- Forex trading times

- What time does the forex market open in South Africa

- Factors to consider when investing in forex in South Africa

- Liquidity

- Volatility

- Trade volume

- The effects of holidays

- 4 Different types of trading strategies

- Why Does the Forex Market Trade 24 hours a Day?

- When Active Markets Overlap

- The Best Hours to Trade in South Africa

- Trading Times and Strategies Correlation

- Best time for position traders

- Best time for swing traders in South Africa

- Best time for day trading in South Africa

- Conclusion

Best Time to Trade Forex in South Africa and Why

There’s usually a recommended time to do certain things, for example, a study conducted in the United Kingdom using data fr om 88 000 adults determined that 10pm is the ideal hour to go to bed.

The Foreign Exchange (also known as Forex) market is no different. Knowing when to trade and when not to trade is important to maximise profits for trading in South Africa.

Forex is the highest transactional market in the world with trillions of dollars being traded every single month.

There are a number of factors that determine the best time to trade Forex in South Africa, in this article we will thoroughly breakdown these factors and provide you with the knowledge you need to trade like a pro.

Forex trading times

The forex market is open 24 hours a day, allowing traders to trade all day and all night.

However, just because the market is open it does not necessarily mean you should trade.

For Forex brokers in South Africa, it is imperative to know the forex market operating hours.

The best time to trade is when the market is active with lots of forex traders opening and closing positions, which creates a large volume of trades.

The foreign exchange market is split into four main trading sessions:

- Sydney

- Tokyo

- New York

- London

Trading in Sydney starts at 10pm GMT and stops at 7am GMT

Trading in Tokyo starts at 11pm GMT and stops at 9am GMT

Trading in London starts at 8am GMT and stops at 7pm GMT

Trading in New York starts at 1pm GMT and stops at 10pm GMT

Concentrate your trading activity during the trading hours of the three busiest trading sessions: Tokyo, London, and New York. Most market activity will occur when one of these three markets open. The most active times will occur when two or more trading sessions overlap and are open at the same time.

What time does the forex market open in South Africa

The question what time does the forex market open in South Africa? Has been asked numerous times and here’s the answer. The Forex market opens at 11pm South African Standard Time (SAST) on Sunday and closes at 11pm on Friday, while weekends are generally closed for trading. It is not advisable to trade during holidays due to inactivity.

Factors to consider when investing in forex in South Africa

Liquidity

In the forex market, liquidity refers to a currency pair’s ability to be bought and sold without causing a significant change in its exchange rate. A currency pair is said to have a high level of liquidity when it is easily bought or sold and there is a significant amount of trading activity for that pair.

The level of liquidity is determined by how much money flows through the market and how many traders want to buy a particular asset.

Volatility

Volatility measures how large the upswings and downswings are for a particular currency pair. When a currency’s price fluctuates wildly up and down, it is said to have high volatility. When a currency pair that does not fluctuate as much, it is said to have low volatility. Volatility helps you realise whether a stock fits your portfolio or not.

Trade volume

Volume is a measure of quantity. In trading, the volume is the amount of a particular asset traded over a period of time. It is the number of units, shares, or contracts that change hands between a buyer and a seller. The more actively traded an asset is, the higher the volume will be (and vice versa).

Volume is a key indicator of market activity and liquidity, which means that it is often presented alongside price information. It is worth noting that the number of actual transactions is not given in the trading volume, it is the number of assets traded that is counted.

When a market is described as “active” it indicates that the trading volume will be higher, and if the market is described as “inactive” it means that the trading volume will be lower.

The effects of holidays

Holidays are known to have a negative impact on trading, they are known for not being the best time to trade forex. There are a lot of reasons to avoid trading on holidays, market inactivity, lack of liquidity and unexpected behavior may make trading on holidays very difficult.

For example, Forex brokers in South Africa should be aware that Christmas or Thanksgiving Day, operations at the New York Stock Exchange (NYSE) is not possible. Also, most exchanges close on New Year's holidays. Every trader who operates in the market should follow the forex holidays.

4 Different types of trading strategies

A forex trading strategy defines a system that a forex trader uses to determine when to buy or sell a currency pair.

One way to maintain your discipline, which refers to having and sticking to your trading plan is to have a range of Forex trading strategies that you use on rotation.

When you have Forex trading strategies that are insightful and have been well researched and tested it gives you confidence when you trade. Because you know the markets will respond well.

Having confidence in your strategies make it easier for you to follow the rules of your Forex strategy and therefore helps you maintain your discipline.

Forex brokers in South Africa, should have a good forex trading strategy which allows them to analyse the market and confidently execute trades with sound risk management techniques.

1. Scalping. These are very short-lived trades, possibly held for just a few minutes. A scalper seeks to quickly beat the bid/offer spread, and skim just a few pips of profit before exiting and is considered one of the most advanced Forex trading strategies out there.

Due to the very fast nature of these trades, analysis is usually done on the very small-time frames. These trades also tend to have smaller profit targets in terms of points or pips than longer term traders.

Because the traders tend to be smaller, the goal fr om a scalping trader’s point of view is to take lots of trades with small risks and small rewards.

That means with a typical trading day, a scalper trader will look to take a good number of trades. For this reason, it’s important that a scalper keeps their risk low as its easy to see how quickly you could become emotional when trading this frequently within small periods of time.

2. Day trading. These are trades that are exited before the end of the day. This removes the chance of being adversely affected by large moves overnight. Day trading strategies are common among Forex trading strategies for beginners. The analysis for these trades is usually done on the 30 minutes, 1-hour and 4-hour time frames.

These trades tend to have larger targets than when scalping as typically a trader will look to take advantage of one of the main moves a market makes within that day.

Because the trades take longer to set up and play out compared to scalping, the frequency of these traders is lower. On average a day trader may take between 2- 10 trades per week and so they tend to risk a little more on each trade than a scalper. It is advisable to have precise entry and exit techniques when day trading to maximise your profitability.

3. Swing trading. Positions held for several days, whereby traders are aiming to profit fr om short-term price patterns. A swing trader might typically look at bars for 2 hours daily, most swing traders’ strategies and trading decisions are based on technical analysis.

Swing trades can typically last anywhere from a day to a number of months or even longer. Analysis for these trades tend to be on the daily, weekly, and monthly timeframes. Due to the extended time frame of these trades, the targets tend to be significantly larger than those of scalping and day trading.

Another by-product of the longer trade durations is that the trade frequency of this style is even lower than day trading. A swing trader would typically take somewhere between 2-12 trades per month. This also means that a swing trader may risk a little more on each trader.

The entries and exists on swing can be less precise as the trade typically takes place over a much larger price range.

4. Positional trading. Long-term trend following, seeking to maximise profit from major shifts in price. A long-term trader would typically look at the end of day charts. The best positional trading strategies require immense patience and discipline on the part of traders. It requires a good amount of knowledge regarding market fundamentals.

Position trading eliminates market noise, there are times when trading on shorter time frames you get caught up in the market price fluctuations, rumours, or the constant monitoring of the market.

It also allows for flexibility, while day traders monitor the price action very closely and their screen time is considerably higher, position traders don’t have to deal with such problems.

Position traders execute fewer trades, and they don’t monitor the trades all the time, meaning that they don’t have to deal with the daily stress that comes from trading. Because of their position they have plenty of room to survive the markets volatility.

Why Does the Forex Market Trade 24 hours a Day?

The reason the Forex market is able to operate 24 hours a day is because of the different time zones it operates in.

Forex trading is done using electronic communications networks (ECNs), all over the world, mostly by major banks and for a range of individuals all over the global.

There is no physical person facilitating the trades, unlike in stock trading wh ere there is a broker present and he or she works certain hours a day. The Forex market is nonstop.

However, depending on the currency pairs you target, you may need to navigate different time zones to find the best time to trade. It is best to find the time when both your target currencies are highly active, so you can make global decisions and keep the whole picture in sight.

Also, Forex brokers in South Africa, note that the first 2 hours of a trading session usually demonstrate peak activities. Therefore, get yourself ready as the day begins.

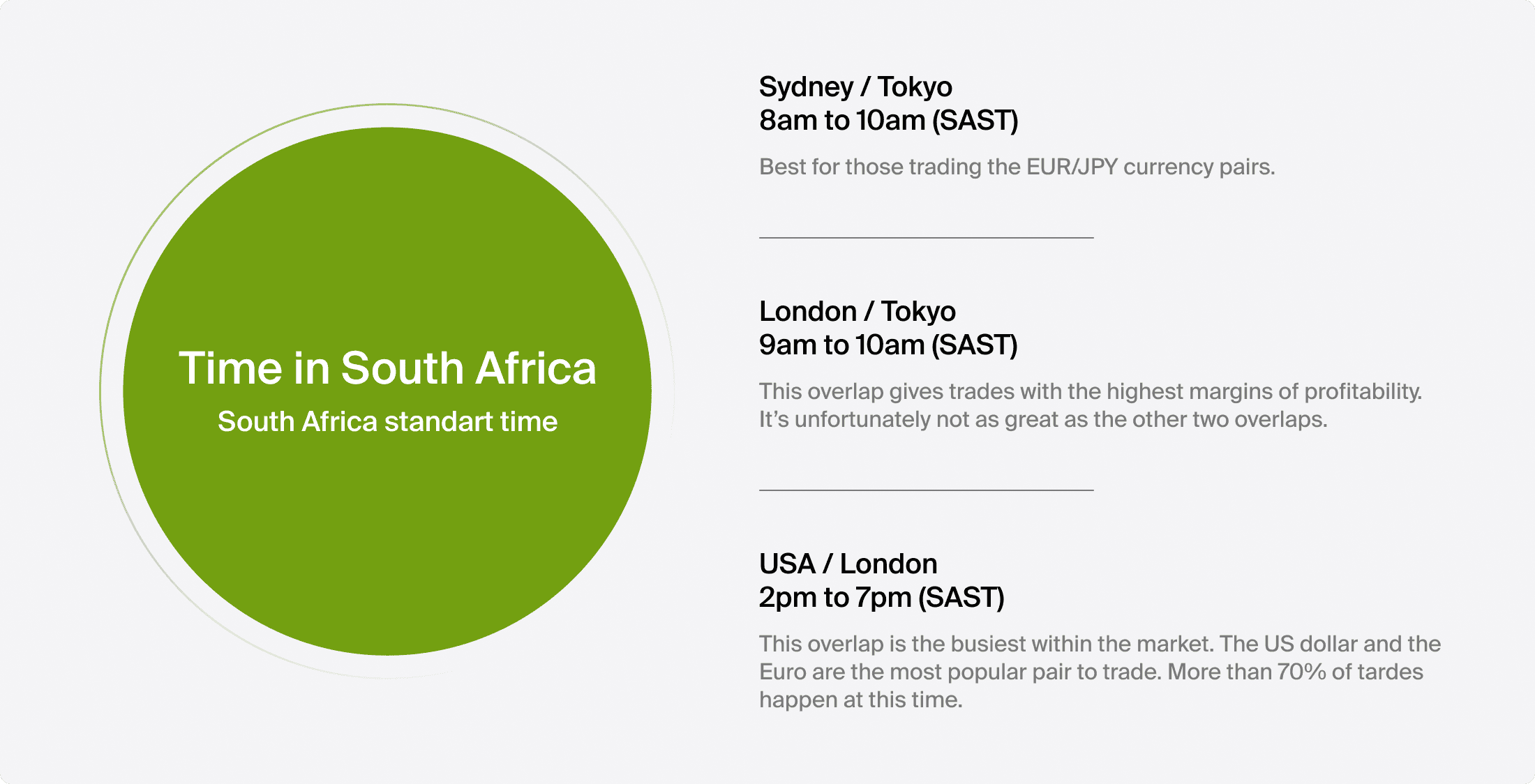

When Active Markets Overlap

The most active time in the Forex market is the overlap between London and New York trading sessions.

It is the time when more than 70% of all trades happen, with the most popular currencies traded being the U.S. dollar and the Euro. It is the optimal time to trade because volatility is high, bringing opportunity for profit, while the spreads are tight due to high liquidity, which increases profitability.

The second significant overlap that still brings plenty of opportunities to trade is the London and Tokyo session crossover. This overlap is not as volatile and active as the London/New York session overlap. Most U.S. traders are asleep at that time; however, it still offers plenty of opportunities, especially for those trading the EUR/JPY currency pair, which is the most affected during this overlap.

The Best Hours to Trade in South Africa

The best time to trade in South Africa is generally between 10:00 and 16:00, that'. During these hours South Africans can catch the last two trading hours of the Tokyo session, which overlaps with the opening of the London session, and a few hours later this session overlaps with the opening of the US markets.

The London and the US sessions are generally the most active trading hours as all market participants affect the currency market in some way. Those who trade in South Africa should be aware of what happens during the London and US sessions. These sessions are prone to important economic news and data being released that potentially have a great impact on exchange rates.

By understanding market sessions, you can identify suitable forex strategies based on market activity in those sessions. You will also understand the best hours in South Africa to trade. Volatile market sessions and major currency pairs are ideal for applying a forex scalping strategy if your risk appetite can handle it.

Trading Times and Strategies Correlation

It is undeniable that the world of Forex is complicated and nuanced, navigating it can be challenging but it is not impossible.

In this world all things matter, the big things and the little things. Choosing the best time to trade can help you identify a strategy that works best for you as a South African trader.

It is also important as a trader to know what time does the forex market open in South Africa.

Simply put correlation is a way that something moves compared to another. Looking to see if there are patterns between two different asset classes or two different occurrences.

It is normal for traders to use different strategies that allow them to sel ect the ideal time to trade. It is advisable that traders familiarise themselves and also have an in depth understanding of different trading styles of Forex.

Best time for position traders

Because this refers to a long-term means of trading wh ere traders hold the trade for weeks even months. It is not ideal for beginner traders who are looking to optimize their time.

Position trading requires you to adopt a higher time frame wh ere you look at daily, weekly, and monthly charts.

Generally, position traders try to look at the bigger picture of the market and don’t get affected by short-term fluctuations and keep faith that the market will correct itself eventually. They put more emphasis on the long-term performance of an asset. They wait for a trend to emerge, before they trade the forex, rather than rushing to make quick profits fr om price fluctuations. By nature, position traders are closer to investors than other trader types.

They usually rely on both technical and fundamental analysis to make trading decisions referring to the daily, weekly, and monthly price charts when evaluating any given position.

Best time for swing traders in South Africa

Generally, the best timeframe for swing trading is daily bars. And while it’s possible to swing trade in other timeframes, the daily timeframe holds quite big advantages that make it a good choice for almost any trader.

The daily timeframe might not be the most exciting choice you can make, at least according to some. However, we would argue that it’s the smartest choice you can make as a beginning trader.

Traders are advised to be aware of the risk and capital management if they want to opt for a short timeframe.

To all the Forex brokers in South Africa, here are the advantages of this timeframe:

- It’s more significant and reliable than other timeframes

- A trading strategy for daily bars is much easier to execute

- It’s harder to curvefit

- You can find a lot of good trading strategies for this timeframe

Best time for day trading in South Africa

The day trading style focuses on relatively small price movements within a trading day. Day traders will typically leverage their market exposure through margin trading. They have more options, however, when it comes to choosing their timeframes, depending on how long they plan to hold their positions.

Traders use day trading to exploit movements over a few minutes to hours, provided that all positions are closed by the end of the day. Because of this, they usually use small time frames, such as 15-minute or hourly charts.

In day trading, the objective is to earn a tiny profit on each trade and add to those earnings over time. When things go wrong, customer service is essential, as well as fast and reliable trade execution.

With day trading, there are more opportunities for trades and there is less risk of losing months' worth of investments overnight. You can also have tighter stop losses and better margin use with shorter time frames. A shorter time frame is ideal for scalpers and momentum traders who seek to take advantage of sharp movements in price.

Hourly time frames are used by short-term traders, who hold trades from several hours to a week.

While shorter time frames are most popular, some traders feel most comfortable with longer-term charts like the 1-hour charts. The longer time frame allows for more time to analyse the market without feeling rushed.

Conclusion

If you have ever travelled to another country and needed to exchange your currency for the currency used in that country, you have participated in the Forex trading markets.

When currencies are exchanged, they have a certain price which is called an exchange rate, the price of a currency is determined by supply and demand.

The global forex market size is $2.09 quadrillion as of 2021. In comparison, the total global gross domestic product (GDP) of 194 countries is $93.86 trillion as of last year

Around 180 currencies are traded in the forex market. The major currency pairs are EUR/USD, USD/JPY, GBP/USD and USD/CHF. These are some of the most widely traded currency pairs in the forex market.

You're able to trade forex 24 hours per day, this is because the major markets are open, and they are located in four geographical areas that are in different time zones. The best times to trade in South African is between 10am and 4pm, that is known as the best forex trading time.

The four major markets are Sydney, Tokyo, New York (US), and London. The USD/EUR is the most commonly traded currency pair in the world accounting for nearly 20% of all forex transactions.

The most active time in the Forex market is the overlap between London and New York (US) trading sessions, this is the time when more than 70% of all trades happen.

The best market liquidity, volatility and trading conditions are generally experienced during this time.

Having a trade strategy helps you maintain your discipline there are four trade strategies that one can implement on the markets are:

- Scalping

- Day trading

- Swing trading

- Positional trading

You may be wondering what time does the Forex market open in South Africa? Simple it opens at 11pm South African Standard Time (SAST) on Sunday and closes at 11pm on Friday, for Forex trading in South Africa.

In closing forex brokers in South Africa, you form part of a quadrillion dollar business, I’m sure that feels good.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.