What is CFD trading and how does it work? Contracts for differences (CFDs) are categorised as leveraged products – arrangements made in a futures contract whereby differences in settlement are made through cash payments, rather than by the delivery of physical goods or securities. This means that with a small initial investment, there is potential for returns equivalent to that of the underlying market or asset. Instinctively, this would be an obvious investment for any trader. Unfortunately, margin trades can not only magnify profits but losses as well.

Types of risk that are often overlooked are counterparty risk, market risk, client money risk, and liquidity risk.

The counterparty is the company which provides the asset in a financial transaction. When buying or selling a CFD, the only asset being traded is the contract issued by the CFD provider. This exposes the trader to the provider's other counterparties, including other clients that the CFD provider conducts business with. The associated risk is the event that the counterparty fails to fulfill its financial obligations.

If the provider is unable to meet these obligations, then the value of the underlying asset is no longer relevant. It is important to recognise that the CFD industry is not highly regulated and the broker's credibility is based on reputation, longevity, and financial position rather than government standing or liquidity. There are excellent CFD brokers, but it's important to investigate a broker's background before opening an account. In fact, US-based customers are forbidden fr om trading CFDs under current US regulations.

Contracts for differences are derivative assets that a trader uses to speculate on the movement of underlying assets, like stocks. If one believes the underlying asset will rise, the investor will adopt a long position. Conversely, investors will adopt a short position if they believe the value of the asset will fall. You hope that the value of the underlying asset will move in the direction most favourable to you. In reality, even the most educated investors can be proven wrong.

Unexpected news or economic data, changes in market conditions and government policy can result in quick changes. Due to the nature of CFDs, small changes may have a big impact on returns. An unfavourable effect on the value of the underlying asset may cause the provider to demand a second margin payment. If margin calls can't be met, the provider may close your position or you may have to sell at a loss.

In countries wh ere CFDs are legal, there are client money protection laws to protect the investor fr om potentially harmful practices of CFD providers. By law, money transferred to the CFD provider must be segregated fr om the provider's money in order to prevent providers from hedging their own investments. However, the law may not prohibit the client's money from being pooled into one or more accounts.

When a contract is agreed upon, the provider withdraws an initial margin and has the right to request further margins from the pooled account. If other clients in the pooled account fail to meet margin calls, the CFD provider has the right to draft from the pooled account, which can potentially affect returns.

Market conditions affect many financial transactions and may increase the risk of losses. When there are not enough trades being made in the market for an underlying asset, your existing contract can become illiquid. At this point, a CFD provider can require additional margin payments or close contracts at inferior prices.

Due to the fast-moving nature of financial markets, the price of a CFD can fall before your trade can be executed at a previously agreed-upon price, also known as gapping. This means the holder of an existing contract would be required to take less than optimal profits or cover any losses incurred by the CFD provider.

What is CFD in trading? A contract for differences (CFD) is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the current value of an asset and its value at contract time. CFDs allow traders and investors an opportunity to profit from price movement without owning the underlying assets. The value of a CFD does not consider the asset's underlying value, only the price change between the trade entry and exit.

It is an advanced trading strategy that is utilised by experienced traders only. There is no delivery of physical goods or securities with CFDs. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset. For example, instead of buying or selling physical gold, a trader can simply speculate on whether the price of gold will go up or down.

Essentially, investors can use CFDs to place bets on whether or not the price of the underlying asset or security will rise or fall. Traders can bet on either upward or downward movement. If the trader who has purchased a CFD sees the asset's price increase, they will offer their holding for sale. The net difference between the purchase price and the sale price is calculated together. The net difference representing the gain from the trades is settled through the investor's brokerage account.

On the other hand, if the trader believes that the asset's value will decline, an opening sell position can be placed. To close the position, the trader must purchase an offsetting trade. Then, the net difference of the loss is cash-settled through their account.

A long position means the trader expects the value of the security or asset in question to increase.

EXAMPLE:

For example, you take a position in stock Kaya trades at R10 and an increase is expected. You have R10,000 and the initial margin is 10%, it's the equivalent of purchasing 10,000 shares (calculated as follows: R10,000/R10 = 1,000 shares divided per 10% = 10,000). Let's assume that in two weeks the stock price increases to R5.10 at the CFD close-out. This means you will have profited by R1,000. However, in this situation, you are assuming the market moves in your favour. Trading CFDs involves risk, especially for those who are not familiar with the underlying assets they are trading. Due to trading with leverage, it is possible to lose more than your initial capital if the market goes down when you've traded on it going up.

A short position means the trader expects the value of the security, index, commodity or currency in question to decrease.

In CFD trading, leverage is the ability to trade without paying for the full value of your position upfront. Instead, you only have to pay a deposit called your margin.

While leverage is a powerful benefit, it will also increase your risk. So, before you start trading on margin, it's a good idea to learn how they work – and how to manage risk using stop losses.

CFD margin is the deposit that you'll need to have in your account to trade a contract for difference. You'll also see it referred to as a market's margin factor or margin requirement.

Margin factors vary across markets, and are always given as a percentage. The percentage tells you how much of your position's full value you'll need to deposit. Generally speaking, the higher the requirement, the more volatile or illiquid the market.

Often seen as a risk management approach, hedging in forex and CFDs is when a trader hedges one investment by making another.

This is done to insure an open position and in forex, many traders use this strategy to offset risk of adverse price movements in a volatile currency. This is possible with CFD trading as both long and short positions are available.

For example, if a trader wanted to invest in USD but insure themselves against specific volatility, perhaps when the monthly nonfarm payroll data is due to appear, they could buy EUR/USD and sell USD/JPY. This way the balance is kept neutral if the price of USD falls.

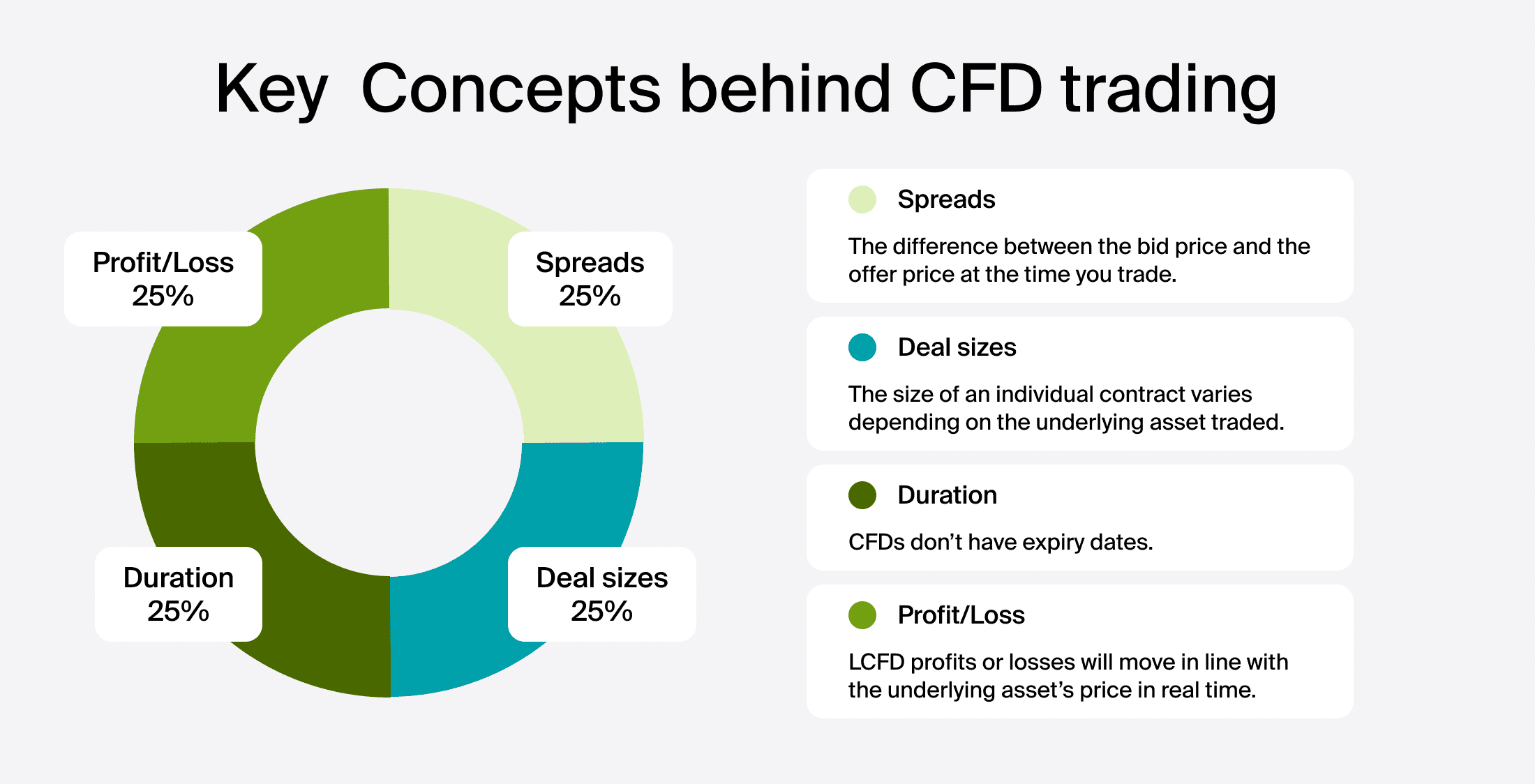

What does CFD stand for? It stands for contracts for differences. How does CFD trading work? Let's closely look at four of the key concepts behind CFD trading: spreads, deal sizes, durations, and profit/loss.

The costs of trading CFDs includes:

There is usually no commission for trading forex pairs and commodities. However, brokers typically charge a commission for stocks. The opening and closing trades constitute two separate trades, and thus you are charged a commission for each trade.

Contracts for differences (CFDs) are contracts between investors and financial institutions in which investors take a position on the future value of an asset. The difference between the open and closing trade prices are cash-settled. There is no physical delivery of goods or securities. The client and broker exchange the difference in the initial price of the trade and its value when the trade is unwound or reversed.

CFDs don't have expiry dates so when a CFD is written over a futures contract the CFD contract has to deal with the futures contract expiration date. The industry practice is for the CFD provider to "rollover" the CFD position to the next future period when the liquidity starts to dry in the last few days before expiry, thus creating a rolling CFD contract.

Once you've identified an opportunity and you're ready to trade, you can open a position. From this point, your CFD profits or losses will move in line with the underlying asset's price in real time.

In order to calculate the profit or loss earned from a CFD trade, you multiply the deal size of the position (total number of contracts) by the value of each contract (expressed per point of movement). You then multiply that figure by the difference in points between the price when you opened the contract and when you closed it.

Profits & loss =

(total number of contracts x expressed per point of movement)

x (closing price - opening price)

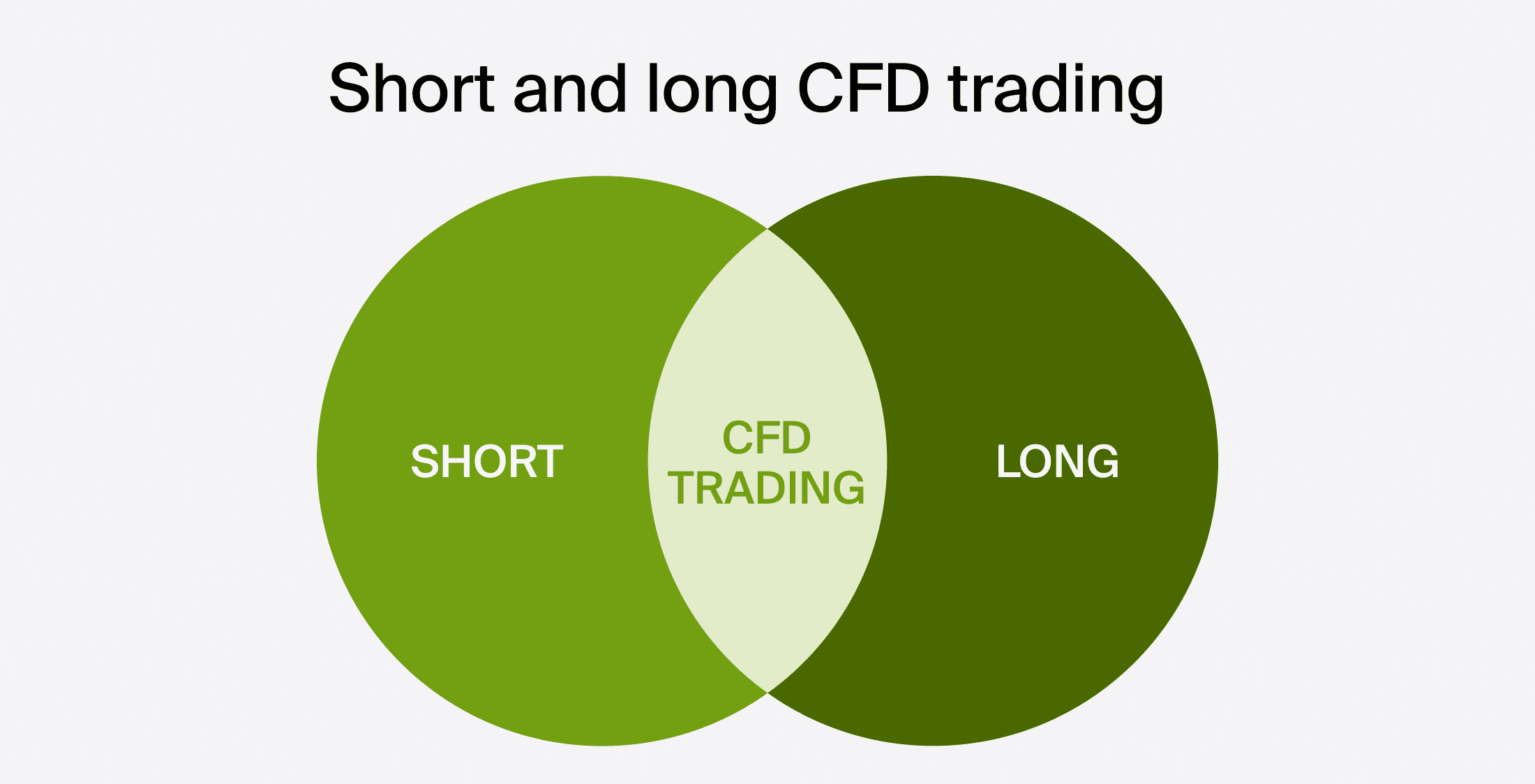

CFDs allow you to speculate an asset's price movement in either way. This means that you can profit not only when an asset rises in price (goes long), but also when it falls (goes short).

When you open a CFD position, you sel ect the number of contracts you would like to trade (buy or sell). Your profit will rise in line with each point the market moves in your favour. Conversely, you could make a loss if the market moves against you.

If for example your prediction was correct and the price rises over the next week to 220/222. You make the decision to close your trade by selling at 220 cents (the current selling price)

Commission is charged when you exit a trade, a charge of R250 would be applied when you close a trade, as 0.10% of the trade size is R250 (10,000 units x 220 cents = 22,000 x 0.10%).

The price has moved 10 cents in your favour fr om 210 cents (the initial buy price or opening price) to 220 cents (the current price). Multiply this by the number of units you bought (10,000) to calculate your profit of R2,200 then subtract the total commission charge (R200 at entry + R220 at exit = R420) which results in a total profit of R1,780.

Your prediction was wrong and the price of Mokoena and Associates drops over the next hour to a sell/buy price of 1,549/1,550. You feel the price is likely to continue dropping, so to lim it your potential loss you decide to sell at 1,549 (the new sell price) to close the position.

The price has moved 51 points (1,600–1,549) against you. Multiply this by the size of your position (1,000 units) to calculate your loss, which is R510.

The total commission charges to open and close a buy position would be calculated as follows:

1,000 (units) x 1,600 cents (price) x 0.10% = R16.00

1,000 (units) x 1,549 cents (price) x 0.10% = R15.49

Total commission = R16.00 + R15.49 = R31.49

Therefore, your total loss of Mokoena and Associates is your gross loss + total commissions.

R510 + R31.49 = a net loss of R541.49.

You think the Chicken Licken shares are going to appreciate and want to open a long CFD position.

You purchase 100 CFDs on Chicken Licken shares at R160 a share. The total value of the trade is R16,000. If Chicken Licken appreciates to R170, you make R10 a share – a R1,000 profit. If, however, the price falls to R150 a share, you lose R10 a share – a R1,000 loss.

Example steps of that possible trade are:

1. The share price is R165. You start looking at the market.

2. The share price falls to R160. You decide to open a trade (buy the CFDs).

3. The price of your CFD rises to R170. You close your trade (sell the CFDs), making a profit of R10.

Please take note that there is always a risk of loss with any trade.

You think the Chicken Licken price will fall. You can open a short CFD position. This is known as short-selling.

You decide to sell 100 CFDs on Chicken Licken at R170 a share. The price falls to R160, giving you a profit of R1,000, or R10 per share. If, however, the price rises to R180 a share, you lose R1,000, or R10 a share.

Example steps of that possible trade:

1. The share price is R165. You start looking at the market.

2. The price of your CFD rises to R170. You open a trade (sell the CFDs).

3. The price falls to R160. You close your trade (buy the CFDs).

Margin trading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies. Margin is not a cost or a fee, but it is a portion of the customer's account balance that is set aside in order to trade. The amount of margin required can vary depending on the brokerage firm and there are a number of consequences associated with the practice.

There are two types of margin you should be familiar with when trading CFD shares.

1. Deposit margin – refers to the funds held in security that is required as a protection against possible losses.

2. Maintenance margin – the minimum amount of equity that an investor must maintain in the margin account after the purchase has been made.

The margin required depends on the deal offered by your broker. It also varies between asset classes and within different regulated areas.

For example, you buy 100 CFDs on Chicken Licken at R135.10. Your initial outlay is R2,702 (R135.10 x 100 shares x 20% margin). Apple stock moves to R150. You decide to sell.

The profit from this trade is R1,490 (R14.90 x 100 shares = R1,490).

| CFD trade | Share trade | |

| Sell / Buy Price | 135.05 / 135.10 | 135.05 / 135.10 |

| Deal | Buy at 135.10 | Buy at 135.10 |

| Funds available (Balance) | R3,000 | R3,000 |

| Leverage | 5:1 | 1:1 |

| Deal size | 100 shares | 20 shares |

| Funds required to open a trade | R2,702 = R135.10 Buy price x 100 shares x 20% margin | R2,702 = R135.10 Buy price x 20 shares |

| Close price | Sell 100 shares at 150 | Sell 20 shares at 150 |

| Profit | R1,490 (14.9pt increase x 100 shares = R1,490) | R298 (14.9pt increase x 20 shares = R298) |

CFDs are available for a range of underlying assets, such as shares, indices, commodities, and exchange traded funds (ETFs).

CFDs are cash-settled but allowed to use margin trading so that investors need only put up a small amount of funds to trade CFDs in a larger volume of transactions.

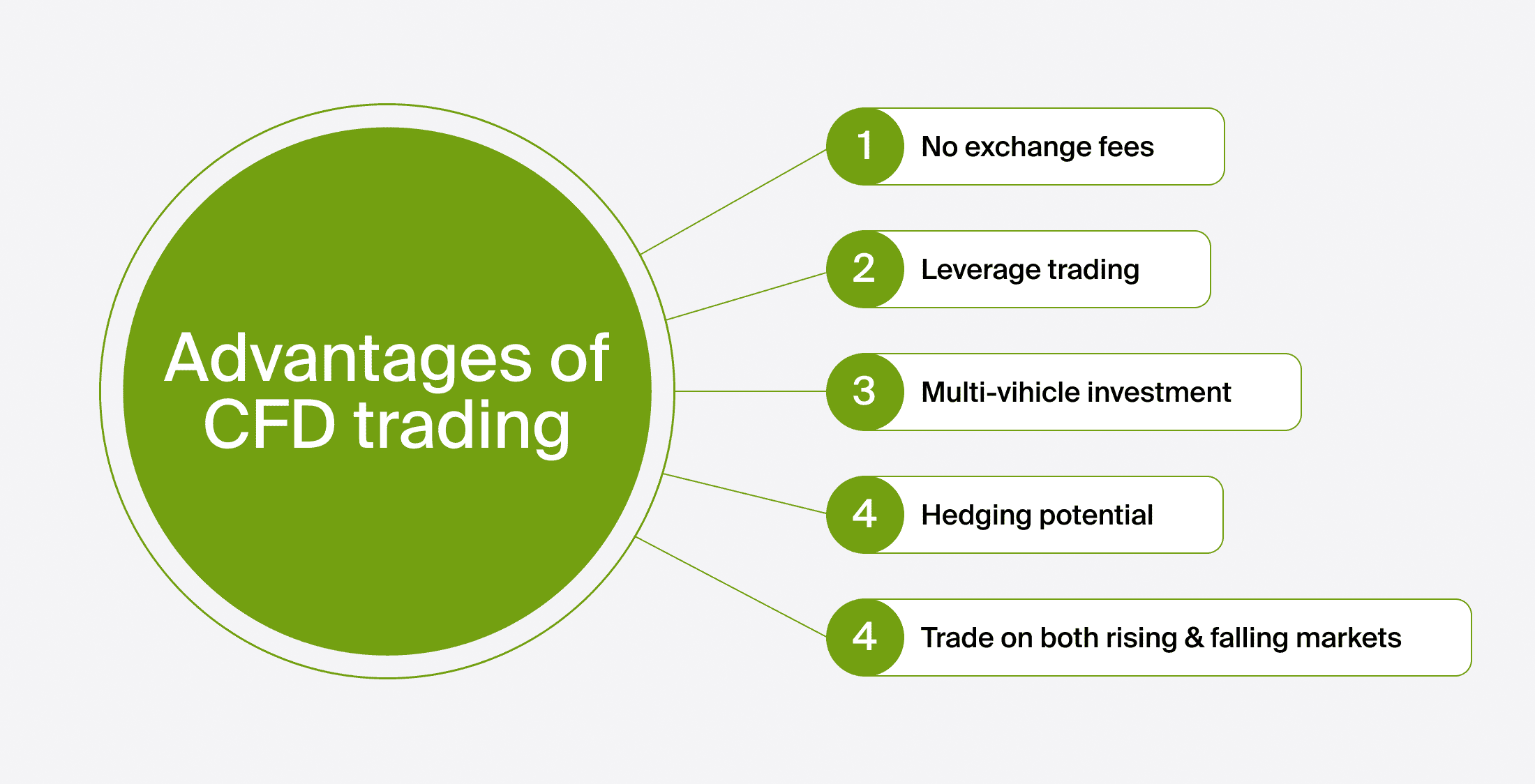

Before you decide on which CFD to invest in, take a look at the advantages of CFD trading.

CFD brokers offer many of the same order types as traditional brokers, including stops, limits, and contingent orders, such as “one cancels the other" and “if done". Some brokers offering guaranteed stops will charge a fee for the service or recoup costs in another way.

Brokers make money when the trader pays the spread. Occasionally, they charge commissions or fees. To buy, a trader must pay the ask price, and to sell or short, the trader must pay the bid price. This spread may be small or large depending on the volatility of the underlying asset; fixed spreads are often available.

CFD trading provides higher leverage than traditional trading. Standard leverage in the CFD market is subject to regulation. It once was as low as a 2% maintenance margin (50:1 leverage) but is now limited in a range of 3% (30:1 leverage) and could go up to 50% (2:1 leverage). Lower margin requirements mean less capital outlay for the trader and greater potential returns. However, increased leverage can also magnify a trader's losses.

Brokers currently offer stock, index, treasury, currency, sector, and commodity CFDs. This enables speculators interested in diverse financial vehicles to trade CFDs as an alternative to exchanges.

With CFDs you can take a position on a market that is rising in price, and one that is falling. If you decide to buy an asset in the hope that its price will rise, this is known as "going long".

Hedging can be performed through various financial instruments, however, derivatives, such as contracts for difference (CFDs), remain one of the popular hedging tools among traders. Hedging with CFDs has a number of distinctive characteristics:

CFD trading is fast-moving and requires close monitoring. As a result, traders should be aware of the significant risks when trading CFDs. There are liquidity risks and margins that you need to maintain; if you cannot cover reductions in values, then your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset.

Leverage risks expose you to greater potential profits but also greater potential losses. While stop-loss limits are available from many CFD providers, they can't guarantee that you won't suffer losses, especially if there's a market closure or a sharp price movement. Execution risks also may occur due to lags in trades.

While CFDs offer an attractive alternative to traditional markets, they also present potential pitfalls. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves. The spread also decreases winning trades by a small amount compared to the underlying security and will increase losses by a small amount. So, while traditional markets expose the trader to fees, regulations, commissions, and higher capital requirements, CFDs trim traders' profits through spread costs.

The CFD industry is not highly regulated. A CFD broker's credibility is based on reputation, longevity, and financial position rather than government standing or liquidity. There are excellent CFD brokers, but it's important to investigate a broker's background before opening an account.

A spread in trading is the difference between the buy (offer) and sell (bid) prices quoted for an asset. The spread is a key part of CFD trading, as it is how both derivatives are priced.

Many brokers, market makers and other providers will quote their prices in the form of a spread. This means that the price to buy an asset will always be slightly higher than the underlying market, while the price to sell will always be slightly below it.

Spread can have a variety of other meanings in finance but they all refer to the difference between two prices or rates.

Holding costs are those associated with storing inventory that remains unsold. These costs are one component of total inventory costs, along with ordering and shortage costs.

The holding cost can be positive or negative depending on the direction of your position and the applicable holding rate.

If you want to trade or view our price data for certain instruments, you will need to activate the relevant market data subscription.

When trading share CFDs on a platform, a commission is charged to your CFD account when you execute an order.

CFD trading strategies that can be applied using leverage to the financial markets, even the most inexperienced trader can understand them. These strategies involve a number of trading methods, the most popular is Long vs. Short.

If an investor has long positions, it means that the investor has bought and owns those shares of stocks. By contrast, if the investor has short positions, it means that the investor owes those stocks to someone, but does not actually own them yet.

For instance, an investor who owns 100 shares of Tesla (TSLA) stock in their portfolio is said to be long 100 shares. This investor has paid in full the cost of owning the shares.

Continuing the example, an investor who has sold 100 shares of TSLA without yet owning those shares is said to be short 100 shares. The short investor owns 100 shares at settlement and must fulfil the obligation by purchasing the shares in the market to deliver.

It is commonplace for short investors to borrow the shares from a brokerage firm in a margin account to make the delivery. Then, with hopes the stock price will fall, the investor buys the shares at a lower price to pay back the dealer who loaned them. If the price doesn't fall and keeps going up, the short seller may be subject to a margin call from their broker.

A margin call occurs when an investor's account value falls below the broker's required minimum value. The call is for the investor to deposit additional money or securities so that the margin account is brought up to the minimum maintenance margin.

Short selling, also known as going short or making a short sale, is a technique used by traders and investors to try to profit from falling asset prices.

An investor buys a security in the hope of selling it at a higher price. This is known as a long position. When short selling, the process starts the other way around. An investor sells first, then buys. This is known as a short position.

A stop-loss (SL) level is the predetermined price of an asset, set below the current price, at which the position gets closed in order to lim it an investor's loss on this position. Conversely, a take-profit (TP) level is a preset price at which traders close a profitable position.

Instead of using market orders in real-time, traders can set these levels to trigger automatic selling without having to monitor the markets 24/7. Binance Futures, for example, has a Stop Order function that combines stop-loss and take-profit orders. The system decides if an order is stop-loss or take-profit based on trigger price levels and last price or mark price when the order is placed.

Negative balance protection means that even if markets move rapidly against your trades, your account will not be negative. This is especially important to new traders that may not be familiar with how rapidly markets move during announcements, market openings or general market volatility.

What does CFD mean in forex? Negative balance protection ensures that traders with losing positions don't end up with a negative balance in their forex trading account. If you find yourself in a bad trade and are losing money fast, a margin call can save you fr om going into debt. Simply put, a margin call automatically closes your rapidly dropping open positions.

In today's complex environment, negative balance protection can help traders manage volatility and take advantage of high-volume trading sessions without having to worry about going into debt. After all, most traders would agree that low volatility isn't ideal when trading retail forex because it limits opportunities. However, too much of anything can be equally as bad. What is CFD in forex trading? In the case of forex, too much volatility can wipe out your trading account in a matter of moments. This is why negative balance protection is so important.

Financial hedging is a strategy that helps traders to offset risk within their trading portfolio. Some examples of effective hedging strategies include pairs trading and the use of derivatives, such as forward contracts. You can also trade on safe haven assets as a hedge, such as gold, certain currencies, government bonds, and defensive stocks, as these financial instruments could be considered less vulnerable to negative market shocks than others.

Example:

Let's take an example of a pairs trade using CFDs.

Assume that an investor owns 1,000 Disney shares on a separate stockbroking account and is concerned that the company's share price will drop after a recent poor earnings report. He decides to short sell an equal of 1,000 Disney shares using a CFD trading account in the hope that any losses on the shareholding position may be offset by a successful short trade.

Assume that Disney's share price does indeed fall by 10%. Although the trader's shareholding account is now worth less in value, the trader has made a 10% gain on his CFD trade, and is able to buy the stock back at a lower price if he wants to. This is an example of a successful hedging strategy.

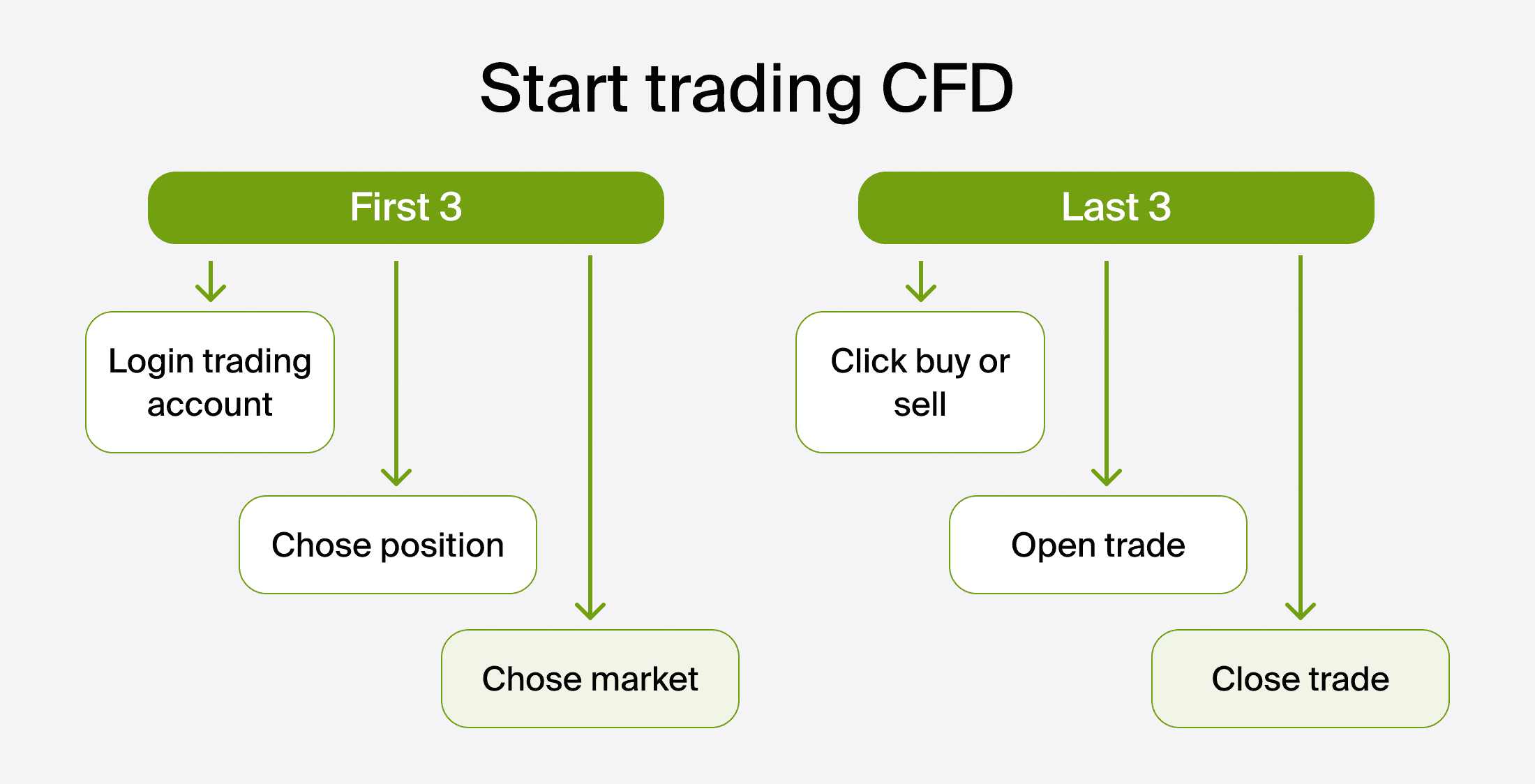

We've gone through quite a lot of material on the background of CFD's, we've looked at the risks as well as the benefits. You're probably wondering how you can put all of this in practice and stay trading CFD's online. In this section will also answer what is a CFD trading account? We're going to take you through all the steps involved, we've made them as easy to grasp as possible. This is how to trade CFD's online.

Open an account with a CFD broker that has a great reputation. You can use a live account, wh ere you make deposits and use them to trade on the financial markets. Another option is you could use a demo account, which gives you the opportunity to get to know the software and practise your skills with virtual currency.

What is a CFD platform? It's a platform you use to trade CFDs.Some trading platforms offer perks for CFD options that others don't, literally giving you more variety or better CFD products than their competitors. Others may have better interfaces or have different jurisdictions depending on their countries of origin.

Choosing the best CFD trading platform is one of the things you need to think about first when trading CFDs online. It's also a factor to consider when choosing a CFD broker.

It's not necessary to have a CFD trading platform especially designed for trading CFDs. If your broker offers CFDs then you'll be able to trade them on the platform they work with.

You now have your CFD trading platform and everything you need to get started is in place. You should now start thinking about how to trade CFDs and the trading methodology you're going to use. Given that there are myriad potential trades available across a lot of markets, it's essential that you have a plan.

Elements to consider in your trading approach:

You're now at the most exciting step in learning how to trade CFDs, making your first trade on a live or demo account. Simple follow these steps:

You now have an answer to the question "what are CFDs", you also have an understanding of how they work, some of their advantages, the risks involved and how you can start trading CFDs.

CFDs allow traders and investors an opportunity to profit from price movement without owning the underlying assets. The value of a CFD does not consider the asset's underlying value, only the price change between the trade entry and exit points.

Like any form of investing, there is also the very real possibility of losing and money, as well as making it. Which is why it is essential that you don't stop educating yourself, keep up to date with the latest developments in the trading industry.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Both contracts for difference (CFDs) and futures are part of the wider financial derivatives market but, what are the key differences in trading them?

In CFD trading, you have to decide whether the price of an asset will rise or whether it will fall. If you decide, after having made sure to do your own research, that it is likely to go up, you open what is called a long position. If you think the price could fall you open a short position.

Futures trading, on the other hand, is an agreement to carry out a transaction at some point in the future at a price agreed today.

Other differences include:

● Leverage. The use of leverage, or borrowing money in order to get more access, or exposure, to a market is commonplace with CFDs, but it less common, although still possible, with futures. Note that leverage can magnify both profits and losses.

● Physical assets. Buyers who keep their position in a future contract beyond the due date should be ready for a physical delivery of an underlying asset if it exists in physical form, while CFDs are purely hypothetical. For example, traders comparing oil CFDs vs. futures in the commodity should keep that in mind.

● Contract sizes: CFDs always trade per contract, while futures' contract sizes vary. When deciding on an instrument, stock traders, for example, can choose between single stock futures vs. CFDs on stocks.

● Flexibility. CFDs can be more flexible and can operate on a short-term basis, while futures can be more of a longer-term investment.

● ETFs. Futures can be traded as part of an exchange traded fund (ETF), designed to track a particular group of assets.

The short answer to this is yes, you can trade CFDs (Contracts for Difference) without leverage, with some brokers. In fact, if you are beginning or starting out as a CFD trader or speculator, or trying a new trading platform (see my list here of best CFD trading platforms) then trading CFDs with low or no leverage could be a good idea as you learn the markets and systems.

Reducing or removing the leverage on trades can reduce the risk associated with any position. Of course, this by no means determines if you will turn a profit or lose money in a trade. Leverage magnifies and speeds up the rate at which your position changes, and can be dangerous in the hands of a novice trader. It's the ultimate financial double edged sword; your gains will be multiplied if the market moves in your favour, and likewise if the market on the underlying asset moves against you then your losses will be magnified.

CFDs also have a valid role as a hedging tool to help investors profit from a falling market. For many investors, the idea of utilising leverage to hedge may seem odd in first light, but with proper understanding of the mechanics and risks of CFDs, CFD hedges can actually make your shareholdings safer than they would otherwise be.

Hedging is an effective investment mechanism that aims at cancelling or eliminating the risks involved in another form of investment. A hedge is a position opened in one financial instrument with the scope of offsetting exposure to price fluctuations in an opposite position in another asset. Example: selling a CFDshort to offset a previous share purchase. The ultimate goal is that of minimising the speculative exposure to unwanted risk. For instance, an investor who holds Next shares might want to open a short CFD position to hedge his long exposure in Next shares. In this way, should the price of Next shares go down, the investor will still not suffer since the losses incurred in the share portfolio will be compensated by the CFD hedge.

Prior to the advent of CFDs, the only way to reduce risk exposure was by using options. A limitation with options is that it only allows multiples of 1,000 units; thus, if one has invested in 2460 stocks, he will be able to hedge for 2,000 or 3,000, using options. Hedging using CFDs, on the other hand, allows for 1 to 1 hedging to account for the risk in equity investments completely.

In most cases, CFDs are treated as a revenue account rather than capital.

This means your trading profits will be taxed as ordinary income and are not subject to capital gains tax (CGT). Any losses you incur are generally deductible and, in some cases, can be used to offset against your other sources of income such as employment wages.

© 2025 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.