Delve deep in the realm of Forex trading with an overview of the best currency pairs to trade. Unlock profit potential with Forex major pairs, as well as minor and exotic ones.

Currency trading, also famous as Forex or Foreign Exchange Trading, is the process of buying and selling currencies in the Foreign Exchange Market. It's a dynamic global market where traders speculate on the cost of one currency relative to another. Forex trading is a well-known investment avenue due to its accessibility and possibility of profits.

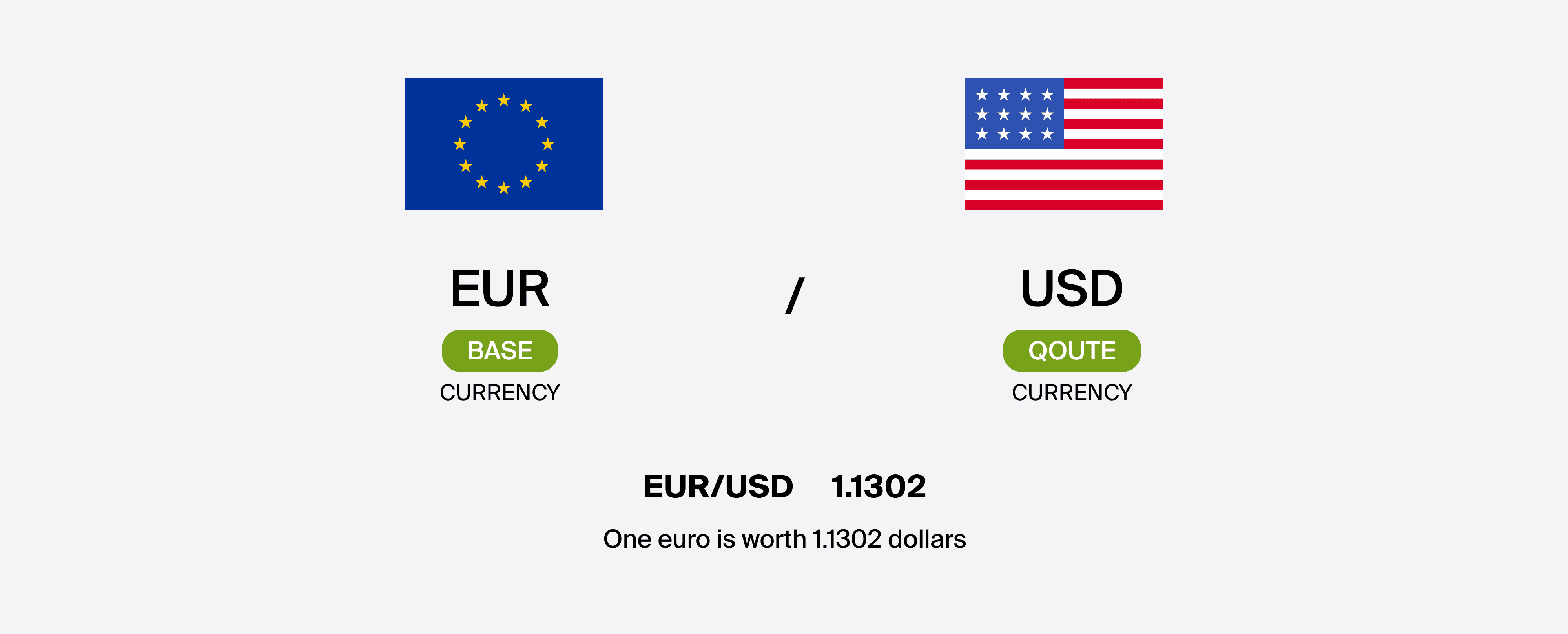

A currency pair consists of two currencies, where the 1st one is the base currency and the second one is the quote currency. The rate of exchange denotes the relative cost of the base currency to the quoted one. Understanding currency pairs is essential for prosperous trading in the Forex market.

Here are the tips for currency trading:

For prosperous Forex trading, you need to be aware of market trends. This involves analysing historical and current data to identify whether a currency pair is in an uptrend (bullish) or a downtrend (bearish). Traders are recommended to utilise technical and fundamental analysis for making informed decisions.

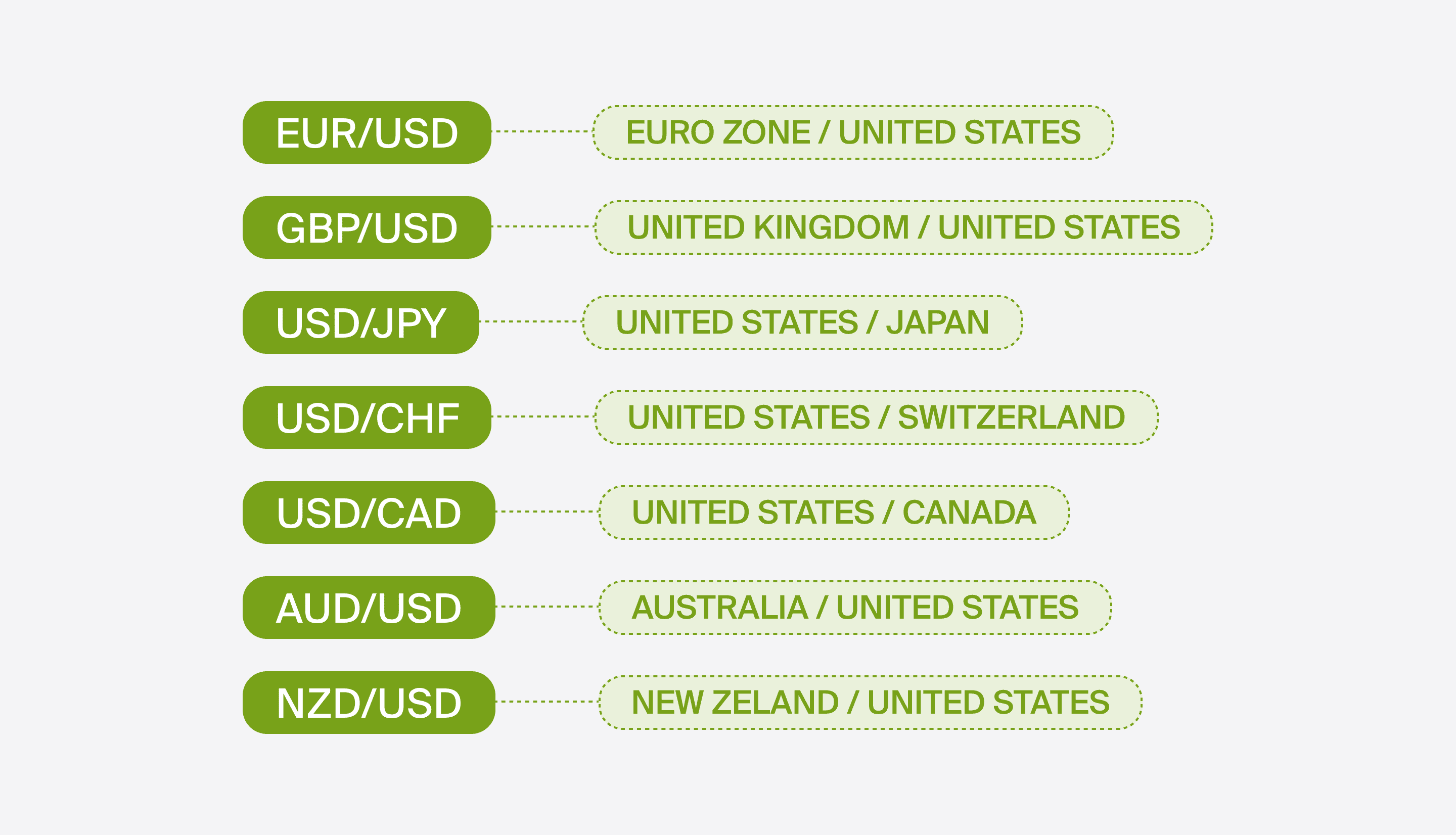

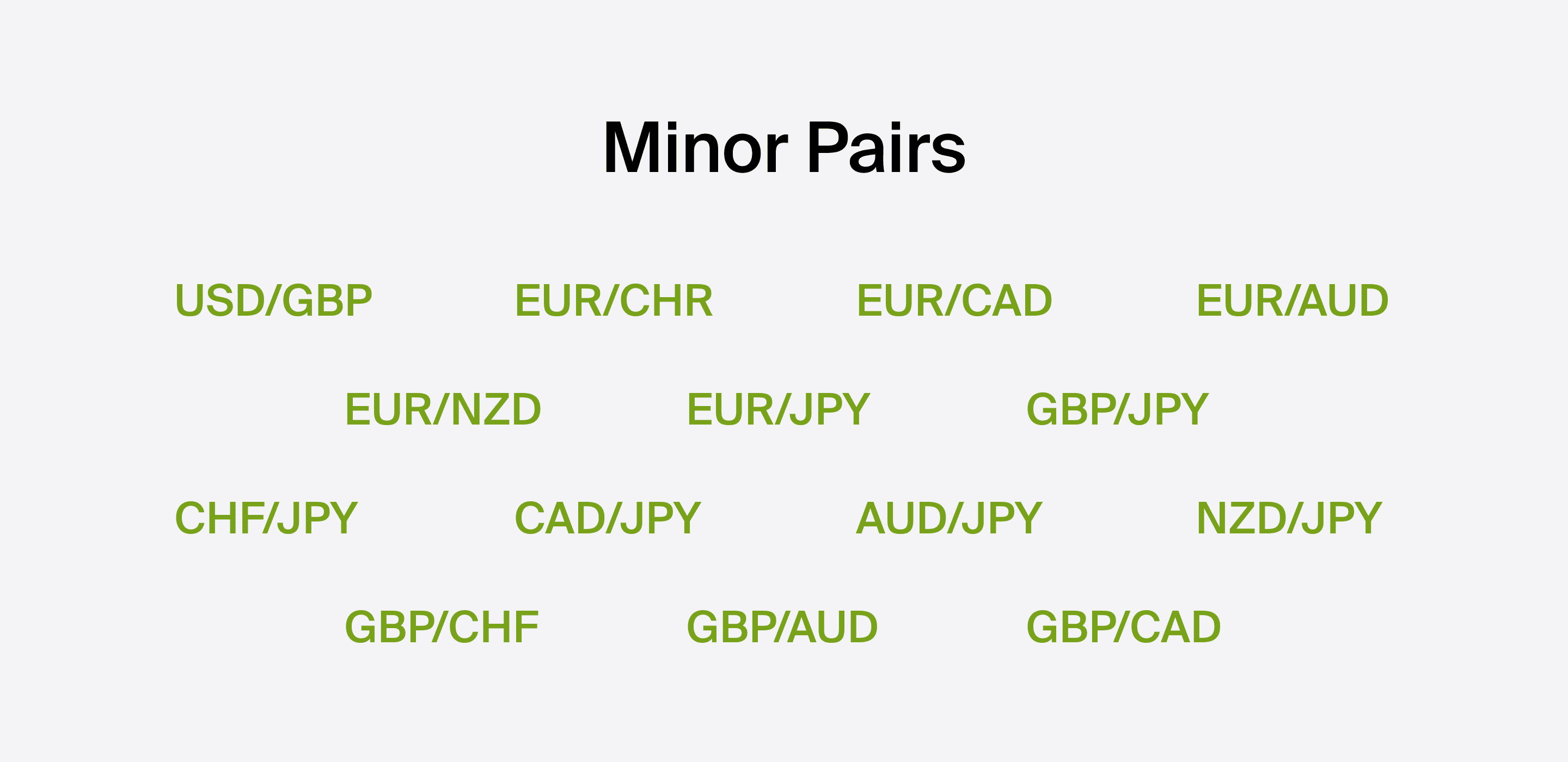

Certainly, when choosing the best currency pairs to trade it's important to take into consideration the various options in existence, including major, minor, and exotic currency pairs.

Here's a breakdown of each category:

Advantages of major currency pairs for Forex trading:

Advantages of minor currency pairs for trading:

Considerations for trading exotic currency pairs:

When selecting the best pairs to trade with small account or large one, traders are recommended to assess their risk tolerance, trade objectives, and experience level. Major currency pairs are frequently more suitable for beginners due to their stability and abundant resources. And more skilled traders may explore minor pairs for diversification or exotic pairs for unique opportunities, but they should be aware of the increased risk associated with these pairs.

Risk management is a crucial aspect of Forex trading. Traders are recommended to implement risk management strategies, including setting stop-loss orders to restrict possible losses. It's important to determine the amount of capital to risk per trade and avoid overleveraging. Diversification of the trading portfolio may also aid in minimising overall exposure to risk.

Determining exit points is crucial for success in Forex trading. Traders may utilise different strategies, such as technical analysis, fundamental analysis, or a combination of both, to determine optimal entry and exit points.

Before trading real money, traders should practise on a demo account with virtual money. This provides an opportunity for becoming familiar with the trade platform, testing strategies, and gaining experience without financial risk. It's an invaluable step for both beginners and experienced traders to refine their skills and build confidence.

Certainly, the currency pairs are influenced by several key factors. Here are the primary factors that impact currency pairs:

Liquidity refers to the speed and simplicity with which a currency pair can be bought or sold without significantly affecting its price. The liquidity of currency pairs varies throughout the trading day. The major currency pairs tend to have high liquidity, meaning there are many buyers and sellers in the market, and transactions can be executed quickly. High liquidity generally results in narrower bid-ask spreads, reducing trading costs. And exotic currency pairs often have lower liquidity, which can lead to wider spreads and increased price volatility.

Volatility measures the degree of price fluctuations within a currency pair. Currency pairs can experience varying levels of volatility due to factors such as economic events, geopolitical developments, and market sentiment. High volatility can present trading opportunities but also increased risk. Traders should be aware of economic calendars, news releases, and events that may impact the volatility of specific currency pairs. For example, the ZAR is susceptible to volatility linked to South African economic data and global commodity prices.

The Forex market operates 24 hours a day, five days a week, and trading sessions overlap as they move from one financial centre to another. The time of day has a significant impact on currency pair activity and liquidity. For traders, it's important to be aware of trading sessions as they can affect the trading environment. For instance:

Traders should consider their trading style and objectives when choosing the most suitable trading session, as well as factor in the impact of time zone differences.

Successful Forex trading involves understanding how these factors — liquidity, volatility, and time of day — interact with currency pairs. Traders should develop strategies that account for these dynamics, be aware of economic calendars and news releases, and stay informed about global events that could influence the Forex market.

Traders can access the global Forex market and trade a variety of currency pairs. To succeed in currency trading, it's vital to understand market trends, select the best Forex pairs to trade, manage risk, know when to exit positions, and practice on a demo account. Additionally, being aware of factors like liquidity, volatility, and the time of day can significantly impact trading decisions. By following these tips and staying informed, traders can maximise their potential in the Forex market.

Lloyd has been trading, investing and teaching about financial markets for over a decade. He has a thorough understanding of financial services provider legislation as well as investment asset classes and categories. Lloyd is a certified RE5 representative and holds a COB Investment certificate from the Moonstone Business School of Excellence.

It's generally best to buy and sell Forex when major trading sessions overlap, as this is when liquidity and trading activity are the highest.

The worst times to trade Forex are typically during market lulls when major trading sessions are closed, like during weekends or the overlap of the Sydney and Tokyo sessions, as liquidity can be limited.

The best times to trade EUR/USD are during the overlap of the London and New York trading sessions, typically from 1:00 PM to 5:00 PM (UTC) (3:00 PM to 7:00 PM SAST).

Exotic currency pairs are those that involve one major currency and one from a smaller or emerging market, such as US Dollar/Turkish Lira or Euro/South African Rand.

© 2026 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.