In this guide, we delve into the essence of scalping, offering a comprehensive overview of what it entails. From understanding the definition of scalping to essential tips before and during the practice, the advantages and disadvantages it brings, and an exploration of some of the best Scalping Strategies available, this text equips you with the knowledge you need to get started with this Trading Strategy.

Scalping refers to a trading strategy focused on profiting from small price movements in currency pairs. Traders employing the scalping technique make numerous quick trades during a trading session, each targeting small, incremental price changes. The goal is to accumulate multiple small gains to generate substantial profits over time.

Scalping entails making rapid buy and sell decisions within a short timeframe, often ranging from seconds to minutes. The primary objective is to take advantage of market volatility and capture tiny price differentials. Traders using this strategy closely monitor charts, using technical analysis tools to identify entry and exit points, and act swiftly to execute their trades.

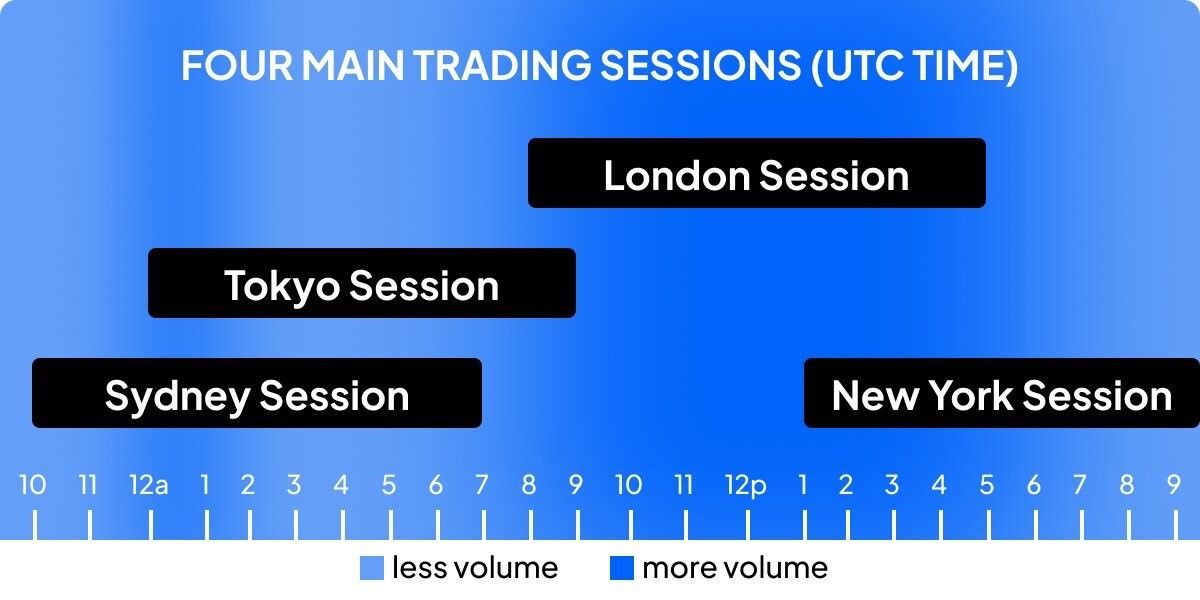

The best time for scalping aligns with the most active and liquid trading sessions in the Forex Market. These periods offer opportunities for quick price movements, making them ideal for scalpers. Here are the key timeframes to consider:

Scalping during the times mentioned above is conducive to capturing quick profits due to higher volatility and trading activity. However, traders should always consider their own schedules and availability when choosing the best time to implement a Scalping Strategy.

Scalping offers several advantages for traders:

Despite its benefits, Scalping Trading Strategies also comes with several drawbacks:

Scalping Strategies can vary. Here are some of the most popular ones:

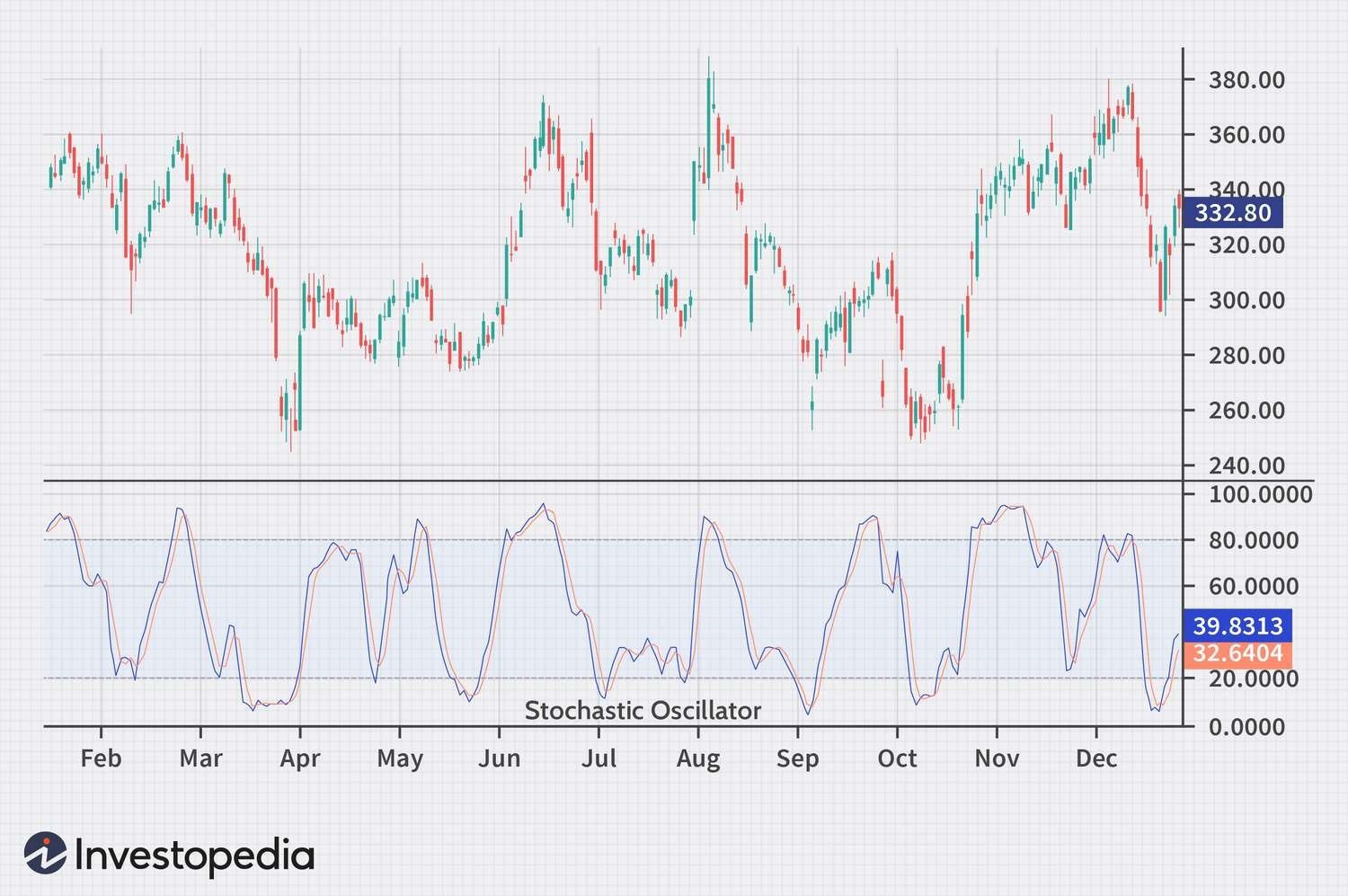

Scalping Using the Stochastic Oscillator:

The Stochastic Oscillator is a common indicator in scalping. It helps traders identify overbought and oversold conditions, allowing for timely entries and exits.

Scalping Using the Moving Average:

Traders use Moving Averages, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA), to identify trend direction and potential reversals for scalping opportunities.

Scalping Using the Parabolic SAR (Stop and Reverse) Indicator:

The Parabolic SAR indicator is used to spot potential trend reversals. It can help scalpers identify entry and exit points in a dynamic market.

Scalping Using the RSI (Relative Strength Index):

The RSI is an indicator that helps traders assess the strength of price movements. Scalpers use RSI to identify overbought and oversold conditions for quick trades.

The choice of the best Scalping Strategy depends on your preferences, risk tolerance, and technical expertise.

It's imperative to be well-informed about the following aspects before implementing your Scalping Trading Strategy:

By following these guidelines, traders can increase their chances of success while mitigating the risks associated with scalping:

Determining if Scalping Strategy is a suitable choice for you requires an evaluation of several factors:

Selecting the right Forex broker for implementing Scalping Trading Strategies is a critical decision that can significantly impact your trading success. Here are some key factors to consider:

Scalping and Day Trading are both popular trading strategies, but they differ significantly in following aspects:

Both strategies can be profitable, but they require different skill sets and mindsets. Scalping suits those who can make quick decisions and monitor the markets closely, while Day Trading allows for a more relaxed approach with fewer trades.

Scalping can be a profitable trading strategy when executed with discipline. To succeed, you should follow the next tips:

Also, the suitability of scalping depends on your individual circumstances, risk appetite, and level of commitment to mastering the strategy.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Yes, scalping can be applied to cryptocurrencies as well, provided you choose a broker that offers crypto trading.

Tax laws may apply to your trading profits. It’s essential to consult with a tax advisor for guidance.

The amount of capital required varies, but it's advisable to start with sufficient capital to manage risk effectively and meet margin requirements.

Scalping can be challenging for beginners, but with proper education, traders of all experience levels can employ this strategy.

© 2025 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.