- Explaining Investing in Netflix Shares

- Fundamentals of Netflix

- How are Netflix Shares Valued?

- Dividends Paid Out by Netflix Per Share

- How to Invest in Netflix?

- Figuring Out Where to Buy Netflix Shares

- Opening a Brokerage Account

- Funding the Account

- Researching Netflix Shares

- Purchasing the Shares

- Watching Your Investment

- Bottom Line and Key Takeaways

How To Invest In Netflix?

Investing in Netflix presents a compelling opportunity for investors seeking exposure to the dynamic world of streaming and entertainment. As a global leader in the industry, Netflix's success story has captured the attention of those looking to diversify their portfolios. In this guide, we will explore the fundamentals that underpin Netflix's value. Also, we will outline the step-by-step process of investing in its shares for investors to navigate.

Explaining Investing in Netflix Shares

Buying shares in Netflix, can be a rewarding venture for investors looking to diversify their portfolios. Netflix, a global streaming giant, has become a household name, and its shares present an attractive opportunity for those interested in the technology and entertainment sectors.

Fundamentals of Netflix

Netflix's journey in the stock market has been marked by significant growth and evolution. The company went public in 2002, debuting at $15 per share. Since then, it has experienced remarkable expansion, with its stock price reaching unprecedented levels. Notably, the streaming service's shift from a DVD rental model to online streaming in 2007 played a pivotal role in its market success. Netflix is constantly adapting to the changing landscape of the entertainment industry, driving its stock value and making it a notable player in the global stock market.

One of key aspects of Netflix fundamentals is the company's subscription numbers. Netflix boasts millions of subscribers worldwide, with a substantial portion coming from international markets. The company's revenue growth is another critical factor, driven by its continuous investment in original content and its ability to attract and retain subscribers.

The production of original and exclusive content has been a cornerstone of Netflix's success. The quality and variety of content, coupled with effective marketing, contribute significantly to subscriber acquisition and retention. Keeping an eye on factors like churn rates, which represent the percentage of subscribers who cancel their subscriptions, provides insights into customer satisfaction and the overall health of the business. Also, understanding Netflix's plans for further international expansion is crucial for investors, as it may impact the company's long-term growth trajectory.

How are Netflix Shares Valued?

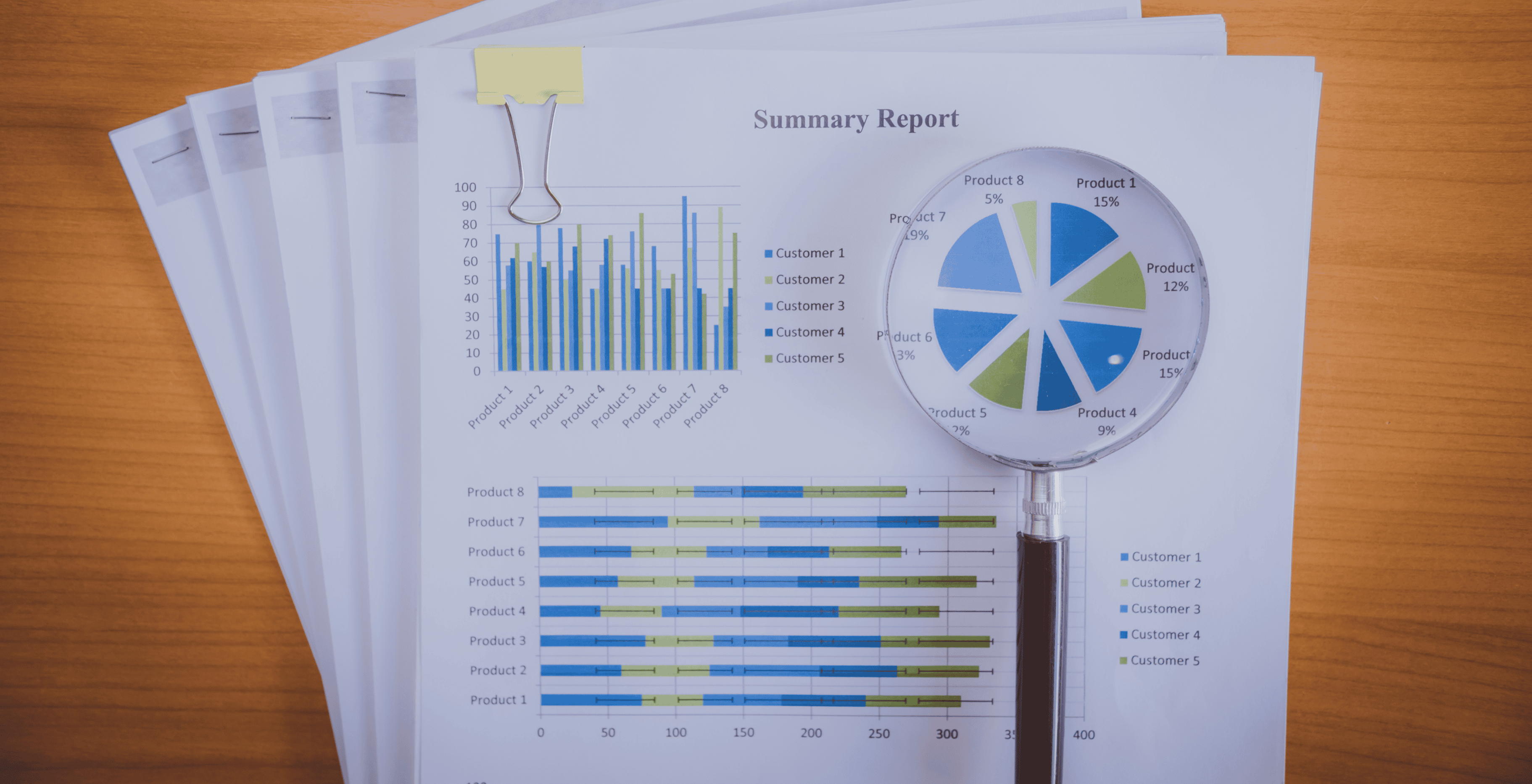

Netflix shares are valued based on several key financial metrics. One primary indicator is the Price-to-Earnings (P/E) ratio, which compares the company's current stock price to its Earnings Per Share (EPS). A high P/E ratio may suggest that investors have high expectations for future earnings growth.

Another crucial factor is the company's Market Capitalisation, which is the total value of all its outstanding shares. Investors often assess whether the current Market Capitalisation justifies the company's growth prospects and market position.

Furthermore, investors consider Netflix's Earnings Growth Rate. A higher Rate of Earnings Growth may contribute to a higher valuation as it indicates the company's ability to generate increasing profits.

It's important for investors to analyse these metrics in the context of the global streaming market and Netflix's position within it. Changes in subscriber numbers, revenue growth, and competition can all influence how the market values Netflix shares.

Dividends Paid Out by Netflix Per Share

Netflix is not known for paying regular dividends. The company reinvests its profits into content creation, global expansion, and technology enhancements rather than distributing them to shareholders in the form of dividends.

Investors interested in dividend income might find other stocks more suitable for their investment goals, as Netflix's primary appeal lies in its potential for capital appreciation. It's essential for investors to be aware that the value of their Netflix investment will come from the growth of the stock rather than any regular dividend payments.

However, it's advisable to verify the current status of Netflix's dividend policy, as companies may alter their strategies over time. Investors should check the latest financial reports and announcements from Netflix for the most up-to-date information on dividend practices.

How to Invest in Netflix?

Figuring Out Where to Buy Netflix Shares

Investors looking to buy Netflix shares can explore local and international brokerage platforms. It's essential to choose a reputable brokerage that provides access to the U.S. stock market, where Netflix is listed. Popular international brokerages that cater to investors include those offering online trading services with access to a wide range of global stocks.

Opening a Brokerage Account

Once you've identified a suitable brokerage, the next step is to open a brokerage account. This process typically involves providing necessary personal information, proof of identity, and completing the required documentation.

Funding the Account

After successfully opening the brokerage account, investors need to fund it. Investors can fund their accounts using various methods, including bank transfers and, in some cases, credit card transactions. It's crucial to be aware of any associated fees and the processing times for deposits.

Researching Netflix Shares

Before making any invest in Netflix, conduct thorough research on its shares. Analyse the company's financial reports, recent performance, and future outlook. Pay attention to factors like subscriber growth, content strategy, and competition within the streaming industry. Stay informed by utilising reputable financial news sources and the investor relations section of Netflix's official website.

Purchasing the Shares

Once confident in your research, proceed to buy Netflix shares. Place a buy order through your brokerage platform, specifying the number of shares you wish to acquire. Consider the current market conditions and set a limit order if necessary.

Watching Your Investment

After buying shares in Netflix, it's crucial to monitor your investment regularly. Stay informed about market trends, Netflix's quarterly reports, and any significant news that may impact the stock. Keep a long-term perspective while being prepared to adjust your strategy if market conditions or the company's performance change.

Investors should be mindful of currency exchange rates, taxes, and any regulatory considerations associated with international stock investments. Diversifying your portfolio and staying informed about global market dynamics will contribute to a more comprehensive investment strategy.

Bottom Line and Key Takeaways

To invest in Netflix shares, you require a strategic approach, incorporating a deep understanding of the company's fundamentals and market dynamics. Investors should stay informed and be prepared for the potential volatility associated with the technology sector.

Lloyd has been trading, investing and teaching about financial markets for over a decade. He has a thorough understanding of financial services provider legislation as well as investment asset classes and categories. Lloyd is a certified RE5 representative and holds a COB Investment certificate from the Moonstone Business School of Excellence.

Diversification is key to managing risk. While Netflix may be a promising investment, it's essential to diversify your portfolio to mitigate potential losses.

Regularly review your investment, especially after significant company announcements or shifts in the market. However, avoid making impulsive decisions based on short-term fluctuations.

Consult with a tax professional to understand any tax obligations related to international investments.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.