Consumer Services

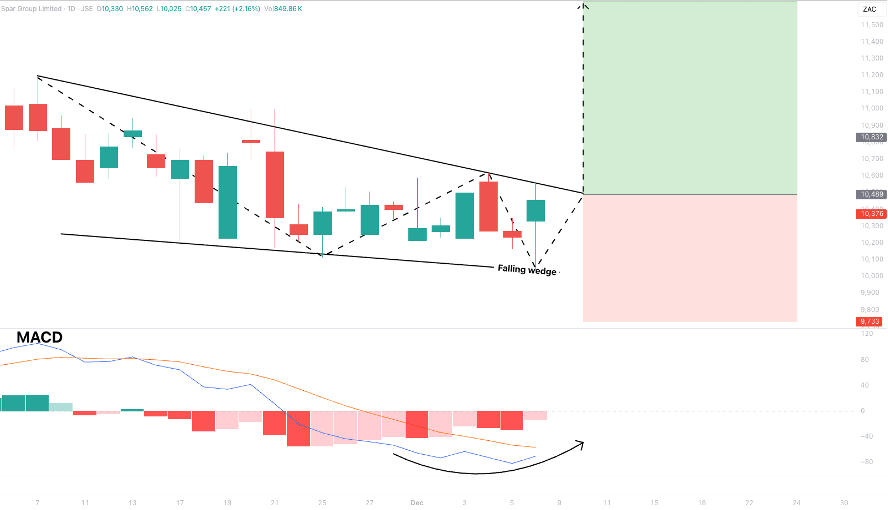

Spar Group Ltd. (SPP): Spar is in the wholesale and distribution of goods and services to SPAR, SUPERSPAR, TOPS, SaveMor, Build it and Pharmacy.

A falling wedge pattern is currently forming, which typically indicates a potential shift toward an upward trend. Adding to this constructive setup, the moving average convergence divergence (MACD) is approaching a bullish crossover, signalling that a change in momentum may soon support a move higher.

A potential Buy/Long idea can be initiated once the price closes above the R105 level, with the target set at R116.43 and the stop loss set at R97.33.

Consumer Services

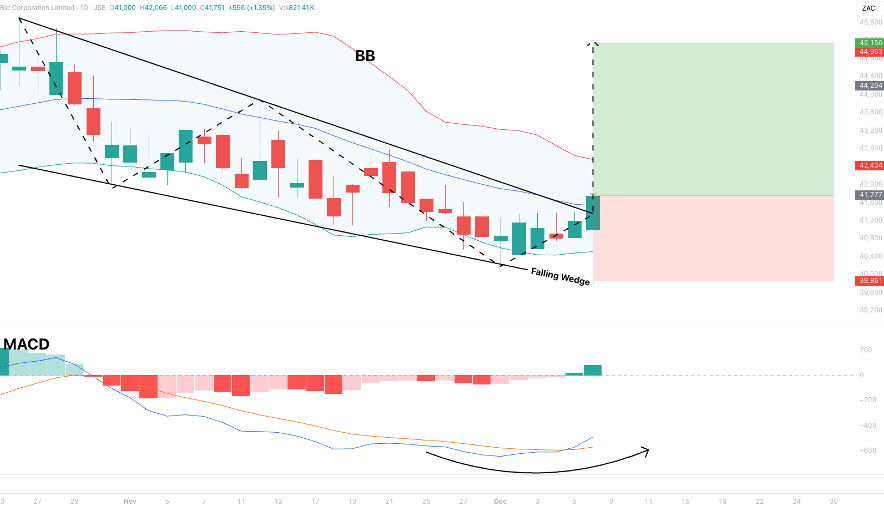

Bid Corporation LTD. (BID): Bid Corp. is in the business of offering comprehensive foodservice solutions. It operates in Australasia, the United Kingdom, Europe and emerging markets.

The share price has confirmed a falling wedge breakout after rebounding from the lower Bollinger Band (BB) and moving higher. This technical signal is further supported by a bullish crossover on the MACD, indicating that upward momentum is strengthening.

A potential Buy/Long idea can be initiated, with the target set at R451.50 and the stop loss set at R398.61.

Financials

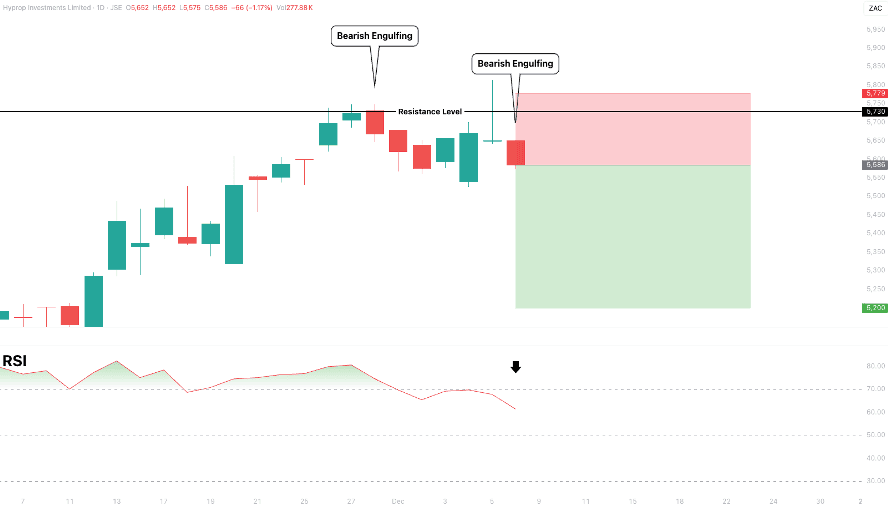

Hyprop Investments Ltd. (HYP): Hyprop is a real estate investment trust that operates shopping mall centres. It operates through South Africa, Eastern Europe and Sub-Saharan Africa.

The share price recently tested resistance at the 2010 high near the R57 level and has since formed two consecutive bearish engulfing candles, signalling potential selling pressure in this zone. In addition, the relative strength index (RSI) has crossed down from overbought territory, indicating that downward momentum is beginning to take hold.

A speculative Sell/Short idea can be initiated, with the target set at R52 and the stop loss set at R57.79.

Industrials

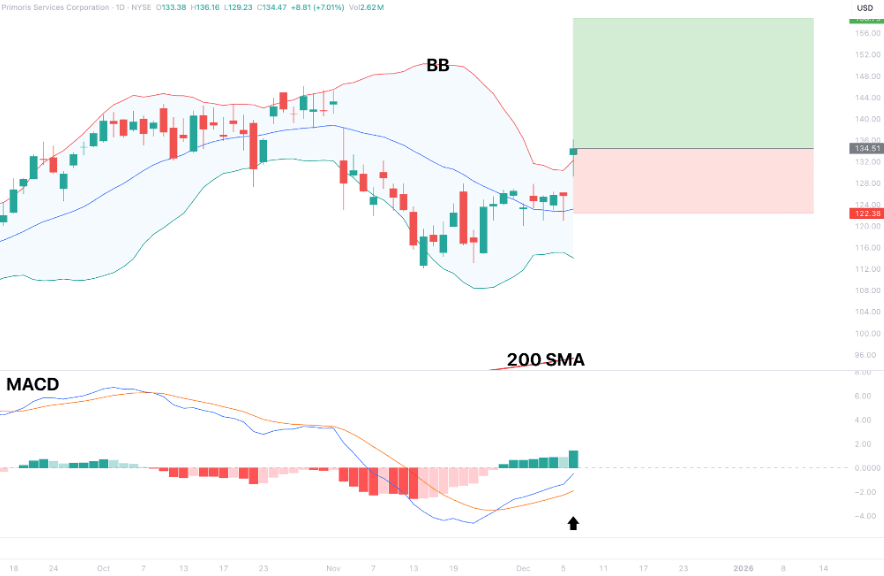

Primoris Services Corp. (PRIM): Primoris is a holding company that offers construction, fabrication, maintenance, replacement and engineering services.

The stock price is trading well above the 200-day simple moving average (SMA), reinforcing that the broader trend remains bullish. It has also closed above the upper band of an expanding Bollinger Band (BB), signalling strong upside momentum. As further confirmation, the moving average convergence divergence (MACD) has produced a bullish crossover, supporting the continuation of the upward move.

A potential Buy/Long idea can be initiated, with the target set at $158.79 and the stop loss set at $122.38.

Information Technology

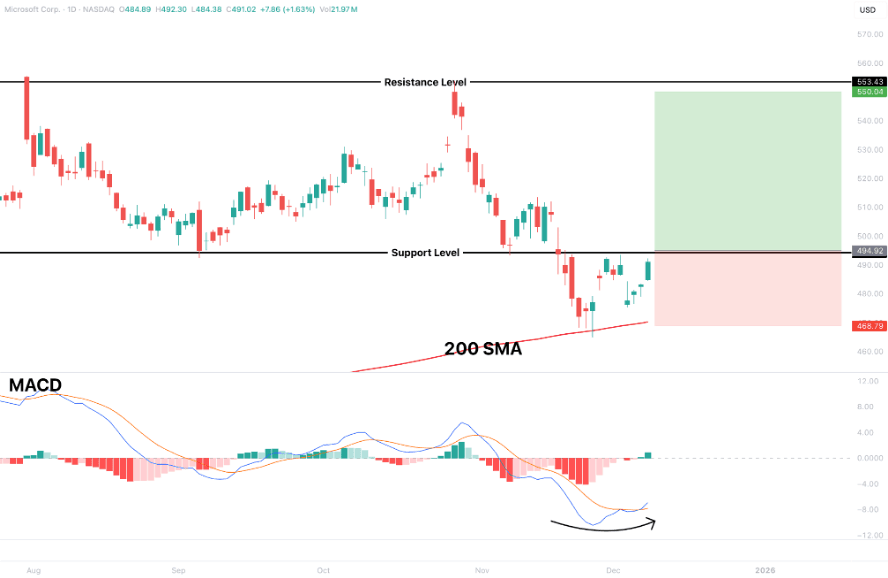

Microsoft Corp. (MSFT): Microsoft develops software and hardware, and offers related solutions and support services.

The stock price has tested the 200-day SMA as a dynamic support level and successfully closed back above it, indicating that buyers remain firmly in control of the broader trend. Price is now approaching the previous consolidation zone, with resistance around $553 and support near $495. As confluence, the MACD has completed a bullish crossover, reinforcing the prospects of continued upward momentum toward resistance.

A potential Buy/Long idea can be initiated once the price closes above $494.92, with the target set at $550.04 and the stop loss set at $468.79.

Real Estate

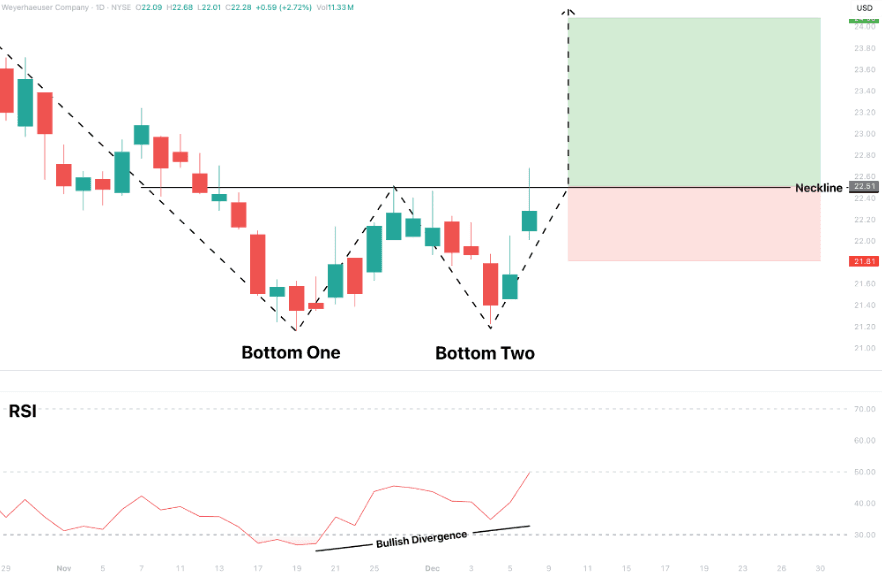

Weyerhaeuser Co. (WY): Weyerhaeuser is in the business of manufacturing, distributing, and selling forest products.

A double-bottom pattern is unfolding, with full confirmation dependent on a breakout and close above the neckline at $22.50. The relative strength index (RSI) has formed a bullish divergence, signalling that downward momentum is fading and increasing the probability of a reversal to the upside.

A potential Buy/Long idea can be initiated once the price closes above the neckline, with the target set at $24.08 and the stop loss set at $21.81.

Disclaimer:

*Any opinions, views, analysis, or other information provided in this article is provided by BROKSTOCK SA trading as BROKSTOCK as general market commentary and should not be viewed as advice according to the FAIS Act of 2002. BROKSTOCK SA does not warrant the correctness, accuracy, timeliness, reliability, or completeness of any information provided by third parties. You must rely upon your judgement in all aspects of your investment decisions, and all decisions are made at your own risk. BROKSTOCK SA and any of its employees shall not be responsible for and will not accept any liability for any direct or indirect loss, including, without limitation, any loss of profit which may arise directly or indirectly from the use of the market commentary. The content contained within the article is subject to change at any time without notice. BROKSTOCK SA is an authorised financial services provider - FSP No. 51404. T&Cs and Disclaimers are applicable: https://brokstock.co.za/

** This article was prepared by BROKSTOCK analyst Maboko Seabi

© 2025 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.