Discover the Exchange-Traded Funds (ETFs) in South Africa with BROKSTOCK. In this article we will delve into the concept of ETF trading, the types of ETF and their distinctive features.

Investing in South Africa has gained prominence over the years, with a diverse range of opportunities available to both novice and skilled investors. One such financial instrument that has attracted significant attention is Exchange-Traded Funds (ETFs).

An Exchange-Traded Fund is a financial instrument that lets investors obtain access to a diversified portfolio of assets, such as stocks, bonds, commodities, or a combination of them. These funds are traded on stock exchanges, much like individual stocks, offering investors the chance to buy and sell shares throughout the trade day.

Exchange-Traded Funds is an attractive choice for various individuals and institutions. South African ETFs would suit:

Novice Investors

ETFs are an excellent option for individuals new to investing. They provide a straightforward way to access diversified portfolios without requiring an in-depth understanding of the stock market. Novice investors can start small and gradually build a diversified portfolio.

Experienced Investors

Seasoned investors often use ETFs to fine-tune their portfolios or obtain access to thematic investing ETF. They appreciate the flexibility and liquidity that ETFs offer, allowing them to adjust their investment strategies as market conditions change.

Retirement Savers

Investors planning for their retirement can benefit from including ETFs in their retirement portfolios. ETFs offer diversified exposure, which can help mitigate risk and improve long-term returns.

Institutional Investors

Pension funds, insurance firms, and other institutional investors utilise ETFs to efficiently manage large sums of money. These investors appreciate the transparency and low costs associated with ETFs.

Tax-Efficient Investors

ETFs tend to be tax-efficient due to their unique structure - they tend not to distribute capital gains. This makes them a suitable choice for investors looking to minimise tax implications on their investments.

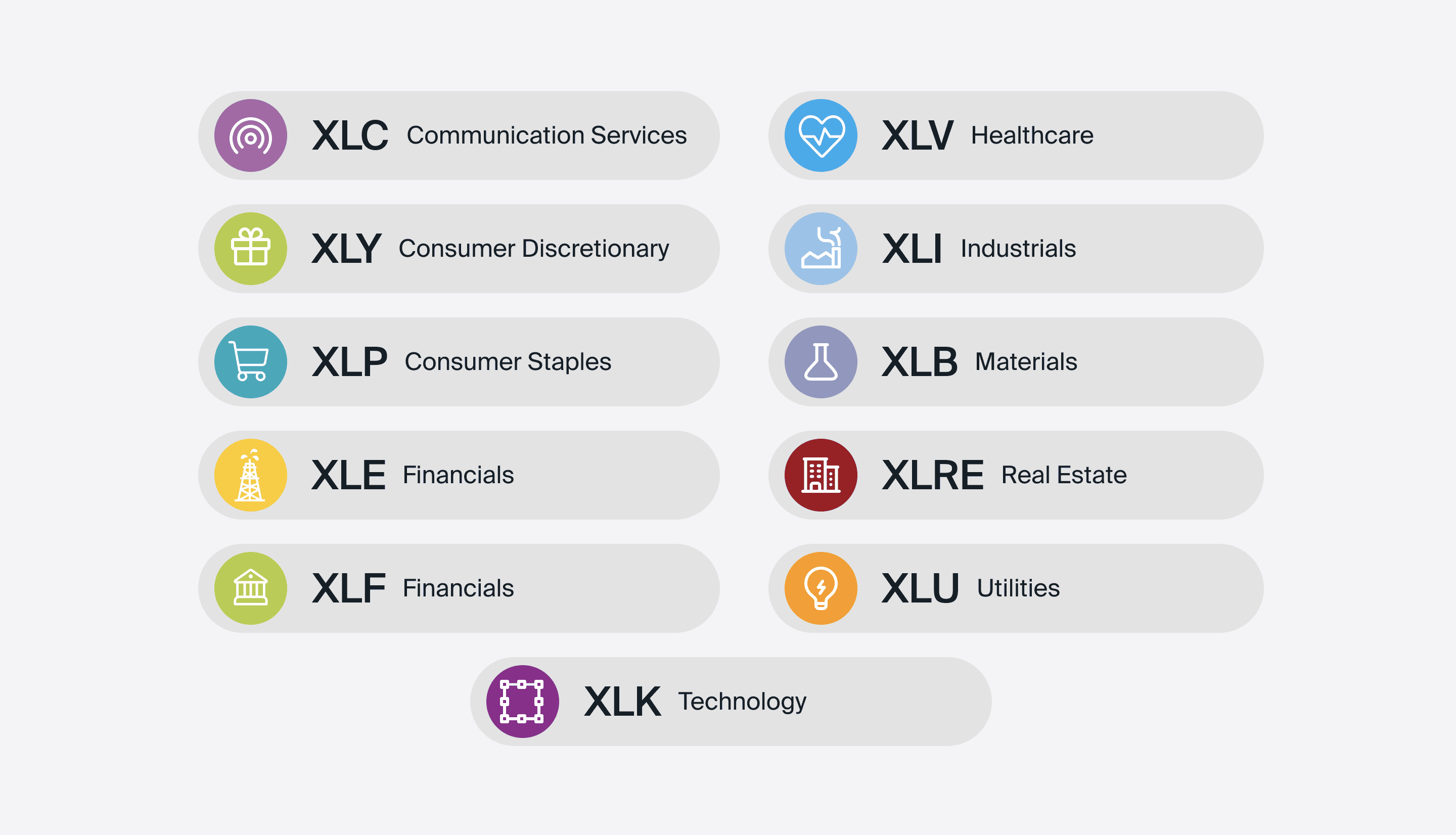

Here are main types of ETFs available:

Investing in Exchange-Traded Funds proposes a range of benefits that have made them increasingly popular among local investors:

While investing in ETFs have numerous advantages, there are some drawbacks that investors should consider:

Investors should carefully evaluate their financial objectives, risk tolerance, and tax considerations when incorporating ETFs into their investment portfolios.

Investing in Exchange-Traded Funds is a straightforward process, and it can be broken down into three key steps:

Opening a Brokerage Account:

Selecting an ETF:

Developing a Trading Strategy:

Once you've chosen an ETF and formulated a trading strategy, you can place your buy orders through your brokerage platform. Monitor your investments regularly and make adjustments as needed to stay aligned with your financial objectives.

Assessing ETFs is a crucial step. Here are key factors to consider when evaluating ETFs:

Here are a few examples of ETFs available:

Replicates the JSE Top 40 Index, which comprises the 40 biggest companies by market capitalisation in South Africa

Designed for investors seeking reduced portfolio volatility, this ETF dynamically adjusts its allocation between equities and bonds.

This ETF tracks the performance of short-term South African government bonds, providing a low-risk fixed-income investment option.

For global exposure, this ETF tracks the S&P 500 Information Technology Index, focusing on tech companies in the United States.

An alternative to the traditional Top 40 ETF, this ETF equally weights all components of the FTSE/JSE Top 40 Index.

Offering worldwide diversification, this ETF tracks the MSCI ACWI Index, providing exposure to global equities.

This ETF tracks the African ex-South Africa universe, capturing potential growth opportunities across the continent.

This ETF invests in a diversified portfolio of property companies, providing exposure to the local real estate sector.

Investors have increasingly considered the differences between Exchange-Traded Funds and Mutual Funds. Here's a comparison:

ETFs:

Mutual Funds:

An ETF is a financial instrument allowing investors to gain exposure to a diversified portfolio of assets. ETFs are ideal for investors seeking liquidity, transparency, diversification, low costs, and tax advantages. The disadvantages of ETFs you should consider are market risks, brokerage costs, price volatility, selection complexity, and tracking error. When comparing ETFs with mutual funds, ETFs often emerge as the more cost-effective and tax-efficient option.

Lloyd has been trading, investing and teaching about financial markets for over a decade. He has a thorough understanding of financial services provider legislation as well as investment asset classes and categories. Lloyd is a certified RE5 representative and holds a COB Investment certificate from the Moonstone Business School of Excellence.

The amount needed to invest in an ETF can vary, but it's often as low as the price of one share.

The best ETFs for beginners depend on their specific goals and risk tolerance, but popular choices include Satrix Top 40, NewFunds TRACI 3 Month, and Ashburton Global 1200 Equity ETF.

ETFs are similar to mutual funds in that they pool investors' money to invest in a diversified portfolio of assets. However, ETFs are traded on stock exchanges throughout the day, while mutual funds are priced at the end of the trading day.

In South Africa, ETF trading may be subject to Capital Gains Tax (CGT) and, for foreign ETFs, Dividend Withholding Tax (DWT). The exact tax treatment can vary based on individual circumstances and the specific ETF.

© 2025 BROKSTOCK SA (PTY) LTD.

BROKSTOCK SA (PTY) LTD is an authorised Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BROKSTOCK SA (PTY) LTD Proprietary Limited trading as BROKSTOCK. BROKSTOCK SA (PTY) LTD t/a BROKSTOCK acts solely as an intermediary in terms of the FAIS Act, rendering only an intermediary service (i.e., no market making is conducted by BROKSTOCK SA (PTY) LTD t/a BROKSTOCK) in relation to derivative products (CFDs) offered by the liquidity providers. Therefore, BROKSTOCK SA (PTY) LTD t/a BROKSTOCK does not act as the principal or the counterparty to any of its transactions.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BROKSTOCK SA (PTY) LTD pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BROKSTOCK SA (PTY) LTD, a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BROKSTOCK SA (PTY) LTD will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BROKSTOCK SA (PTY) LTD may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BROKSTOCK SA (PTY) LTD's direct control. In exchange for using the Site, the user agrees not to hold BROKSTOCK SA (PTY) LTD, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BROKSTOCK SA (PTY) LTD is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BROKSTOCK SA (PTY) LTD you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.