- What Does Scalping Mean?

- Explaining Scalping

- What is the Best Time for Scalping?

- What are the Benefits of Scalping?

- What are the Drawbacks of Scalping?

- What are the Best Scalping Strategies?

- What Should You Know Before Starting to Scalp?

- Advices for Scalping

- How to Find Out if Scalping is Suitable for Me?

- Choosing a Forex Scalping Broker

- Scalping contra Day Trading

- Scalping:

- Day Trading:

- Bottom Line and Key Takeaways

Forex Scalping Strategy

In this guide, we delve into the essence of scalping, offering a comprehensive overview of what it entails. From understanding the definition of scalping to essential tips before and during the practice, the advantages and disadvantages it brings, and an exploration of some of the best Scalping Strategies available, this text equips you with the knowledge you need to get started with this Trading Strategy.

What Does Scalping Mean?

Scalping refers to a trading strategy focused on profiting from small price movements in currency pairs. Traders employing the scalping technique make numerous quick trades during a trading session, each targeting small, incremental price changes. The goal is to accumulate multiple small gains to generate substantial profits over time.

Explaining Scalping

Scalping entails making rapid buy and sell decisions within a short timeframe, often ranging from seconds to minutes. The primary objective is to take advantage of market volatility and capture tiny price differentials. Traders using this strategy closely monitor charts, using technical analysis tools to identify entry and exit points, and act swiftly to execute their trades.

What is the Best Time for Scalping?

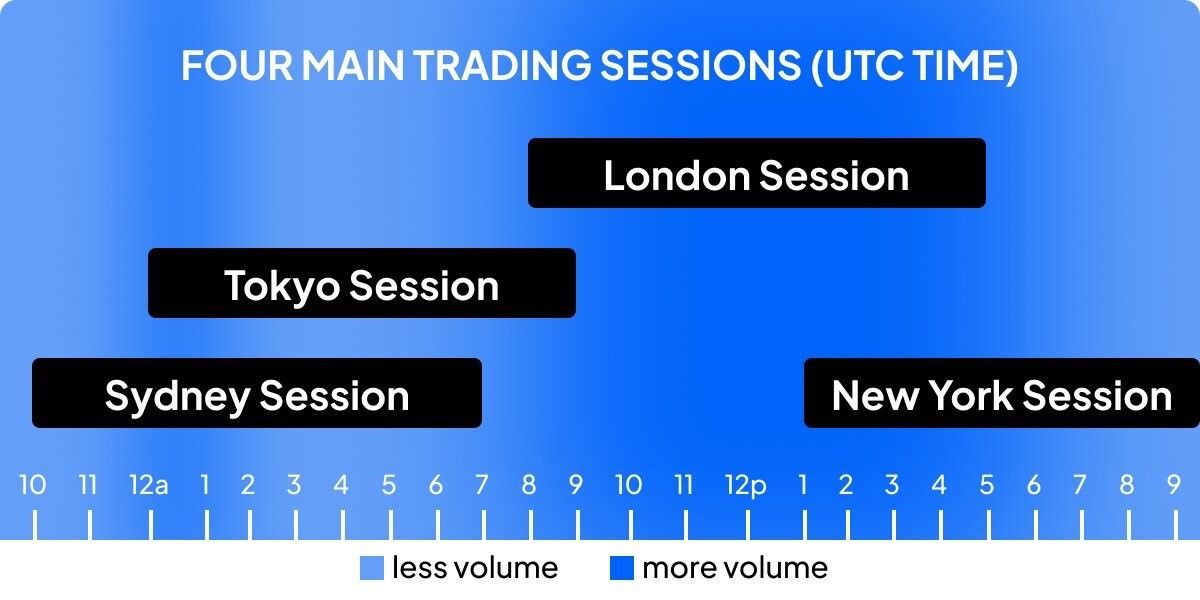

The best time for scalping aligns with the most active and liquid trading sessions in the Forex Market. These periods offer opportunities for quick price movements, making them ideal for scalpers. Here are the key timeframes to consider:

- Overlap of the London and New York Sessions: This occurs between 14:00 and 18:00 South African Standard Time (SAST). It's when the two most significant Forex Markets are open simultaneously, resulting in increased liquidity and higher trading volumes. This overlap offers the best opportunities for scalpers to take advantage of price fluctuations.

- Asian Session: The early hours of the Asian session (between 00:00 and 10:00 SAST) can also be suitable for scalping. Although liquidity is lower compared to the London-New York overlap, some currency pairs, like the JPY crosses, exhibit volatility during this period.

- Economic Data Releases: Traders should be aware of key economic data releases from various regions. Major economic events can lead to rapid price movements, creating scalping opportunities. To maximise effectiveness, it's advisable to consult an economic calendar to plan trades around these events.

Scalping during the times mentioned above is conducive to capturing quick profits due to higher volatility and trading activity. However, traders should always consider their own schedules and availability when choosing the best time to implement a Scalping Strategy.

What are the Benefits of Scalping?

Scalping offers several advantages for traders:

- Quick Profits: Scalping aims to capitalise on small price movements, leading to frequent and quick profits. In a market known for volatility, this strategy can be lucrative.

- Lower Risk Exposure: Smaller trade sizes and tight stop-loss orders are common in scalping, reducing the potential for significant losses.

- Leverage Efficiency: Scalping allows for efficient use of leverage, potentially magnifying profits.

- High Liquidity: The Forex Markets are highly liquid, making it easier for scalpers to enter and exit positions without significant slippage.

- Independence from Long-Term Trends: Scalping is less influenced by long-term economic events, making it suitable for traders who prefer to avoid extended exposure to market conditions.

What are the Drawbacks of Scalping?

Despite its benefits, Scalping Trading Strategies also comes with several drawbacks:

- Stress and Emotional Strain: The rapid pace of scalping can be emotionally taxing. It requires a high level of discipline and the ability to make quick decisions without letting emotions interfere.

- High Transaction Costs: Frequent trading results in higher transaction costs, as brokers often charge spreads and commissions for each trade. This can eat into profits.

- Market Noise: Short-term charts used in scalping can be noisy, making it challenging to distinguish genuine signals from random price fluctuations.

- Time-Consuming: Scalping demands constant monitoring of the markets, which can be time-consuming and unsuitable for traders with limited availability.

- Risk of Overtrading: The excitement of scalping can lead to overtrading, where traders take excessive positions, increasing their risk exposure.

What are the Best Scalping Strategies?

Scalping Strategies can vary. Here are some of the most popular ones:

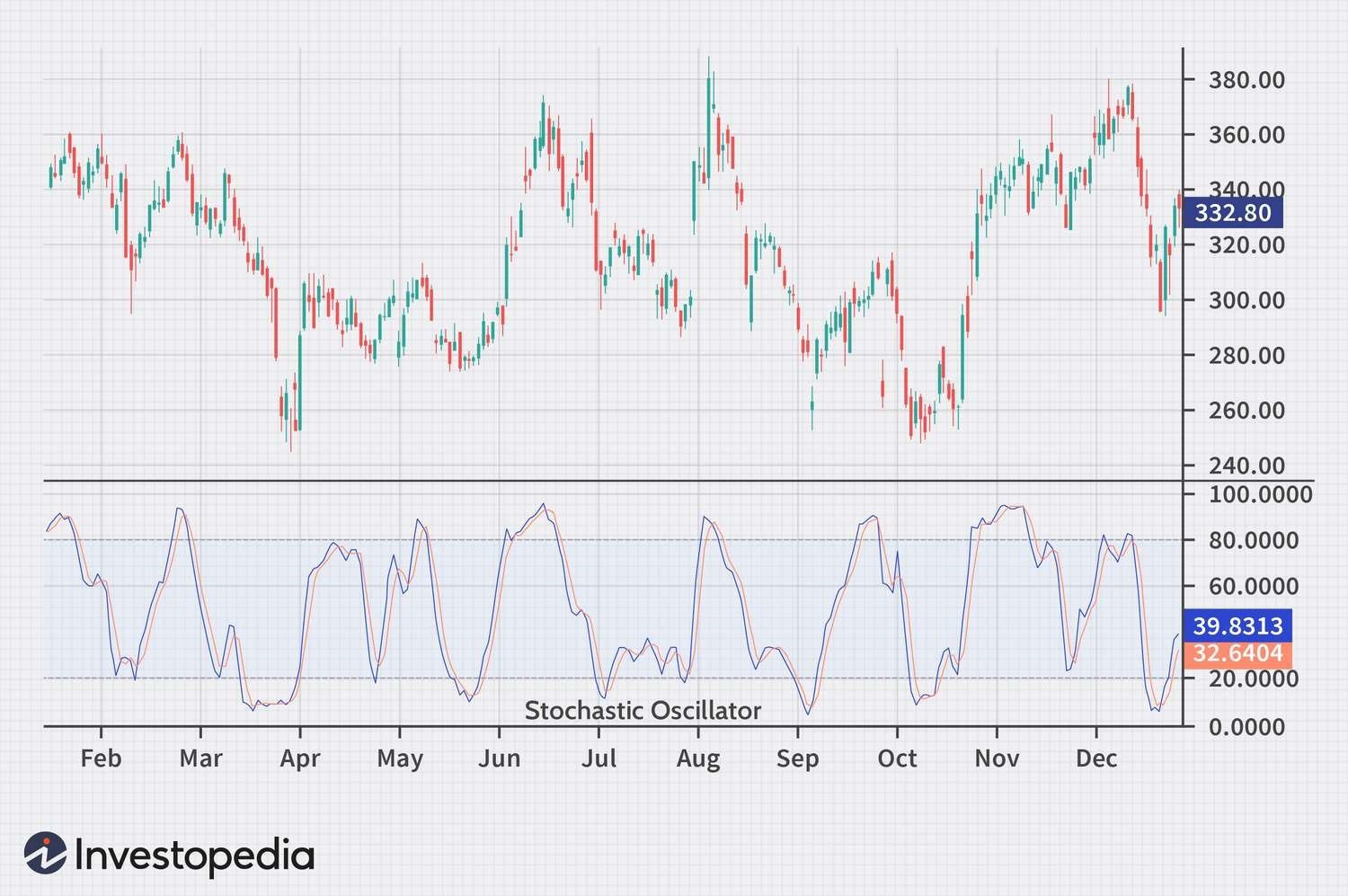

Scalping Using the Stochastic Oscillator:

The Stochastic Oscillator is a common indicator in scalping. It helps traders identify overbought and oversold conditions, allowing for timely entries and exits.

Scalping Using the Moving Average:

Traders use Moving Averages, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA), to identify trend direction and potential reversals for scalping opportunities.

Scalping Using the Parabolic SAR (Stop and Reverse) Indicator:

The Parabolic SAR indicator is used to spot potential trend reversals. It can help scalpers identify entry and exit points in a dynamic market.

Scalping Using the RSI (Relative Strength Index):

The RSI is an indicator that helps traders assess the strength of price movements. Scalpers use RSI to identify overbought and oversold conditions for quick trades.

The choice of the best Scalping Strategy depends on your preferences, risk tolerance, and technical expertise.

What Should You Know Before Starting to Scalp?

It's imperative to be well-informed about the following aspects before implementing your Scalping Trading Strategy:

- Market Dynamics: Understand the unique dynamics of the Forex Market, which can be influenced by economic events and geopolitical factors. Stay updated on events that can affect the exchange rates.

- Regulatory Environment: Be aware of the regulatory framework in South Africa. Ensure you are trading with a broker regulated by the Financial Sector Conduct Authority (FSCA) to safeguard your interests.

- Technical Analysis: Proficiency in technical analysis is essential for scalping. Familiarise yourself with chart patterns, indicators, and other tools used to identify entry and exit points.

Advices for Scalping

By following these guidelines, traders can increase their chances of success while mitigating the risks associated with scalping:

- Risk Management: Prioritise risk management. Set clear stop-loss levels, define the maximum allowable loss per trade, and stick to your risk management rules.

- Demo Trading: Practise with a demo account to hone your skills and develop confidence in your Scalping Strategy before risking real capital.

- Use Leverage Wisely: While leverage can amplify profits, it also magnifies losses. Be cautious and use leverage prudently.

- Discipline: Maintain discipline and stick to your trading plan. Avoid impulsive decisions and emotional trading.

- Stay Informed: Keep abreast of economic events and news that can influence the Forex Market. Economic calendar tools can help with this.

- Choose the Right Broker: Select a broker that offers competitive spreads, fast execution, and is regulated by the FSCA to ensure a secure trading environment.

- Patience and Practice: Scalping skills improve with practice and experience. Be patient and refine your strategy over time.

How to Find Out if Scalping is Suitable for Me?

Determining if Scalping Strategy is a suitable choice for you requires an evaluation of several factors:

- Risk Tolerance: Assess your ability to handle rapid market fluctuations and whether you are comfortable with the inherent risk in scalping, especially in the volatile market.

- Time Availability: Scalping necessitates constant monitoring of the markets. Ensure you have the time and availability to actively trade and make quick decisions, given time zone differences.

- Psychological Preparation: Scalping can be emotionally demanding, given the rapid pace and intensity. Evaluate your mental preparedness to make quick and sometimes frequent trading decisions.

- Trading Knowledge: A solid understanding of technical analysis is crucial in scalping. Ensure you possess the necessary skills and knowledge to read charts, identify trends, and make quick decisions based on this analysis.

Choosing a Forex Scalping Broker

Selecting the right Forex broker for implementing Scalping Trading Strategies is a critical decision that can significantly impact your trading success. Here are some key factors to consider:

- Regulation: Ensure that the broker is regulated by a recognised authority in South Africa, such as the FSCA. This provides a level of security and assurance that the broker operates within legal boundaries.

- Low Spreads: Scalping is highly sensitive to trading costs. Look for brokers that offer tight spreads, as narrower spreads can reduce your trading costs and increase your profit potential.

- Execution Speed: Fast order execution is crucial for scalping. In the fast-paced environment of scalping, delays in order execution can lead to missed opportunities. Test the broker's execution speed using a demo account.

- Scalping-Friendly Policies: Some brokers may have specific policies that affect scalping. Check if the broker has any restrictions on scalping or if they offer special accounts tailored for scalpers.

- Quality of Trading Platform: The trading platform should be user-friendly and equipped with advanced charting tools and indicators to assist with your analysis.

- Customer Support: Ensure the broker offers reliable customer support. It's essential to have responsive support in case you encounter issues while scalping.

- Educational Resources: Look for brokers that provide educational resources, webinars, and market analysis to help you improve your scalping skills.

Scalping contra Day Trading

Scalping and Day Trading are both popular trading strategies, but they differ significantly in following aspects:

Scalping:

- Timeframe: Involves very short-term trades, often lasting seconds to minutes.

- Frequency: Scalpers make a high number of trades during a single trading session, aiming to capture tiny price movements.

- Risk Management: Scalpers typically employ tight stop-loss orders to limit potential losses.

- Profit Objective: The goal is to accumulate small, frequent gains to generate substantial profits over time.

- Analysis: Scalping relies heavily on technical analysis and short-term chart patterns.

Day Trading:

- Timeframe: Day traders hold positions throughout a trading day, closing them by the end of the day.

- Frequency: Fewer trades compared to scalping, with a focus on quality over quantity.

- Risk Management: Day traders often use wider stop-loss orders compared to scalpers.

- Profit Objective: The aim is to profit from intraday price movements, and traders may target larger price swings.

- Analysis: Day trading involves a combination of technical and fundamental analysis.

Both strategies can be profitable, but they require different skill sets and mindsets. Scalping suits those who can make quick decisions and monitor the markets closely, while Day Trading allows for a more relaxed approach with fewer trades.

Bottom Line and Key Takeaways

Scalping can be a profitable trading strategy when executed with discipline. To succeed, you should follow the next tips:

- Master technical analysis and chart patterns.

- Develop a strict risk management strategy.

- Choose a broker with favourable scalping conditions.

- Practice with a demo account before trading with real money.

Also, the suitability of scalping depends on your individual circumstances, risk appetite, and level of commitment to mastering the strategy.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Yes, scalping can be applied to cryptocurrencies as well, provided you choose a broker that offers crypto trading.

Tax laws may apply to your trading profits. It’s essential to consult with a tax advisor for guidance.

The amount of capital required varies, but it's advisable to start with sufficient capital to manage risk effectively and meet margin requirements.

Scalping can be challenging for beginners, but with proper education, traders of all experience levels can employ this strategy.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.