Financials

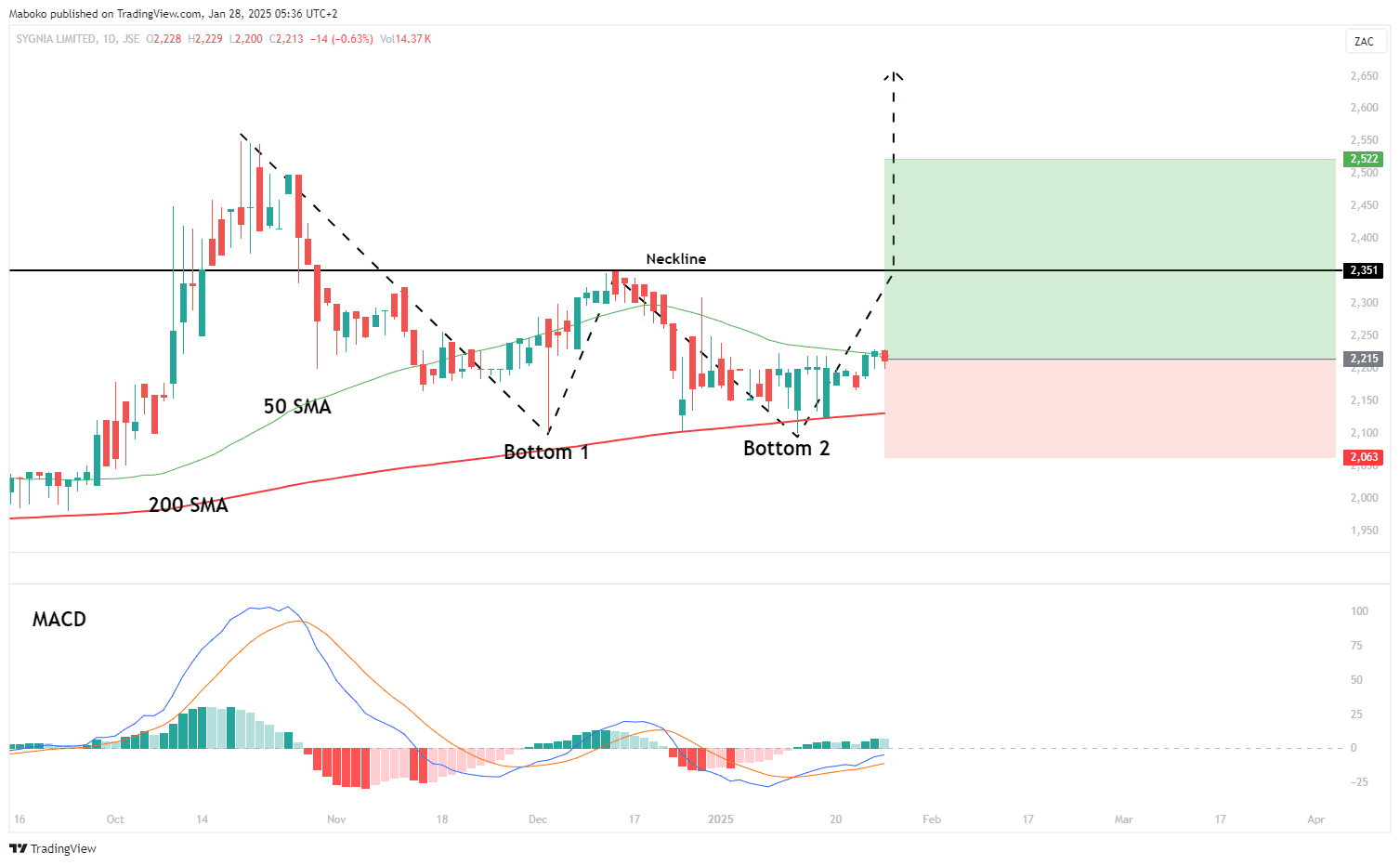

Sygnia Ltd. (SYG): Sygnia is a holding company that offers investment management and administration services to institutional and retail clients. Its services include asset and transaction management, investment and liability administration, stockbroking, and digital financial advice.

A double bottom pattern is forming, with the neckline at R23.51, serving as the key confirmation level of a bullish trend continuation. The share has closed above the 50-day and 200-day simple moving averages (SMAs), signalling upward price movement continuation. Additionally, the moving average convergence divergence (MACD) indicates bullish momentum, reinforcing the positive outlook.

A Buy/Long idea can be initiated with the stop loss set at R20.63 and the target set at R25.22.

Health Care

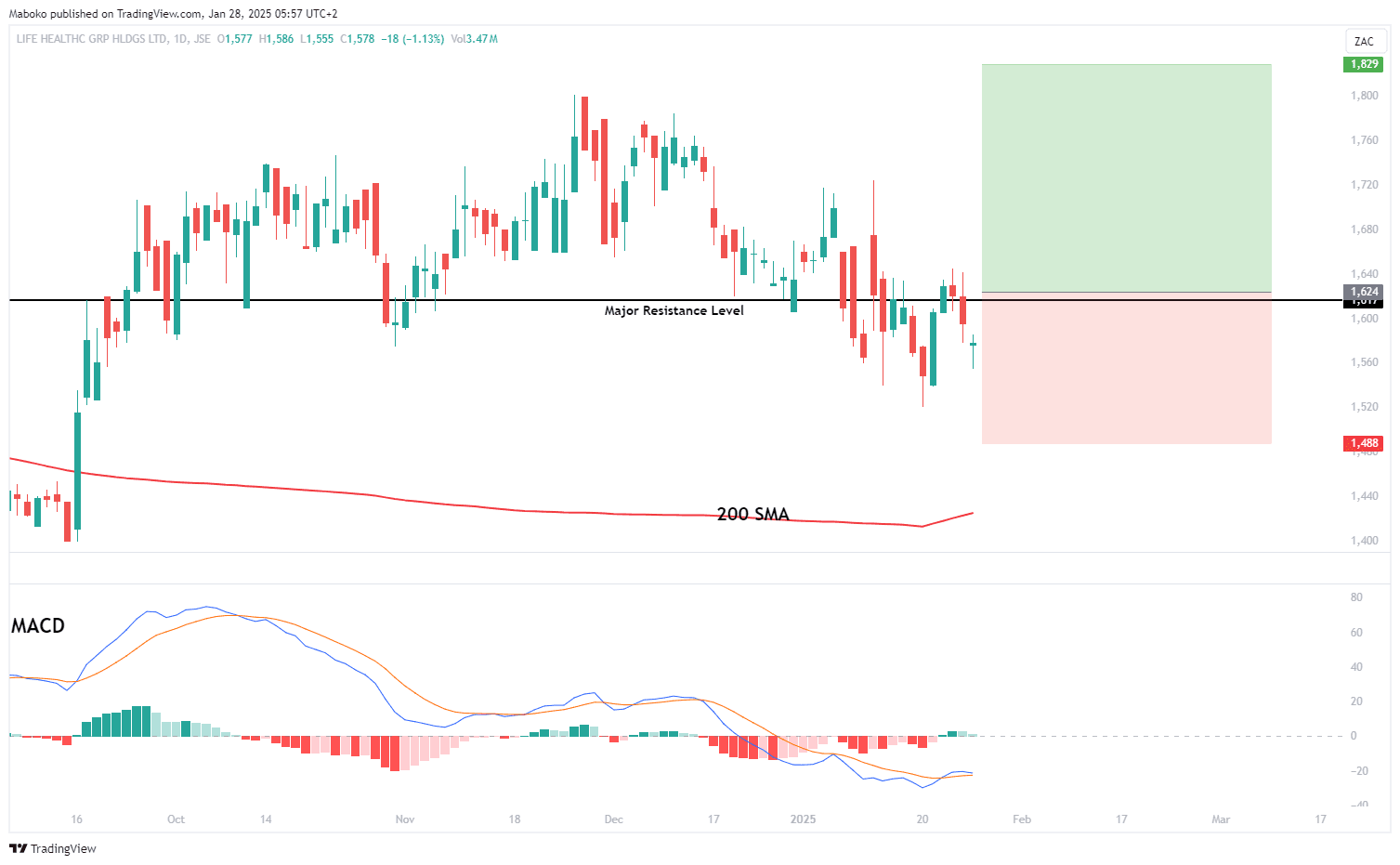

Life Healthcare Group Holdings Ltd. (LHC): Life Healthcare is an investment company that operates hospitals. In South Africa, the group focuses on hospitals, healthcare and complementary services. Its international division offers diagnostics services.

The share price is currently trading just below the resistance level at R16. However, the MACD has made a bullish crossover, indicating upward momentum. Additionally, the price remains above the 200-day SMA, suggesting that the bulls are still in control of the trend.

A potential Buy/Long can be initiated with the target set at R18.29 and stop loss set at R14.88.

Health Care

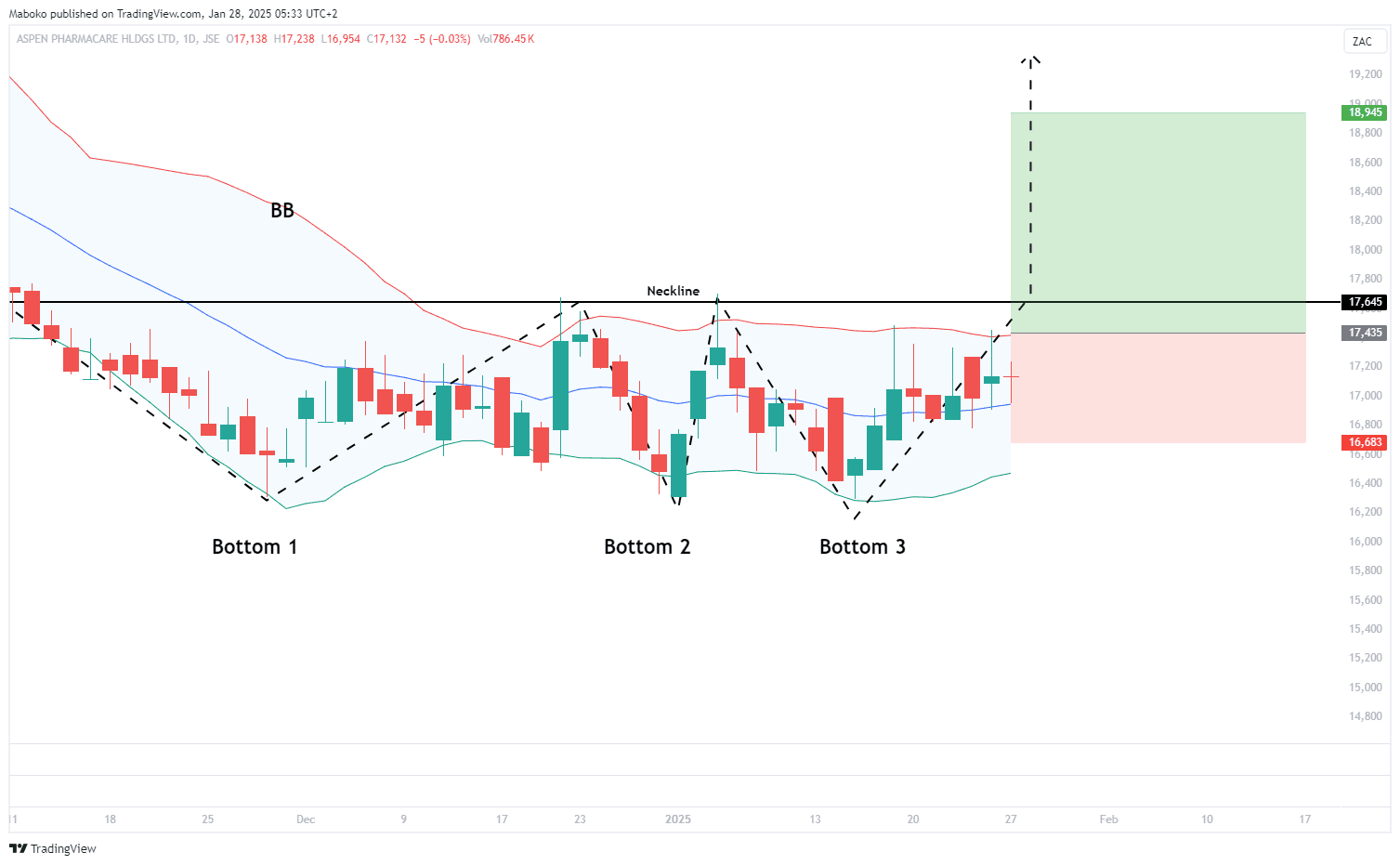

Aspen Pharmacare Holdings Ltd. (APN): Aspen Pharmacare Holdings Ltd. manufactures and supplies branded and generic pharmaceutical products. It operates through commercial pharmaceuticals and manufacturing.

A triple bottom pattern is forming, with the confirmation neckline at R176.45. The price has recently tested the lower Bollinger Band (BB), and a close above the upper band at R174.35 would signal strong bullish momentum, supporting the potential breakout.

This presents an opportunity to Long/Buy with the target set at R189.45 and stop loss set at R166.83.

Consumer Staples

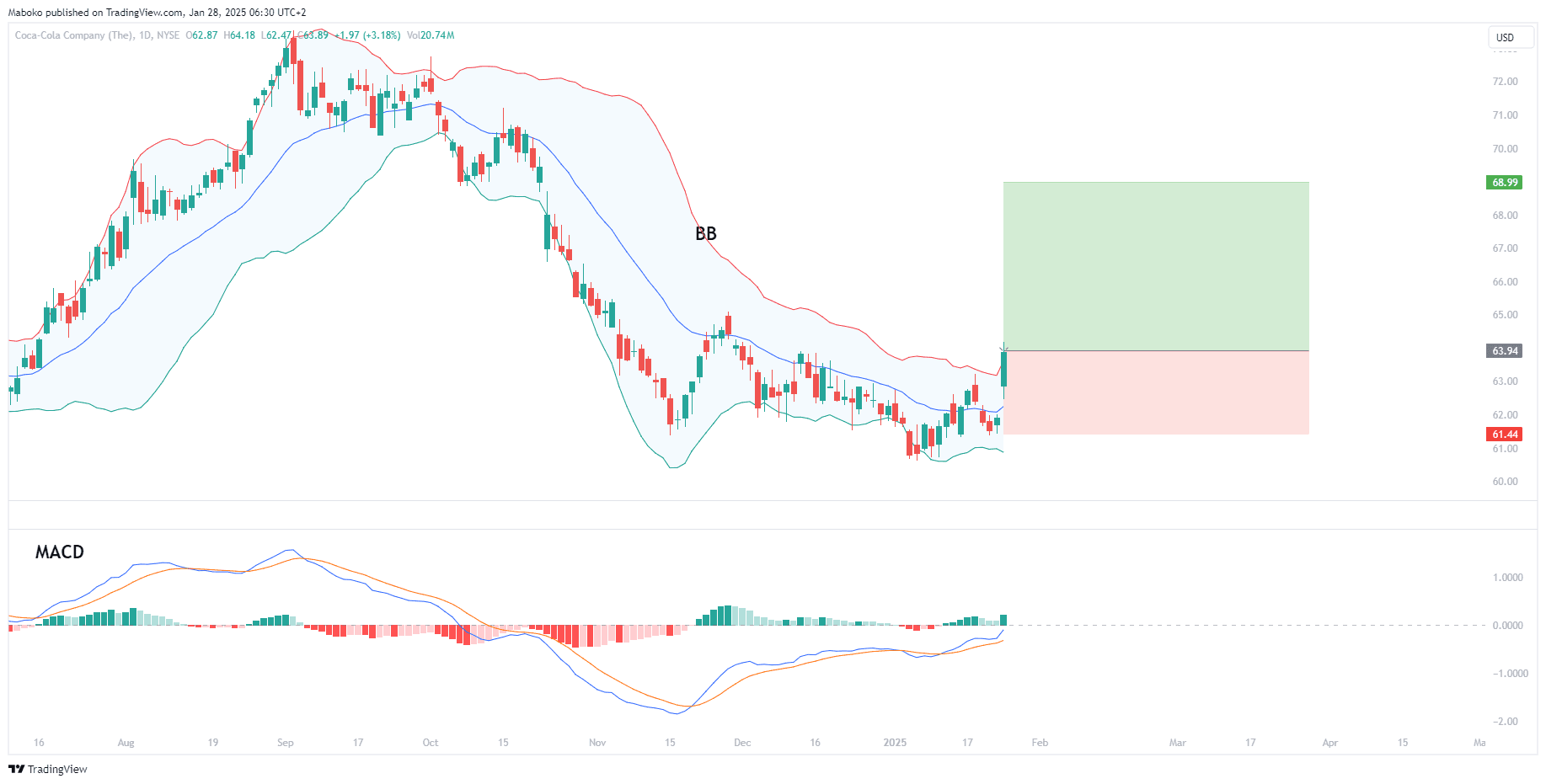

The Coca-Cola Co. (KO): Coca-Cola is in the manufacturing and marketing of non-alcoholic beverages. It operates in Europe, the Middle East and Africa, Latin America, North America, Asia Pacific, Global Ventures, and Bottling Investments.

The share price has broken above the upper Bollinger Band (BB), indicating strong bullish momentum. Additionally, the moving average convergence divergence (MACD) has shown bullish divergence, further supporting the potential for upward movement.

A potential Buy/Long idea can be initiated with the take profit (TP) set at $68.99 and the stop loss (SL) set at $61.44.

Consumer Staples

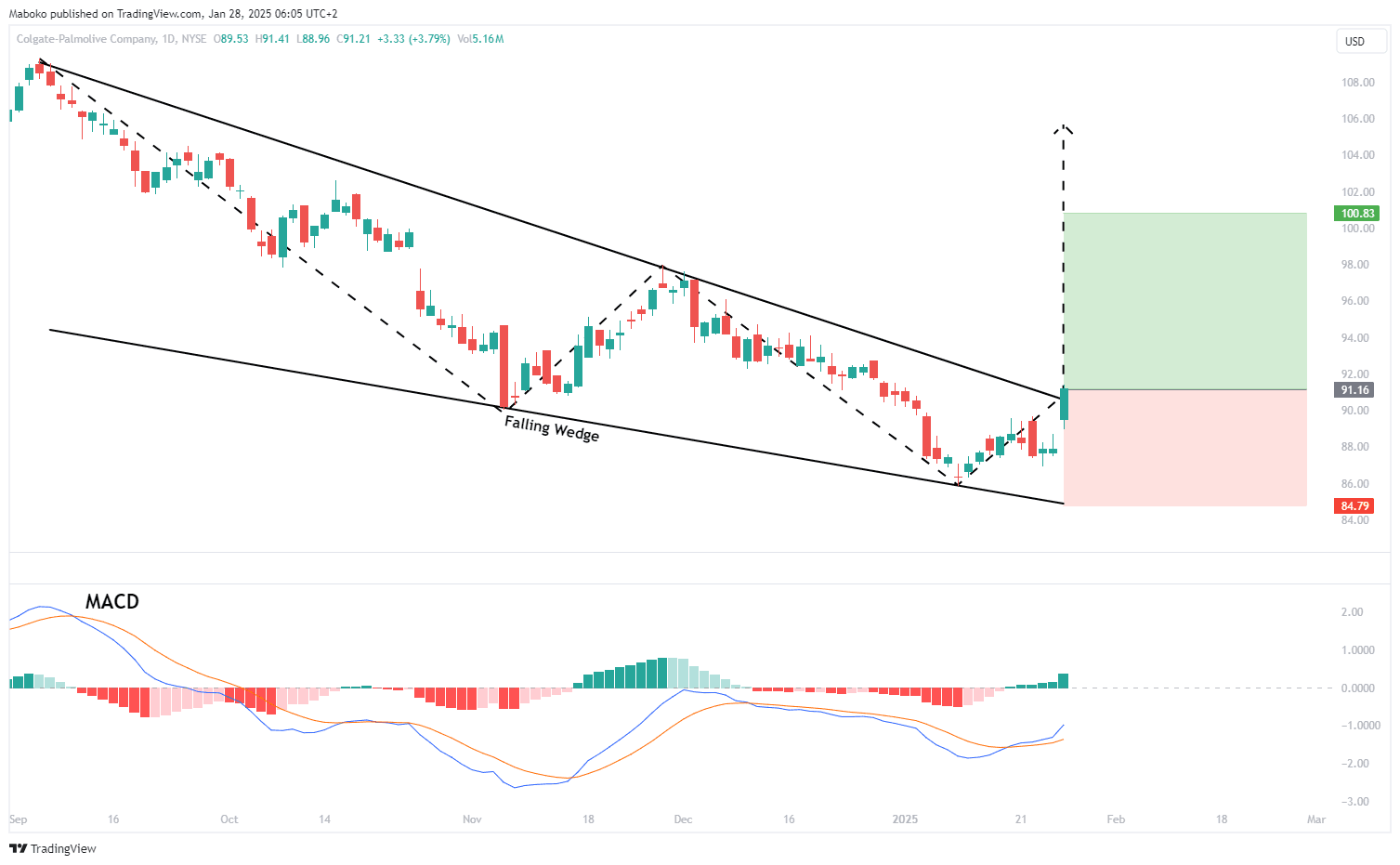

Colgate-Palmolive Co. (CL): Colgate-Palmolive is in the manufacturing and distribution of consumer products. It operates through the oral, personal, home care, and pet nutrition segments.

The share price has broken above the upper boundary of the rising wedge pattern, signalling a potential change in trend direction. The MACD has made a bullish crossover and exhibited bullish divergence, suggesting that downward momentum is fading and upward momentum is building.

A potential Buy/Long idea can be initiated with the take profit (TP) set at $100.83 and the stop loss (SL) set at $84.79.

Technology

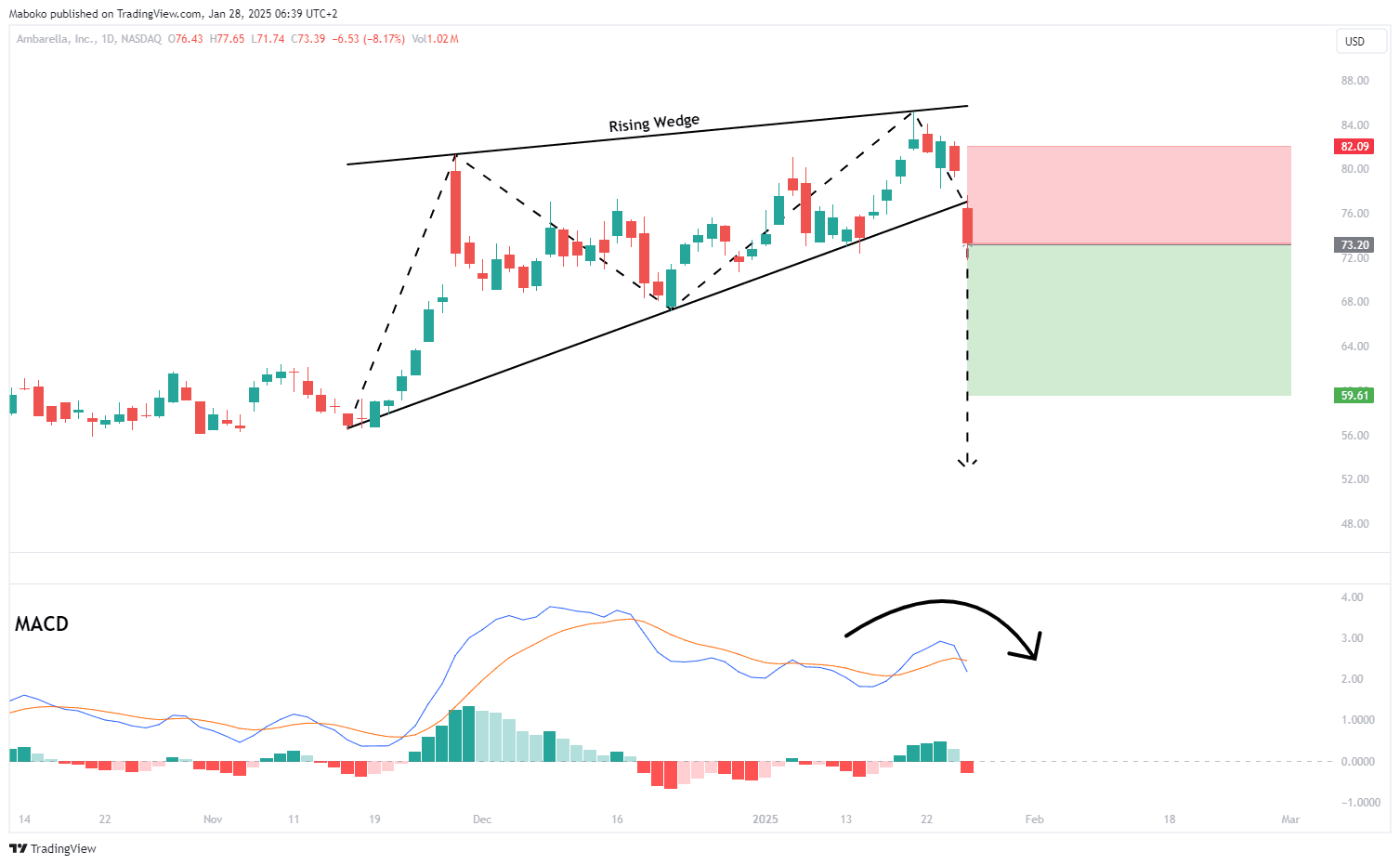

Ambarella, Inc. (AMBA): Ambarella is in the development of low-power system-on-chip or SoC, semiconductors, and software for cutting-edge artificial intelligence (AI) applications. Its products include video security, advanced driver assistance (ADAS), electronic mirror, drive recorder, driver or cabin monitoring, autonomous driving, and other robotics applications.

The share price has broken below the rising wedge pattern, signalling a potential change in trend direction to bearish. The MACD has made a bearish crossunder and shown bearish divergence, further confirming the downward momentum.

A speculative Sell/Short idea can be initiated, with the TP set at $59.61 and the SL set at $82.09.

Disclaimer:

*Any opinions, views, analysis or other information provided in this article is provided by BCS Markets SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BCS Markets SA does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions and all decisions are made at your own risk. BCS Markets SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss including without limitation any loss of profit which may arise directly or indirectly from use of the market commentary. The content contained within the article is subject to change at any time without notice. BCS Markets SA is an authorised financial services provider FSP No. 51404.

** This article was prepared by BROKSTOCK analyst Maboko Seabi