Basic Materials

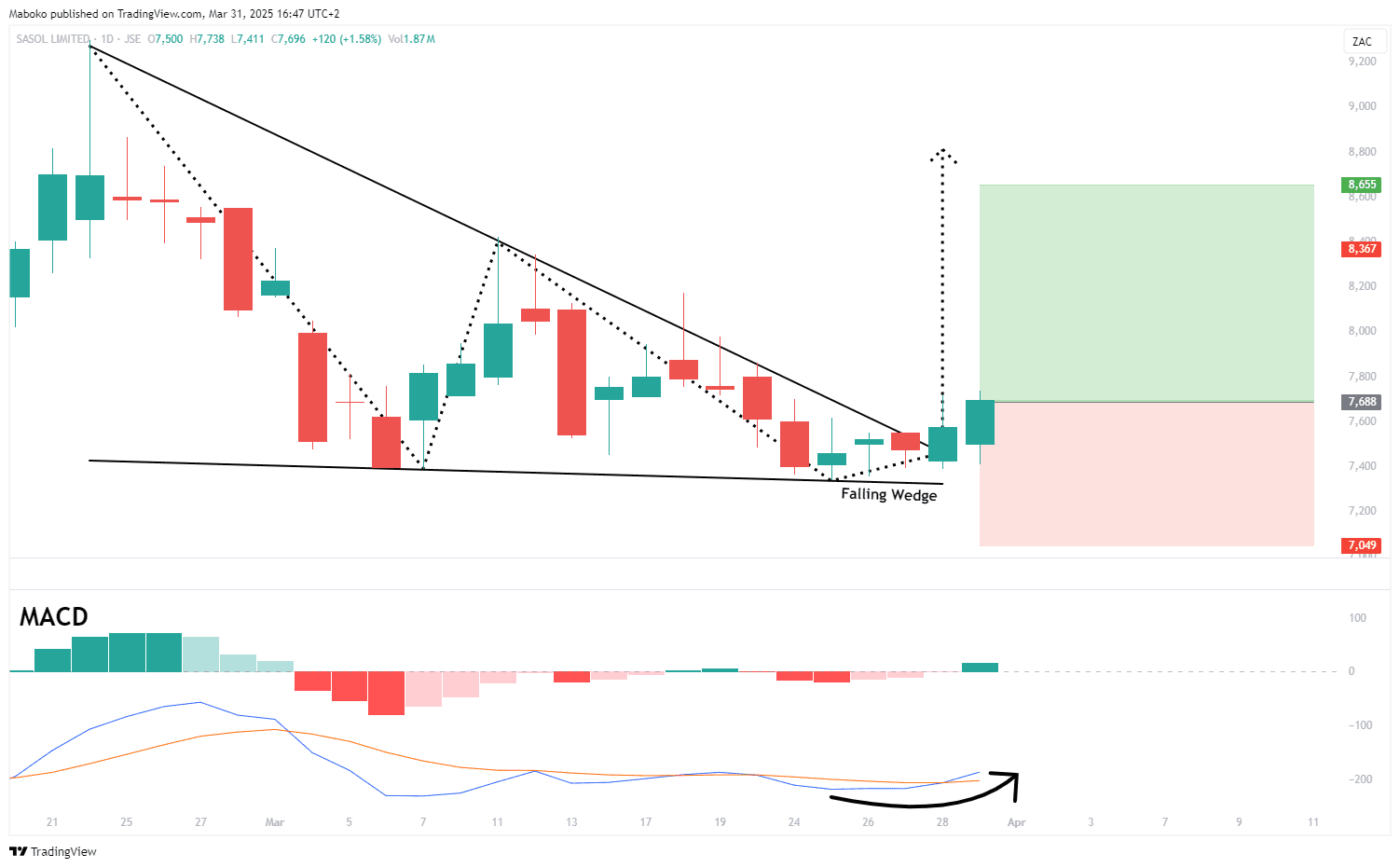

Sasol Ltd. (SOL): Sasol Ltd. is a chemical and energy company that sources, produces, and markets chemical and energy products.

A falling wedge pattern breakout has been confirmed at R75, signalling a potential trend reversal to the upside. As confluence, the moving average convergence divergence (MACD) has made a bullish crossover, reinforcing upward momentum.

A potential Buy/Long idea can be initiated, with the target set at R86.55 and the stop loss set at R70.49.

Consumer Services

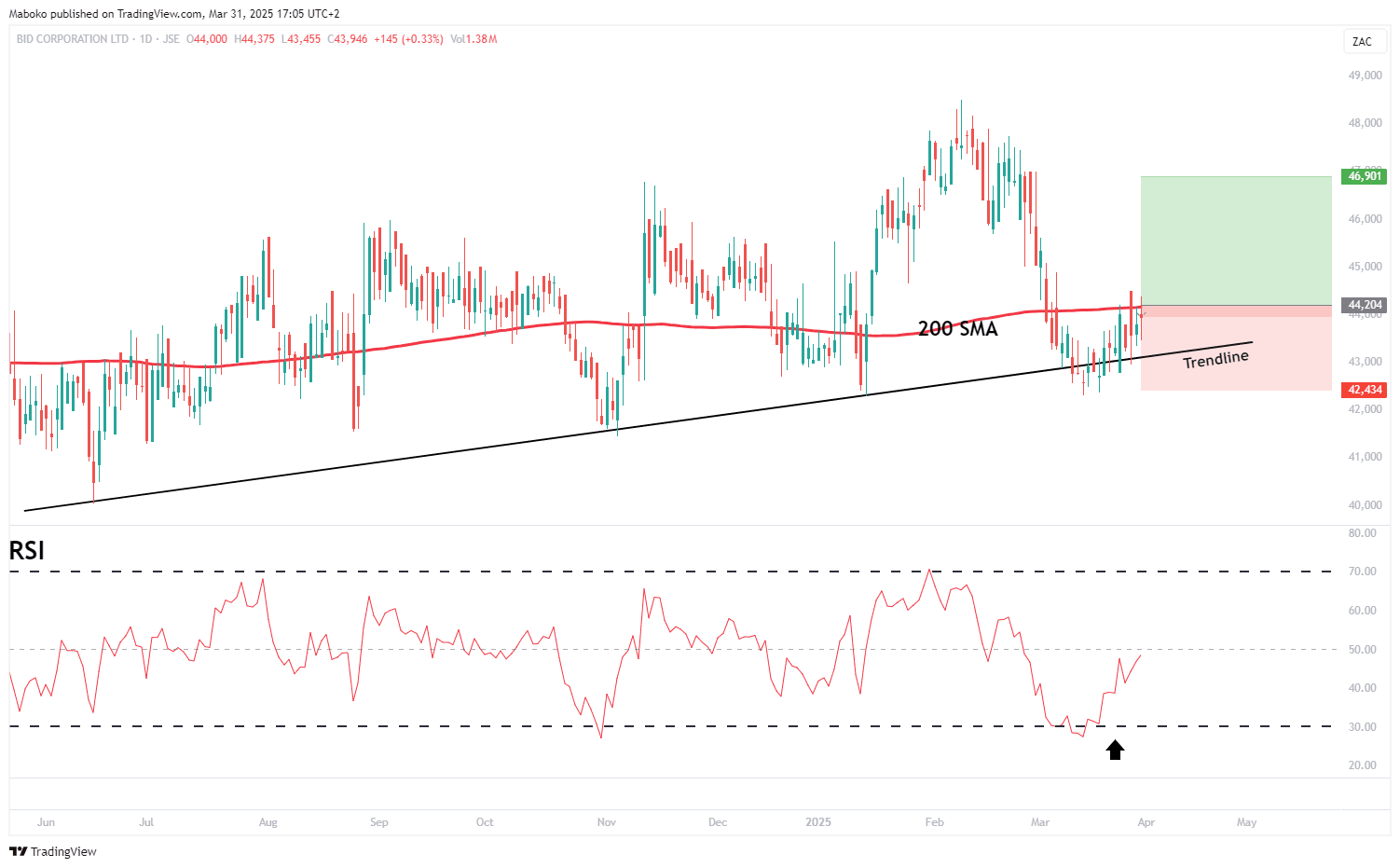

Bid Corporation LTD. (BID): Bid Corp. Ltd. offers comprehensive food service solutions. It operates in Australasia, the United Kingdom, Europe, and Emerging Markets.

The share price recently tested the ascending trendline at the R430 region. However, it closed below the 200-day simple moving average (SMA). A close above the SMA would signal that bulls are in control, potentially confirming trend continuation. As confluence, the MACD has made a bullish crossover, supporting upward momentum.

A potential Buy/Long idea can be initiated once the price closes above the SMA at R442.05, with the target set at R469.01 and the stop loss set at R424.34.

Consumer Services

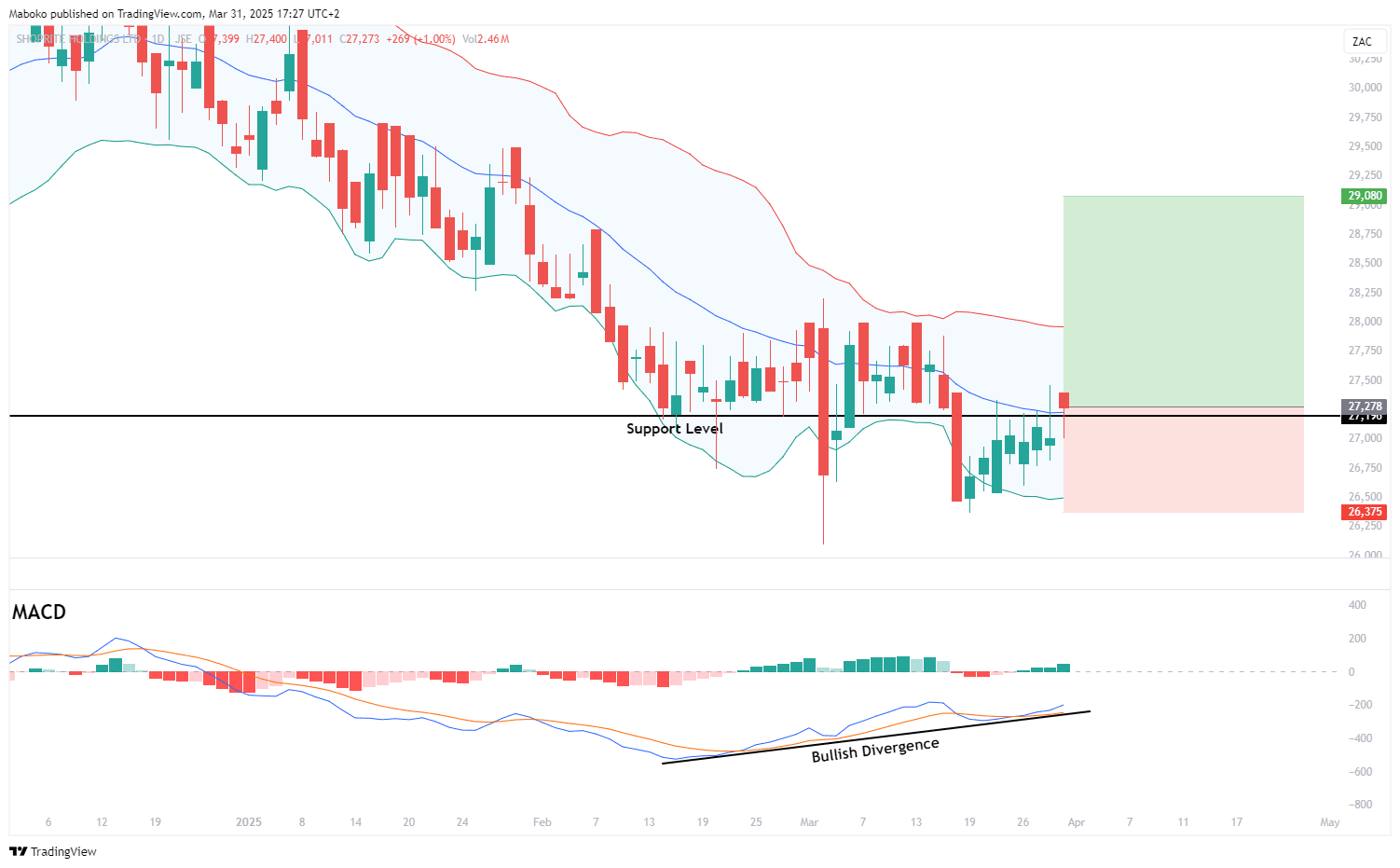

Shoprite Holdings Ltd. (SHP): Shoprite is an investment company that manages retail stores.

The share price recently tested the support level at R271.96 and has been trading along the lower bound of the Bollinger Bands (BB), suggesting a potential rebound. As confluence, the MACD has formed a bullish divergence, indicating that downward momentum may be fading, with a possible shift to the upside.

A potential Buy/Long idea can be initiated, with the target set at R290.80 and the stop loss set at R26.

Consumer Discretionary

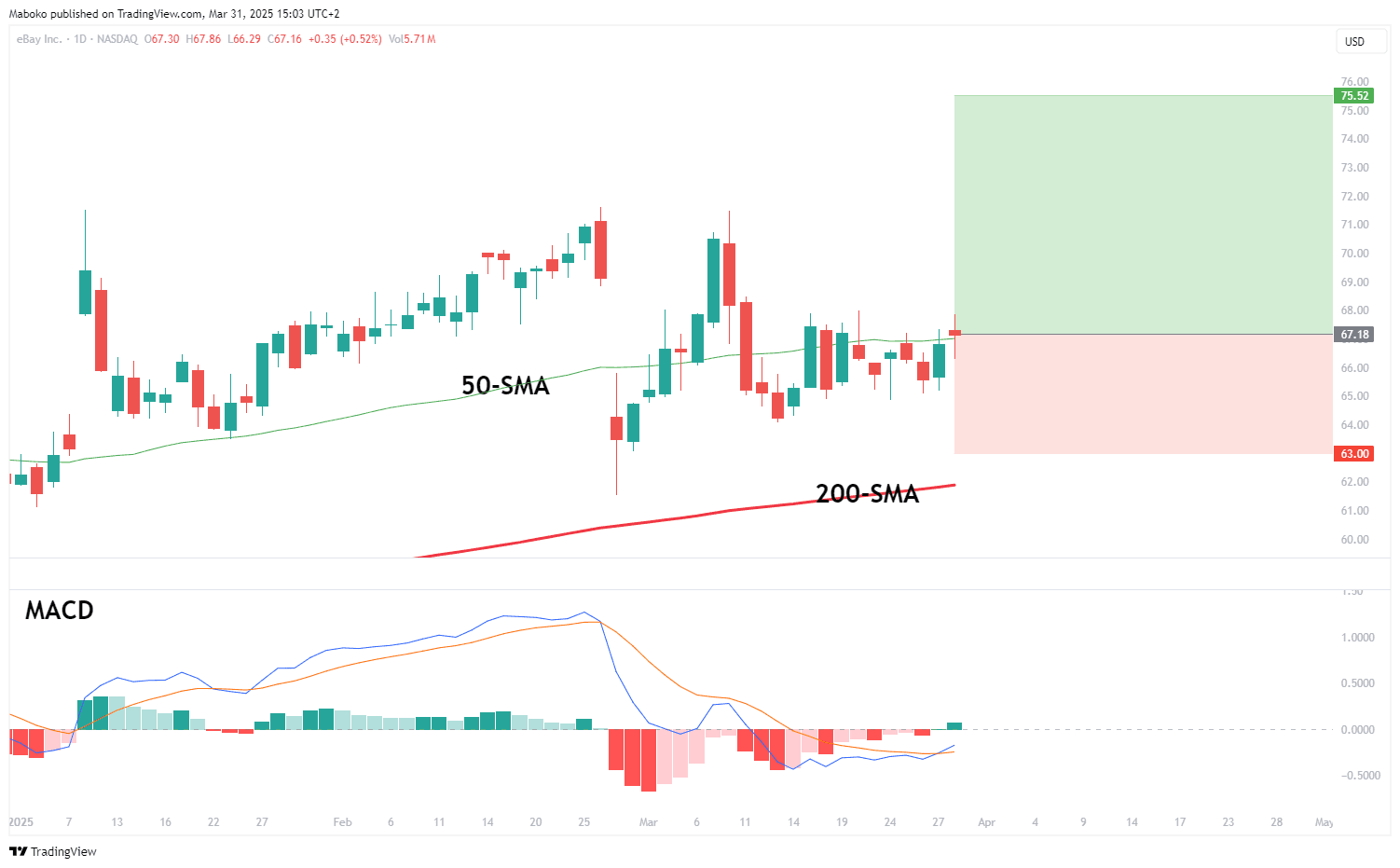

eBay, Inc. (EBAY): eBay is a commerce company whose platforms include a suite of mobile apps, an online marketplace, and localised counterparts, including off-platform businesses in South Korea, Japan, and Turkey. It offers various product categories, including parts and accessories, collectibles, fashion, electronics, and home & garden.

The share price closed above the 50-day simple moving average (SMA), a historically significant level for trend continuation. As confluence, the price is trading above the 200-day SMA, reinforcing that bulls are in control of the trend. Additionally, the moving average convergence divergence (MACD) has made a bullish crossover, suggesting upward momentum may continue.

A potential Buy/Long idea can be initiated, with the target set at $75.52 and the stop loss set at $63.

Financials

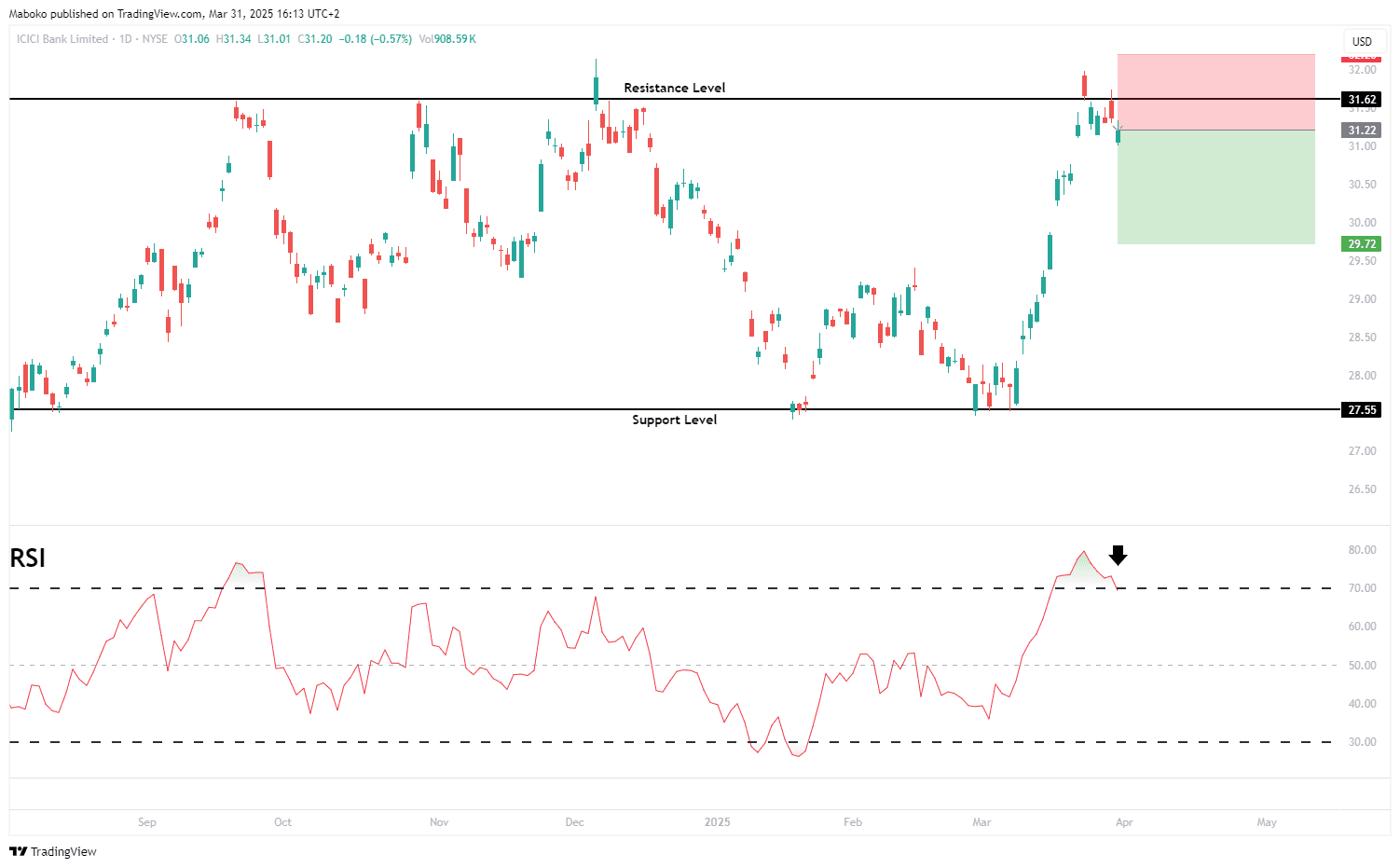

ICICI Bank Ltd. (IBN): ICICI Bank offers banking and financial services, which include retail banking, corporate banking, and treasury operations.

The share price has tested the resistance level at $31.62 within its consolidation range, with support at $27.55. The relative strength indicator (RSI) is in overbought territory, indicating the price may be due for a potential pullback. A cross below the overbought region would reinforce downward momentum.

A speculative Sell/Short idea can be initiated with the target set at $29.72 and the stop loss set at $32.20.

Communication Services

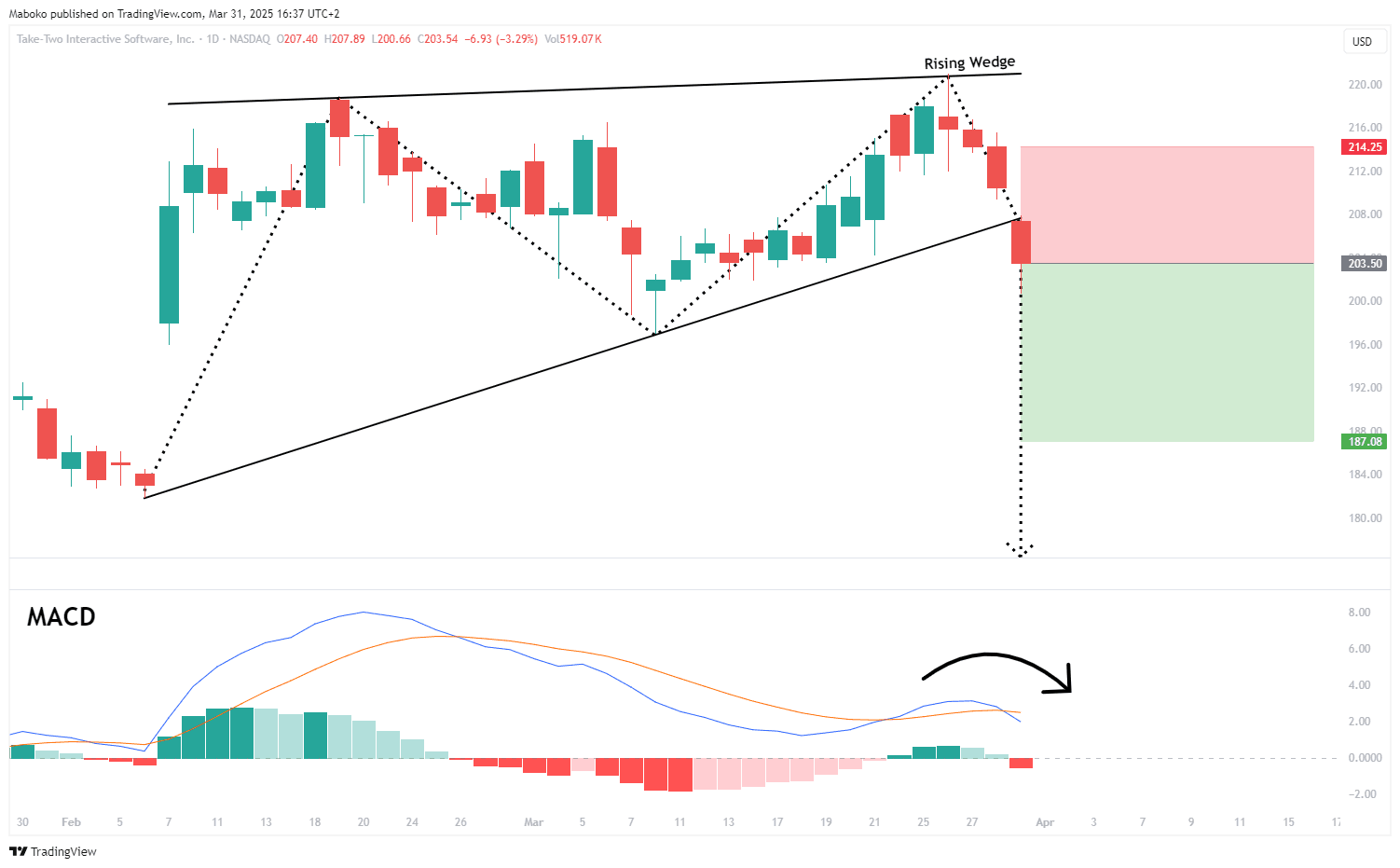

Take-Two Interactive Software, Inc. (TTWO): Take-Two is in the development, publishing, and marketing of interactive software games. Its products are designed for console systems, handheld gaming systems, personal computers, smartphones, and tablets. They are delivered through physical retail, digital download, online platforms, and cloud streaming services.

A rising wedge pattern has been triggered at the $208 level, indicating a potential trend reversal. As confluence, the moving average convergence divergence (MACD) has made a bearish crossover and formed a bearish divergence, suggesting that upward momentum is weakening and favoring a move to the downside.

A speculative Sell/Short idea can be initiated with the target set at $187.08 and the stop loss set at $214.25.

Disclaimer:

*Any opinions, views, analysis or other information provided in this article is provided by BCS Markets SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BCS Markets SA does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions and all decisions are made at your own risk. BCS Markets SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss including without limitation any loss of profit which may arise directly or indirectly from use of the market commentary. The content contained within the article is subject to change at any time without notice. BCS Markets SA is an authorised financial services provider FSP No. 51404.

** This article was prepared by BROKSTOCK analyst Maboko Seabi