Consumer Services

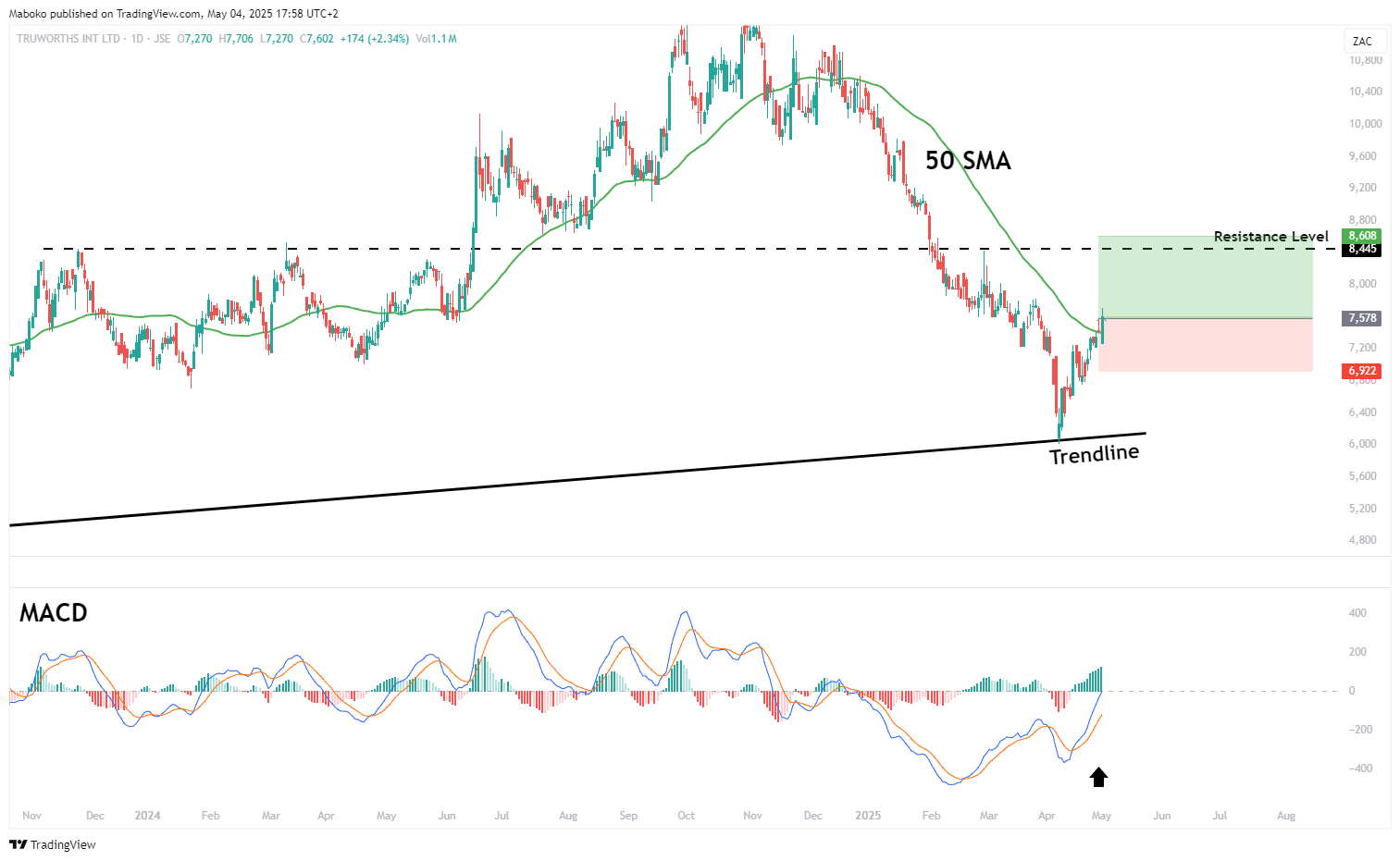

Truworths International Ltd. (TRU): Truworths International Ltd. is an investment holding company that retails fashion apparel, footwear, and accessories. It operates through the Truworths and office segments in South Africa, the United Kingdom, Germany, and the Republic of Ireland.

The share price has recently tested the upward trendline for the third time since March 2020, with each test resulting in a higher high, indicating a strong, sustained uptrend. Historically, a close above the 50-day simple moving average (SMA) has supported further upside. However, the price is now approaching a key resistance level around the R84.50 region, which may act as a hurdle for continued upward movement.

A potential Buy/Long idea can be initiated, with the target set at R84.45 and the stop loss set at R69.22.

Consumer Services

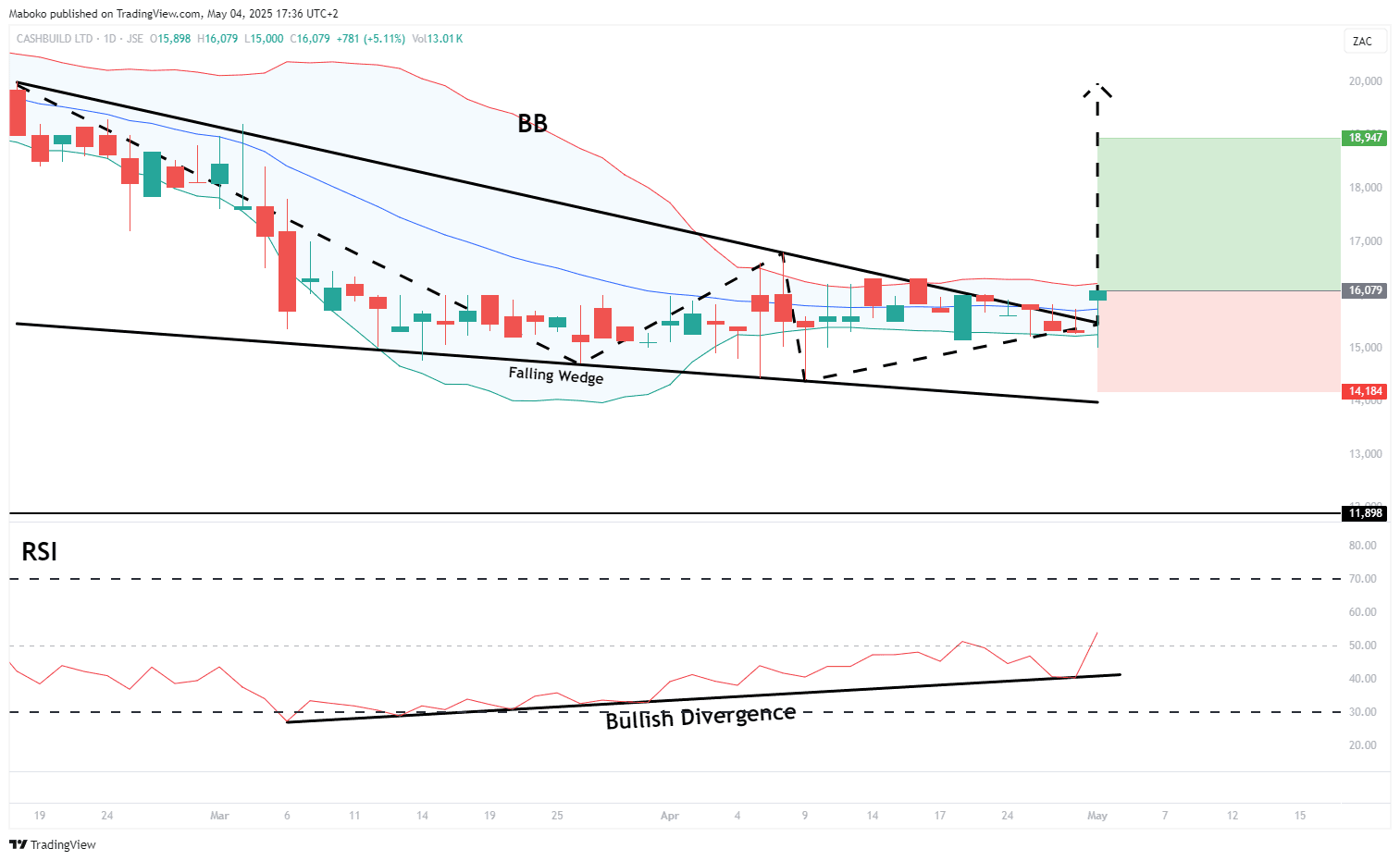

Cashbuild Ltd. (CSB): Cashbuild is in the retail of building materials and associated products.

The share price has just broken out of a falling wedge pattern, signalling a potential trend reversal. As confluence, the Bollinger Bands (BB) have contracted, indicating that a significant price movement may be imminent. Additionally, the relative strength indicator (RSI) has formed a bullish divergence, suggesting that the recent downward momentum is weakening and upside momentum may be building.

A potential Buy/Long idea can be initiated, with the target set at R189.47 and the stop loss set at R141.84.

Financials

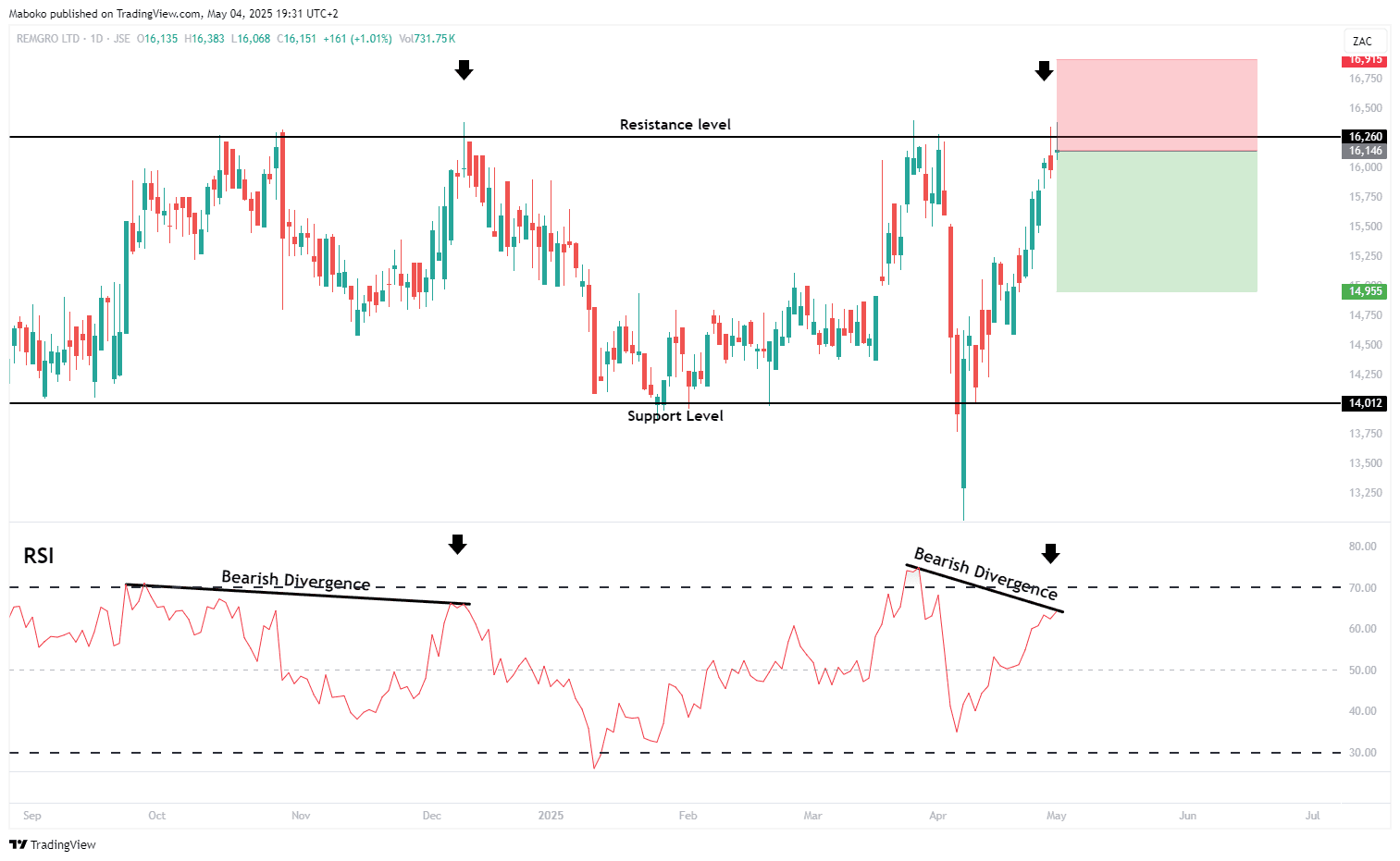

Remgro Ltd. (REM): Remgro is an investment holding company. It operates through the following divisions: healthcare, consumer products, financial services, infrastructure, diversified investment vehicles, media, portfolio investment, social impact investments, and central treasury.

The share price recently tested the resistance level at R162.60, while the RSI formed a bearish divergence. Historically, this pattern has preceded a move lower, with the price often retesting the support level around the R140 region.

A speculative Sell/Short idea can be initiated with the target set at R149.55 and the stop loss set at R169.15.

Information Technology

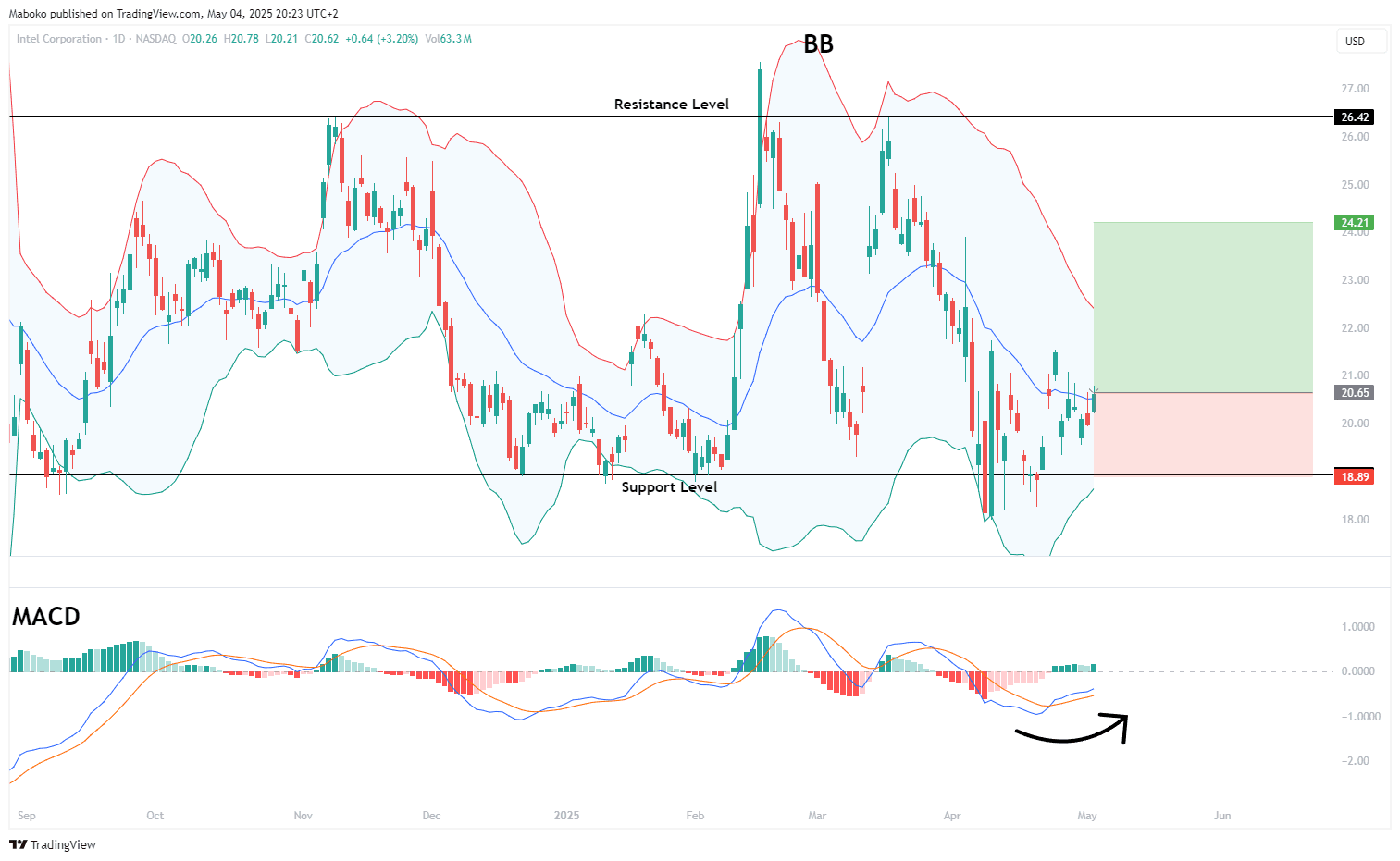

Intel Corp. (INTC): Intel Corp designs, manufactures, and sells computer products and technologies. It offers networking, data storage and communications platforms.

Since August 2024, the stock has been trading within a defined range, bounded by support at $18.90 and resistance at $26.42. Recently, the price tested the support level and simultaneously touched the lower bounds of the Bollinger Bands, a region that has historically signalled potential reversals. As confluence, the moving average convergence divergence (MACD) is showing upward momentum, suggesting a possible bounce from current levels.

A potential Buy/Long idea can be initiated, with the target set at $24.21 and the stop loss set at $18.89.

Communication Services

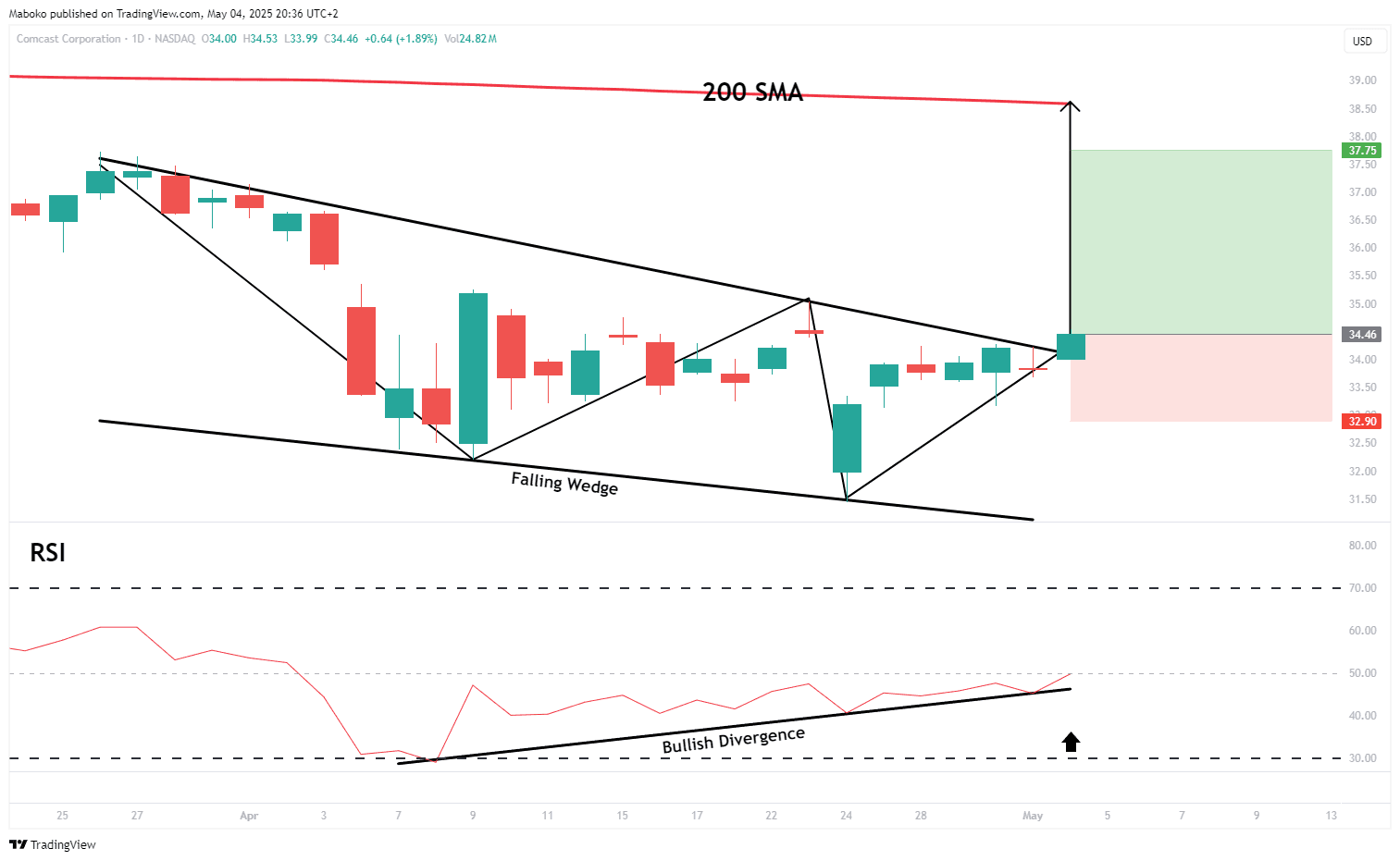

Comcast Corp (CMCSA): Comcast Corp offers video, internet, and phone services. It operates through residential connectivity, platforms, business services connectivity, media, studios, and theme parks.

The share price has broken out of a falling wedge pattern to the upside, a move typically associated with bullish reversals. Supporting this, the relative strength indicator (RSI) has formed a bullish divergence, indicating weakening downward momentum. However, the price remains below the 200-day simple moving average (SMA), suggesting that the broader trend is still bearish. This breakout may represent a short-term retracement within a downtrend.

A speculative Buy/Long idea can be initiated with the target set at $32.75 and the stop loss set at $32.90.

Information Technology

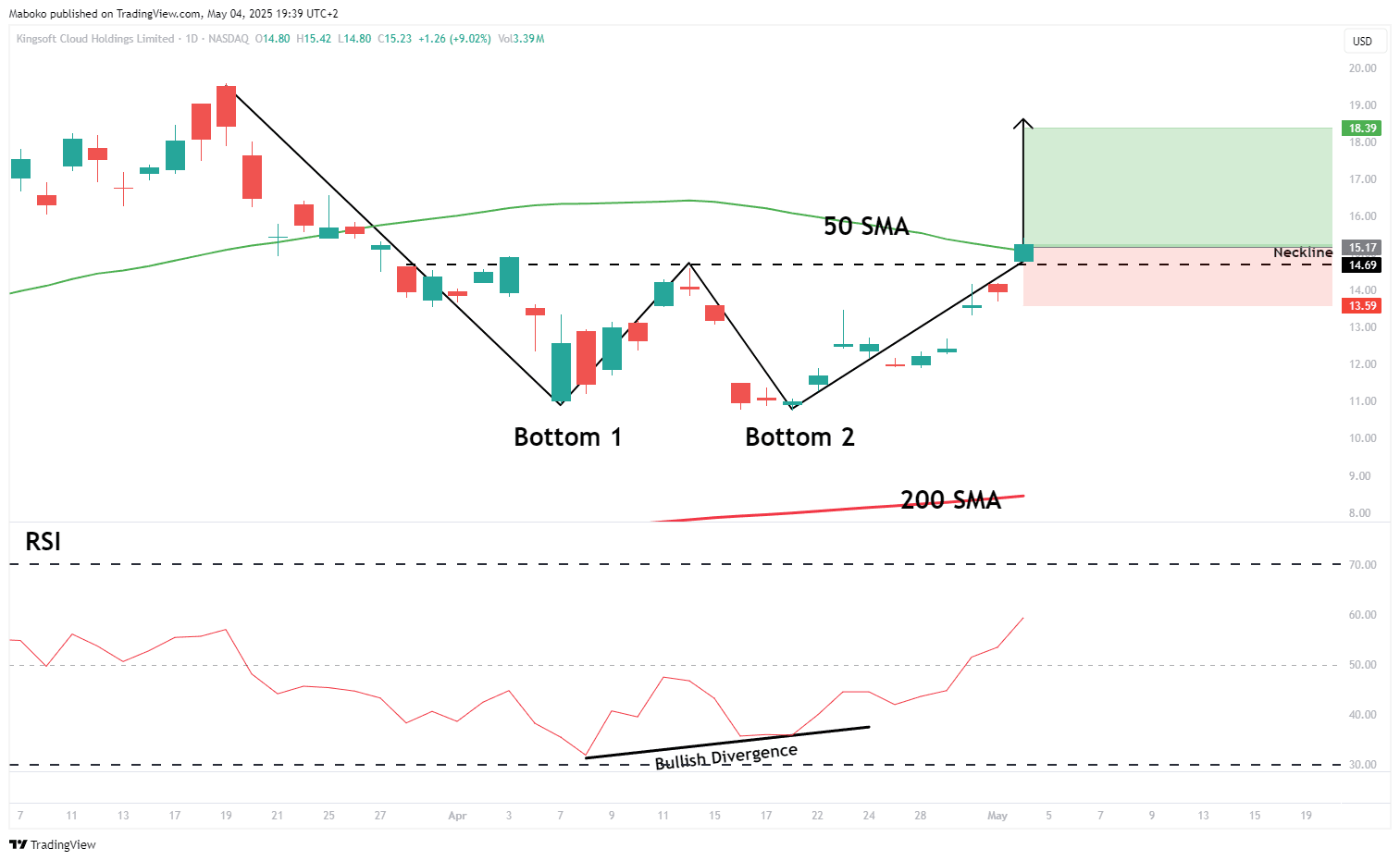

Kingsoft Cloud Holdings Ltd. (KC): Kingsoft provides cloud storage and computation services, including infrastructure, cutting-edge products and industry-specific solutions across public, enterprise and AIoT cloud services.

A double bottom pattern has confirmed a bullish breakout, with the price closing above the 50-day SMA, signalling potential trend continuation. The share is also trading above the 200-day SMA, reinforcing the bullish outlook. Additionally, a bullish divergence on the RSI suggests that downward momentum is fading, further supporting the case for continued upward movement.

A potential Buy/Long idea can be initiated with the target set at $18.39 and the stop loss set at $13.59.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi