Johann Rupert’s Reinet Investments is in advanced talks to sell its 49.5% stake in the UK-based Pension Insurance Corporation Group (PIC) to Athora Holdings Ltd, in a deal potentially worth £5.7 billion (around R135 billion).

PIC is Reinet’s largest asset, accounting for approximately 54% of its Net Asset Value, making it a cornerstone of the Rupert empire. The news follows Reinet’s earlier sale of its stake in British American Tobacco (BAT), which funded a large cash pile now comprising 26% of its portfolio.

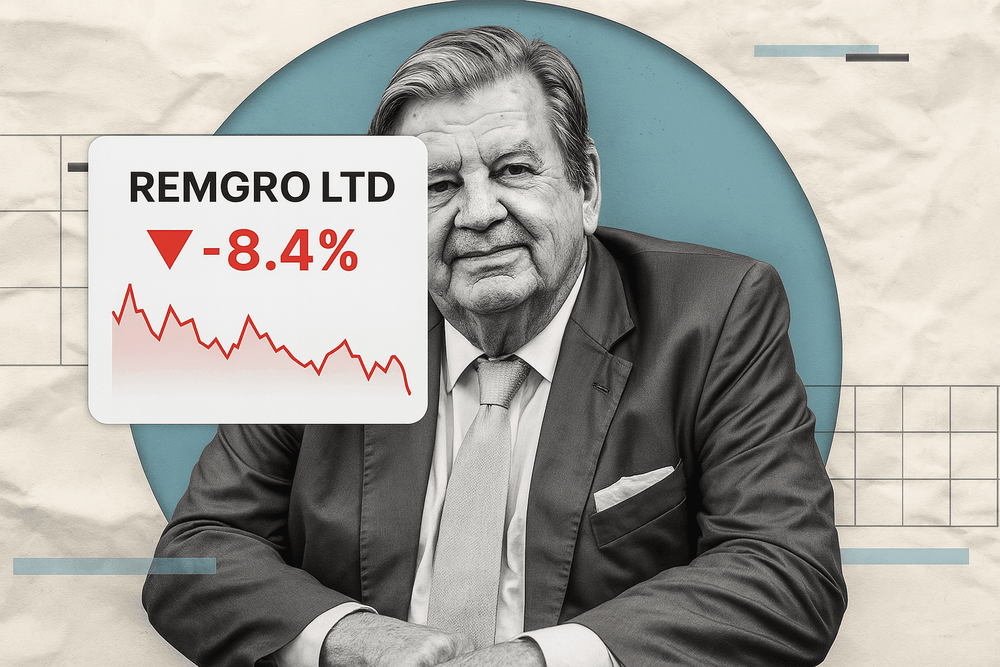

● Liquidity Boost: A successful deal would raise substantial cash for Reinet—enabling new investments across Remgro, Richemont, and beyond.

● Asset Rebalancing: This move could reshape Reinet’s portfolio by reducing exposure to insurance and increasing flexibility in capital allocation.

● Market Sentiment: Previously seen as stable and conservative, Reinet could be viewed as more dynamic—raising interest among investors watching SA’s global investment footprint.

● Deal Certainty: Reinet emphasized there is no guarantee the transaction will proceed, and details remain subject to confirmation.

● Strategic Direction: Watch where Reinet redirects its capital—will it scale up industrial investments, diversify into new sectors, or return funds to investors?

● Currency & Rand Impact: A large inflow of funds could influence the rand and SA market sentiment, especially if proceeds are repatriated.

Disclaimer:

This content has been generated using AI technology and is intended for informational purposes only. While efforts have been made to ensure accuracy and relevance, this text should not be considered professional advice or an official statement. Always verify information from authoritative sources before making any decisions. This is not financial advice.