Discover the Best US Stocks to Buy Now with BROKSTOCK, South Africa's Premier Stock Market Broker for US Shares. Maximise your investments with expert insights.

Investing in US stocks has become increasingly accessible and popular for local investors. Thanks to advancements in technology and the availability of online brokerage platforms, South African investors can now easily access and trade US stocks. This presents an excellent opportunity to diversify your investment portfolio and gain exposure to the global markets.

Yes, investing in US shares from South Africa is not only possible but also highly encouraged. Many investors are looking to diversify their portfolios and tap into the opportunities offered by the US stock market. With the right guidance and the use of reliable brokerage platforms, you can participate in the global financial markets with ease.

US stock markets primarily consist of the New York Stock Exchange (NYSE) and the NASDAQ. These markets operate from 4:30 PM to 11:00 PM South African Standard Time (SAST). Investors should consider the time zone difference when planning their trading activities.

Investors have access to a wide range of US shares that can be traded on various platforms. These shares encompass some of the world's most prominent companies from different sectors. Some popular types of US shares traded include:

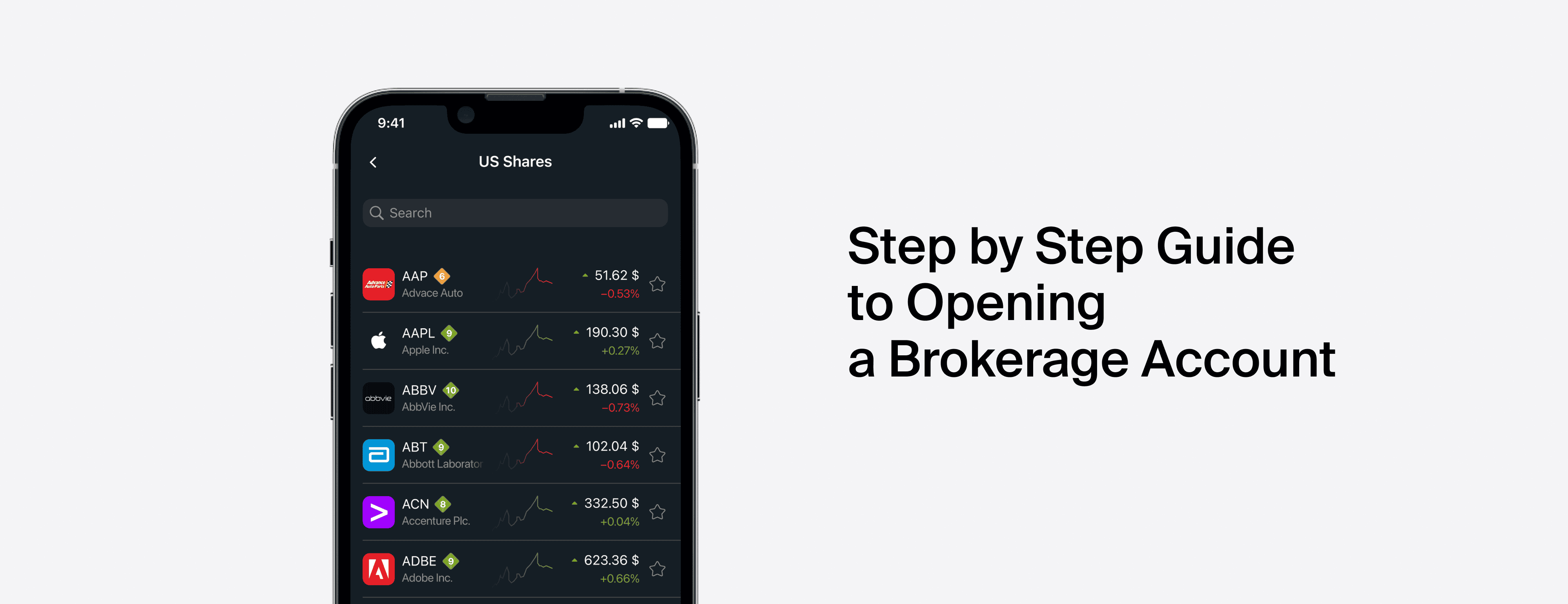

If you want to know how to buy US stocks from South Africa, follow these steps to open a brokerage account:

You have two main order types:

Many brokerage platforms offer virtual or demo accounts. These are valuable for investors because they allow you to practise trading with virtual funds, gaining experience and confidence without risking real money. It's an excellent way to familiarise yourself with the platform and trading strategies.

To assess your profits when buying US shares, consider the following:

Investing in US stocks with international brokers can offer several advantages for investors:

However, there are also some drawbacks to consider when investing with international brokers:

Investing in US stocks with local brokers can have its advantages for investors:

There are also some drawbacks when you trade US stocks with local brokers:

The choice between investing in US stocks with international or local brokers should be based on your specific needs and priorities. Consider factors such as market access, trading costs, regulatory compliance, and your comfort level with currency exchange risks.

The prices of US shares can be influenced by a variety of factors, both macroeconomic and company-specific. Here are some key factors:

Managing risks associated with US stocks is essential for prudent investing. Here are some strategies for risk management:

Spread your investments across different sectors and asset classes to reduce the impact of a downturn in any single investment.

Thoroughly research companies before investing. Understand their financials, competitive position, and growth prospects.

Evaluate your risk tolerance to ensure your investments align with your financial goals and comfort level. Adjust your portfolio accordingly.

Allocate your assets among stocks, bonds, and other investments in a way that matches your risk tolerance and time horizon.

Keep up with market news and events that can impact your investments. Be prepared to make informed decisions when necessary.

When it comes to buying US shares, it's crucial to choose a reputable and reliable brokerage that can provide you with the necessary tools, security, and support for your investment journey. While the best broker for you may depend on your specific needs and preferences, here are some of the top brokerage platforms that have gained recognition and trust among investors:

BROKSTOCK is a popular choice for investors looking to trade US shares. It offers a user-friendly interface, a broad selection of US stocks, competitive fees, and responsive customer support. Additionally, it provides educational resources to help investors make informed decisions.

EasyEquities is known for its straightforward approach to investing. It allows investors to buy fractional shares of US stocks, making it accessible to those with smaller budgets. The platform offers a user-friendly mobile app and various educational tools.

If you're already a Standard Bank customer, Webtrader can be a convenient choice. It provides access to US shares and offers integration with your existing Standard Bank accounts. This can simplify the process for those who prefer to have their banking and investments with the same institution.

Saxo Bank is a trusted international broker that caters to South African investors. It provides access to a broad range of US shares, along with research and analysis tools for informed decision-making.

Absa offers US share trading services to investors. They provide research and market insights to assist investors in making informed decisions.

Nedbank's online share trading platform gives investors access to US shares. The platform offers educational resources and research tools to support investors.

Before making a decision on selecting a broker, take the time to compare different brokers and choose the one that best suits your needs and objectives.

Investing in US stocks is a smart way to diversify your portfolio and access global opportunities. To get started, open a brokerage account with a trusted platform, learn about market and limit orders, and consider using a virtual account for practice. Additionally, continuously assess your profits and make informed decisions. With the right broker and a well-thought-out investment strategy, investors can harness the potential of the US stock market.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Yes, there is a list of penny US shares, which typically refers to stocks trading at very low prices, often less than $5.

Some of the best US blue chip stocks include companies like Apple, Microsoft, Amazon, and Alphabet. For bank shares, JPMorgan Chase and Bank of America are among the top choices.

The decision on which US shares to buy should be based on your financial goals, risk tolerance, and thorough research.

The current status of the US stock market can be checked by accessing financial news websites or using stock market tracking apps.

Whether it's better to invest in the US market depends on your investment goals, risk tolerance, and diversification strategy. The US market can offer diverse opportunities, but it's important to assess how it aligns with your financial objectives.

© 2025 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.