Understanding how to calculate Forex profit is essential for anyone involved in currency trading. Forex profit calculation involves determining the gains or losses resulting from changes in exchange rates between two currencies. This process is crucial for traders and investors looking to optimise their financial strategies in the volatile foreign exchange market.

A Forex profit calculator is a powerful tool that simplifies the complex calculations involved in assessing profits or losses in currency trading. In South Africa, where the Rand is susceptible to fluctuations, having a reliable profit calculator becomes indispensable. This tool allows traders to input variables such as trade size, entry and exit points, and currency pair rates, providing an instant and accurate projection of potential profits or losses.

The importance of Forex profit calculation lies in several key aspects:

To calculate Forex profit, you need a straightforward formula:

For buy position (closing price - opening price)*trade size in lots* 1 lot size

For sell position (opening price - closing price)*trade size in lots* 1 lot size

However it's essential to consider additional factors, influencing profit calculation. Transaction costs, such as spreads and fees, play a role in determining the actual profit. In South Africa, where the Rand can be susceptible to external pressures, a comprehensive approach to Forex profit calculation is crucial for accurate financial analysis. Utilising tools like Forex profit calculators aids traders and investors in making informed decisions amid the unique challenges and opportunities presented by the local market.

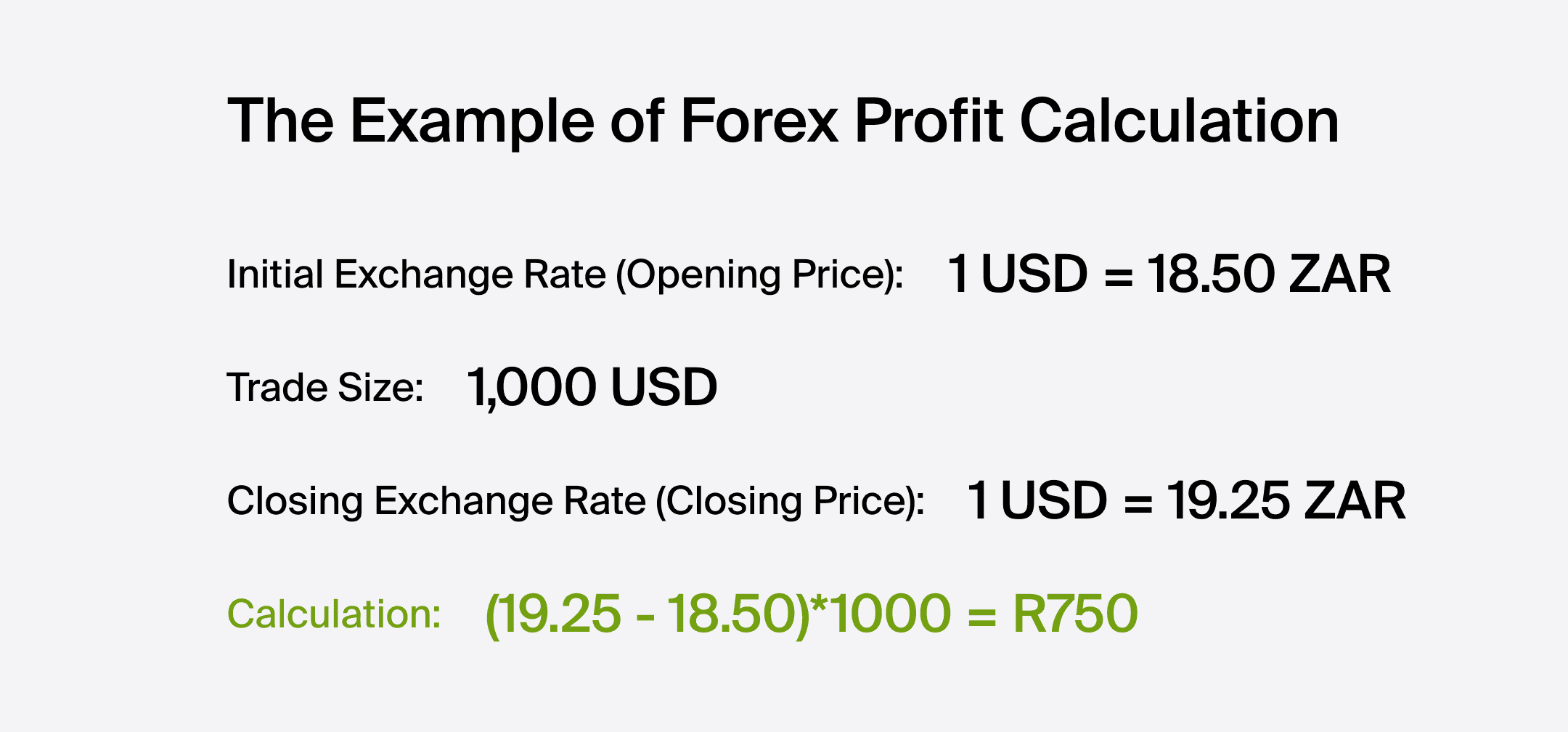

Let's consider a hypothetical scenario of Forex profit calculation using the South African Rand (ZAR) and the U.S. Dollar (USD):

Thus, the trader has gained R750 profit.

Mastering the art of Forex profit calculation is imperative for financial success in the market. Utilising a Forex profit calculator, understanding the intricacies of the formula, and staying informed about economic indicators will empower traders to navigate the complexities of the foreign exchange market.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Yes, South African traders should be aware of Rand's sensitivity to global economic factors and geopolitical events.

Diversifying your portfolio, staying informed about market trends, and utilising risk management tools can help minimise risks associated with Forex Trading.

A profit calculator is a valuable tool for traders, providing quick and accurate calculations. But it’s not essential to use it.

© 2025 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.