Consumer Services

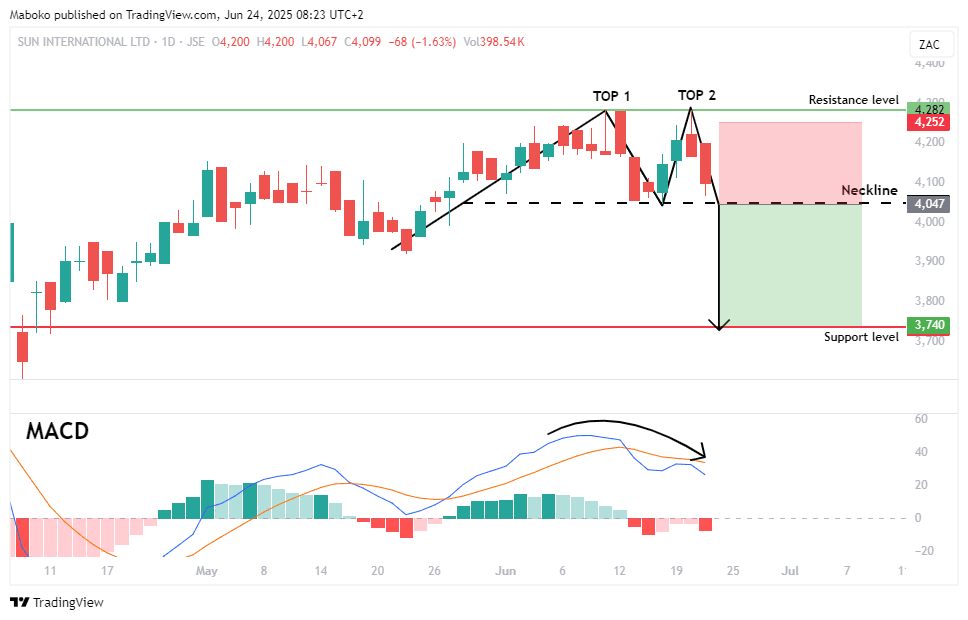

Sun International Ltd. (SUI): Sun International Ltd. is in the investment and management of resorts and hotels, casinos, and entertainment properties.

The share price is trading within a defined range, with resistance at R42.83, where it has formed a potential double top, a bearish reversal pattern that signals weakening upside momentum. However, confirmation is pending a close below the neckline at R40.50. Should that occur, the price may gravitate toward the range support at R37.40. The moving average convergence divergence (MACD) has made a bearish crossunder, reinforcing the likelihood of downward momentum and validating the emerging reversal setup.

A speculative sell/short idea can be initiated, with the target set at R37.40 and the stop loss set at R42.52.

Basic Materials

South32 Ltd. (S32): South32 Ltd. operates as a metal and mining company. It operates through the following mines: Worsley Alumina, Hillside Aluminium, Mozal Aluminium, Brazil Alumina, South Africa Energy Coal, Illawarra Metallurgical Coal, Eagle Downs Metallurgical Coal, Australia Manganese, South Africa Manganese, Cerro Matoso, Cannington, and Hermosa.

A rising wedge trading pattern has completed a bearish breakout, with the price closing at R33.86, a technical signal often associated with a trend reversal to the downside. Adding confluence, the price has also closed below the lower Bollinger Band boundary, indicating increased volatility and reinforcing the likelihood of continued downward momentum. This setup suggests that bears are gaining control, and further downside pressure may follow.

A speculative Sell/Short idea can be initiated, with the target set at R35.37 and the stop loss set at R29.54.

Health Care

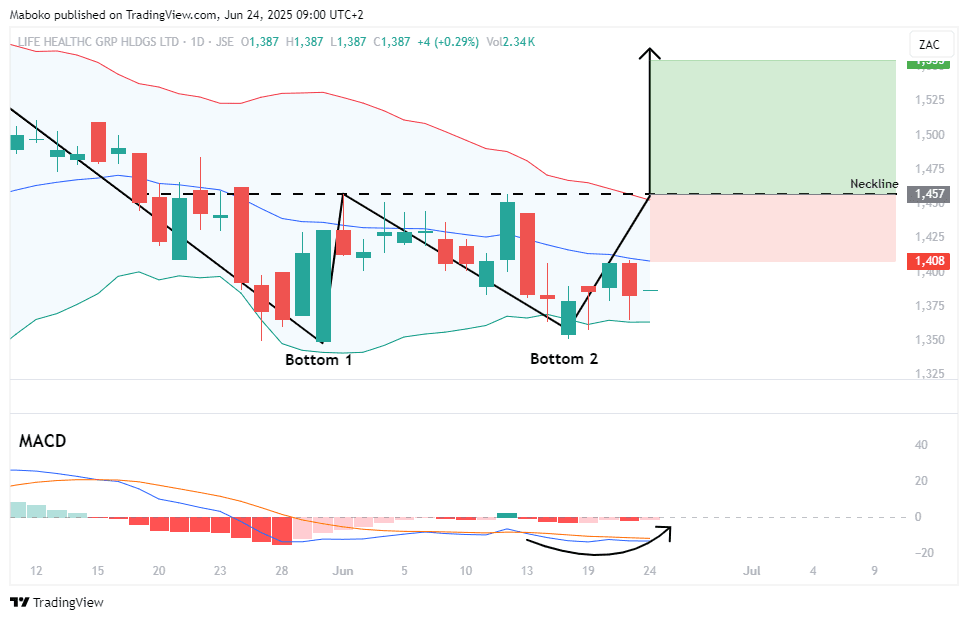

Life Healthcare Group Holdings Ltd. (LHC): Life Healthcare is an investment company that operates hospitals. In South Africa, the group focuses on hospitals, healthcare, and complementary services. Its international division offers diagnostics services.

A double bottom trading pattern is unfolding, with the second trough confirmed and both lows supported by tests of the lower Bollinger Band, indicating fading bearish pressure. The price is now approaching the neckline at R14.57, and momentum to the upside appears imminent. A bullish crossover on momentum indicators further supports the potential for sustained upward movement, suggesting buyers are regaining control.

A potential Buy/Long idea can be initiated, with the target set at R15.55 and the stop loss set at R14.08.

Technology

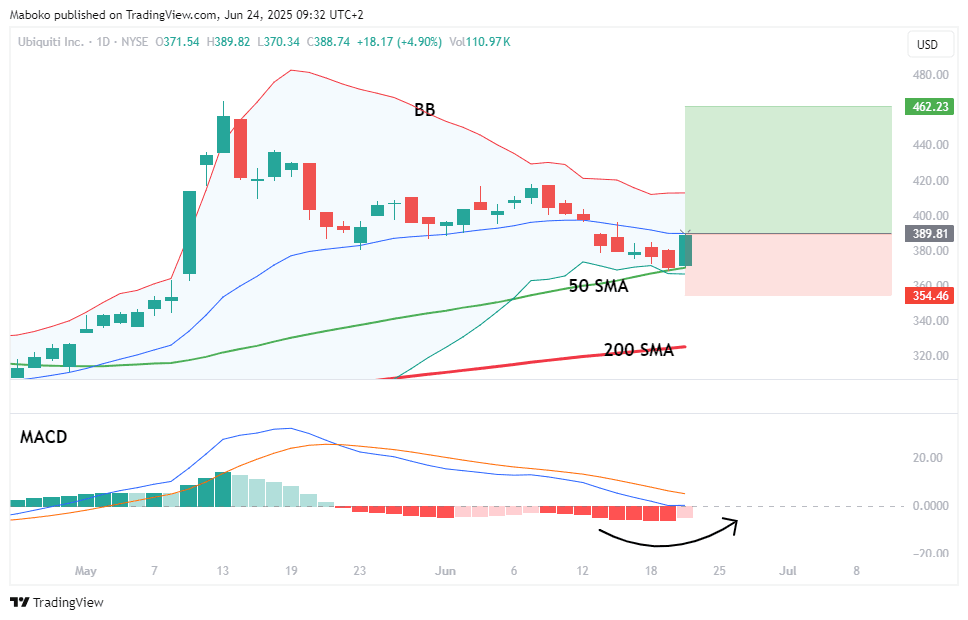

Ubiquiti, Inc. (UI): Ubiquiti is in the business of selling hardware equipment and providing related software platforms.

The Bollinger Bands are contracting, indicating that a significant price move may be imminent. As confluence, the share price is trading above both the 50-day and 200-day simple moving averages (SMAs), reinforcing the prevailing bullish trend. While momentum remains positive, the moving average convergence divergence (MACD) has yet to confirm a bullish crossover, suggesting that traders should watch for a confirmed breakout to validate direction.

A potential Buy/Long idea can be initiated, with the target set at $462.23 and the stop loss set at $354.46.

Consumer Discretionary

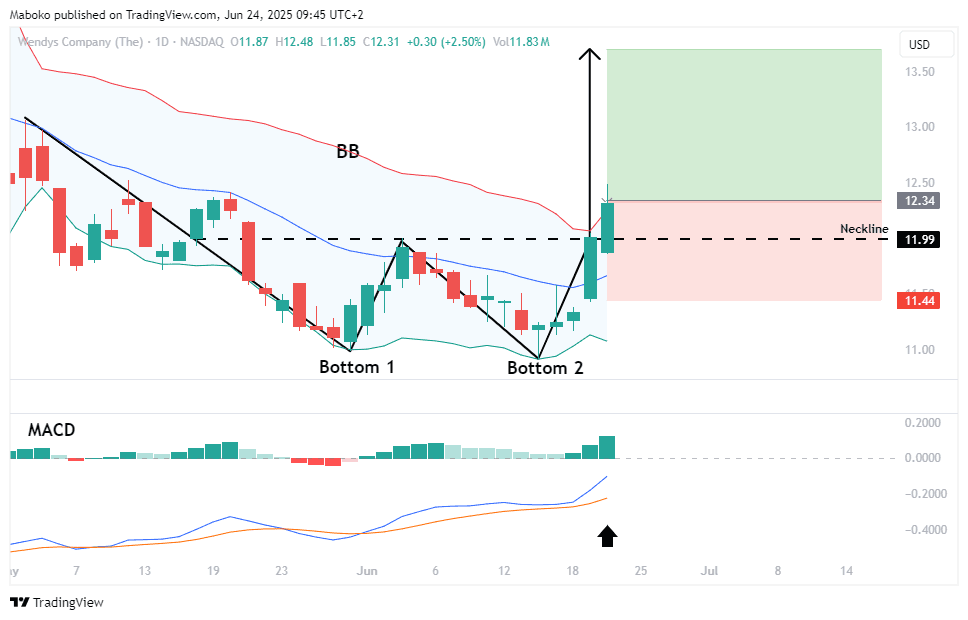

The Wendy’s Co. (WEN): Wendy’s operates, develops and franchises a system of quick-service restaurants.

An inverse head and shoulders pattern has been confirmed with a breakout and close above the neckline at $215, signalling a bullish reversal. This move is further reinforced by the price closing above the 200-day simple moving average (SMA), suggesting that the longer-term trend has shifted in favour of the bulls.

A potential Buy/Long idea can be initiated, with the target set at $13.70 and the stop loss set at $11.44.

Energy

Ovintiv, Inc. (OVV): Ovintiv is in the production and development of oil, natural gas liquids and natural gas producing plants.

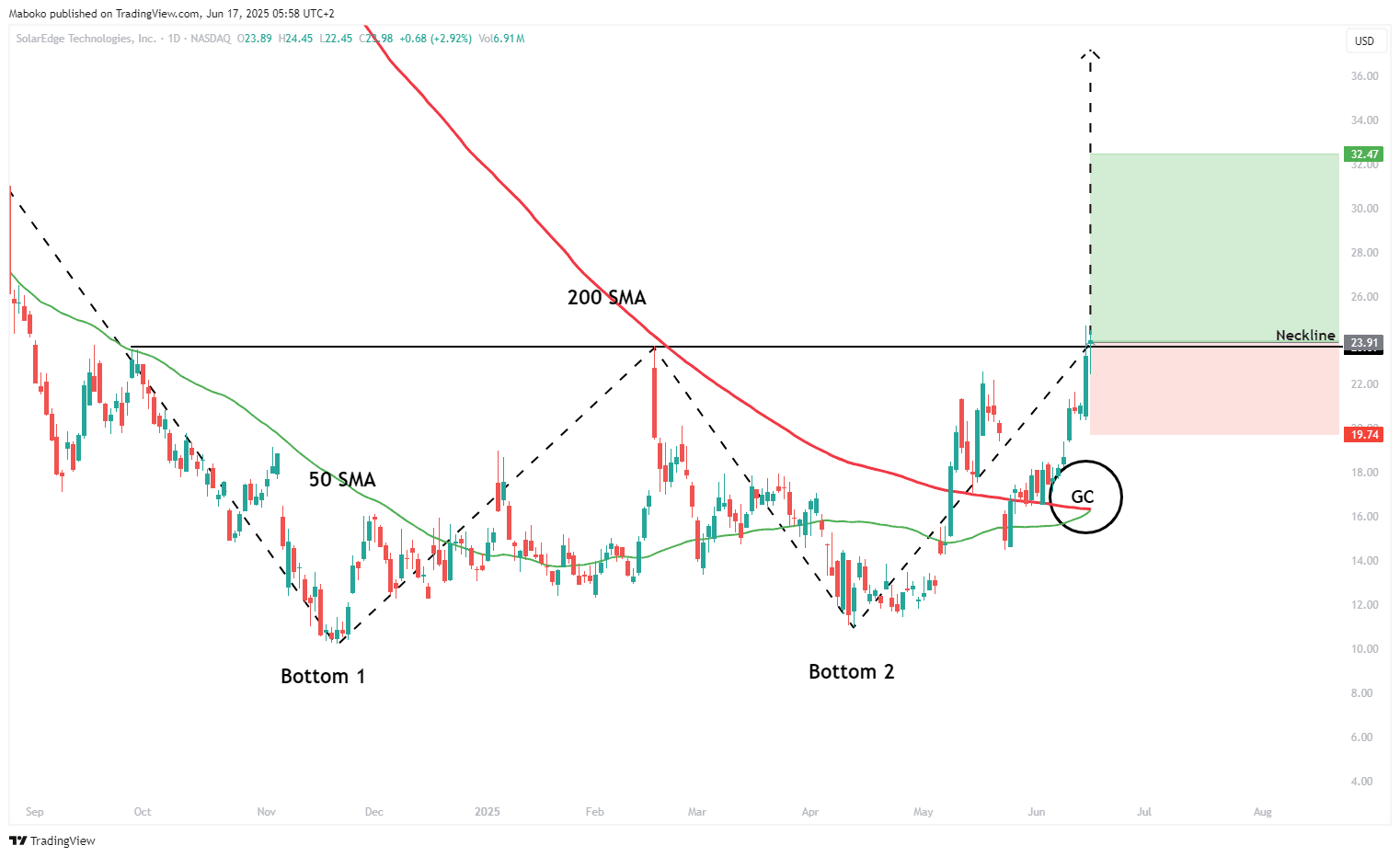

A double bottom trading pattern has unfolded, confirmed by a close above the neckline at $23.70, indicating a potential trend reversal to the upside. This bullish signal is further strengthened by the occurrence of a golden cross, where the 50-day SMA has crossed above the 200-day SMA, suggesting a shift in long-term momentum in favour of the bulls.

A speculative sell/short idea can be initiated, with the target set at $30.52 and the stop loss set at $42.88.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi