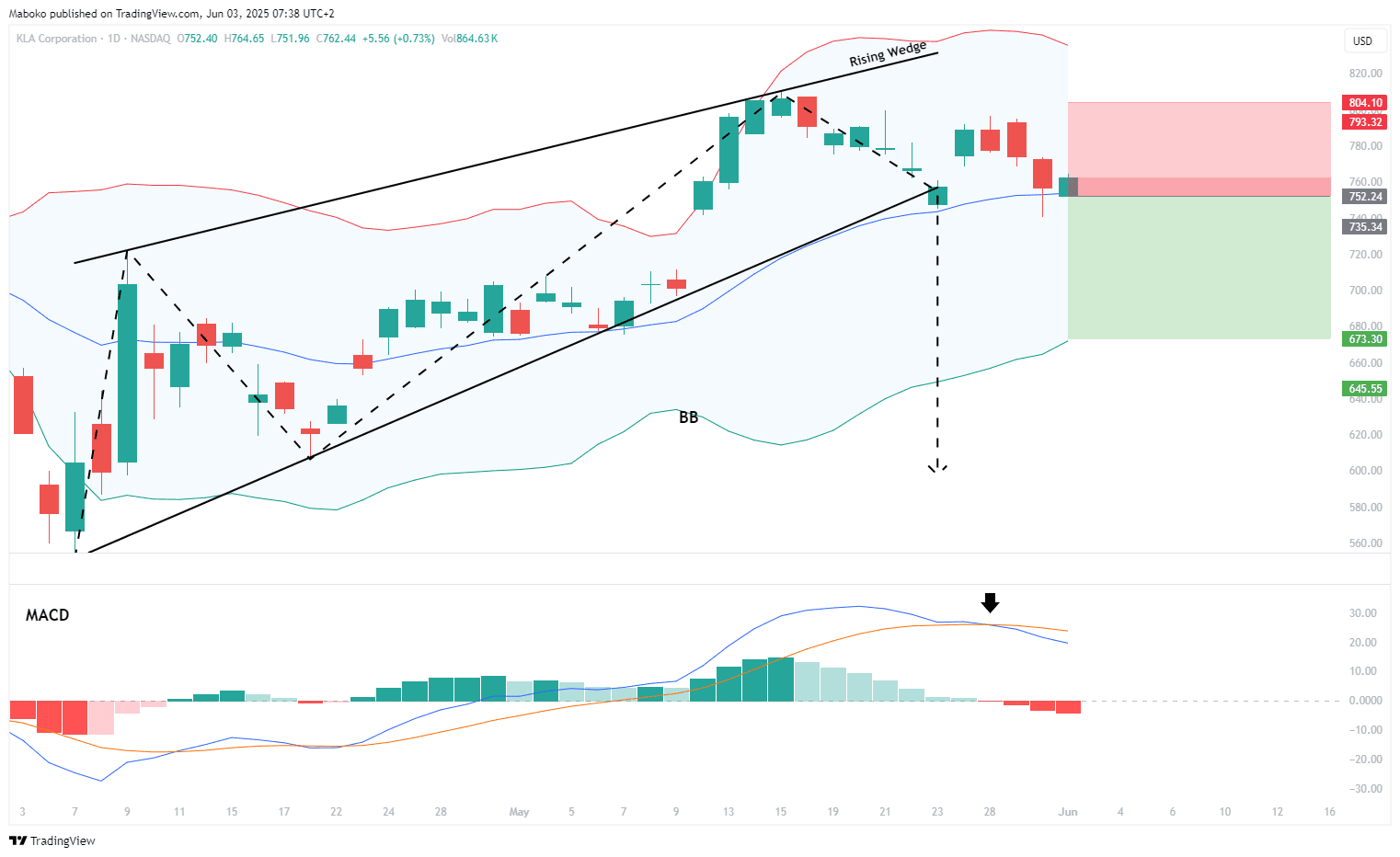

KLA Corp. (KLAC): KLA is in the supply of process control and yield management solutions for the semiconductor and related nano-electronics industries.

A rising wedge trading pattern has unfolded with a bearish breakout below the lower boundary at $757, indicating potential downside. The price previously tested the upper band of the Bollinger Bands, but failure to hold that level and a potential close below the midline of the band suggests increasing bearish pressure. This is further supported by a bearish MACD cross, reinforcing the likelihood of continued downward momentum toward the next support level near the lower Bollinger Band.

A speculative Sell/Short idea can be initiated, with the target set at $673.30 and the stop loss set at $804.10.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi