Telecommunications

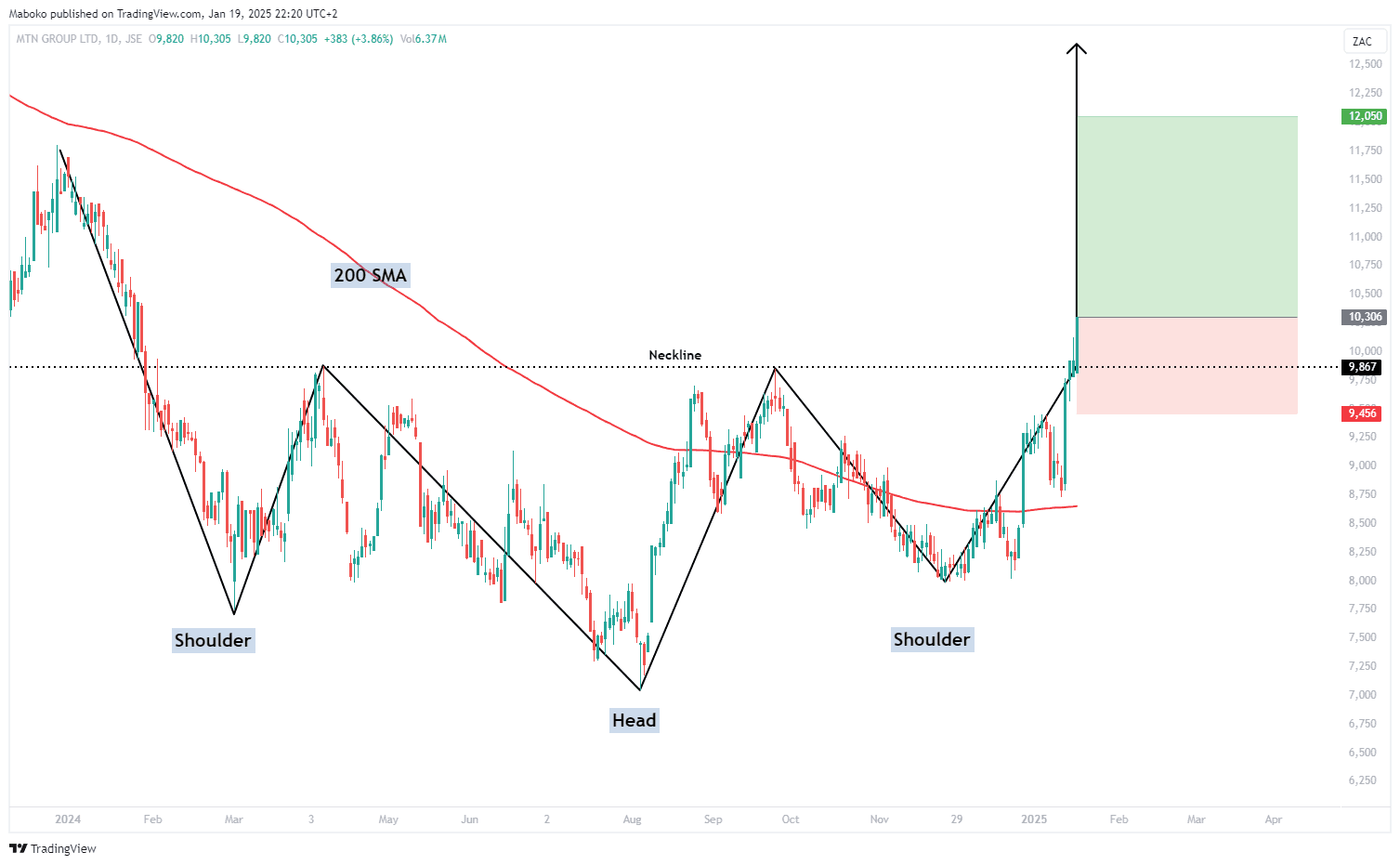

MTN Group Ltd. (MTN): MTN Group Ltd. offers voice, data, fintech, digital, enterprise, wholesale, and application programming interface services. It operates in South Africa, Nigeria, Southern and East Africa, West and Central Africa, the Middle East, and North Africa.

The share price has confirmed a bullish breakout from an inverted head and shoulders pattern at R98.67, indicating a potential trend reversal. Additionally, the price has closed above the 200-day simple moving average (SMA), reinforcing that bulls are now in control of the trend.

A Buy/Long idea can be initiated with a stop loss set at R94.56 and the target set at R120.50.

Financials

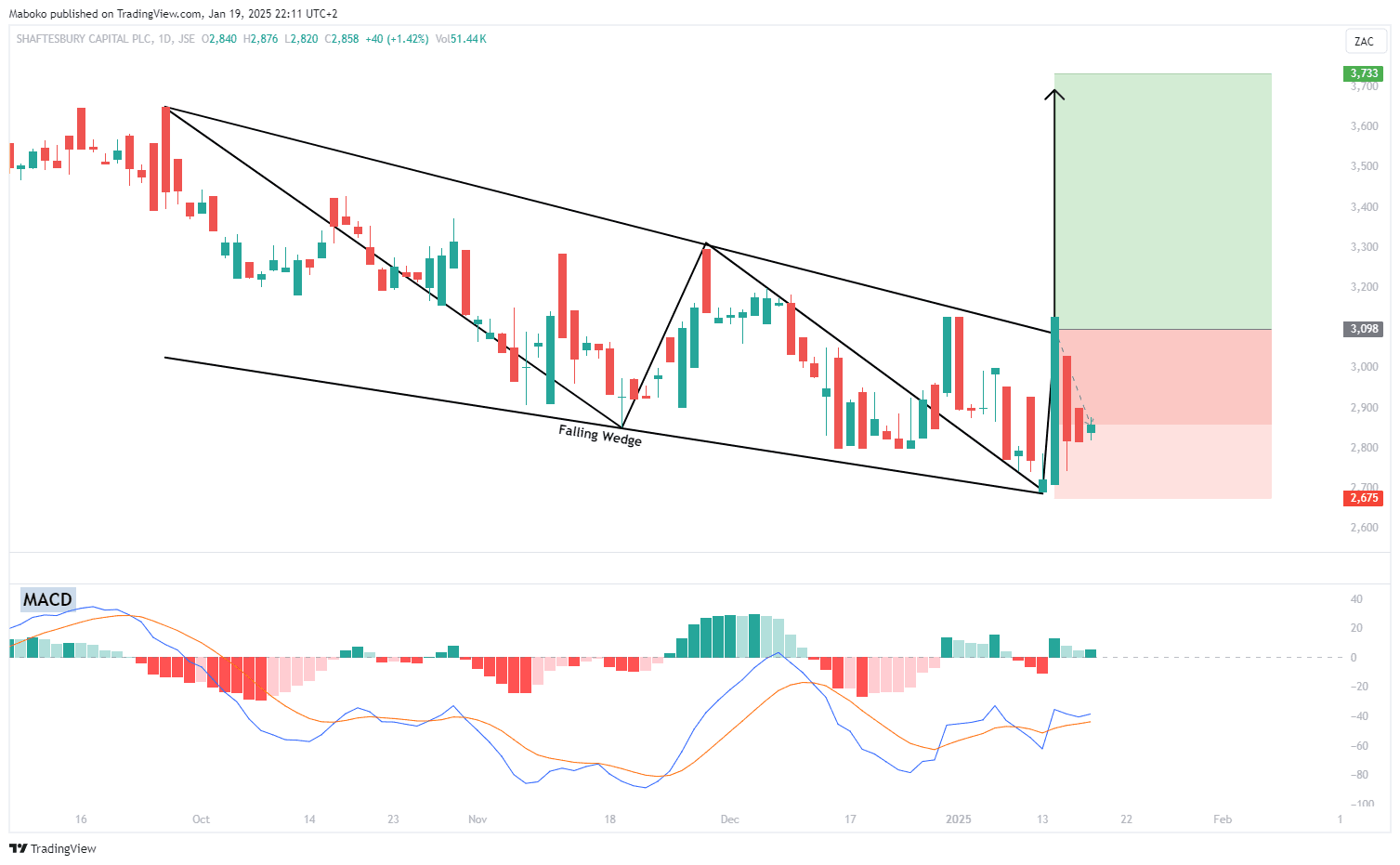

Shaftesbury Capital Plc (SHC): Shaftesbury operates as a real estate investment trust that invests in London's West End including Covent Garden, Carnaby, Soho, Chinatown, and Fitzrovia.

The share price is trading within a falling wedge pattern and has not yet confirmed a bullish breakout. However, the moving average convergence divergence (MACD) has signalled a bullish crossover, indicating potential upward momentum.

A potential Buy/Long can be initiated with the target set at R37.33 and stop loss set at R26.75.

Financials

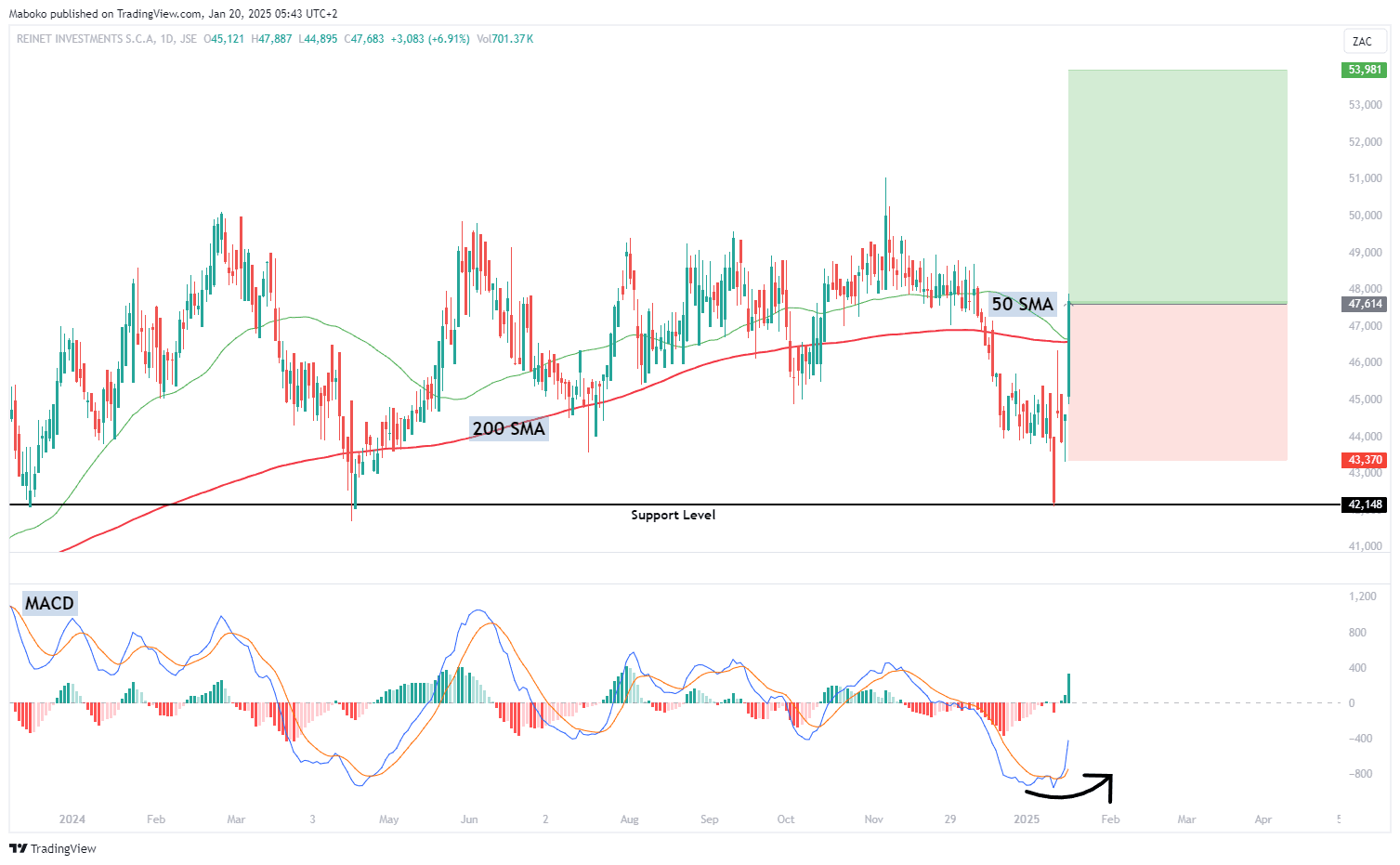

Reinet Investments (RNI): Reinet Investments is an investment company for listed and unlisted equities, bonds, real estate, and derivative instruments.

The share price recently tested a significant support level at R421.48. On Friday, it surged and closed above both the 50-day and 200-day SMAs, indicating that bulls are in control of the trend. Additionally, the MACD has made a bullish crossover, suggesting upward momentum is building.

This presents an opportunity to Long/Buy with the target set at R539.81 and stop loss set at R433.70.

Information Technology

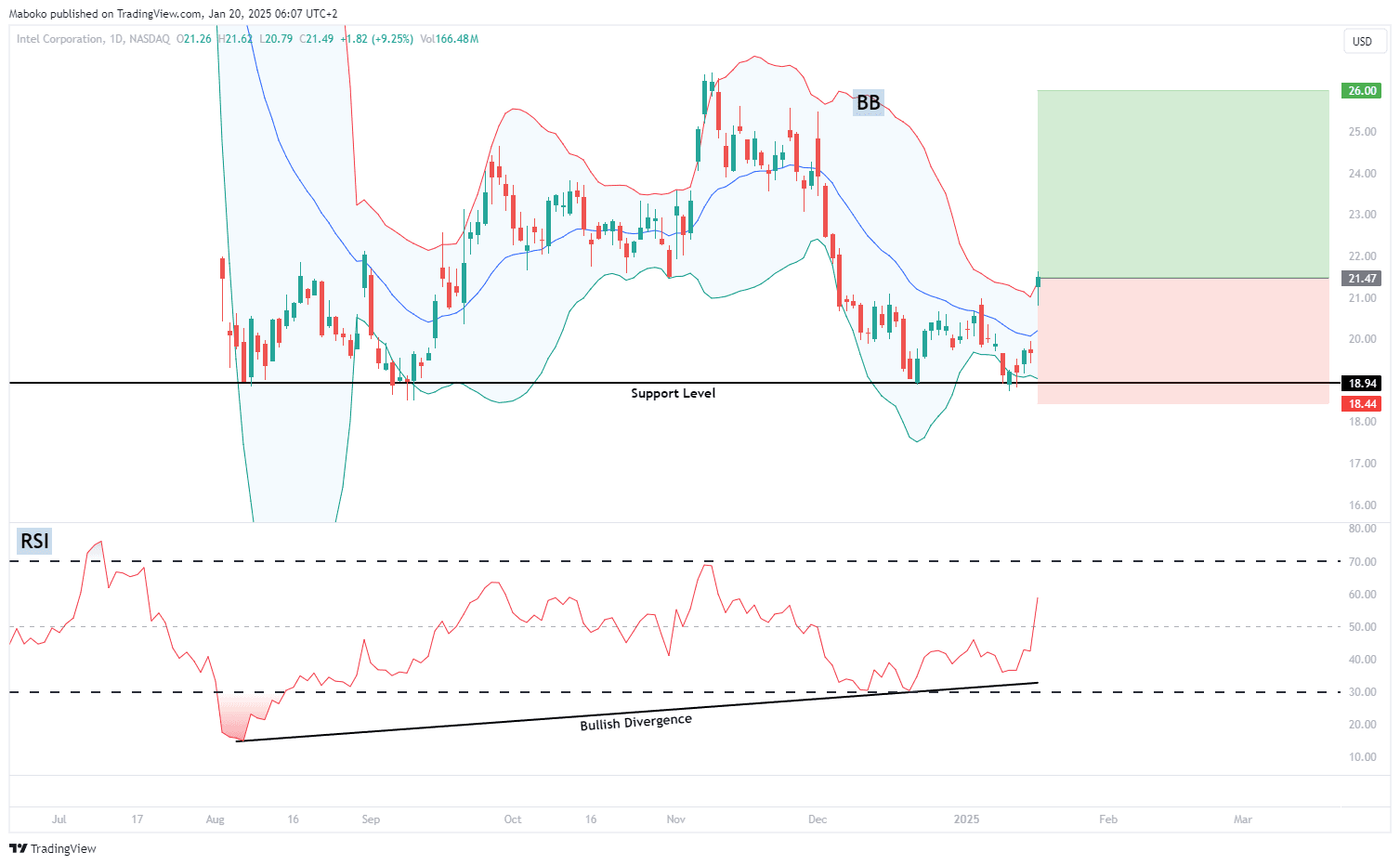

Intel Corp. (INTC): Intel Corp. designs, manufactures, and sells computer products and technologies. It delivers computer, networking, data storage, and communications platforms.

The share price has tested a major support level around the $18 region. It has also closed above the upper Bollinger Band (BB), indicating a potential continuation in the current upward direction. Furthermore, the Relative Strength Index (RSI) has shown a bullish divergence, suggesting that downward momentum is weakening and favouring a shift to upward momentum.

A potential Buy/Long idea can be initiated with the take profit (TP) set at $26.00 and the stop loss (SL) set at $18.44.

Communication Services

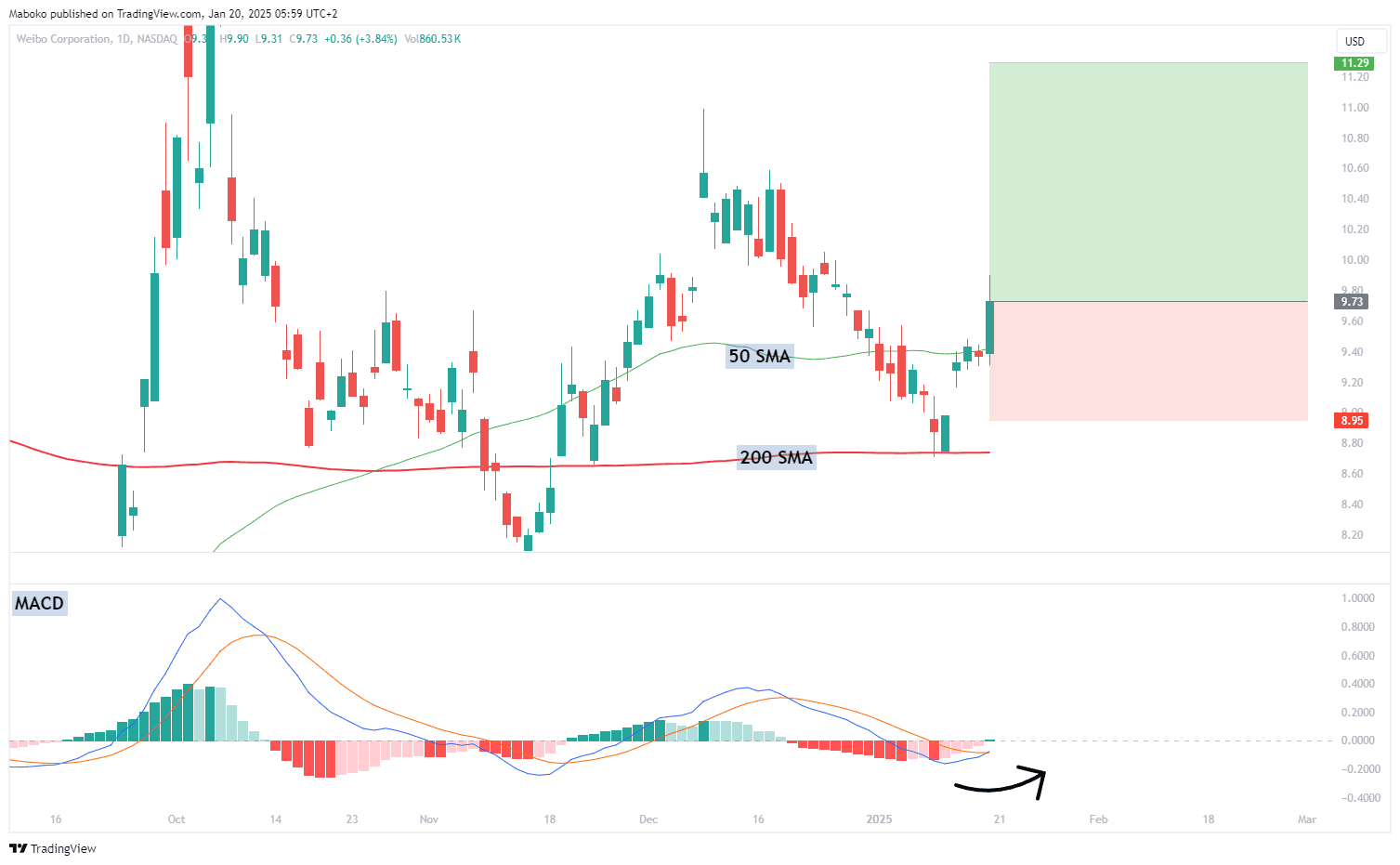

Weibo Corp. (WB): Weibo Corp. is in the creation, distribution, and discovery business of Chinese-language content.

The share price has tested the 200-day simple moving average (SMA) as a dynamic support/resistance level and closed above it, along with the 50-day SMA, signalling a continuation of the upward trend. Additionally, the moving average convergence divergence (MACD) has made a bullish crossover, reinforcing upward momentum.

A speculative Sell/Short idea can be initiated, with the TP set at $11.29 and the SL set at $8.95.

Consumer Discretionary

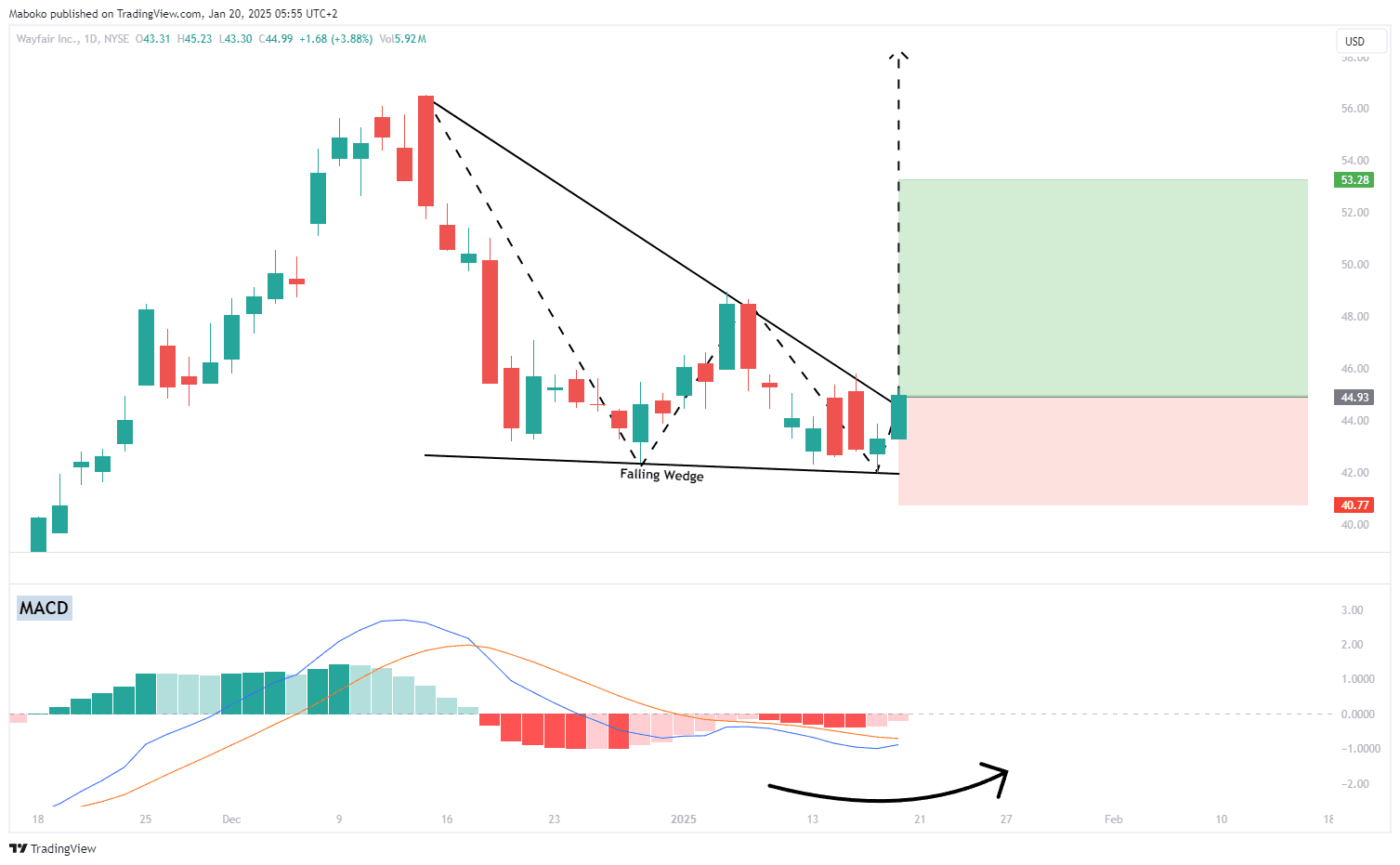

Wayfair, Inc. (W): Wayfair is an online home furnishing store. It operates through the US and international divisions.

On Friday, the share price closed above the upper boundary of the falling wedge pattern at $44.90, confirming a bullish breakout. Additionally, the MACD is on the verge of a bullish crossover, supporting the potential for upward momentum.

A potential Buy/Long idea can be initiated with the TP set at $53.28 and the SL set at $40.77.

Disclaimer:

*Any opinions, views, analysis or other information provided in this article is provided by BCS Markets SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BCS Markets SA does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions and all decisions are made at your own risk. BCS Markets SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss including without limitation any loss of profit which may arise directly or indirectly from use of the market commentary. The content contained within the article is subject to change at any time without notice. BCS Markets SA is an authorised financial services provider FSP No. 51404.

** This article was prepared by BROKSTOCK analyst Maboko Seabi