Financials

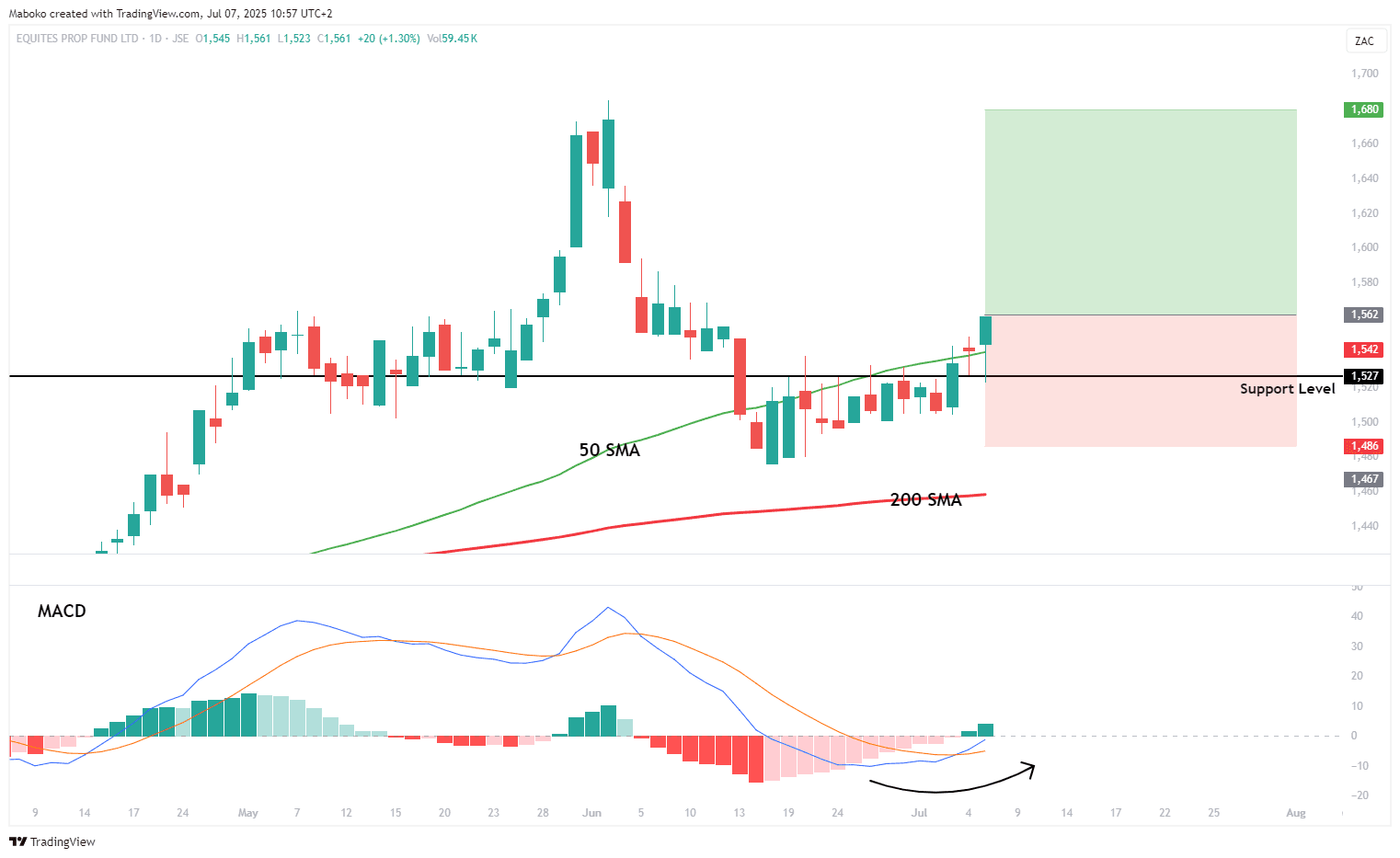

Equites Property Fund Ltd (EQU): Equites Property Fund Ltd. manages logistics properties. It operates through the industrial United Kingdom and South Africa.

The share price has closed above a key resistance level, now acting as support, which signals strength in the current uptrend. This move is supported by a close above the 50-day simple moving average (SMA), indicating continued upward movement. Additionally, the recent moving average convergence divergence (MACD) bullish crossover reinforces the building positive momentum, suggesting further upside potential.

A potential Buy/Long idea can be initiated, with the target set at R16.80 and the stop loss set at R14.86.

Consumer Services

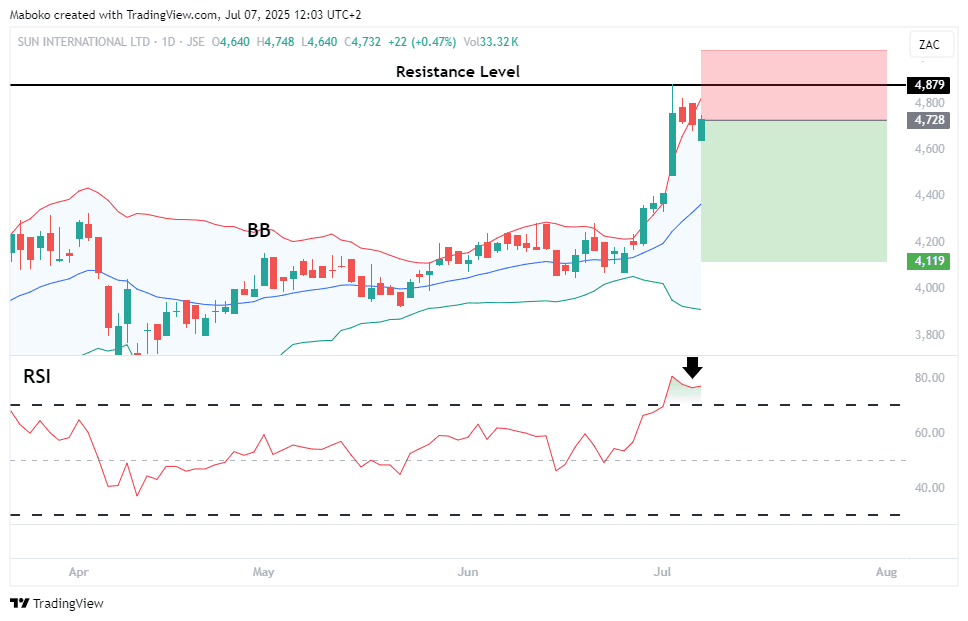

Sun International Ltd (SUI): Sun International is in the investment and management of resorts and hotels, casinos, and entertainment properties.

The price recently tested the resistance level around R49 following strong upward momentum, evidenced by a prior close above the upper Bollinger Band. However, Friday's close below the band suggests a potential cooling-off period. As confluence, the RSI is in overbought territory, indicating that downward momentum may be imminent as the rally shows signs of exhaustion.

A speculative Sell/Short idea can be initiated, with the target set at R41.19 and the stop loss set at R50.30.

Consumer Goods

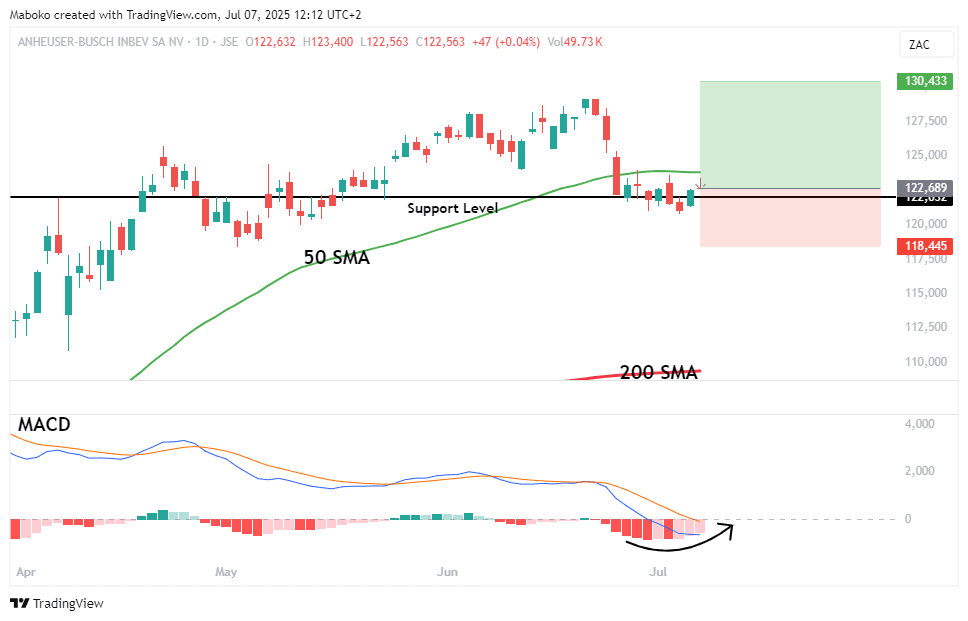

Anheuser-Busch InBev SA/NV (ANH): Anheuser-Busch InBev SA/NV is a holding company that manufactures and distributes alcoholic and non-alcoholic beverages. It operates in North America, South America, and the Asia Pacific and exports globally.

The share price is trading well above the 200-day moving average, reflecting a prevailing long-term uptrend. The price recently broke above the R1220 level, which was previously resistance turned support, and has since retested and closed above it, reinforcing this level as a key support zone. A close above the 50-day SMA, accompanied by a bullish MACD crossover, would further validate the continuation of the upward trend.

A potential Buy/Long idea can be initiated, with the target set at R1304.33 and the stop loss set at R1184.45.

Consumer Discretionary

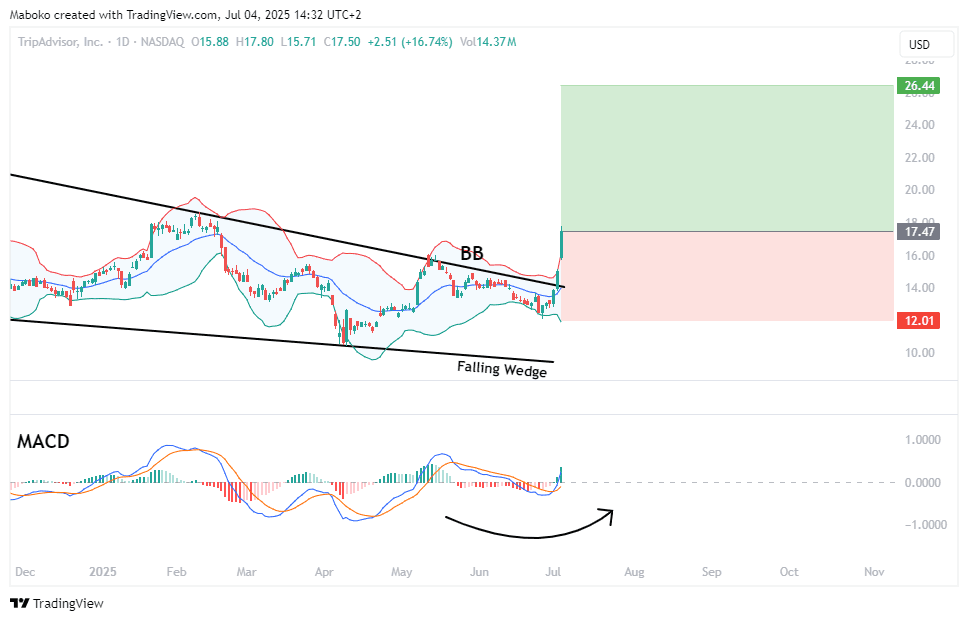

TripAdvisor, Inc. (TRIP): TripAdvisor is an online travel company that owns and operates a portfolio of online travel brands.

The overall trend remains bearish, however, the price has broken above the upper boundary of the falling wedge pattern, a bullish reversal signal. This breakout is reinforced by an expanding Bollinger Band and a close above its upper band, indicating strong upward momentum. Additionally, the moving average convergence divergence (MACD) has confirmed a bullish crossover, further supporting the case for a shift in momentum to the upside.

A potential Buy/Long idea can be initiated, with the target set at $26.44 and the stop loss set at $12.01.

Information Technology

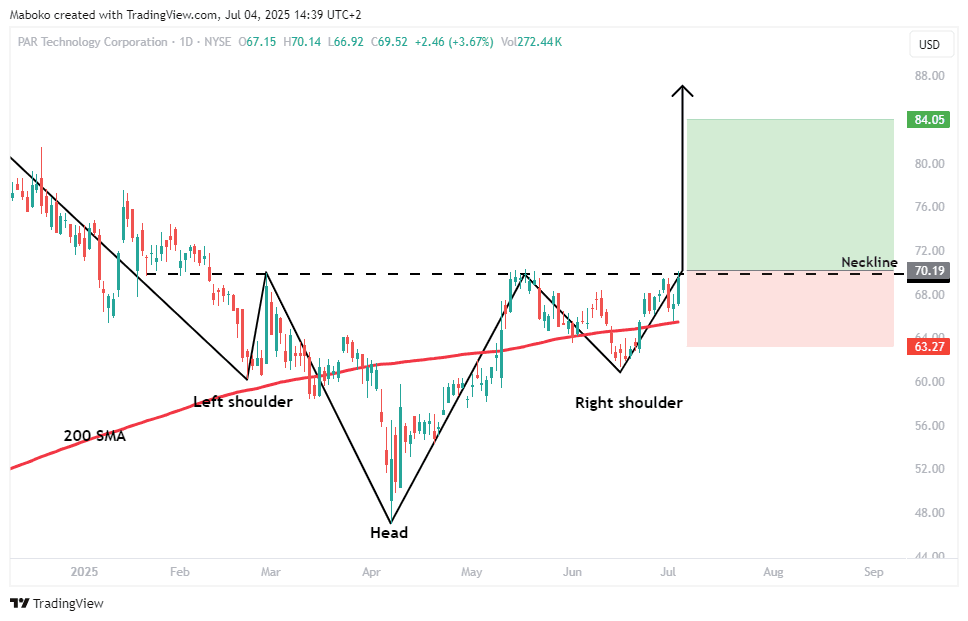

PAR Technology Corp. (PAR): PAR offers the hospitality industry software and hardware support services.

An inverted head and shoulders pattern is unfolding, with the neckline at $70. A confirmed close above this level would signal a potential trend reversal to the upside. As confluence, the price has already closed above the 200-day simple moving average (SMA), reinforcing the likelihood of a shift in trend direction and suggesting growing bullish momentum.

A potential Buy/Long idea can be initiated, with the target set at $84.05 and the stop loss set at $63.27.

Consumer Discretionary

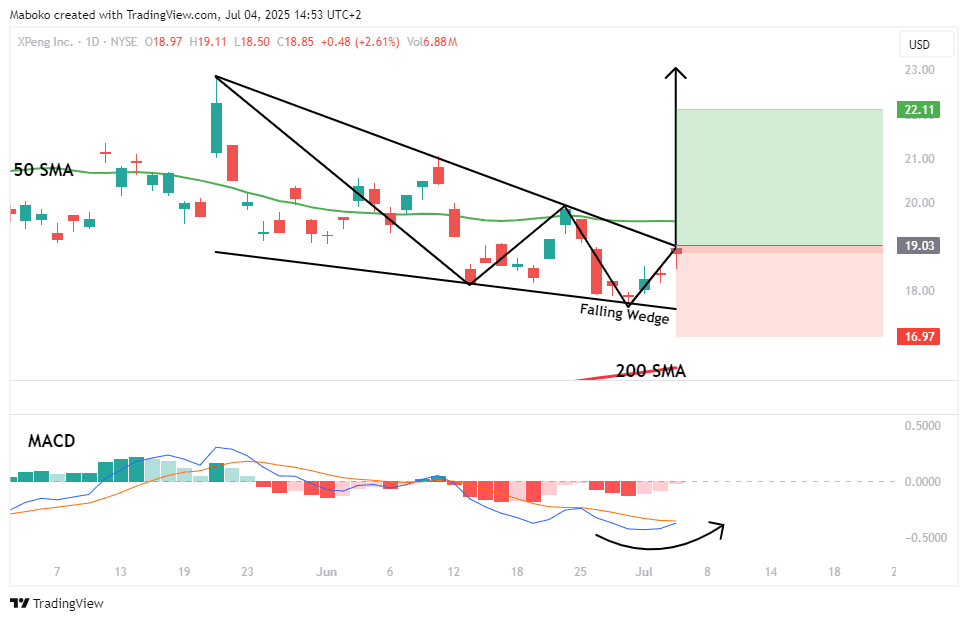

XPeng, Inc. (XPEV): XPeng is in the design, development, manufacturing, and marketing of smart electric vehicles.

The stock price is trading within a falling wedge pattern, with a breakout confirmation expected on a close above $19.20. A subsequent close above the 50-day SMA would reinforce the bullish trajectory, especially as the stock remains in an established uptrend, trading above the 200-day SMA. Additionally, the MACD is on the verge of a bullish crossover, supporting the case for continued upward momentum.

A potential Buy/Long idea can be initiated, with the target set at $22.11 and the stop loss set at $16.97.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi