Consumer Services

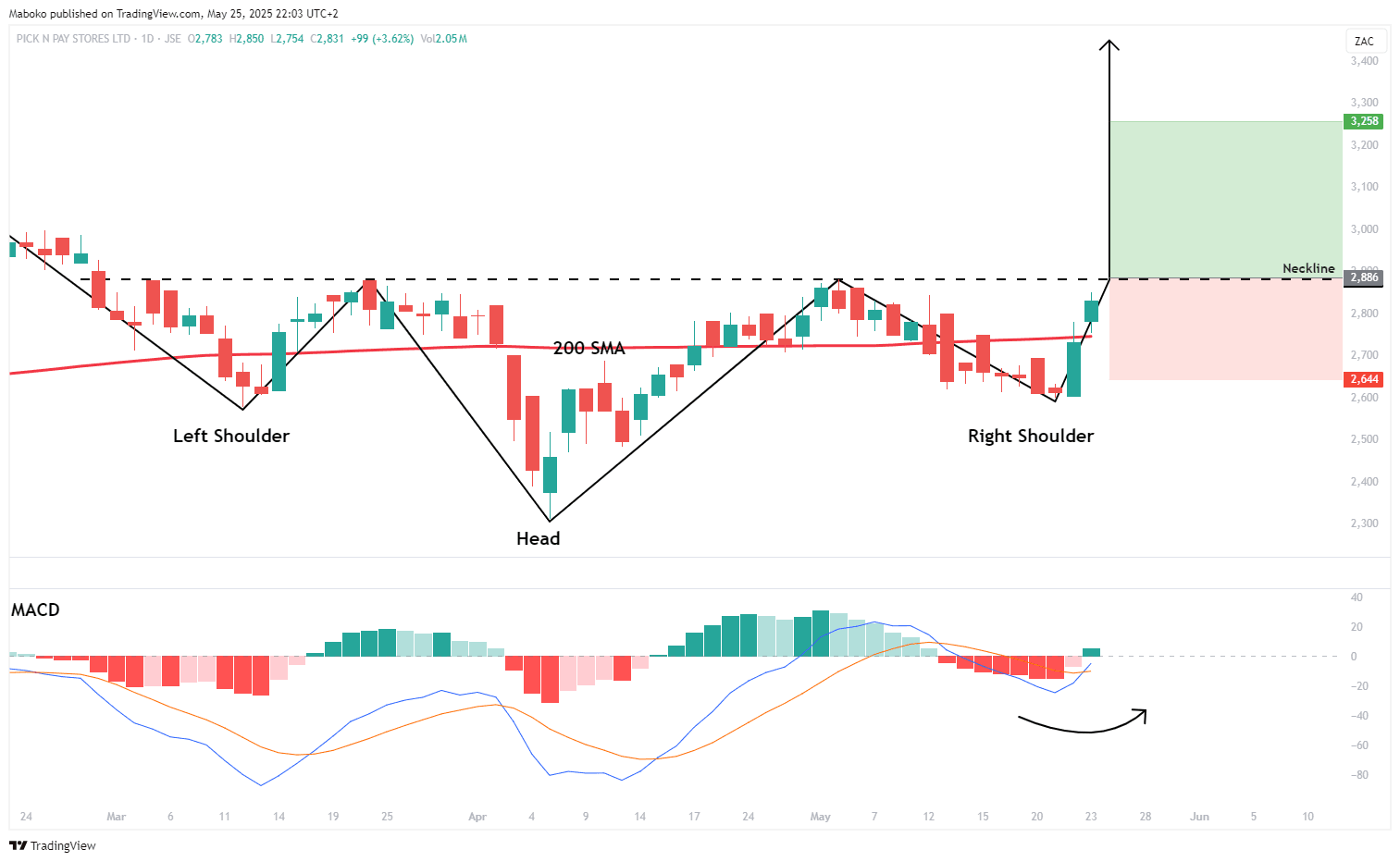

Pick n Pay Stores Ltd. (PIK): Pick n Pay Stores Ltd. is an investment holding company which trades retail food, clothing, general merchandise, pharmaceuticals, and liquor. It operates throughout South Africa and the rest of Africa.

An inverse head and shoulders pattern is unfolding, with the head formed at R23.12 and the shoulders around the R26 level. A bullish breakout confirmation is still pending, with the neckline at R28.88 yet to be breached. However, the share is trading above the 200-day simple moving average (SMA), reinforcing the bullish bias. The moving average convergence divergence (MACD) has made a bullish crossover, indicating strengthening upward momentum and supporting the case for a potential breakout if the price closes decisively above R28.88.

A potential Buy/Long idea can be initiated once the price closes above R28.88, with the target set at R32.58 and the stop loss set at R26.44.

Basic Materials

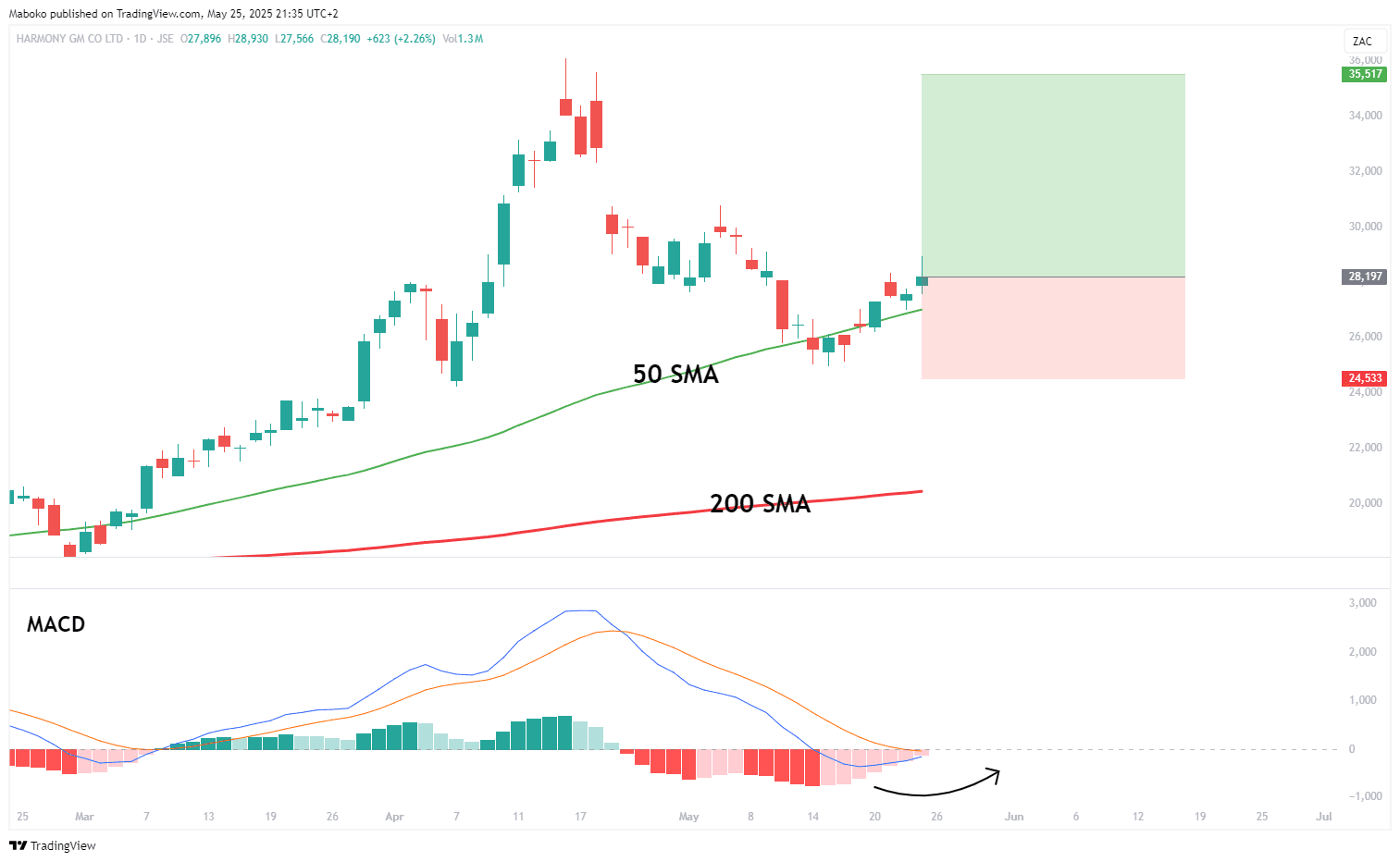

Harmony Gold Mining Co. Ltd. (HAR): Harmony Gold Mining Co. Ltd. is in the mining and exploration of gold. This includes building mines, open-pit operations, sales, financial management, land rehabilitation and mine closures.

The share price has tested and closed above the 50-day SMA, indicating potential trend continuation, especially as it remains well above the 200-day SMA, signalling strong underlying bullish momentum. While the MACD has not yet confirmed a bullish crossover, it is showing signs of convergence, supporting the case for a possible continuation of upward momentum.

A potential Buy/Long idea can be initiated, with the target set at R355.17 and the stop loss set at R245.33.

Industrials

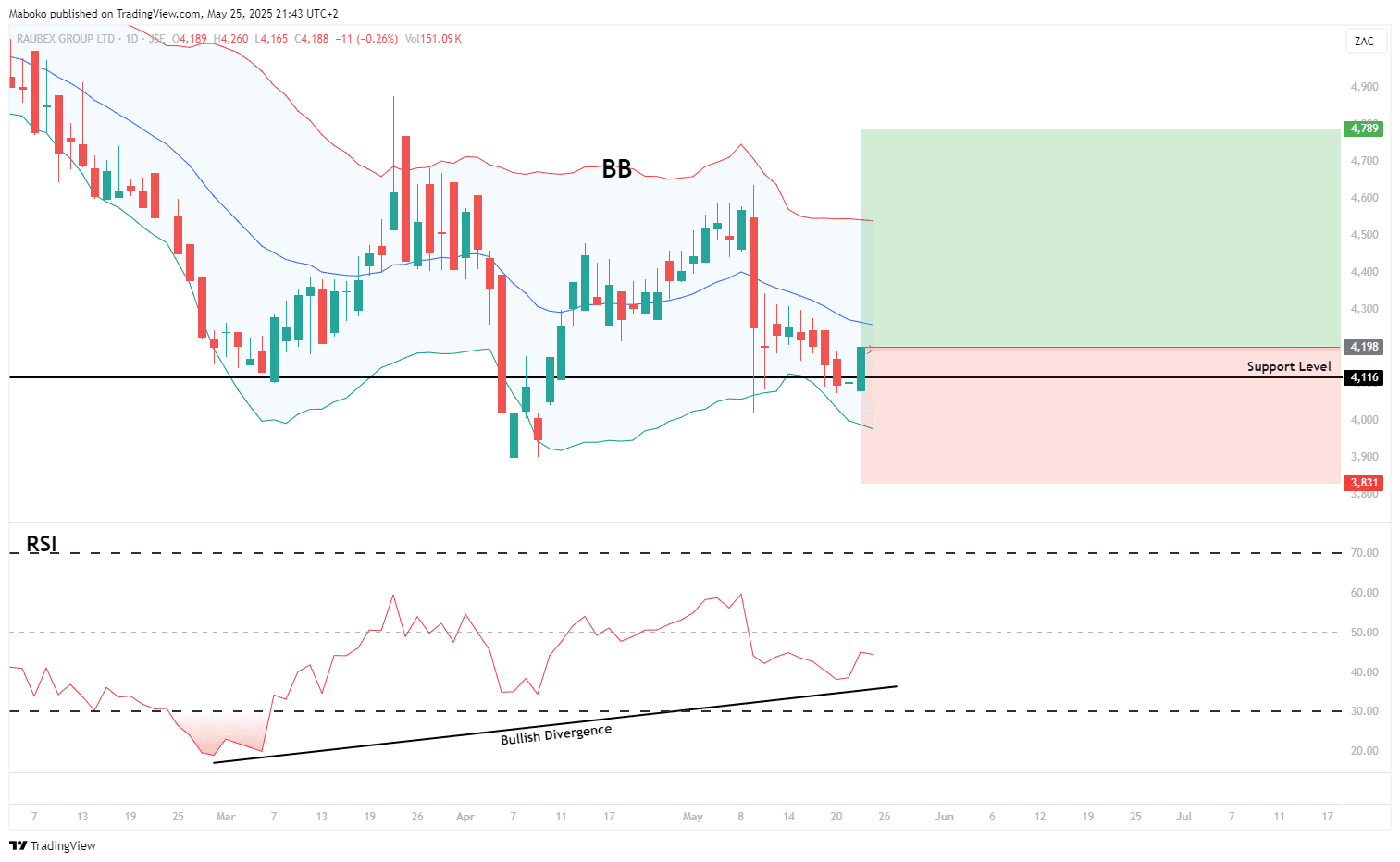

Raubex Group Ltd. (RBX): Raubex is an infrastructure development investment company. It operates through materials, roads and earthworks, and infrastructure.

The share has repeatedly tested the support level at R41, coinciding with touches on the lower band of the Bollinger Bands, typically a sign of price exhaustion. Meanwhile, a bullish divergence on the MACD suggests weakening downside pressure with each test of support, indicating a potential shift in momentum in favour of a rebound or upward move.

A potential Buy/Long idea can be initiated, with the target set at R47.89 and the stop loss set at R38.31.

Materials

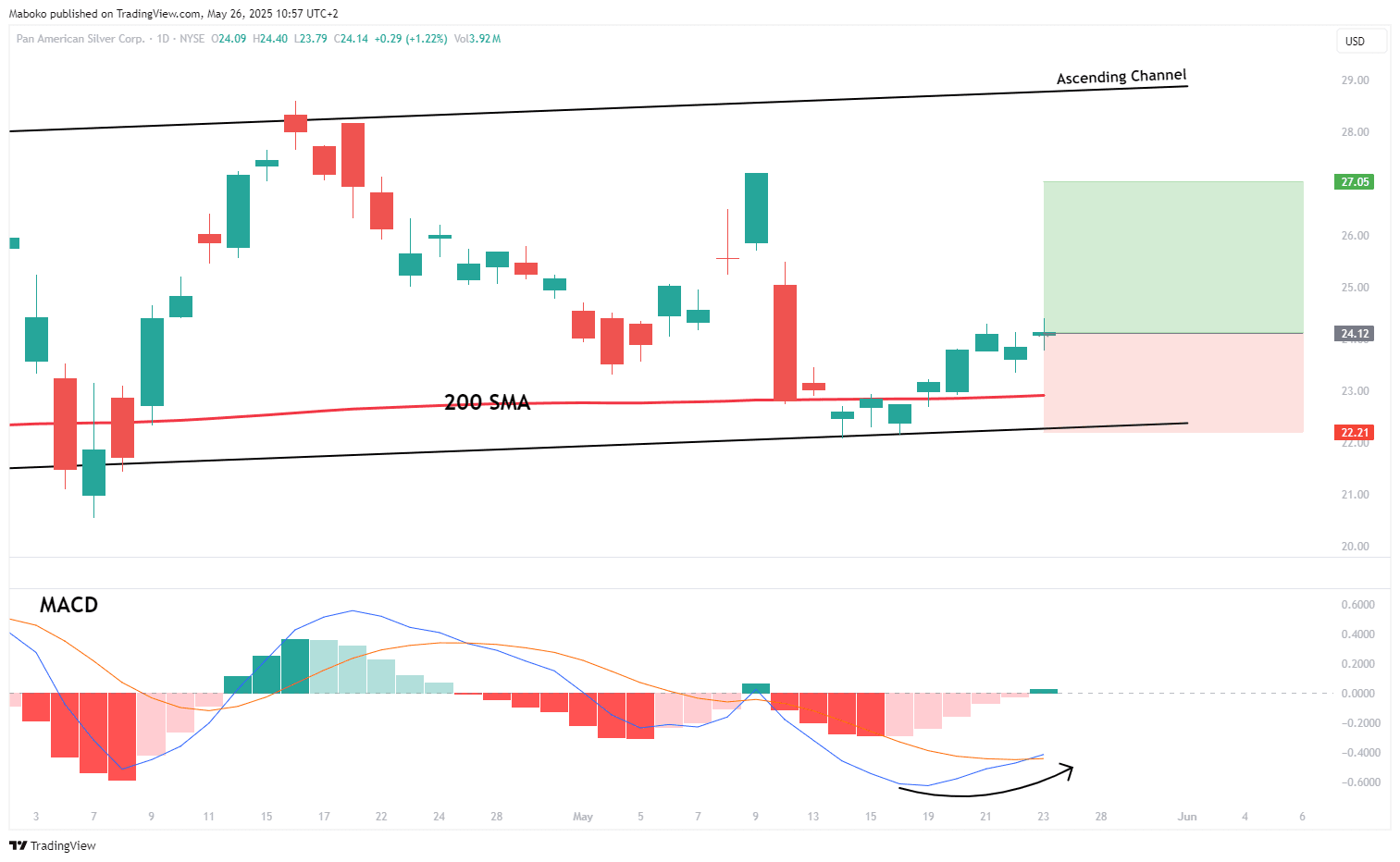

Pan American Silver Corp. (PAAS): Pan American is in the operation, development, and exploration of silver and gold producing properties and assets.

The stock has been trading within an ascending channel, recently finding support at the lower boundary around $22.20. As confluence, the price has closed above the 200-day simple moving average (SMA), reinforcing the view that bulls remain in control of the broader trend. Additionally, a bullish crossover on the moving average convergence divergence (MACD) signals a potential shift in momentum to the upside, supporting the case for a continuation of the upward trajectory.

A potential Buy/Long idea can be initiated, with the target set at $27.05 and the stop loss set at $22.21]

Communication Services

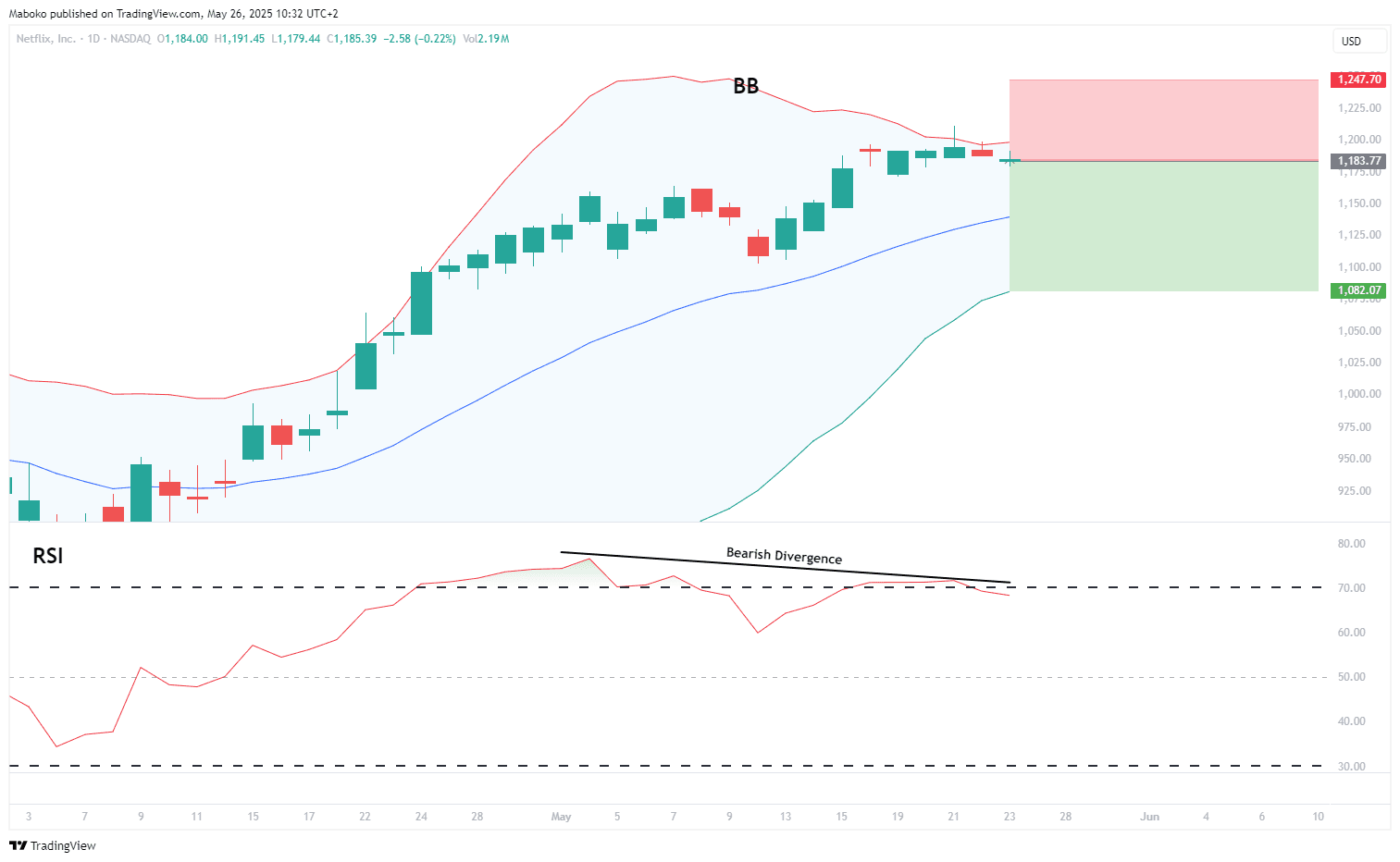

Netflix, Inc. (NFLX): Netflix provides entertainment services. It also offers activities for leisure time, entertainment videos, video gaming, and other sources of entertainment.

The stock price has reached a new all-time high of $1 211.22, coinciding with a test of the upper band of the Bollinger Bands, which typically signals overextension. As confluence, the relative strength indicator (RSI) has formed a bearish divergence, indicating that while price is rising, momentum is weakening. This setup suggests a potential short-term retracement toward the middle or lower band of the Bollinger Bands as the market consolidates.

A speculative Sell/Short idea can be initiated, with the target set at $1082.07 and the stop loss set at $1247.70.

Information Technology

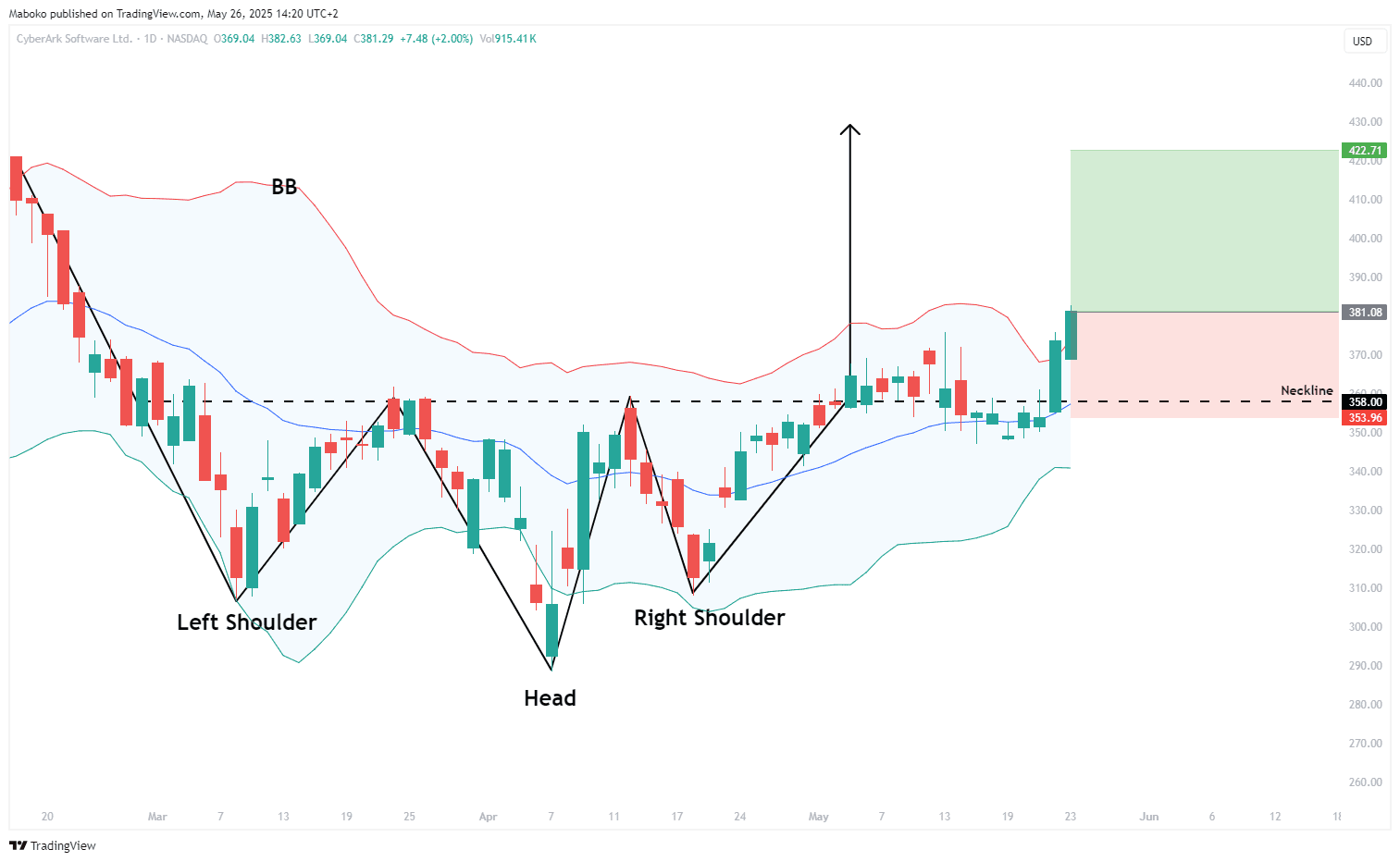

CyberArk Software Ltd. (CYBR): CyberArk is in the business of developing, marketing, and selling access security software solutions.

An inverted head and shoulders pattern has confirmed a bullish breakout, with the price closing above the neckline at $358. As confluence, the price also broke above the upper band of the Bollinger Bands at $370, signalling strong bullish momentum. This breakout suggests a continuation of the upward trend, supported by both price action and volatility expansion.

A potential Buy/Long idea can be initiated, with the target set at $422.71 and the stop loss set at $353.96.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi