Technology

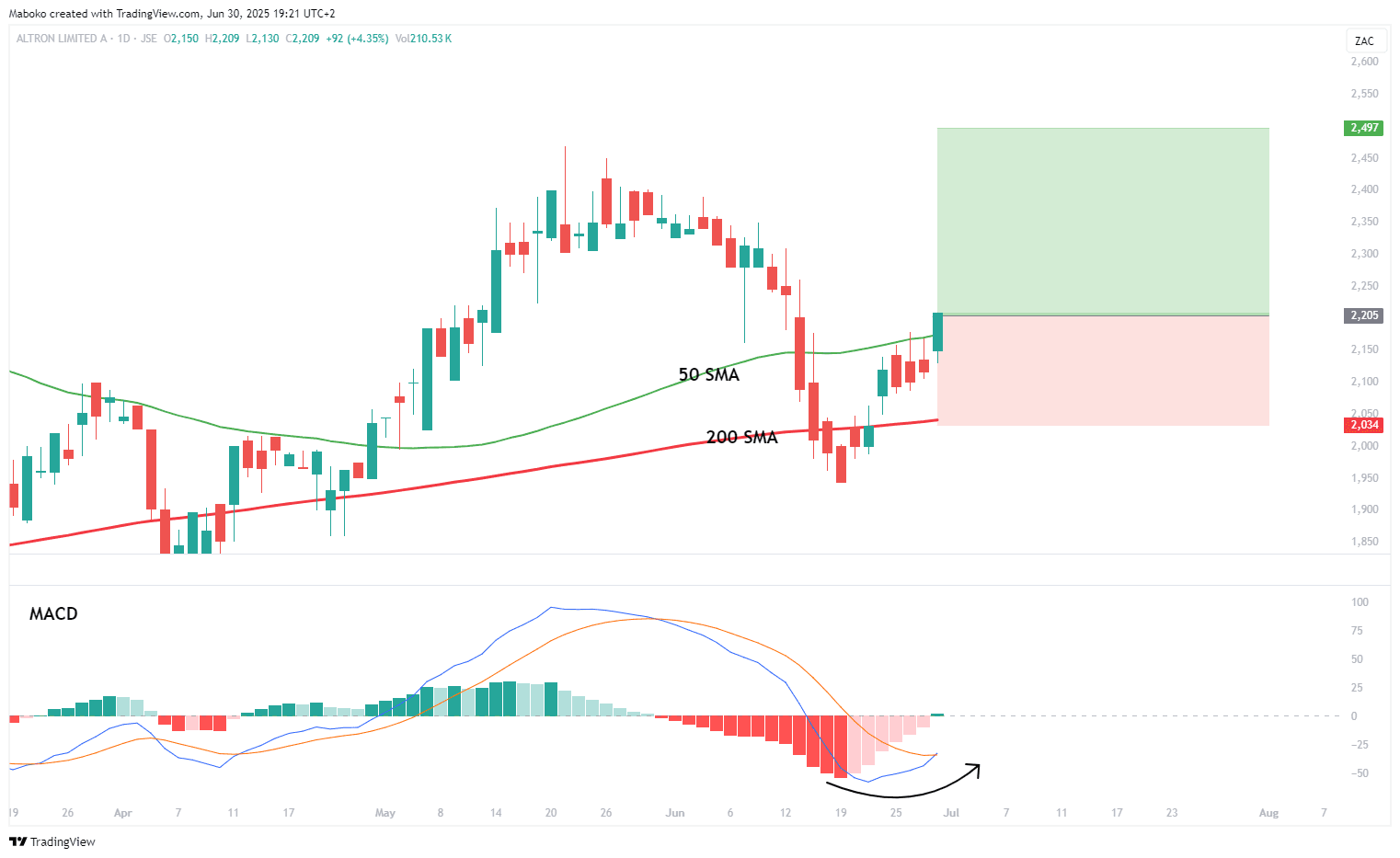

Altron Ltd. (AEL): Altron Ltd. is in the business of technology solutions. It operates in managed services, digital transformation, its own platforms, and Altron Arrow.

The share price closed above the 50-day simple moving average (SMA) after successfully testing the 200-day SMA as dynamic support, indicating potential continuation of the upward trend. This bullish signal is further supported by a moving average convergence divergence (MACD) crossover, suggesting strengthening momentum to the upside.

A potential Buy/Long idea can be initiated, with the target set at R24.97 and the stop loss set at R20.34.

Consumer Services

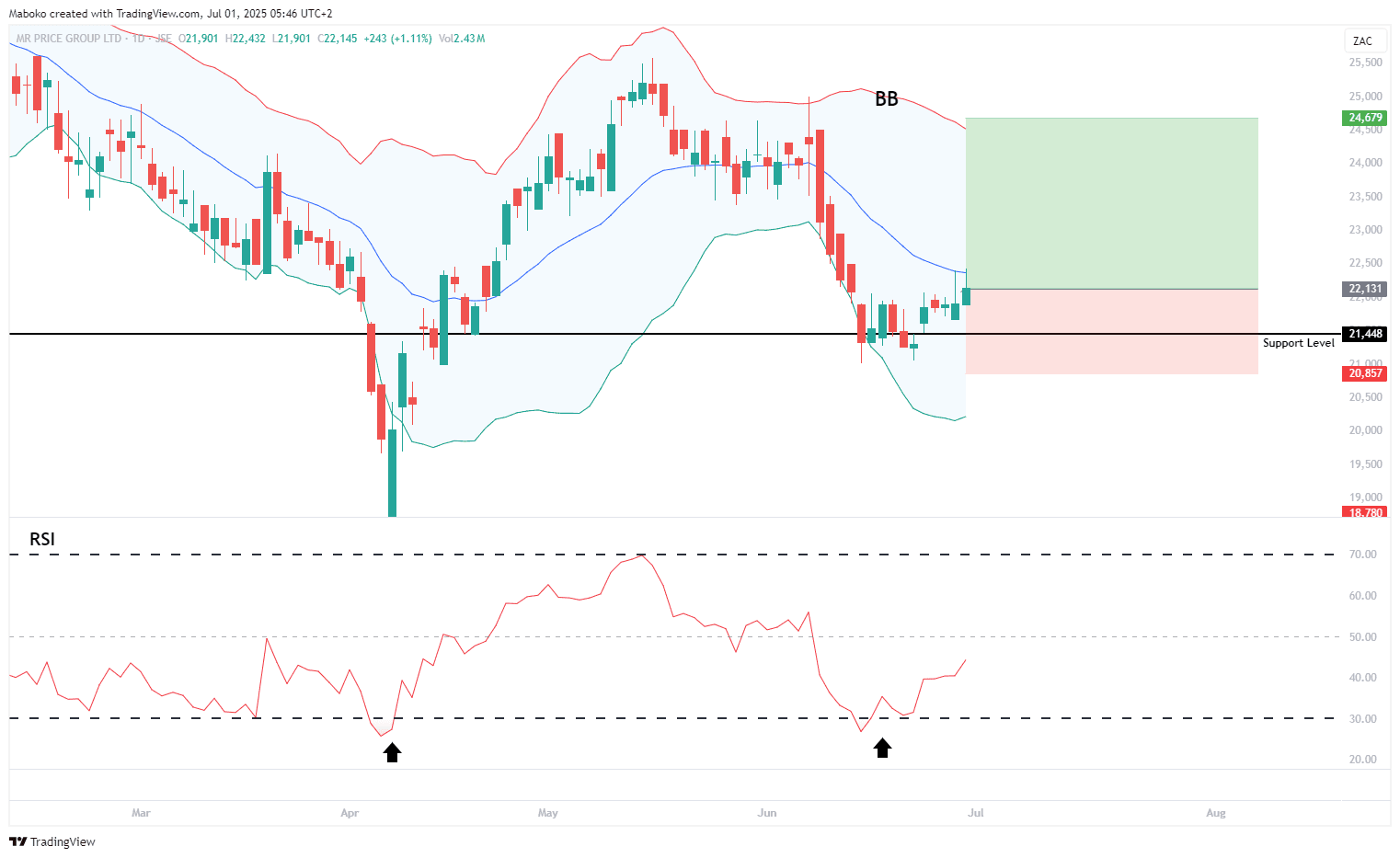

Mr. Price Group Ltd. (MRP): Mr. Price Group Ltd. is in the clothing and retail business. It operates through apparel, home, financial services, telecoms, and central services.

The share price has tested a key support level at R215, coinciding with a touch of the lower Bollinger Band, which often signals exhaustion in selling pressure. The relative strength indicator (RSI) has just exited oversold territory, indicating that bearish momentum is waning and a potential reversal or upward move may be unfolding.

A potential Buy/Long idea can be initiated, with the target set at R246.79 and the stop loss set at R208.57.

Financials

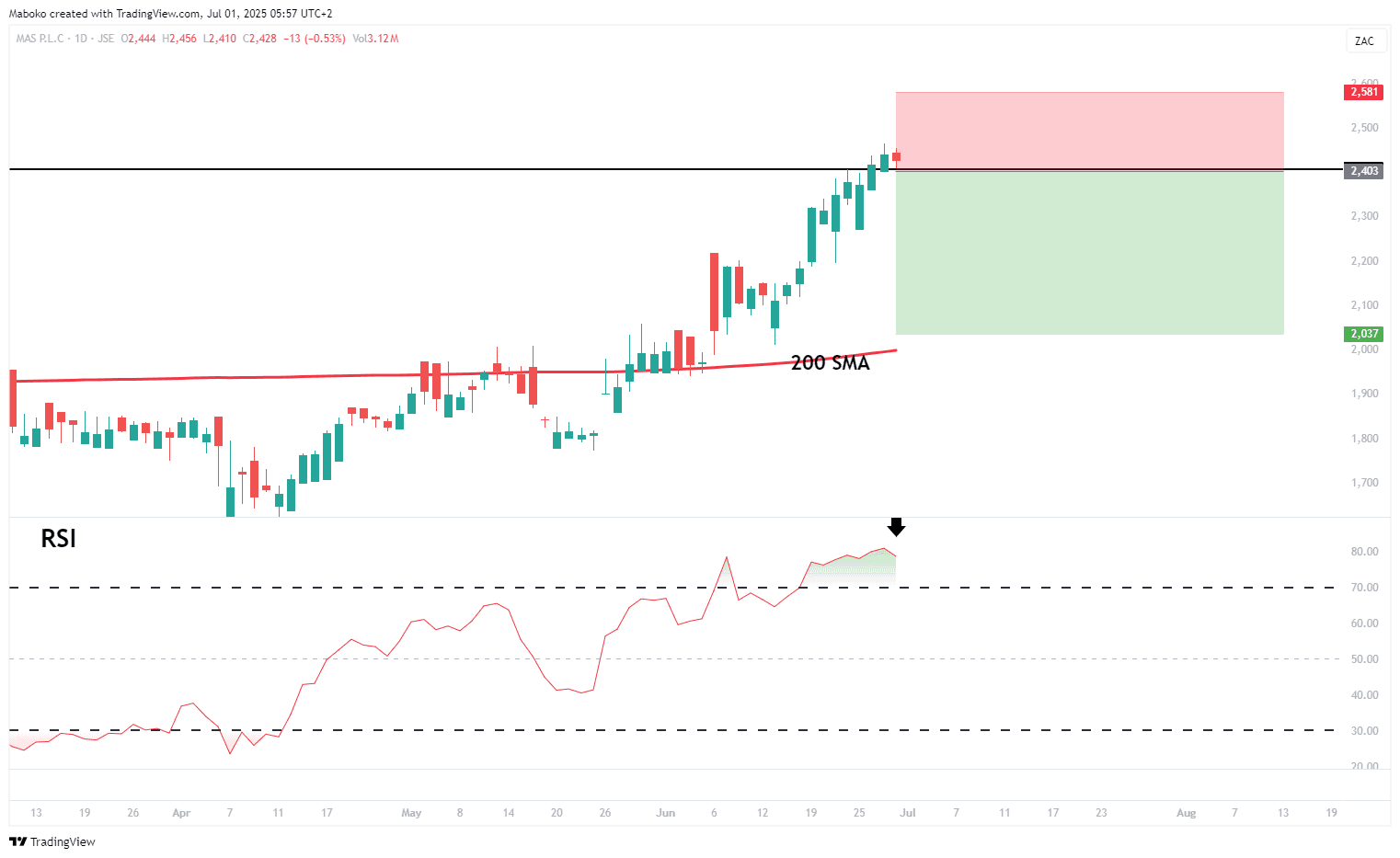

MAS Plc (MSP): MAS Plc is in the real estate investment, acquisition, and development business.

The share price is currently testing the resistance level at R24, with the RSI in overbought territory, typically a potential short-term pullback warning. However, with the broader trend still pointing upward, any downside may prove to be a temporary correction within a continuing bullish trend.

A speculative Sell/Short idea can be initiated, with the target set at R20.37 and the stop loss set at R25.81.

Health Care

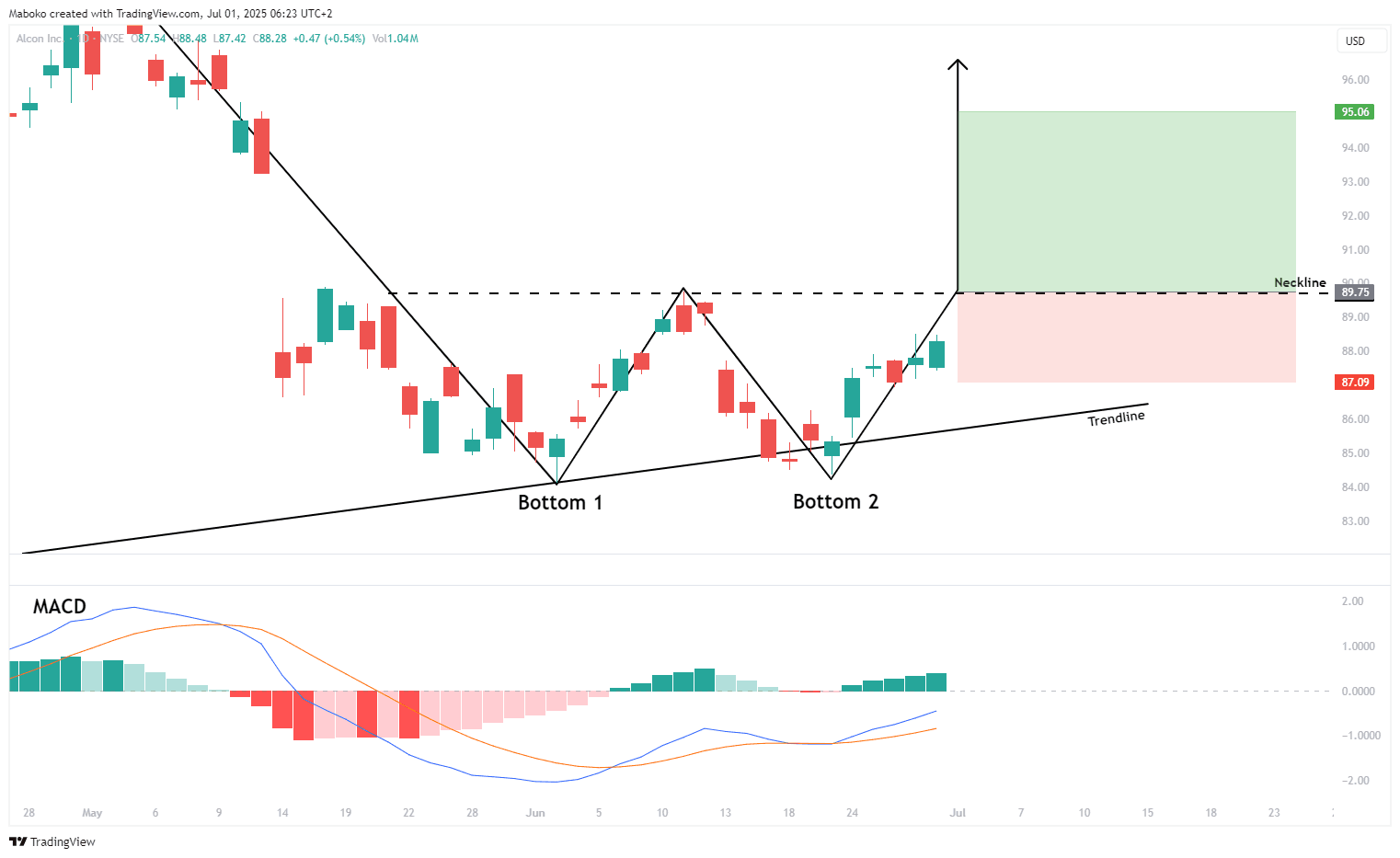

Alcon, Inc. (ALC): Alcon is in the development, manufacturing, and marketing of surgical equipment and devices, pharmaceutical eye drops, and consumer vision care products to treat eye diseases and disorders.

A double bottom pattern is unfolding, with both troughs forming near the trendline at the $84.30 region. To confirm the bullish reversal, the price needs to close above the neckline at $89.80. Supporting this setup, the moving average convergence divergence (MACD) is showing upward momentum, indicating that buyers may be regaining control.

A potential Buy/Long idea can be initiated, with the target set at $95.06 and the stop loss set at $87.09.

Consumer Discretionary

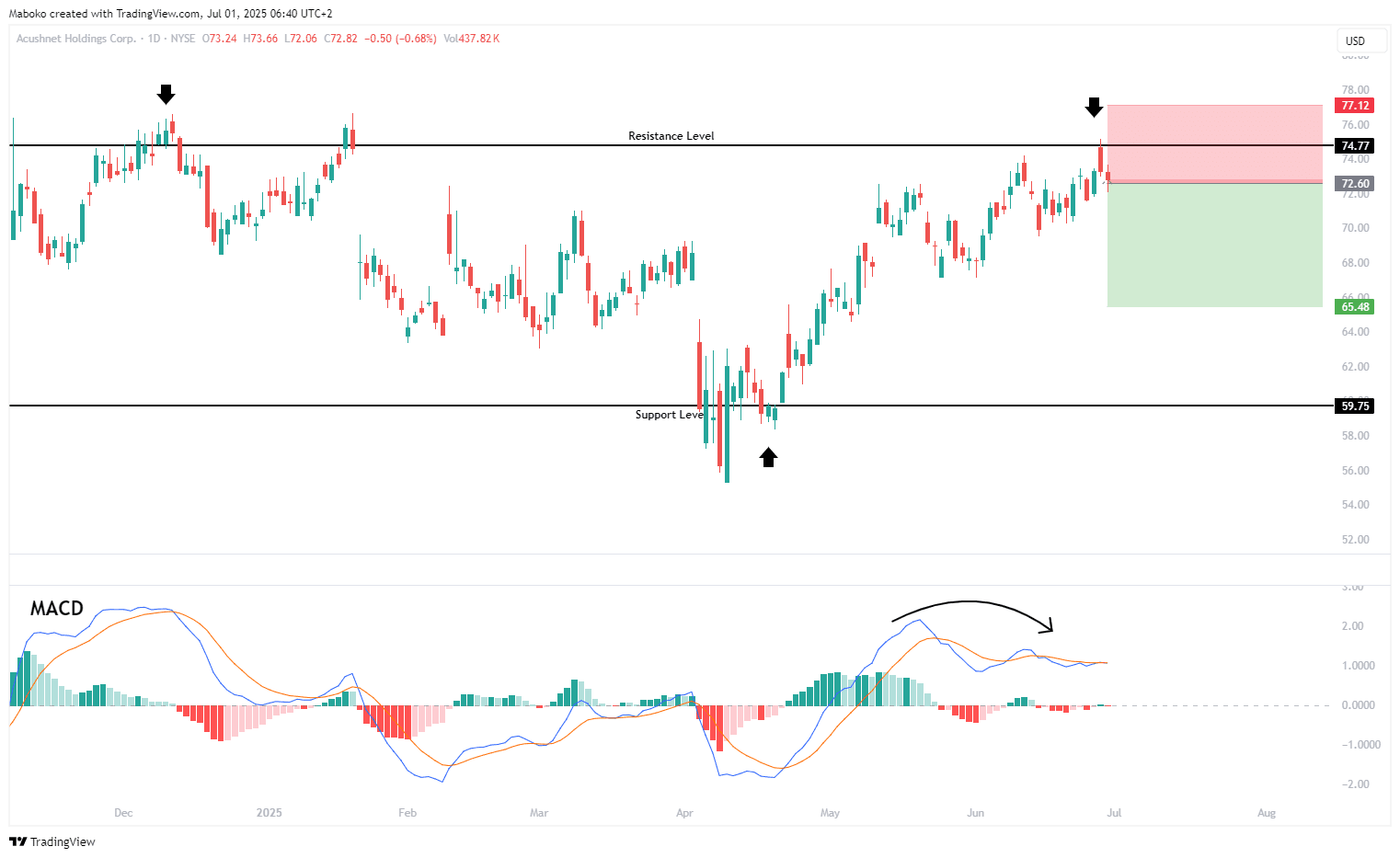

Acushnet Holdings Corp. (GOLF): Acushnet Holdings is involved in the design, development, manufacturing, and distribution of performance-driven golf products.

The share price has been trading within a defined horizontal channel, with support at $59.75 and resistance at $74.77. After recently testing the resistance level, the price failed to break above and closed below it, indicating potential weakness. As confluence, the MACD has made a bearish crossunder, reinforcing the likelihood of downward momentum within the range.

A speculative Sell/Short idea can be initiated, with the target set at $65.48 and the stop loss set at $77.12.

Information Technology

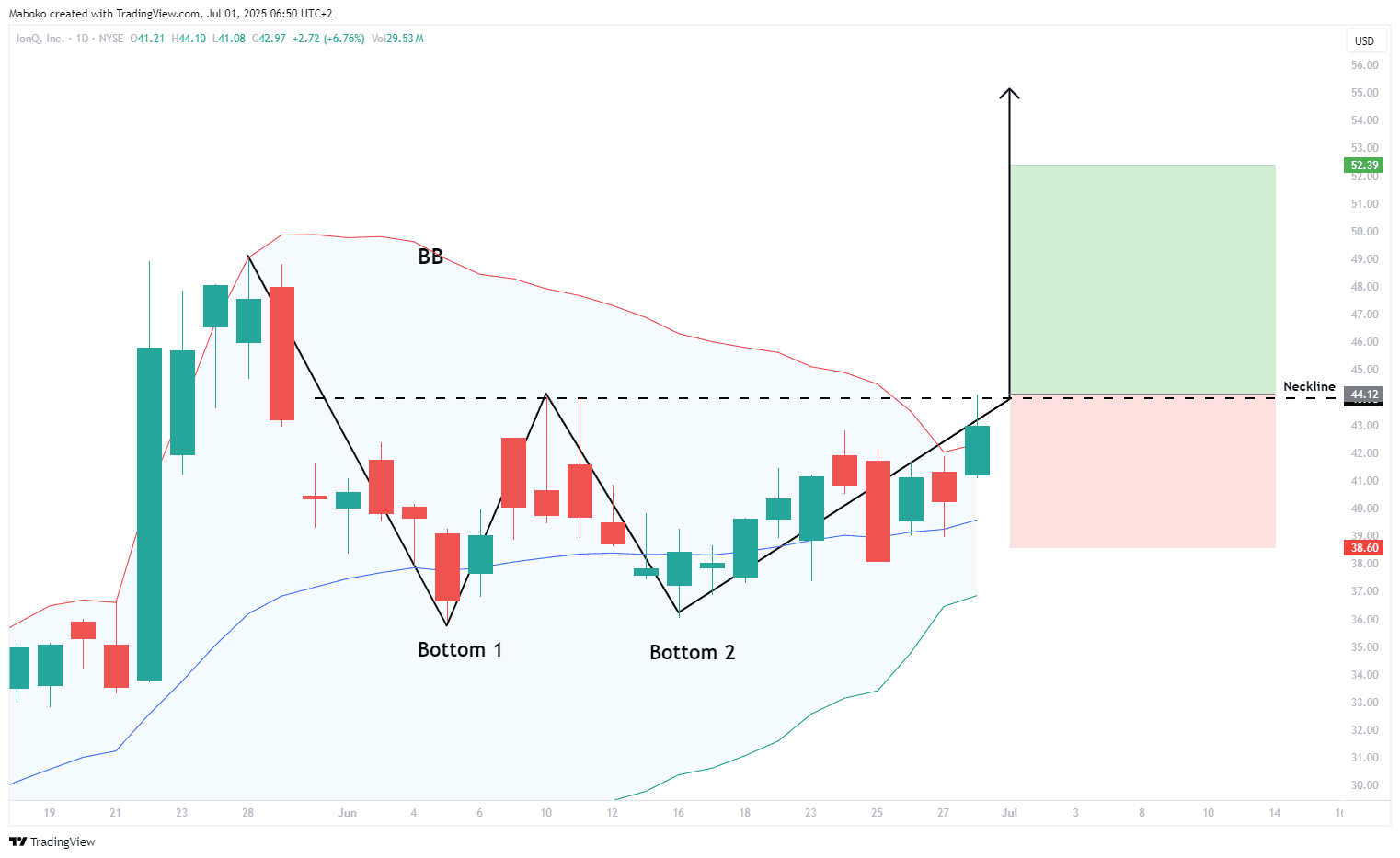

IonQ, Inc. (IONQ): IonQ develops and manufactures quantum computers. The firm specialises in quantum computing and quantum information processing.

A double bottom trading pattern is unfolding, with confirmation marked by a close above the neckline at $44. This imminent bullish breakout will potentially coincide with a brief contraction in the Bollinger Bands, followed by a close above the upper band, signalling a surge in upside momentum and reinforcing the potential for continued upward movement.

A potential Buy/Long idea can be initiated, with the target set at $52.39 and the stop loss set at $38.60.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi