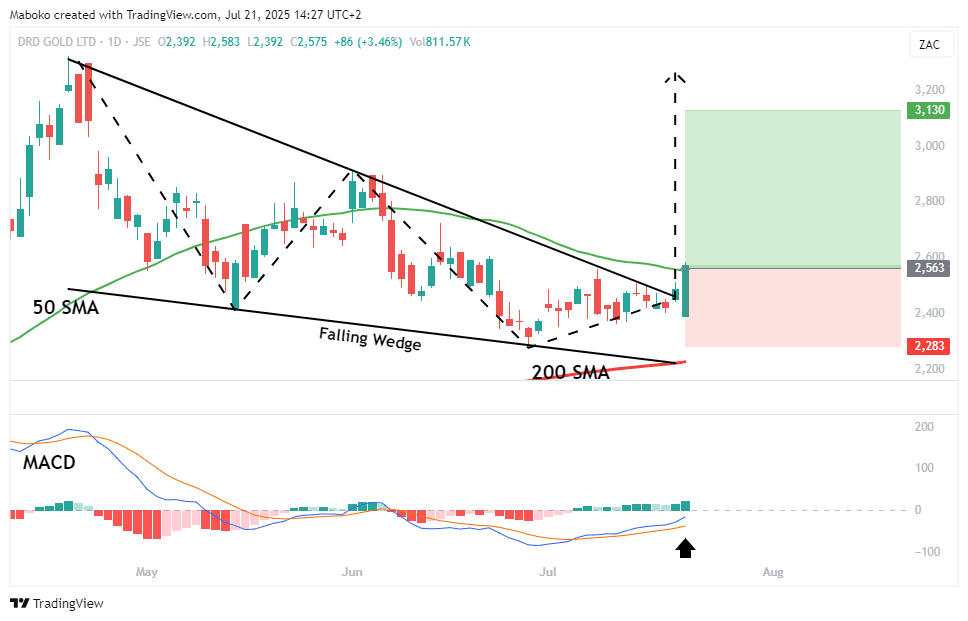

DRDGOLD Ltd. (DRD): DRDGOLD Ltd. re-treats surface gold in the Johannesburg area. It deals with both the extraction and processing of gold.

A bullish breakout has occurred from the falling wedge pattern at R24.62, with the price now trading above the 200-day simple moving average (SMA), and signalling a shift in trend direction. A close above the 50-day SMA would further validate the upward continuation. The moving average convergence divergence (MACD) has confirmed a bullish crossover, supporting sustained upward momentum. DRD will report its earnings on 20 August 2025.

A potential Buy/Long idea can be initiated, with the target set at R31.30 and the stop loss set at R22.83.

Financials

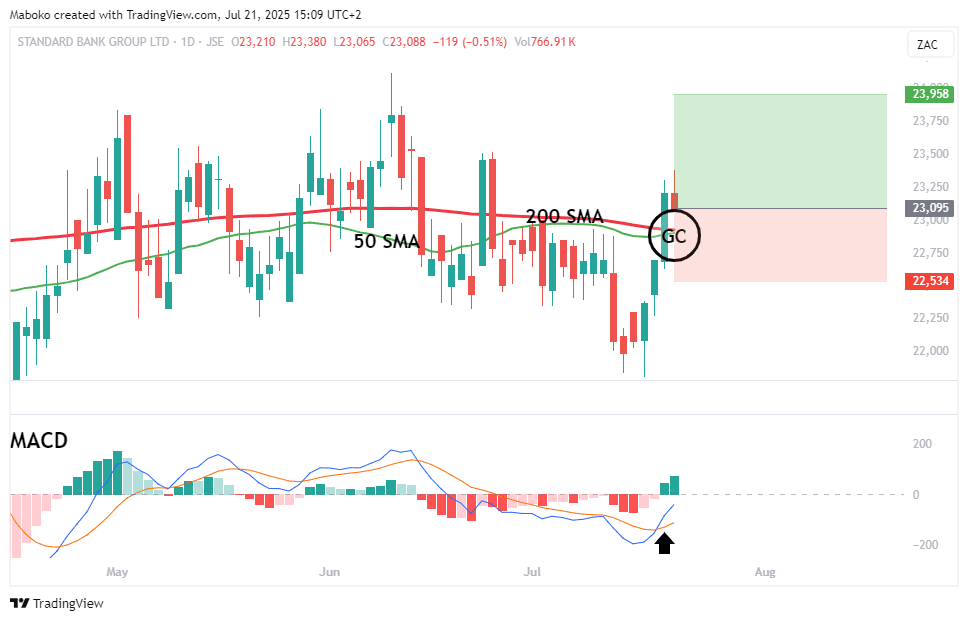

Standard Bank Group Ltd. (SBK): Standard Bank Group Ltd. is a holding company that provides integrated financial and related solutions to clients.

A golden cross is imminent, with the 50-day SMA approaching a crossover above the 200-day SMA – an indication of a potential shift to a bullish trend. The price has already closed above both moving averages, reinforcing this directional change. Additionally, the MACD has made a bullish crossover, suggesting that upward momentum is gaining traction. Keep a lookout for the earnings report, which will be released on 14 August 2025.

A potential Buy/Long idea can be initiated, with the target set at R239.58 and the stop loss set at R225.34.

Consumer Services

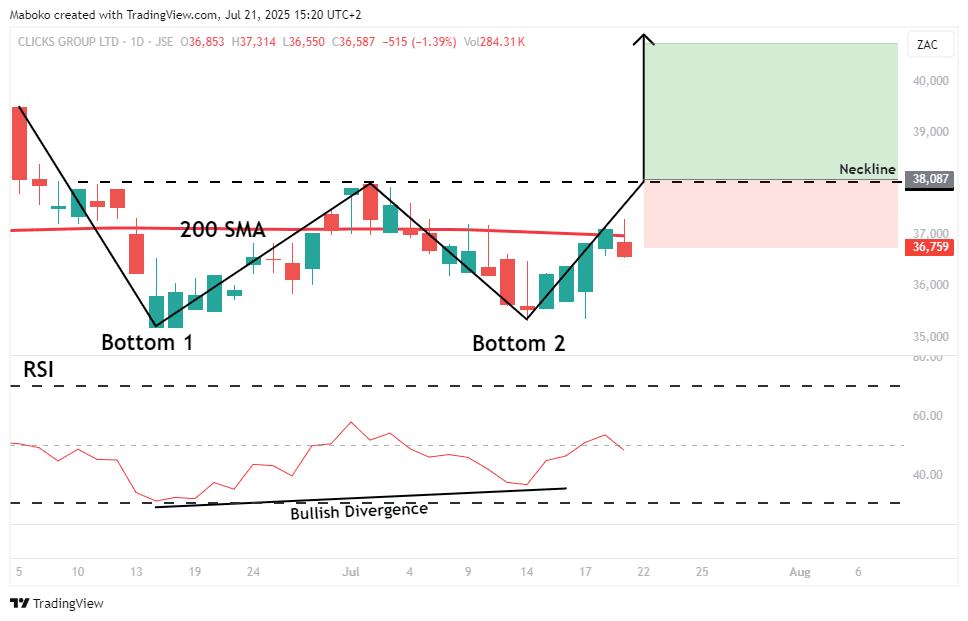

Clicks Group Ltd. (CLS): Clicks is an investment holding company in the retail trade of healthcare products. It operates through the retail and distribution segments.

A double bottom pattern is unfolding, with the neckline positioned at R380. A decisive close above both the neckline and the 200-day SMA would confirm the reversal and indicate that bulls are regaining control of the trend. Supporting this setup, a bullish divergence on the relative strength indicator (RSI) suggests that downward momentum is weakening, adding to the likelihood of a shift to the upside.

A potential Buy/Long idea can be initiated when price closes above the neckline at R380, with the target set at R407.42 and the stop loss set at R367.59.

Financials

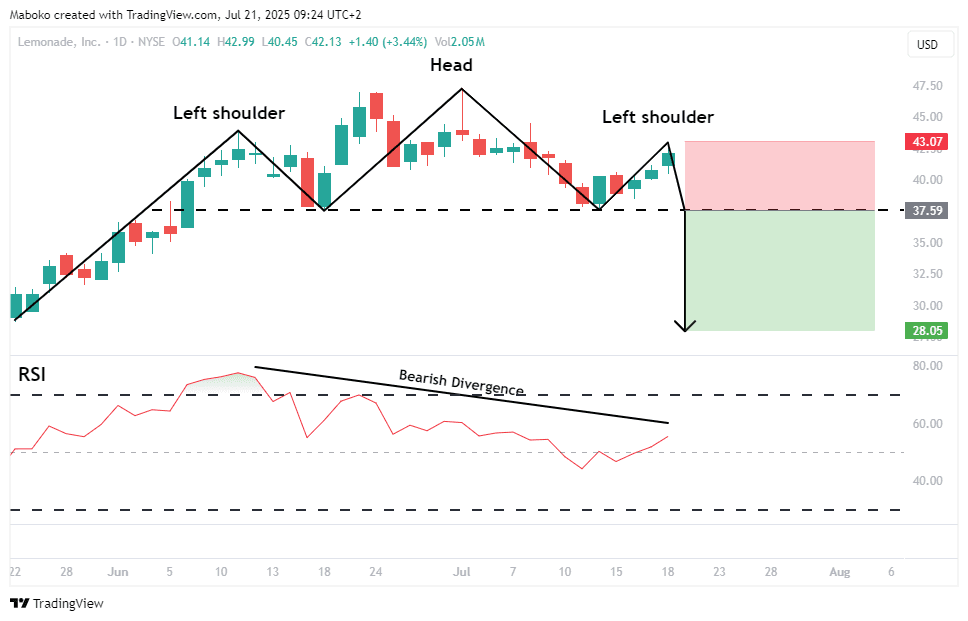

Lemonade, Inc. (LMND): Lemonade is a holding company that offers insurance services. The firm's products include renters and homeowners insurance, and pet insurance.

A head and shoulders pattern is unfolding, a classic bearish reversal formation, indicating potential exhaustion of the prior uptrend. The neckline sits at $37.59, and a close below it would confirm the pattern. The relative strength indicator (RSI) is showing a bearish divergence, reinforcing the lack of sustained upward momentum and supporting the case for a potential trend reversal. Keep a lookout for the earnings report, which will be delivered on the 5th of August 2025.

A speculative Sell/Short idea can be initiated once the price closes below the neckline, with the target set at $28.05 and the stop loss set at $43.07.

Consumer Discretionary

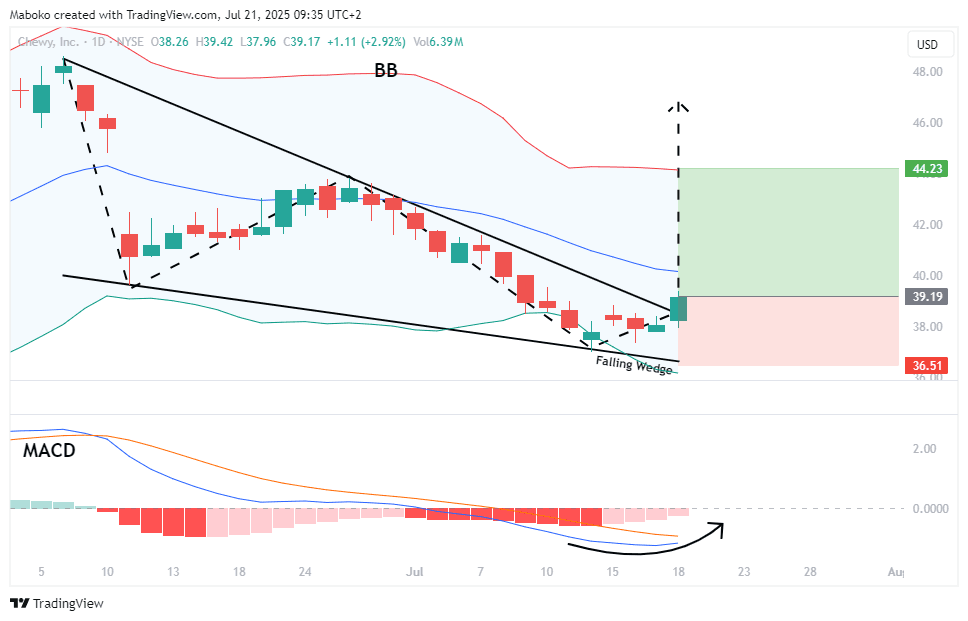

Chewy, Inc. (CHWY): Chewy operates as an online retailer of pet food and other pet-related products and services. It supplies pet medications, food, treats and other pet health products and services for dogs, cats, fish, birds, small pets, horses and reptiles.

The stock price has broken out of a falling wedge pattern, a bullish signal indicating a potential trend reversal. As confluence, the price recently tested the lower bound of the Bollinger Bands, typically associated with oversold conditions, while the moving average convergence divergence (MACD) is on the verge of a bullish crossover. Together, these signals support the case for upward momentum.

A potential Buy/Long idea can be initiated, with the target set at $44.23 and the stop loss set at $36.51.

Consumer Discretionary

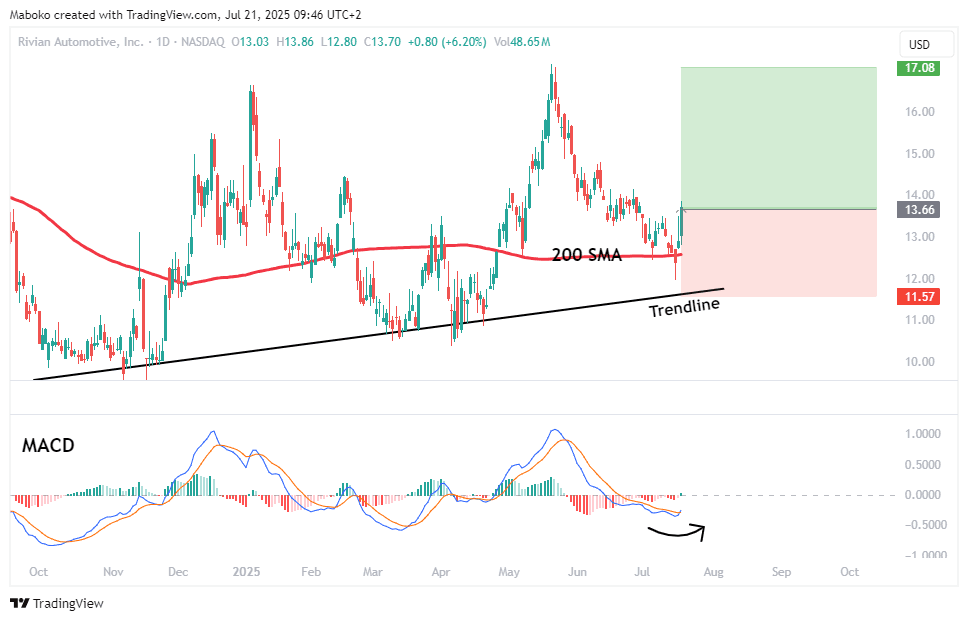

Rivian Automotive, Inc. (RIVN): Rivian is involved in the design, development, and manufacturing of category-defining electric vehicles and accessories.

The stock price has been in an established uptrend and recently tested and closed above the 200-day simple moving average (SMA), reaffirming bullish control of the trend. As confluence, the MACD has formed a bullish crossover, reinforcing the likelihood of continued upward momentum. Keep a lookout for the earnings report, which will be delivered on the 5th of August 2025.

A potential Buy/Long idea can be initiated, with the target set at $17.08 and the stop loss set at $11.57.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi