- Is Now a Good time to Invest in Companies in South Africa

- Graphical Overview

- Best companies to buy shares in JSE

- Naspers (NPN)

- Shoprite (SHP)

- Best companies to buy shares from: comparative tables

- Cheapest shares to buy on the JSE

- JSE shares moving up

- JSE shares moving down

- Top 10 in South Africa by volume

- Top 10 shares to buy by price

- Related Investing Topics

- How to Use Compounding Interest Accounts

- How to Research Stocks

- What is a Good Return on Investment?

- Where to invest $1,000 right now

- Final takeaways for using this best stock in JSE list

Best Shares to Buy in South Africa in 2024

Research from Credit Suisse Research Institute and London Business School confirmed the value of resources in the South African economy. For more than a century, from 1900 to 2016, the country’s resource market outperformed larger economies.

Resources made South Africa a safe investment destination and helped build a diversified economy. With a wider range of options for investors, the country is still considered a safe and profitable destination whilest leaving the question of which shares to buy right now in South Africa, open.

Is Now a Good time to Invest in Companies in South Africa

Are there opportunities for investors in South Africa’s volatile market? Or should caution prevail? Is now the time to sell to lim it losses or should you continue to invest? Or even, which companies to invest in South Africa at the moment?

The loudest voices advise against investing without acknowledging that market volatility or even a downturn offers opportunities to brave investors.

It may seem counterintuitive to invest as your portfolio loses value, but investing now is an opportunity to buy low and sell high later. To put it another way, buying in good times only means you will pay more, and you lose the opportunity for higher gains earned over the long term.

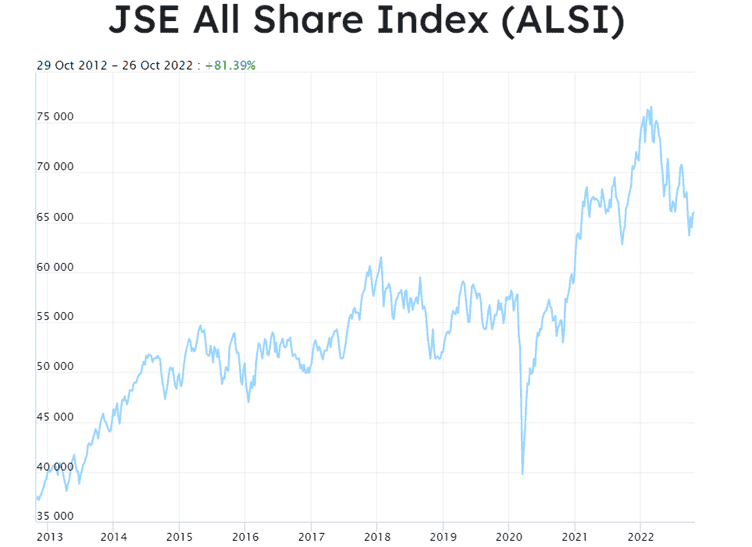

Are South African companies a solid investment? The short answer is yes. One of the major reasons is the strength of the JSE, one of the world’s premier exchanges. Its earned reputation provides investors with the confidence to know they are investing into a well-regulated and controlled market. While the market has not matched the pre 2016 annualised 7.2% return, investing remains the best way to secure your financial future.

Should you invest now? The question you need to ask yourself is: What is the opportunity cost of not investing in a volatile market?

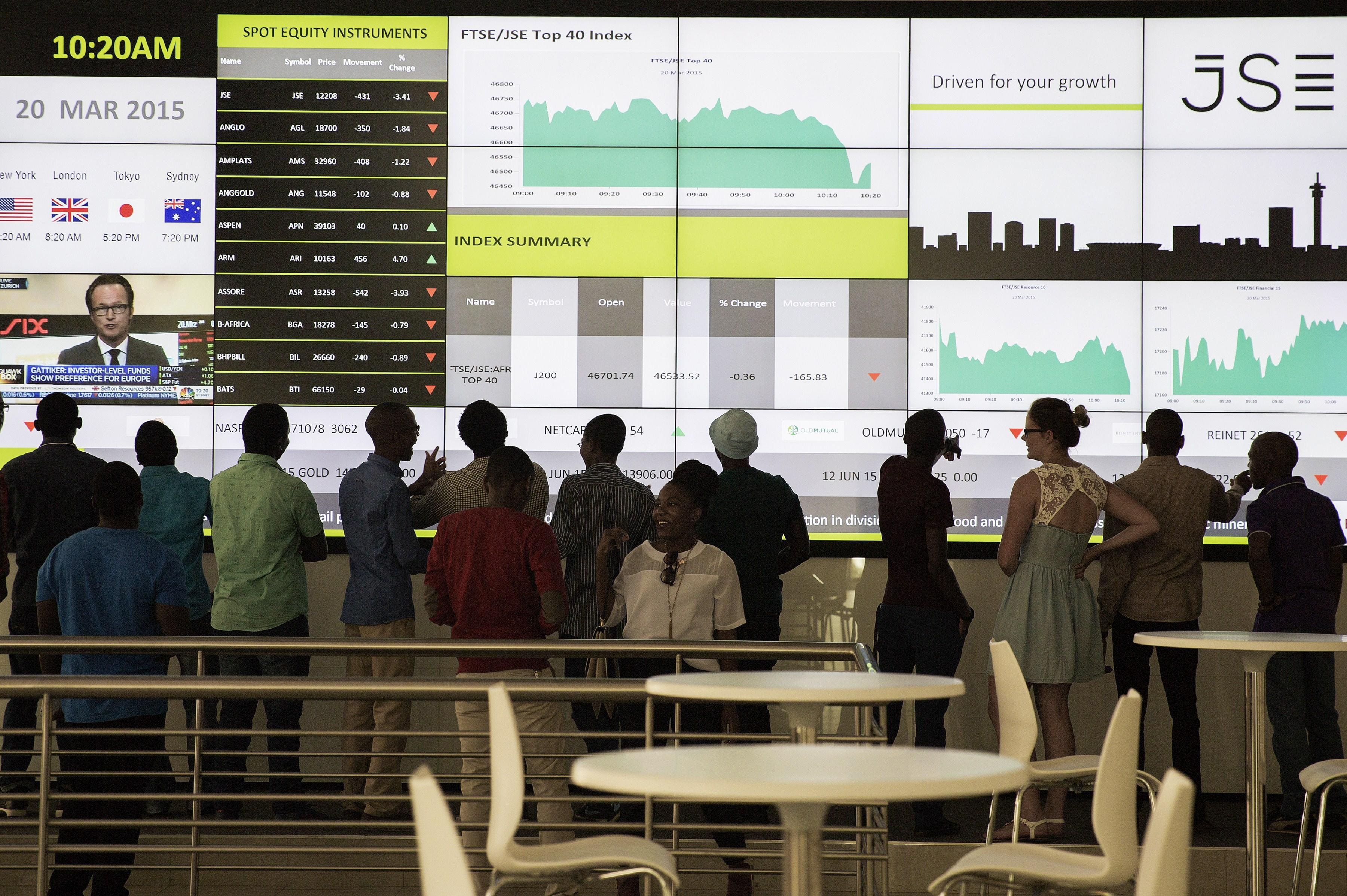

Graphical Overview

Best companies to buy shares in JSE

Naspers (NPN)

Naspers, best known as a media company, has diversified into e-commerce, food delivery and early-stage funding that generated R22 billion in revenue in 2021. It is one of the largest JSE listed companies, representing 15% of the total value of all the listings on the exchange. Despite losing 9.19% in value over 12 months and being one of the more expensive shares on the JSE, South African asset managers believe that it may be one of the best performing shares on jse in 2022-2025 period.

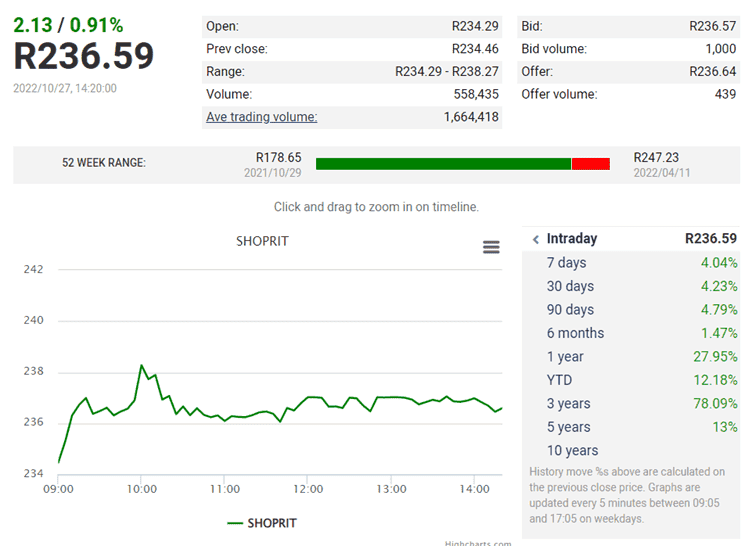

Shoprite (SHP)

Shoprite saw the value of their holdings grow 47.83% over a year that included the tail end of a pandemic, lower consumer demand and rising food inflation. With more than 2 800 stores in 14 African countries, a Shoprite or one of its other brands is easy to find. Accessibility has entrenched brand loyalty and earned the company a bullish reputation among analysts.

Best companies to buy shares from: comparative tables

Cheapest shares to buy on the JSE

Below is the list of relatively cheap shares to buy in South Africa at the moment

| NAME | PRICE | BACKGROUND |

| Netcare Ltd | R15.62 | The largest private healthcare provider in South Africa, it operates over 300 medical facilities in Africa and the UK. |

| Grindrod | R9.88 | Grindrod’s diverse holdings include logistics services and a niche financial services company. Through subsidiaries and joint ventures, it operates in 24 countries. |

| Zeder Inv. Ltd | R1.89 | Zeder, first listed in 2006, is a diverse agri-sector holding company with investment in machinery, distribution, processing, marketing, and financing. |

JSE shares moving up

A list of best jse shares to buy in 2022-2024 in accordance with their positive growth shown over the last 12 month

| NAME | PRICE | BACKGROUND |

| PepKor Holdings | R22.41 | A low 11% of Pepkor’s shares are held by individual investors. The building, clothing, general retail and fintech company is favourite of institutional investors. |

| Sibanye Stillwater | R44.10 | With a price-earnings ratio of 6.1 and 13.3% profit margin on $8.5 billion, the mining and processing company has had a Buy rating over the last year. |

| MTN Group | R12.16 | Over 12 months to June 2022, MTN improved HEPS fr om R3.87 to R5.67 as it grew its customer base to 282 million. |

NAMEPRICEBACKGROUNDPepKor HoldingsR22.41A low 11% of Pepkor’s shares are held by individual investors. The building, clothing, general retail and fintech company is favourite of institutional investorsSibanye StillwaterR44.10With a price-earnings ratio of 6.1 and 13.3% profit margin on $8.5 billion, the mining and processing company has had a Buy rating over the last year.MTN GroupR12.16Over 12 months to June 2022, MTN improved HEPS fr om R3.87 to R5.67 as it grew its customer base to 282 million.

JSE shares moving down

A list of so-called “shares for sale” in South Africa in 2022 to be weary of.

| NAME | 12 MONTH PERFORMANCE | BACKGROUND |

| Hammerson PLC | + 0.24% | UK property developer and owner Hammerson’s secondary listing on the JSE has a Sell rating. |

| Textainer Group Holdings | Flat | Improvements in the global supply chain has earned Textainer a 100% Hold rating. |

| Kumba Iron Ore | -5.25% | Kumba produces a single commodity, and the value of the share is affected by demand for its iron ore. |

Top 10 in South Africa by volume

A list of South African shares to buy or at least worth considering in 2024 in accordance with their total trading volume.

| SHARE | PRICE | CAP |

| BHP Billiton SA (BHG) | 472.29 | 2,419,230,000,000 |

| Prosus | 892.78 | 1,859,040,000,000 |

| British American Tobacco (BTI) | 686.59 | 1,693,610,000,000 |

| AB InBev (ANH) | 930.98 | 1,634,090,000,000 |

| Glencore (GLN) | 109.01 | 1,415,860,000,000 |

| Richemont (CFR) | 186.65 | 996,080,000,000 |

| Naspers (NPN) | 2,165.50 | 949,410,000,000 |

| Anglo American (AGL) | 601.36 | 813,880,000,000 |

| AmPlats (AMS) | 1,585.30 | 420,540,000,000 |

| FirstRand (FSR) | 64.66 | 366,580,000,000 |

Top 10 shares to buy by price

| SHARE | PRICE | YTD GAIN |

| Grindrod (GND) | R 10.02 | 105.86% |

| Novus Holdings Ltd (NVS) | R 3.84 | 102.60% |

| Stefanutti Stocks (SSK) | R 0.94 | 90% |

| Hammerson Plc (HMN) | R 5.87 | -28.87% |

| Exxaro Resources Limited (EXX) | R 281.52 | 39.81% |

| ArcelorMittal SA Limited (ACL) | R 4.90 | -44.67% |

| Master Drilling Group (MDI) | R 12.80 | 28.92% |

| Sappi (SAP) | R 5430 | 25.78% |

| Octodec (OCT) | R 10.20 | 25.61% |

| Blue Label Telecommunications Ltd (BLU) | R 5.30 | 4.09% |

Related Investing Topics

How to Use Compounding Interest Accounts

Compound interest enables investors to build wealth faster by earning interest on their interest, and the principal. Investing is a good habit to acquire, compounded interest turns a good habit into financial security faster.

For investors there are three ways to benefit from the power of compounded returns.

- Start Early: The sooner you start investing, the better. The amount of time spent in the market fuels portfolio growth. Time works to the advantage of investors, so the earlier investors start the longer they benefit from compound interest.

- Trade Often: Investing a lump sum over a long period will, historically, grow but you run the risk of trading when an asset is high or lose losing value if you invest before a drop. Trading smaller amounts more often allows you to trade according to market conditions and swings in portfolio value can be managed.

- Diversify: Diversified portfolios, one that includes a variety of asset classes, will maintain value better than one invested in one asset or industry. Exchanges offer investors the opportunity to build a basket of investments that can bear the impact of economic cycles. Managing swings in the value of a portfolio multiplies the effect of compound interest on a portfolio.

There are predictable ways to benefit from compounding. Savings accounts, for example, are a low-risk option. However, with the lowered risks come lower returns. Investors balance the increased risk that comes with trading against the enhanced earnings.

How to Research Stocks

Due diligence is the key to determining which South African stocks are best for acquisition in 2022 and onwards. The vocabulary of the market can make investing seem complex, research makes trading simpler. Successful investors appreciate that any strategy is built on leg work, on researching an asset, understanding its performance, and deciding how it fits into a growth strategy.

Analysis through research gives investors the insights they need and guides the decision on whether it fits into their strategy.

Access to the resource’s investors need are easily accessible. BROKSTOCK give traders access to tools like Consensus Forecasts, analysis from asset experts and asset fundamentals.

What do the numbers mean?

Traders can measure an assets financial health and compare different assets by looking at a series of key criteria.

- P/E Ratio: Price to Earnings Ratio measures current share price against its earning per share. Analysts look at either estimated earnings or historic income to set a value.

- PEG Ratio: Dividing an assets PE Ratio by its annual share growth gives you its Price to Earnings Growth Ratio.

- P/B Ratio: Price to Book ration measures the relationship between share price and sales price of a company if it were sold.

- ROA and ROE: Return on Assets gauges how efficiently a company creates revenue, while Return on Equity measures profit earned from every Rand invested by shareholders.

- HEPS: Headline Earnings refers to income earned from business activities. HEPS is measured by deducting extraordinary items like tax liabilities or one-time charges or write- downs from stated profits.

Understanding the numbers is the first step. Deciding on the value of a share to you depends on several criteria that are not easily measured. These include:

Leadership: Does the leadership have a track record of success? Does their management philosophy correspond with your investment strategy?

Strategy: What are the company’s strategies to remain competitive?

The following are not market benchmarks, but they do impact company performance. A McKinsey study in 2019 found that companies that ranked high in the following measurements had above average profitability.

Culture: What reputation has the company earned? Is it ranked among the best places to work? Wh ere does it rank on equality indices?

ESG: Does the company prioritise environmental, sustainability and governance initiatives?

This information can be found in public sources, like the business media, or fr om analysts’ reports.

What is a Good Return on Investment?

A 7–12% return would be considered a good return on any investment. Without the context however this means very little. What investors need to monitor is how their returns match against:

Inflation: Investors need to manage their portfolio to hedge against rising inflation. Smart investors understand that inflation lowers returns as money loses buying power. To counter this, traders will add high return investments or assets with inherent value, like real estate, to their portfolio.

Taxes: South African investors can manage the tax effects on their returns by deducting tax owed yearly or at the end of the investment’s life. Charges levied on annual deductions include taxes on earned interest and capital gains which would lower the value of the portfolio and the benefit earned from compound interest.

Fees: As an investor, awareness of the cost of trading is important. Choosing professional help comes with costs that will impact portfolio value. Even a small percentage difference can have a huge affect on the value of a portfolio. With Brokstock is a low-cost option that allows you to trade and invest for the long term.

Where to invest $1,000 right now

There is direct answer to the question of what shares to buy now south africa

if you have only $1000. One of the key things to remember however is that time is an investor’s friend. The longer you invest, the better your returns. If you had invested $1000 in Amazon shares 10 years ago, that investment would be worth $19 000 today.

In his book ‘A Random Walk Down Wall Street,’ economist and Princeton University professor Burton Malkiel argues that a random market can’t be timed. Instead, he advises, “trust in time rather than timing, start saving early and save regularly.”

Investing $1000 won’t make you rich, it is an important step in reaching financial goals. The world of financial markets is changing, discover the options available for investors no matter their risk profile on Brokstock.

Final takeaways for using this best stock in JSE list

The market is an intricate system that offers complicated investment options. This is not a list of recommendations but is offered only to highlight the opportunities and to reinforce the view that investing is a better option to grow your nest egg. Investing is always a better option to saving to build financial security.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Caution is the best advice for new investors. Look for shares in a sector you are familiar with. Or in a company you know. For example, if you bank with Capitec buy their shares or if you get medical coverage through Discovery, start your portfolio with these shares.

Recent volatility in US tech stocks should be seen as a lesson. High flying tech stocks have reported lower than expected earnings resulting in a sector that drove market growth now dragging markets down. Markets recover, investors spooked into selling will be divesting at a loss. Choose sectors you are familiar with and invest over the long term.

Yes. You can investment opportunities as low as R5 on the JSE.

As a new investor do your research. Company’s publish annual reports with the data that will guide your decision. Or use Brokstocks informational tools to find shares that fit into your strategy.

Don’t be put off by the present market volatility, there are opportunities to grow your investment. Even if you are new to investing. Here are two well know options that offer growth opportunities.

- ABSA

- Anglo American Platinum

South African government bonds, RSA Retail Savings Bonds and Money market funds offer the safest investment options in volatile markets.

South African government bonds, RSA Retail Savings Bonds and Money market funds offer the safest investment options in volatile markets.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.