Discover the

Exchange-Traded Funds (ETFs) in South Africa with BROKSTOCK. In this article we

will delve into the concept of ETF trading, the types of ETF and their distinctive

features.

Explaining ETF Investing

Investing in South

Africa has gained prominence over the years, with a diverse range of

opportunities available to both novice and skilled investors. One such

financial instrument that has attracted significant attention is

Exchange-Traded Funds (ETFs).

What Does an ETF Mean?

An Exchange-Traded

Fund is a financial instrument that lets investors obtain

access to a diversified portfolio of assets, such as stocks, bonds,

commodities, or a combination of them. These funds are traded on stock

exchanges, much like individual stocks, offering investors the chance to buy

and sell shares throughout the trade day.

Who are ETFs For?

Exchange-Traded

Funds is an attractive choice for various individuals and institutions. South African ETFs would suit:

Novice Investors

ETFs are an

excellent option for individuals new to investing. They provide a

straightforward way to access diversified portfolios without requiring an

in-depth understanding of the stock market. Novice investors can start small

and gradually build a diversified portfolio.

Experienced Investors

Seasoned investors

often use ETFs to fine-tune their portfolios or obtain access to thematic investing ETF. They appreciate the flexibility and liquidity that ETFs

offer, allowing them to adjust their investment strategies as market conditions

change.

Retirement Savers

Investors planning

for their retirement can benefit from including ETFs in their retirement

portfolios. ETFs offer diversified exposure, which can help mitigate risk and

improve long-term returns.

Institutional Investors

Pension funds,

insurance firms, and other institutional investors utilise ETFs to efficiently

manage large sums of money. These investors appreciate the transparency and low

costs associated with ETFs.

Tax-Efficient Investors

ETFs tend to be

tax-efficient due to their unique structure - they tend not to distribute

capital gains. This makes them a suitable choice for investors looking to

minimise tax implications on their investments.

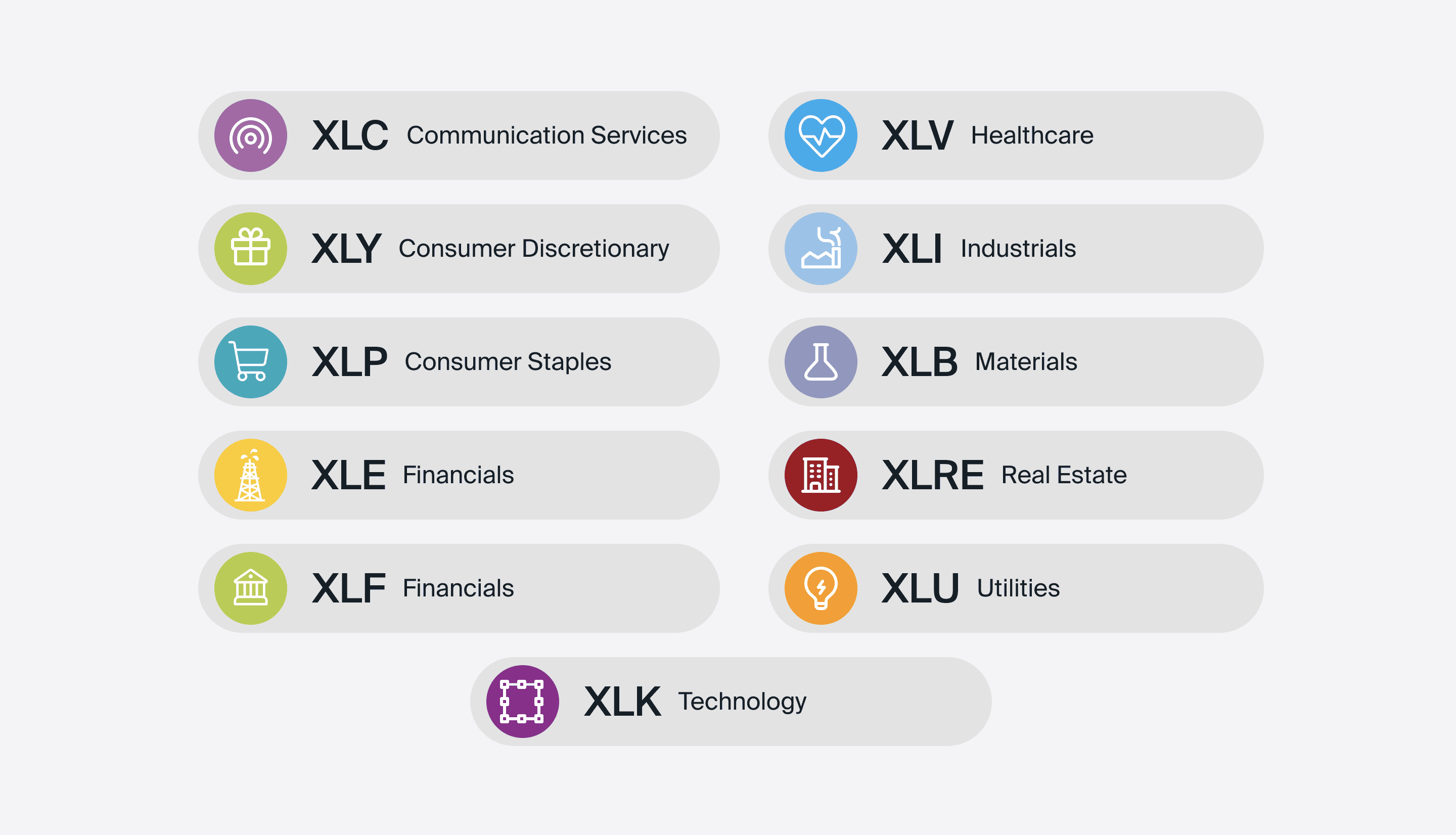

What are the Types of ETFs?

Here are main

types of ETFs available:

- Equity ETFs: These ETFs track certain stock market indices, such as the FTSE/JSE Top 40, and provide exposure to the equities of firms listed on the Johannesburg Stock Exchange (JSE).

- Bond ETFs: Bond ETFs focus on fixed-income securities, including government bonds, corporate bonds, and other debt instruments. They provide an opportunity to invest in the bond market.

- Commodity ETFs: Commodity ETFs track the performance of physical commodities. There are gold ETF investing, platinum, and oil ones. They propose investors a way to obtain access to commodity prices without holding the physical assets.

- Property ETFs: Property ETFs invest in Real Estate Investment Trusts (REITs) and provide exposure to the property sector, including commercial, residential, and industrial properties.

- Currency ETFs: These ETFs track the performance of foreign currencies relative to the South African Rand (ZAR), allowing investors to hedge or speculate on currency movements.

- Global ETFs: Some ETFs propose access to international markets, including global equities, bonds, and emerging markets. They provide diversification beyond the local market.

- Smart Beta ETFs: These ETFs use alternative index-weighting methodologies to target specific investment factors like value, growth, low volatility, or high dividends.

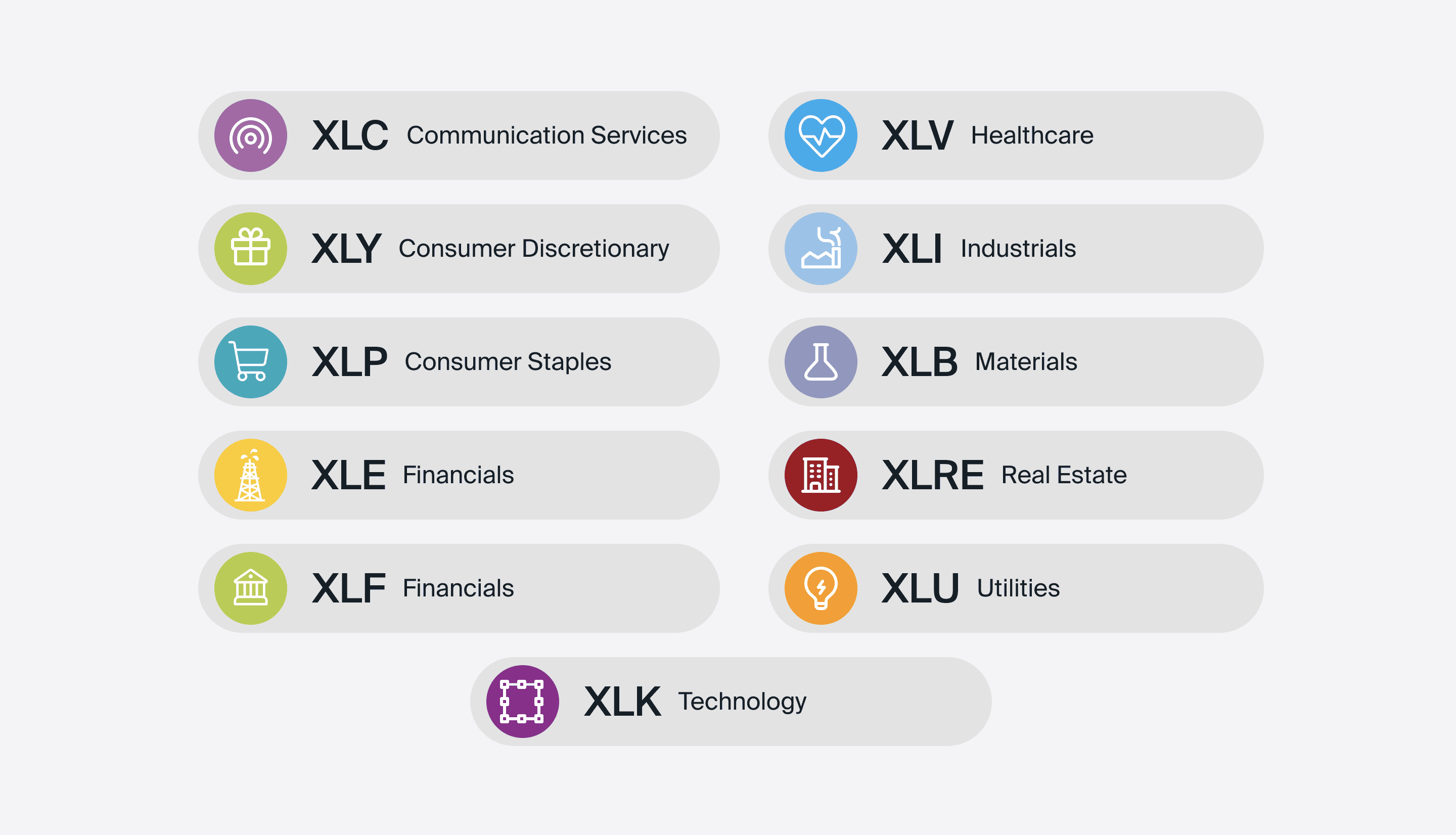

- Sector ETFs: Particular industry ETF investing offers investors targeted exposure in such fields, as financials, technology, or healthcare.

What are the Benefits of ETF Investing?

Investing in

Exchange-Traded Funds proposes a range of benefits that have made them

increasingly popular among local investors:

- Diversification: ETFs allow investors to access a wide range of assets, including equities, bonds, commodities, and more. This diversification aids in spreading risk and reducing the influence of poor performance in any single asset.

- Low Costs: ETFs usually have lower expense ratios in comparison with actively managed funds, making them a cost-effective investment option. This cost efficiency helps investors keep more of their returns.

- Liquidity: ETFs are traded on the Johannesburg Stock Exchange throughout the trade day, providing liquidity and flexibility. Investors may buy or sell ETF stocks at predominant market prices.

- Transparency: ETFs list their top holding and the weightening they have in the fund, offering complete transparency to investors. This transparency allows investors to know exactly what assets are held within the fund.

- Tax Efficiency: ETFs are structured to be tax-efficient. They often have lower capital gains tax implications compared to other investment options.

- Accessibility: ETFs are accessible to a broad range of investors. Whether you have a modest amount to invest or substantial capital, ETFs offer accessibility without high minimum investment requirements.

What are the Drawbacks of ETF Investing?

While investing in ETFs have numerous advantages,

there are some drawbacks that investors should consider:

- Tracking Error: ETFs aim to replicate the performance of a specific index or asset class, but there can be a slight variance, known as tracking error. This means that the ETF's returns may not perfectly match the underlying index.

- Intraday Price Volatility: The intraday trading of ETFs can lead to price volatility. Investors need to be cautious when trading during periods of high market turbulence.

- Dividend Taxation: South Africa has a dividend withholding tax that may apply to the dividends received from ETF investments. Investors should be aware of the tax implications.

- Market Risks: ETFs are still subject to market risks. If the underlying assets within an ETF perform poorly, the ETF's value will decline accordingly.

- Brokerage Costs: While ETF expense ratios are low, investors need to consider the costs associated with buying and selling ETFs, such as brokerage fees and exchange fees.

- Selection Complexity: With a wide variety of ETFs available, choosing the right ones for your investment goals can be challenging. Investors need to conduct research to make informed selections.

Investors should carefully evaluate their financial objectives, risk tolerance, and tax considerations when incorporating ETFs into their investment portfolios.

Starting ETF Investing

Investing in Exchange-Traded Funds is a straightforward process, and it can be broken down into three key steps:

Opening a Brokerage Account:

- Research reputable brokerage platforms, regulated by the FSCA.

- Compare brokerage fees, account types, and available features to select the one that suits your needs.

- Complete the account registration process, which typically involves providing personal information.

Selecting an ETF:

- After opening a brokerage account, explore the range of ETFs investing South Africa.

- Consider your investment objectives, risk tolerance, and time horizon to identify suitable ETFs.

- Review the ETF's information to understand its strategy, expense ratio, and historical performance.

Developing a Trading Strategy:

- Develop an investment strategy that aligns with your financial goals. Decide whether you want to hold ETFs for the short term or long term.

- Consider your asset allocation, diversification, and rebalancing strategy.

- Determine your entry and exit points based on market conditions and your risk tolerance.

Once you've chosen an ETF and formulated a trading strategy, you can place your buy orders through your brokerage platform. Monitor your investments regularly and make adjustments as needed to stay aligned with your financial objectives.

How to Measure ETFs in South Africa?

Assessing ETFs is a crucial step. Here are key factors to consider when evaluating ETFs:

- Investment Objective: Start by defining your investment objective. Are you looking for growth, income, or a specific asset class exposure? Different ETFs are designed to meet various investment goals.

- Underlying Index or Assets: Examine the underlying index or assets that the ETF tracks. Ensure it aligns with your investment strategy and risk tolerance. For example, some ETFs may track the FTSE/JSE Top 40 for broad equity exposure.

- Expense Ratio: Assess the ETF's expense ratio, which represents the annual fees as a percentage of your investment. Lower expense ratios are generally more cost-effective.

- Liquidity: Check the average daily trading volume and bid-ask spread to gauge an ETF's liquidity. Higher liquidity often means lower trading costs.

- Tracking Error: Evaluate the ETF's historical tracking error, which indicates how closely it has followed its benchmark index. Lower tracking errors suggest better replication.

- Dividend Yield: If you're seeking income, look at the ETF's dividend yield. Consider whether it aligns with your income needs.

- Tax Efficiency: ETFs can have different tax implications. Understand how the ETF handles taxation, including capital gains and dividend withholding tax.

- Provider Reputation: Consider the reputation of the ETF provider. Established and reputable providers often offer more reliable products.

- Historical Performance: Review the historical performance of the ETF, although past performance is not a guarantee of future results.

- Holdings and Sector Exposure: Examine the ETF's holdings and sector exposure to ensure it complements your investment portfolio.

- Regulatory Compliance: Ensure the investing ETF complies with South African financial regulations and is registered with the relevant authorities.

What are the Examples of South African ETFs?

Here are a few examples of ETFs available:

Satrix Top 40 ETF

Replicates the JSE Top 40 Index, which comprises the 40 biggest companies by market capitalisation in South Africa

ABSA NewFunds Volatility Managed ETF

Designed for investors seeking reduced portfolio volatility, this ETF dynamically adjusts its allocation between equities and bonds.

ABSA NewFunds TRACI 3 Month ETF

This ETF tracks the performance of short-term South African government bonds, providing a low-risk fixed-income investment option.

Stanlib S&P 500 Info Tech Index Feeder ETF

For global exposure, this ETF tracks the S&P 500 Information Technology Index, focusing on tech companies in the United States.

BettaBeta Equally Weighted Top 40 ETF

An alternative to the traditional Top 40 ETF, this ETF equally weights all components of the FTSE/JSE Top 40 Index.

Ashburton Global 1200 Equity ETF

Offering worldwide diversification, this ETF tracks the MSCI ACWI Index, providing exposure to global equities.

Cloud Atlas AMI Big50 ex-SA ETF

This ETF tracks the African ex-South Africa universe, capturing potential growth opportunities across the continent.

Satrix Property ETF

This ETF invests in a diversified portfolio of property companies, providing exposure to the local real estate sector.

ETFs contra Mutual Funds

Investors have increasingly considered the differences between Exchange-Traded Funds and Mutual Funds. Here's a comparison:

ETFs:

- Cost Efficiency: ETFs typically have lower expense ratios compared to mutual funds. This cost efficiency can lead to higher returns for investors over time.

- Liquidity: ETFs are traded on stock exchanges throughout the trading day, offering investors the flexibility to buy or sell shares at market prices. This liquidity is advantageous for those who want to make real-time decisions.

- Transparency: ETFs disclose the weight of their holdings, allowing investors to know exactly what assets are held in the fund and in what percentage. This transparency helps investors make well-informed choices.

- Tax Efficiency: ETFs are structured to be tax-efficient, often resulting in lower capital gains tax implications, which can boost after-tax returns.

Mutual Funds:

- Professional Management: Mutual funds are actively managed by professional fund managers, making them suitable for investors who prefer to delegate investment decisions to experts.

- End-of-Day Pricing: Mutual funds are priced at the end of the trading day, which means that investors know the price at which they transact only after the market closes.

- Investment Requirements: Mutual funds often have higher minimum investment requirements compared to ETFs.

Bottom Line and Key Takeaways

An ETF is a financial instrument allowing investors to gain exposure to a diversified portfolio of assets. ETFs are ideal for investors seeking liquidity, transparency, diversification, low costs, and tax advantages. The disadvantages of ETFs you should consider are market risks, brokerage costs, price volatility, selection complexity, and tracking error. When comparing ETFs with mutual funds, ETFs often emerge as the more cost-effective and tax-efficient option.