- Things to consider before investing in South Africa in 2024

- Key Takeaways

- Savings vs. Investing in South Africa

- Short-Term vs. Longer-Term Investment Goals

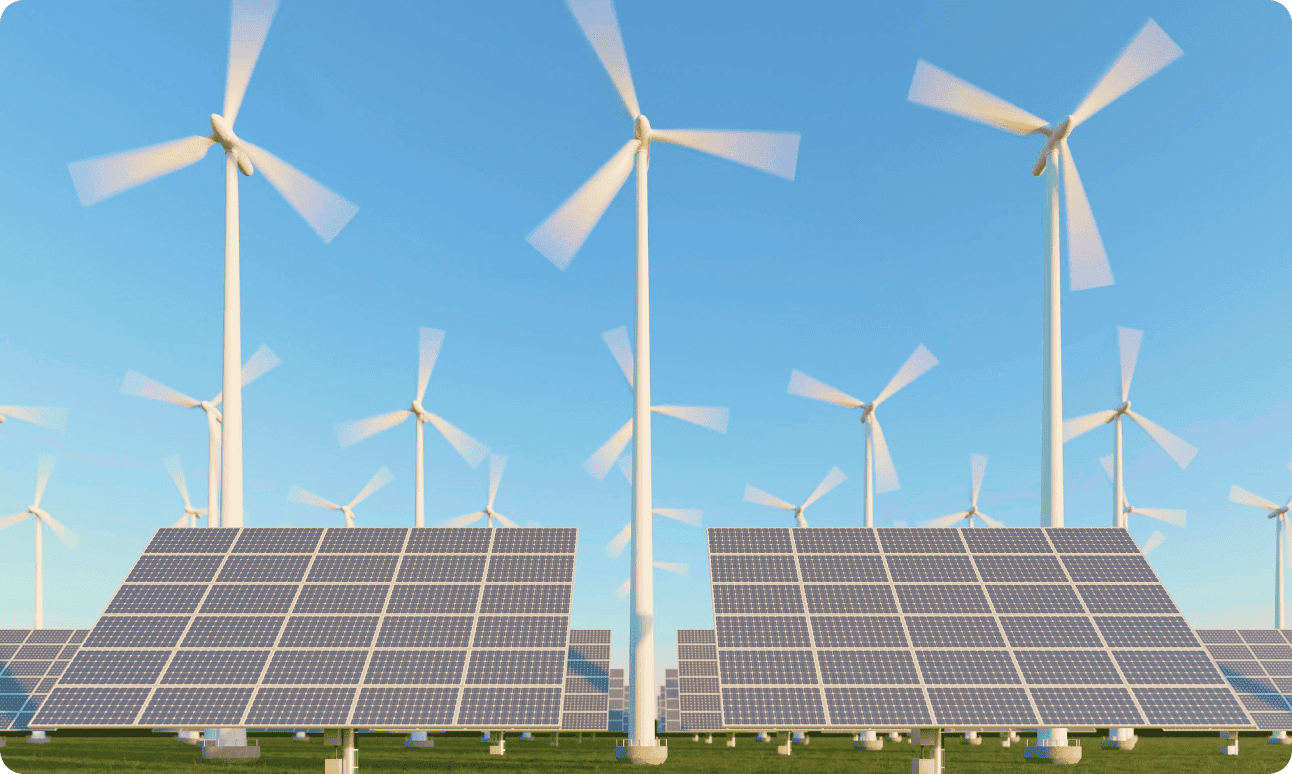

- Future-Forward Investing

- Income vs. Growth Investing

- The Importance of Due Diligence

- Understand Your Investment Objectives Clearly

- Decide on the Willingness To Accept the Risk

- ROI Is Your Key Metric

- Other Things To Keep in Mind at All Times When Investing in South Africa

- Portfolio Diversity

- During Jobs Change Think Long-term About Your Investment Savings

- Who can start investing in South Africa?

- Is There a Bottom Limit?

- 5 Steps To Start Investing

- Set Your Goals

- Decide on the Amount of Help You Need

- Choose an Account Type

- Open an Account

- Deposit and Start Investing

- Generalised Strategies for Best Investment of Money in South Africa

- Portfolio Control Oriented: Stocks

- Hands-off Investment: Robo-advisors

- Conservative Investment Style: Index Funds

- Accepting Risk Investment: Cryptocurrencies

- Retirement and Pension Oriented: Government Bonds

- Inflation Prevention Strategy

- South African Bank Short- and Long-Term Investment Options

- Tax-Free Investing

- Micro-Investing

- How Micro-Investing Works

- Access Accumulator

- Bottom Line

Best Investment Returns Opportunities Analysis in South Africa 2024

Things to consider before investing in South Africa in 2024

South Africa is a country with great potential for investment and the events of 2024 haven’t changed that. Investment in South African assets can allow you to grow your money quite effectively. The country has a diverse economy, rich natural resources, and a large consumer market. However, if you are asking yourself a question of how to invest money in South Africa, it is important to consider the political and economic climate. The country is currently facing high levels of unemployment, inequality, and crime. Despite these challenges, South Africa offers many opportunities for growth, particularly in the renewable energy, technology, and agriculture sectors (here).

With proper due diligence and a long-term perspective, investing in South Africa can be a profitable decision. Having said that, here are a few things you may want to consider before making any move.

Key Takeaways

- South Africa offers many investment opportunities, though you have to be careful.

- Before making any investment:

- There are a number of ways you can invest in South Africa, the decision is all yours.

- Due diligence is the key.

- Ask for advice if you aren’t sure of your skills.

Savings vs. Investing in South Africa

It’s hard to say what are the best ways to invest money in South Africa, however, there are two main options you would most likely have to choose from – savings and investment. Savings and investment are two different ways of managing money. Savings refers to putting money aside for future use, such as for emergencies, a down payment on a house, or retirement. This money is typically kept in low-risk accounts, such as savings accounts or money market funds, and the goal is to maintain the value of the money while it is being saved.

Investing money, on the other hand, is the act of using money to purchase assets with the expectation of earning a return on that investment. Investing can take many forms, such as buying stocks, bonds, real estate, or starting a business. In South Africa, investing can be done through various platforms and instruments like equities, bonds, real estate, commodities and foreign currency. Unlike savings, investing usually involves taking on some level of risk in order to potentially earn a higher return. It's important to note that the return on investment is not guaranteed and the value of the assets may fluctuate over time.

Short-Term vs. Longer-Term Investment Goals

Another thing you might want to consider before asking yourself a question of wh ere can I invest my money in South Africa, is whether you want to go for short or long run investment. When considering investment options in South Africa in 2024, it's important to understand the difference between short-term and long-term investment goals. Short-term investments such as day trading, forex, and short-term bonds may offer quick returns, but they also come with higher levels of risk. On the other hand, long-term investments such as real estate, stocks, and bonds may have a lower risk but require a longer-term commitment. The choice between short-term and long-term investment goals will depend on an investor's risk tolerance, time horizon and overall financial goals. If you are a novice investor, it's advisable to consult with a financial advisor to determine the best investment strategy that aligns with your goals and risk appetite. Despite challenges, South Africa's diverse economy, rich natural resources, and large consumer market offer great opportunities for growth and investment returns.

Future-Forward Investing

Investing in South Africa's future-forward sectors such as technology, renewable energy, and sustainable agriculture can be a profitable decision. These industries are expected to grow as the country's economy continues to develop and the government focuses on modernising infrastructure and promoting sustainable practices (here).

Additionally, with a growing middle class and a young population, there is a large potential consumer market for these products and services. However, as with any investment, it is important to conduct thorough research and due diligence to understand the risks and potential returns before making any decisions.

Income vs. Growth Investing

Understanding the difference between income and growth investing is yet another for you to think about. Income investing focuses on generating regular cash flow through dividends or interest payments, while growth investing focuses on capital appreciation. Both have their own advantages and disadvantages, and yet again the choice between the two will highly depend on your risk tolerance, time horizon, and overall financial goals.

For example, if an investor is looking for regular cash flow, investing in dividend-paying stocks or bonds may be a good option. On the other hand, if an investor is looking for long-term capital appreciation, investing in growth stocks or real estate may be a better fit. Despite some political and economic challenges, South Africa offers a diverse range of assets that can be suitable for both income and growth investing. It's important to conduct thorough research and due diligence to understand the risks and potential returns before making a decision.

The Importance of Due Diligence

Before considering ways to invest your money in South Africa in 2024, it is critical to conduct thorough due diligence in order to understand the risks and potential returns of the investment. This includes researching the company or asset, the industry and market conditions, as well as the political and economic climate of the country. It is also important to have a clear understanding of the government's policies and regulations on foreign investment.

Due diligence helps investors to make informed decisions and reduce the risk of losing their capital. It also helps to identify potential red flags and avoid investing in companies or assets that may not align with the investor's risk tolerance and financial goals. Despite some challenges, South Africa offers a diverse range of assets and opportunities for growth. With proper due diligence, you can make a well-informed decision and potentially reap the benefits of investing in the country.

Understand Your Investment Objectives Clearly

Before investing, it is crucial to have a clear understanding of your investment objectives. And bearing the risk of repeating ourselves once more, this includes identifying your risk tolerance, time horizon, and financial goals. Having a clear understanding of your objectives will help you to develop a well-diversified portfolio that balances risk and return in accordance with your tastes and preferences. But it’s not a one-off task to perform. It's important to regularly review and adjust your investment strategy as your goals and circumstances change. So your investment objectives are a key to risk profile management, and may increase the chances of achieving your desired outcomes.

Decide on the Willingness To Accept the Risk

When investing, it is important to understand and accept the level of risk associated with each investment. Risk is the chance that an investment's actual return will differ fr om the expected return. Understanding and accepting the risks associated with an investment can help an investor make informed decisions and manage their expectations.

However, not all investors are willing to accept the same level of risk. Some investors may prefer to invest in low-risk options such as bonds or savings accounts, while others may be willing to take on higher risks in exchange for the potential for higher returns. It's important to determine your risk tolerance and align it with your investment objectives. A lack of willingness to accept risks can limit the opportunity for growth, while excessive risk-taking can lead to financial loss. The key is to find a balance that aligns with your goals, risk tolerance and overall financial situation.

ROI Is Your Key Metric

Return on Investment (ROI) is a key metric used to measure the performance of an investment. It is calculated by dividing the net profit by the initial investment cost and is expressed as a percentage. ROI is a popular metric as it provides a clear and simple way to measure the performance of an investment and compare it to other potential investments.

ROI is a crucial metric for investors as it helps them to identify the profitability of their investments and make decisions about wh ere to allocate their capital. However, it is important to keep in mind that ROI is not the only metric to consider when evaluating an investment. Factors such as risk, liquidity, and investment time horizon should also be taken into account. Additionally, ROI is not always the best metric to evaluate an investment, as it doesn't take into account the risk or the impact of other variables such as taxes, inflation, or the investment time horizon. Therefore, investors should consider ROI along with other financial metrics to make a well-informed decision.

Other Things To Keep in Mind at All Times When Investing in South Africa

Investing can be a complex and challenging task, but with the right mindset and approach, it can be a great way to grow your wealth. One of the key things to keep in mind when investing is to diversify your portfolio, manage your emotions, be cautious of bad advice, and have a plan for potential job loss. These elements play a crucial role in ensuring the long-term success of your investments. In the following text, we'll delve deeper into the importance of each of these aspects and how they can help you navigate the world of investing with confidence.

Portfolio Diversity

Portfolio diversity is an essential aspect of personal investment. By diversifying your portfolio, you spread your risk across a variety of assets, reducing the impact that any single investment can have on your overall portfolio performance. This allows you to balance potential returns with the level of risk you're willing to take on. Diversification also helps to protect your portfolio against market downturns, which can be especially beneficial during times of economic uncertainty. Additionally, it can help you to achieve your long-term financial goals by investing in a mix of assets that align with your risk tolerance and investment objectives.

During Jobs Change Think Long-term About Your Investment Savings

When going through a job change or even a loss of one, it can be tempting to liquidate your investments to cover expenses. However, it's important to avoid this impulse and to maintain a long-term perspective. Selling investments during a downturn can lock in losses and negatively impact your portfolio's overall performance. Instead, consider maintaining your investments and continuing to contribute to them if possible, especially if you have a long-term investment horizon. Additionally, it's important to have an emergency fund in place to cover unexpected expenses during this time, so that your investments can continue to grow over the long-term. Remember, the stock market can be volatile in the short-term, but historically it has shown growth over the long-term.

Who can start investing in South Africa?

Investing in South Africa is accessible to everyone, regardless of their background or level of income. Whether you're a first-time investor or an experienced one looking to expand your portfolio, there are opportunities for all in the South African investment market. If you are over the age of 18, you're eligible to open an investment account and start investing, including individuals, trusts, and companies. The key to successful investing is having a clear understanding of your financial goals and risk tolerance, and choosing investments that align with them. Start your investment journey today and secure your financial future in South Africa.

Is There a Bottom Limit?

Investing in South Africa does not have a set bottom limit, meaning that anyone can start investing regardless of the amount they have to invest. Many investment options such as mutual funds, exchange-traded funds (ETFs) and stocks allow investors to buy fractional shares, making it possible to start investing with as little as a few hundred rand. Some investment platforms and brokers also have low minimum investment requirements, making it even more accessible to start investing. It is important to remember that the key to successful investing is not the amount invested, but rather a well thought-out investment strategy and regular contributions to grow your portfolio over time.

5 Steps To Start Investing

Investing in South Africa is a simple process, with five key steps that you can follow to ensure success. These steps include:

Set Your Goals

The first step in starting to invest is to set clear financial goals that align with your risk tolerance and time horizon. Knowing what you want to achieve will help you make informed investment decisions and stay on track to reach your objectives.

Decide on the Amount of Help You Need

The next step is to decide whether you need help with your investments or if you're comfortable managing them on your own. This will help you determine whether you need to seek out a financial advisor or if you can handle the process on your own.

Choose an Account Type

Once you know the amount of help you need, you can then choose the type of investment account that is best suited to your needs.

Open an Account

With your goals in mind and the type of account chosen, you can then open an investment account with a bank, brokerage firm, or any other investment platform.

Deposit and Start Investing

With your account open, you can then deposit funds and start investing. This step is the beginning of your journey towards building long-term wealth.

By following these five steps, you can start investing in South Africa with confidence, knowing that you are taking the right steps towards achieving your financial goals.

Generalised Strategies for Best Investment of Money in South Africa

Investing can be a complex and challenging task, but with the right mindset and approach, it can be a great way to grow your wealth. There are many different investment strategies to choose from, each with its own set of benefits and drawbacks. In this text, we will explore some of the most popular investment strategies, including portfolio control oriented, hands-off investment, conservative investment style, accepting risk investment, retirement and pension oriented and inflation prevention strategy.

Portfolio Control Oriented: Stocks

This strategy is for investors who want to take an active role in managing their investments. It involves selecting individual stocks to buy and hold for the long-term, with the goal of maximising returns. Stocks offer the potential for high returns, but also come with a higher level of risk. This strategy requires a significant amount of research and analysis, as well as a thorough understanding of the stock market.

Hands-off Investment: Robo-advisors

This strategy is for investors who want a more passive approach to investing. It involves using a robo-advisor, which is an online investment platform that uses algorithms to create and manage a diversified portfolio based on your risk tolerance and investment goals. Robo-advisors are becoming increasingly popular among investors who want to invest in a diversified portfolio without the need for active management.

Conservative Investment Style: Index Funds

This strategy is for investors who want a more conservative approach to investing. It involves investing in index funds, which are a type of mutual fund that aims to track the performance of a specific stock market index, such as the S&P 500. This strategy is a good option for investors who want to invest in a diversified portfolio with minimal risk.

Accepting Risk Investment: Cryptocurrencies

This strategy is for investors who are willing to accept a higher level of risk. It involves investing in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Cryptocurrencies offer the potential for high returns, but also come with a higher level of risk. This strategy requires a thorough understanding of the cryptocurrency market and a long-term investment horizon.

Retirement and Pension Oriented: Government Bonds

This strategy is for investors who are looking to invest for their retirement or pension. It involves investing in government bonds, which are debt securities issued by a government. Government bonds are considered to be low-risk investments and are a good option for investors who are looking for a steady stream of income.

Inflation Prevention Strategy

This strategy is for investors who want to protect their assets from inflation. It involves investing in assets that have the potential to appreciate in value, such as real estate, gold, or other precious metals. This strategy can help to protect your assets from the effects of inflation and maintain your purchasing power over time.

It's important to note that no single strategy is right for everyone. The best investment strategy is one that aligns with your financial goals, risk tolerance, and investment horizon. It's also important to remember that investing always comes with risk, and it's crucial to have a well-diversified portfolio, to have a long-term perspective, and to have a plan for unexpected events. Consulting a financial advisor can be helpful to evaluate your personal situation and find the best strategy for you.

South African Bank Short- and Long-Term Investment Options

When it comes to investing, there are many options available to South African investors. One popular option is to invest through a bank, which offers a range of short- and long-term investment options. In this text, we will explore some of the most popular investment options offered by South African banks, including Tax-Free Investing, Micro-Investing, Fixed Deposit, Notice Deposit, and Access Accumulator.

Tax-Free Investing

This investment option allows South African investors to invest up to a certain amount per year without paying any tax on the interest earned. The benefit of this option is that it offers investors a higher return on their investment as they don't have to pay taxes on the interest earned. However, the downside is that the investment options are limited and the investment amount is capped.

Pros of Tax-Free Investing in South Africa

- Tax-free interest earned on investment

- Higher return on investment as taxes are not deducted.

- Several investment options are available.

Cons of Tax-Free Investing in South Africa

- Investment options are limited.

- Investment amount is capped.

- Tax-free investment options may have lower returns compared to taxable options.

- Withdrawals from tax-free investments may be subject to penalties or taxes.

Micro-Investing

This investment option is perfect for those who want to start investing with a small amount of money. It involves investing small amounts of money on a regular basis, such as R50 or R100 per month. This approach allows investors to invest in a diversified portfolio without having to save a large sum of money.

How Micro-Investing Works

Micro-Investing in South Africa works by allowing individuals to invest small amounts of money on a regular basis, such as R50 or R100 per month. This approach allows investors to invest in a diversified portfolio without having to save a large sum of money. There are several platforms that offer this service, such as Stash, 22seven and EasyEquities. These platforms use technology to automate the process of investing, making it easy and convenient for investors to start small and grow their investment over time.

Fixed Deposit

A fixed deposit is a savings account with a fixed term and a fixed interest rate. The benefit of this option is that it offers a guaranteed return on investment and the interest rate is generally higher than a standard savings account. However, the downside is that the funds are locked away for a set period and if the funds are withdrawn early, a penalty will be charged.

Notice Deposit

A notice deposit is similar to a fixed deposit, but it allows investors to access their funds with prior notice. This option is suitable for those who want to invest their money for a set period but also want the flexibility to access their funds if needed.

Access Accumulator

This investment option allows investors to invest a lump sum of money and then make additional contributions on a regular basis. The benefit of this option is that it allows investors to build their investment over time and also gives them access to their funds if needed.

When considering a bank investment option, it's important to evaluate your personal situation and find the best strategy for you. It's also important to consider the fees and charges, the investment term, and the interest rates offered by the bank. Before making any investment decisions, it's always recommended to consult with a financial advisor to ensure that you understand the risks and benefits of each investment option.

Bottom Line

Despite the obstacles South Africa has faced in the fast and will most likely keep on facing in future, it remains a lucrative place for making an investment, provided you do your due diligence, and understand the goals you are trying to reach with the investment.

There are a number of industries that seem to be promising from the investment standpoint and the country itself offers a variety of investment options, open for anyone interested.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.