Explore the world of stock market trading with BROKSTOCK. Experience the art of buying shares online and growing your investments.

Stock Trading refers to the buying and selling of shares or ownership stakes in publicly listed companies. It is a way for investors to participate in a company's growth and profit by acquiring a portion of its ownership. Trading stocks is conducted on stock exchanges, and it plays a pivotal role in the broader financial system.

Stock Trading primarily consists of two main types:

Here are the tips to begin online Stock Trading:

To begin Stock Trading, the first step is to open a brokerage account. Choose a reputable and regulated broker that provides a user-friendly trading platform, research tools, and access to the JSE stock market.

When placing orders, you have two main options:

Many online share trading platforms offer virtual or demo accounts, also known as paper trading accounts. These accounts allow you to practice in buying shares online with virtual money. It's a valuable tool for beginners to hone their skills, test strategies, and get comfortable with the trading platform by committing real capital.

Assessing your investment performance is essential when you buy shares online:

Continuously monitor market news and developments that could impact your investments. Being well-informed will help you make timely decisions.

The price of shares is influenced by a variety of factors. Here are some key considerations:

Risk management is a crucial aspect of online Stock Trading. Here are some strategies to help mitigate risks:

Diversify your investment portfolio by spreading your capital across different industries and asset classes. This reduces the impact of poor performance in a single investment.

Conduct thorough research and analysis before making investment decisions. Stay informed about the financial health and prospects of the companies in which you invest.

Understand your risk tolerance and invest in the stock market accordingly. Avoid investing money that you cannot afford to lose, and be prepared for the possibility of temporary market downturns.

Emotional reactions can lead to impulsive decisions. Stick to your trading plan and avoid making rash choices based on fear or greed.

Stock Trading offers a wealth of opportunities, but it requires diligence, knowledge, and discipline. It encompasses Day Trading and Long-Term Investing, each catering to different trading styles and risk profiles. When entering the stock market, it's essential to choose a reliable broker, understand the order types, utilise a virtual account for practice, and meticulously measure your profits. The stock market is influenced by a combination of factors, and managing risks is essential for successful online Share Trading. By diversifying your portfolio, conducting thorough research, understanding your risk tolerance, and controlling emotions, you can navigate the complexities of the stock market with greater confidence.

Lloyd has been trading, investing and teaching about financial markets for over a decade. He has a thorough understanding of financial services provider legislation as well as investment asset classes and categories. Lloyd is a certified RE5 representative and holds a COB Investment certificate from the Moonstone Business School of Excellence.

Trading stocks involves actively buying stocks and selling ones to profit from short-term price movements, while investing typically entails a longer-term approach aimed at building wealth through capital appreciation and dividends.

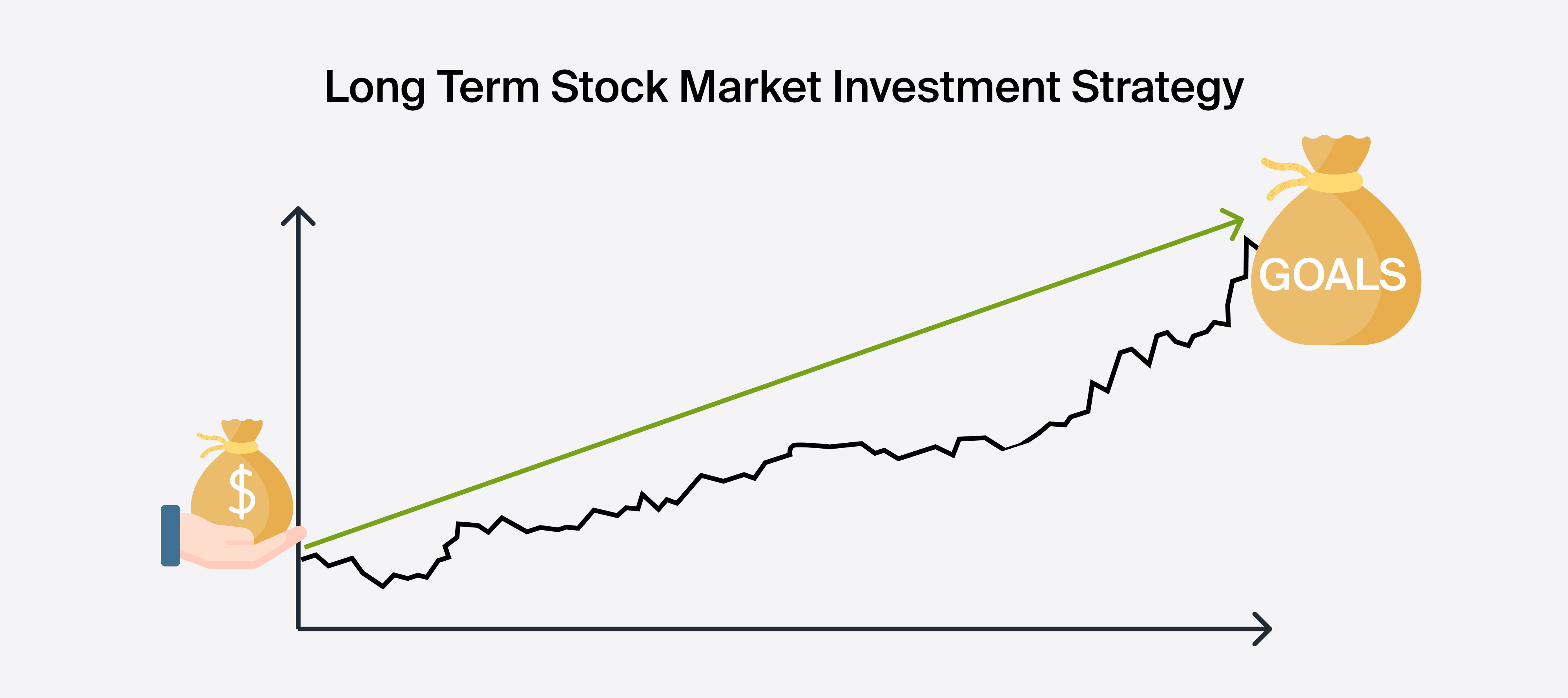

The best Stock Trading Strategy for beginners is typically Long-Term Investing in well-established companies, often referred to as «buy and hold».

Yes, you can trade stocks with $100, but it's essential to manage your investments wisely and consider commission fees when dealing with smaller amounts.

Stocks can be a good investment, but they come with risks. It's essential to conduct thorough research and consider your financial goals and risk tolerance.

Trading shares can potentially bring money through capital appreciation (increased share price) and dividend payments, but it also carries the risk of losing money if share prices decline.

© 2026 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.