In the realm of Forex Trading, intraday indicators hold substantial significance for traders in South Africa and around the world. In this guide, we will delve into the concept of intraday indicators, explore their importance and examples. Also, we will try to find the best trading indicator combination to empower traders in making profitable decisions.

Intraday indicators are technical analysis tools tailored for the fast-paced nature of trading. They assist traders in understanding the price dynamics within one day. By utilising these indicators, traders can assess market conditions, recognise trends, and make accurate entry and exit decisions.

Intraday indicators play a key role in Forex Trading for several reasons:

Trend Indication

They help traders determine the predominant market direction. This is crucial for making decisions on whether to buy or sell a currency pair. In a Market as dynamic as Forex, recognising trends is essential.

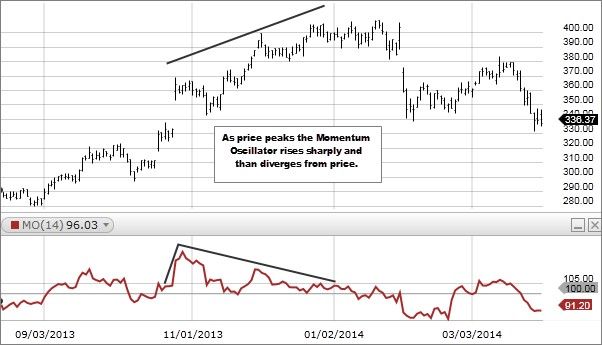

Momentum Indication

Momentum indicators like the Relative Strength Index (RSI) submit insights into the speed and strength of price movements. In a volatile market, understanding momentum is vital for pinpointing entry and exit points.

Volume Indication

These help traders in assessing market participation. A spike in trading volume can signal increased interest and potentially reveal the authenticity of a price move.

Volatility Indication

Given the ever-changing nature of Forex Markets, volatility indicators like Bollinger Bands assist traders in gauging price fluctuations. This information is invaluable for setting stop-loss and take-profit levels.

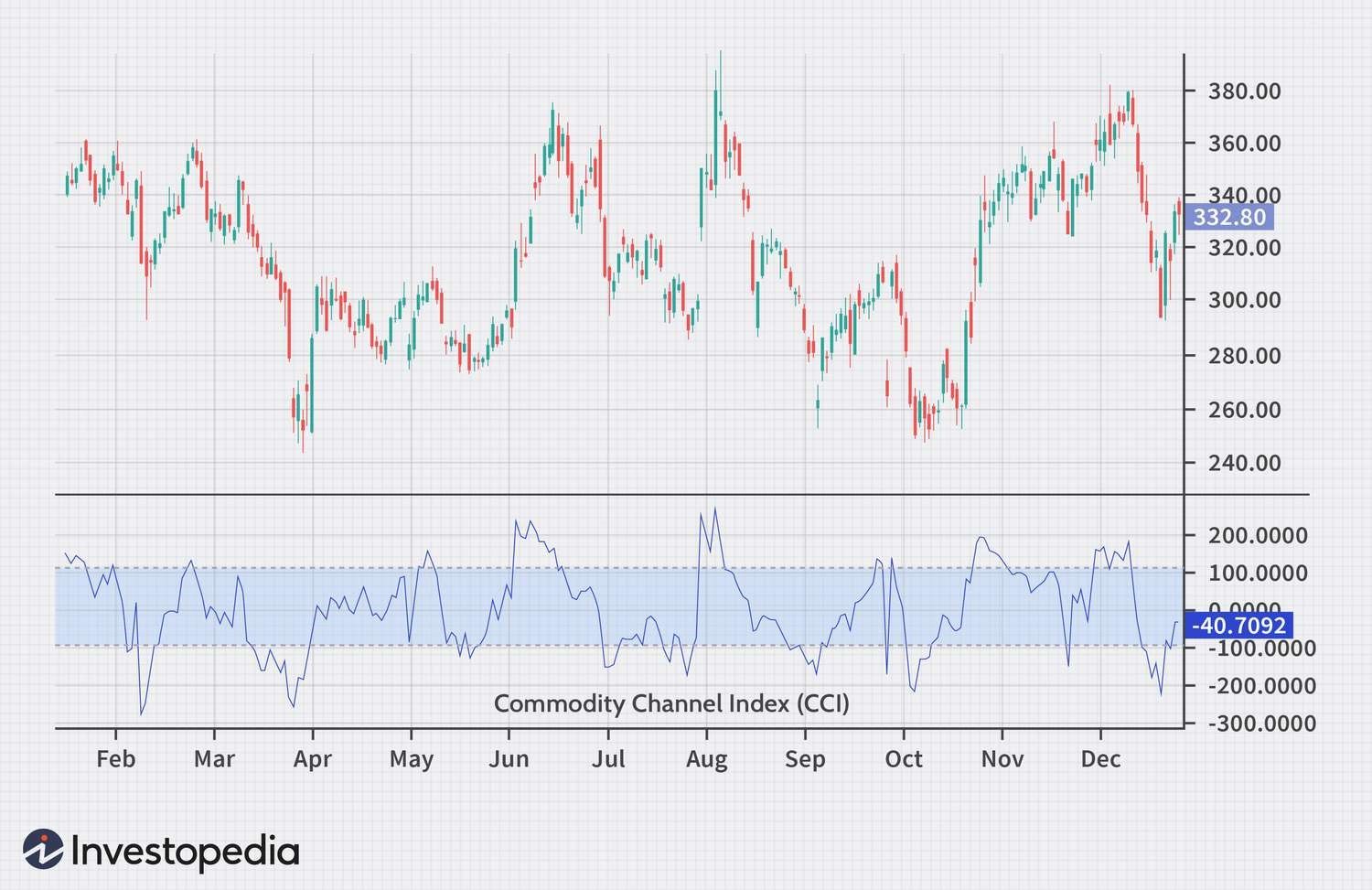

Overbought or Oversold Conditions Indication

Oscillators, such as the Stochastic Oscillator and Commodity Channel Index (CCI), help in determining overbought and oversold conditions. Understanding when a currency pair is at these extremes can be instrumental in predicting potential reversals.

Traders can leverage various intraday indicators to improve their decision-making process. Some best indicators for Intraday Trading comprise:

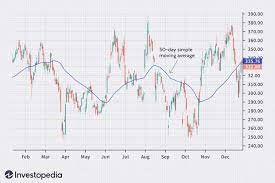

Moving Averages

Moving Averages are often utilised to determine trends. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) are well-known choices among traders. The SMA calculates the average of a set of data points within a specified time window or interval. And the EMA places more weight on recent data points, giving them greater significance in the calculation. It's calculated using a formula that exponentially weights each data point.

Bollinger Bands

These indicators aid traders in assessing price volatility and potential reversal points. In a market as fluid as Forex, Bollinger Bands are indispensable.

Momentum Oscillators

The Moving Average Convergence Divergence (MACD) and RSI are examples of momentum indicators. They submit insights into the strength and speed of price movements, aiding traders in making timely decisions.

Stochastic Oscillator

The Stochastic Oscillator is invaluable for recognizing overbought and oversold conditions in markets. Traders may utilise it to gauge possible reversals and entry/exit points.

Commodity Channel Index

CCI is a momentum oscillator that measures the deviation of a currency pair's price from its statistical average. Traders utilise CCI to spot possible overbought and oversold conditions, similar to the Stochastic Oscillator.

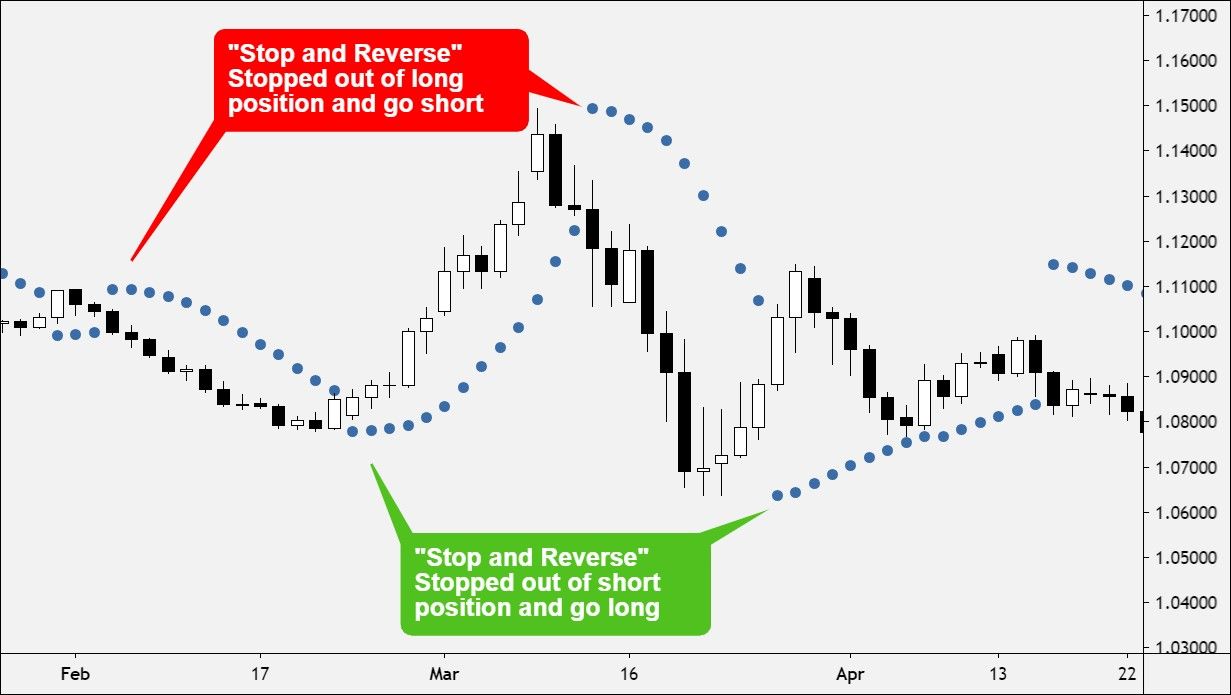

Parabolic Stop and Reverse (SAR)

Parabolic SAR is a popular indicator among traders, signalling possible trend reversals with dots appearing above or below price candles. This tool aids traders in setting effective stop-loss levels and making gainful decisions regarding trend continuations or reversals.

Fibonacci Retracement Levels

Fibonacci Retracement Levels offer key support and resistance levels for traders. These levels, derived from the Fibonacci Sequence, aid in defining possible entry and exit points. Traders utilise this tool to analyse price retracements and extensions, gaining insights into the market's likely reversal and continuation points.

The effectiveness of intraday indicator combination depends on market conditions, the trader's strategy, and risk management. Traders should thoroughly understand how each indicator works and practice using them in various scenarios before applying them to their real trading activities. Here are the best combinations of intraday indicators:

Moving Average + Stochastic

This combination is effective for traders looking to determine trends and possible entry/exit points. Moving Averages smooth out price data, making it easier to spot trends, while the Stochastic Oscillator aids in determining overbought and oversold conditions, signalling potential reversals.

Bollinger Bands + Stochastic

Traders frequently utilise this combination to gauge volatility and overbought/oversold conditions. Bollinger Bands provide a visual representation of price volatility, while the Stochastic Oscillator helps identify entry/exit points, especially when the price is at extreme levels.

MACD + RSI

Combining the MACD and RSI is a powerful duo for comprehensive trend and momentum analysis. MACD provides insights into trend direction and momentum, while RSI helps gauge the strength of price movements. Together, they offer a holistic view of market conditions.

Parabolic SAR + EMA

Traders can use this combination to identify potential trend changes and reversal points. The Parabolic SAR is particularly useful for trend-following, while the EMA provides dynamic support and resistance levels.

Parabolic SAR + Stochastic

This combination is beneficial for traders seeking to spot trend changes and overbought/oversold conditions. The Parabolic SAR helps identify trend reversals, while the Stochastic Oscillator assists in pinpointing entry/exit points.

Fibonacci Retracement Levels + MACD

Traders looking for a comprehensive analysis of trends, momentum, and potential reversals often use this combination. Fibonacci Retracement Levels help identify key support and resistance levels, while the MACD complements this by providing insights into trend direction and strength.

Bottom Line and Key Takeaways

Understanding and harnessing the power of intraday indicators is essential for successful Forex Trading. The best combination of technical indicators can provide traders with a holistic view of market dynamics, aiding in the identification of trends, reversals, and entry/exit points. However, it's important to remember that no indicator is infallible, and risk management remains a critical aspect.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

While these combinations are popular and widely used, their effectiveness depends on market conditions and individual trading strategies. It's essential to backtest and adapt them as needed.

Most trading platforms offer these indicators as built-in tools. Traders can add them to their charts and customise their settings.

Traders can benefit from educational resources, online courses, and practice accounts to hone their skills and understand the nuances of each indicator.