What Are Forex Trading Secrets?

In this text, we delve into forex trading secrets, exploring the critical elements of the approach and attitude required for success. Join us as we uncover the Forex secret strategy, insights, and mindset necessary to navigate the world of Forex Trading.

What Is Forex Trading?

Forex Trading is the process of buying and selling currencies in the foreign exchange market. Forex is the largest financial market in the world, with an average daily trading volume of over $6.6 trillion. Trades are performed via a broker, who acts as an intermediary between the trader and the market.

What Are Secret Approaches to Forex Trading?

Time Frame

The time frame is an essential aspect of Forex trading. Traders must choose a time frame that suits their trading style and personality. The most commonly implemented time frames are:

- Scalping: A short-term trading strategy that involves opening and closing trades within seconds or minutes. Scalping requires traders to have excellent analytical skills and quick reflexes.

- Day Trading: A strategy that involves opening and closing trades within a day. Day traders use technical analysis to identify short-term trends in the market.

- Swing Trading: A strategy that involves holding trades for several days to weeks. Swing traders use fundamental and technical analysis to identify long-term trends in the market.

Methodology

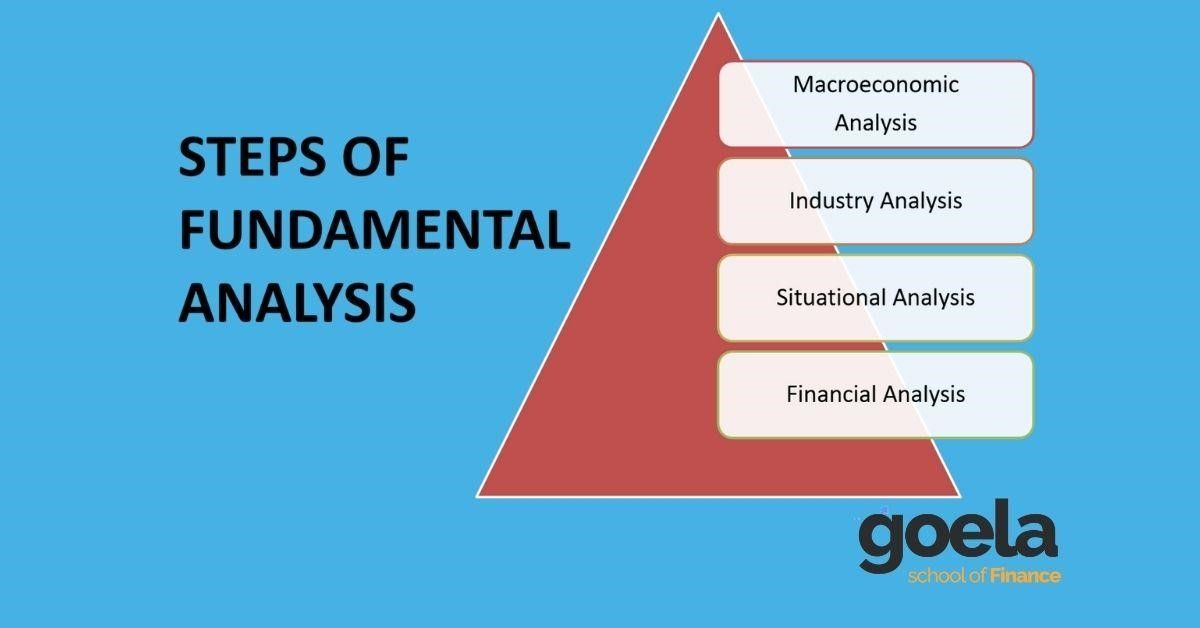

Forex traders use various methodologies to analyse the market and make trading decisions. The most commonly used methodologies in Forex trading are:

- Fundamental Analysis: An approach that involves analysing economic, financial, and other qualitative and quantitative factors that affect currency prices. Fundamental analysis helps traders understand the underlying factors that drive currency prices.

- Technical Analysis: An approach that involves analysing price charts and using technical indicators to identify trends and patterns in the market. Technical analysis helps traders identify entry and exit points for their trades.

Instrument

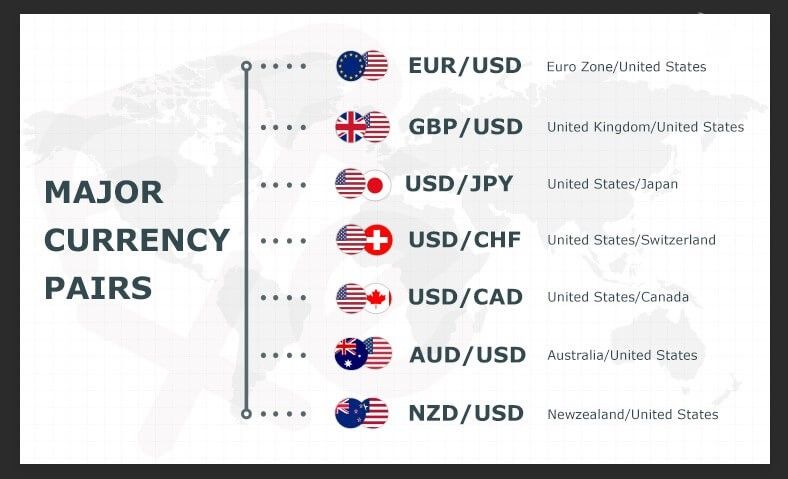

As for the instruments of Forex trading, there are three types of currency pairs:

- Major pairs are currency pairs that include the US dollar as one of the currencies.

- Minor pairs are currency pairs that do not include the US dollar as one of the currencies.

- Exotic pairs are currency pairs that include one major currency and one currency from an emerging economy.

Secrets of Forex: Trading Attitude

Be Patient

Patience is a crucial Forex secret exercised by all successful traders. Traders must wait for the right opportunity to enter or exit a trade. Rushing into a trade can lead to losses.

Be Disciplined

Discipline is essential for successful Forex trading. Traders must follow their trading plan and stick to their strategy. Deviating from the plan can lead to losses.

Be Objective

Forex traders must be objective when making trading decisions. Emotions such as fear, greed, and hope can cloud judgement and lead to poor decisions.

Have Realistic Expectations

Forex traders must have realistic expectations about their profits and losses. They should not expect to get rich overnight or make consistent profits without effort.

Have a Trading Edge

A trading edge is a unique advantage a trader has over other traders. It could be a secret Forex strategy, methodology, or approach that gives the trader an edge in the market.

Do Not Try Hard

Forex traders should not try too hard to make profits. Overtrading or taking unnecessary risks can lead to losses.

Think About Risk

Risk management is crucial for successful Forex trading. Traders must manage their risks by using Stop Loss orders, position sizing, and other risk management tools.

Know When to Walk Away

Forex traders must know when to walk away from a trade. They should exit a trade after reaching their profit target or Stop Loss level.

Don’t Focus on Wins and Losses

Forex traders shouldn’t focus too much on their wins or losses. Instead, they should focus on sticking to their trading plan and secret Forex strategy.

Bottom Line and Key Takeaways

Forex Trading secrets involve having the right approach, attitude, and methodology. Successful Forex traders are patient, disciplined, objective, and have realistic expectations. They use price action, have a trading edge, manage their risks, and know when to walk away from a trade.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Yes, Forex trading is legal in South Africa. The Financial Sector Conduct Authority (FSCA) oversees and regulates these activities in the country.

To become a successful Forex trader, you must have the right approach, methodology, attitude and risk management skills. You must also have patience, discipline, objectivity, realistic expectations, and a unique advantage over other traders.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.