A Forex trading strategy is an essential tool for navigating the complex landscape of the foreign exchange (Forex) market. This strategy is a structured approach that dictates when to enter and exit trades, risk management protocols, and the analytical methods employed. In this guide, we’ll delve into the core elements of these strategies, showcase some of them, and provide guidance on comparing and selecting the most appropriate strategy to align with your trade objectives.

A Forex trading strategy is a well-determined plan traders use to navigate the volatile and always-changing Forex markets. These strategies are designed to aid traders in making good decisions concerning when to enter or exit a trade, manage risk effectively, and ultimately maximise profits. Having a well-thought-out strategy is crucial for successful trading.

It's important to recognise the key components of a solid Forex trading strategy:

Traders have access to a wide range of the best Forex trading strategies. Each has its advantages and is suitable for different trading styles and risk tolerances. Let's explore some of the best strategies commonly employed by traders:

Price Action Trading Strategy

Price Action Trading relies on analysing historical price movements to forecast future price directions. Traders who use this strategy focus on candlestick patterns, support and resistance levels, and trendlines to make trade decisions.

Range Trading Strategy

Range Trading involves determining price ranges within which a currency pair tends to trade. Traders who use this strategy aim to buy low and sell high within these established ranges.

Trend Trading Strategy

Trend Trading is a popular approach, as traders attempt to profit from the continuous directional movements of currency pairs. Determining and following trends is crucial in this strategy.

Position Trading Strategy

Position Trading is a long-term strategy suited to traders looking to hold positions for weeks or months. It relies on fundamental analysis and macroeconomic factors to make trade decisions.

Day Trading Strategy

Day Trading is a short-term strategy where traders open and close positions within the same trading day. Traders using this strategy rely on technical analysis to determine short-term price movements.

Scalping Trading Strategy

Scalping is an ultra-short-term strategy where a trader’s objective is to profit from small price movements. This strategy requires quick execution and tight spreads.

Swing Trading Strategy

Swing Trading seeks to grab medium-term price movements within a trend. Swing traders may hold positions for a few days or weeks.

Carry Trade Strategy

The Carry Trade Strategy involves borrowing funds in a low-interest-rate currency and investing them in a higher-yielding currency. Traders should consider interest rate differentials when they use this strategy.

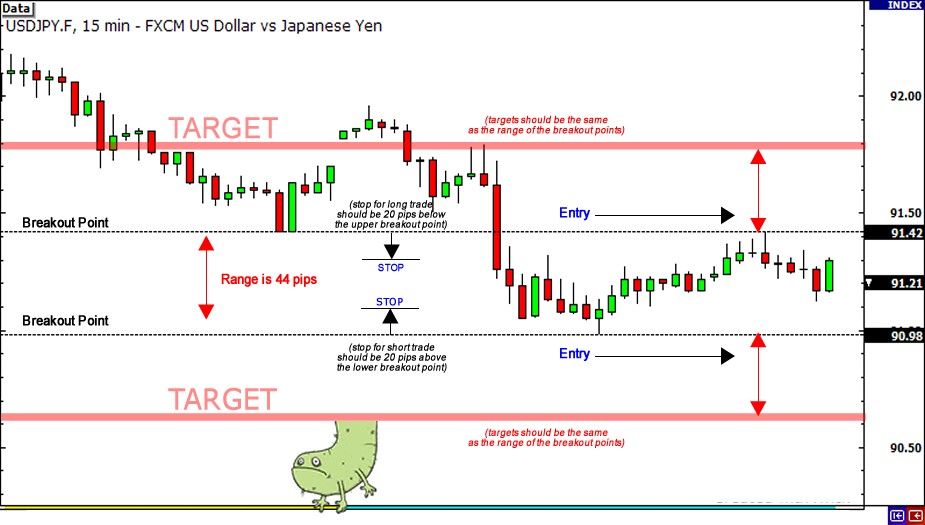

Breakout Trading Strategy

Breakout trading is focused on identifying points where currency pairs break out of established price ranges. Traders look for these opportunities to profit from strong price movements.

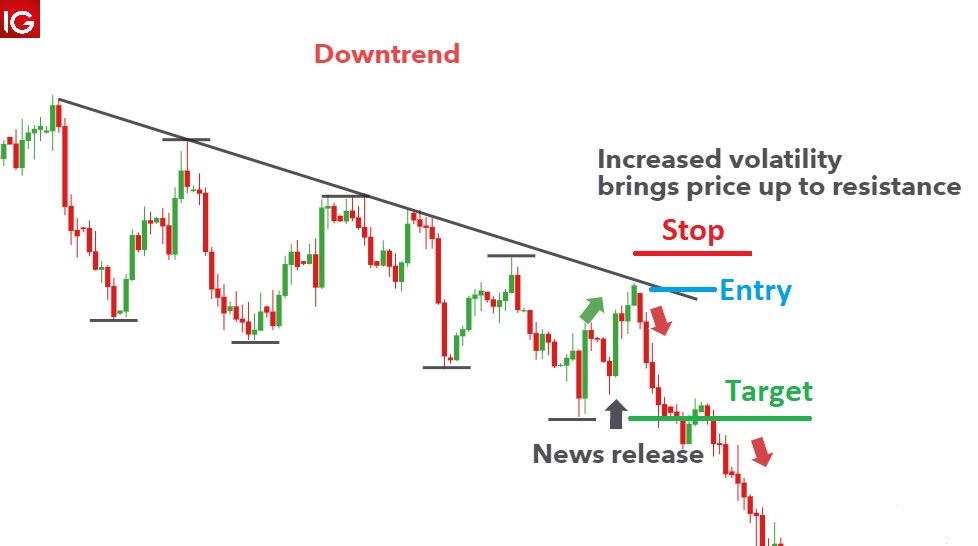

News Trading Strategy

News trading involves trading based on economic news releases and events. This strategy requires staying updated on both domestic and international financial news.

Retracement Trading Strategy

Retracement trading looks for temporary reversals within a trend. Traders aim to enter positions at favourable retracement levels.

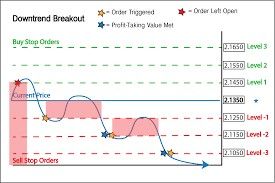

Grid Trading Strategy

Grid trading involves placing buy and sell orders at predetermined price levels. Traders use this strategy to profit from ranging markets.

Momentum Trading Strategy

Momentum trading relies on the principle that strong price trends tend to continue. Traders identify assets with strong momentum and ride the trend.

MACD Trading Strategy

The Moving Average Convergence Divergence (MACD) is a popular technical indicator traders use to identify potential buy and sell signals.

Choosing the right Forex trading strategy requires a deep understanding of each strategy's strengths and weaknesses. Here's a comparative overview of some key factors to consider:

Discovering the most suitable Forex trading strategy for your circumstances often involves trial and error. Here's a step-by-step approach to help you determine the best fit:

While well-established successful Forex trading strategies exist, many traders prefer to develop unique approaches. To create your own strategy, follow these steps:

Bottom Line and Key Takeaways

Forex trading presents exciting opportunities, but it also carries significant risks. Choosing the right trading strategy is essential to your success as a trader. Remember these key takeaways:

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Yes, you can start Forex trading with a small amount of capital. Many brokers offer micro or mini accounts that allow traders to begin with a limited investment.

The best time frame for Forex trading depends on your trading style and goals. Short-term traders may prefer intraday time frames like 15-minute or 1-hour charts, while long-term traders may use daily or weekly charts.

You can stay updated on Forex market news by following financial news websites, subscribing to Forex newsletters, and using economic calendars that provide information on upcoming economic events and announcements. Additionally, many brokers offer news feeds and analysis within their trading platforms.

Yes, many traders trade Forex part-time while maintaining other jobs or commitments. The flexibility of the Forex market allows traders to participate at their convenience, whether during evenings, weekends, or specific market sessions.

© 2026 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.