- What Does JSE Stock Trading Mean?

- What Is the Role of the JSE?

- The History of the JSE

- The JSE Index

- What Are the Types of Shares Traded on the JSE?

- Starting JSE Stock Trading

- How to Open a Brokerage Account?

- Using Market Orders and Limit Ones

- Using a Virtual Account

- How to Efficiently Measure Your Profits?

- When and How Will You Get the Dividends?

- What Impacts the Prices on JSE Shares?

- How to Manage Risks?

- Diversification

- Research

- Risk Tolerance

- Regular Monitoring

- Bottom Line and Key Takeaways

JSE-listed Companies Stocks – Johannesburg Stock Exchange Shares Price List

Discover all the JSE listed companies on BROKSTOCK, South Africa's leading stock market broker. Compare prices, read research reports, and buy shares online.

What Does JSE Stock Trading Mean?

JSE stock trading refers to the buying and selling of shares of companies listed on the Johannesburg Stock Exchange (JSE), which is the primary stock exchange in South Africa. It provides a platform for investors to trade in a wide range of publicly-owned companies, allowing them to buy and sell shares to potentially benefit from price fluctuations and earn returns on their investments.

What Is the Role of the JSE?

The Johannesburg Stock Exchange plays a multifaceted role in South Africa:

- Capital Formation: The JSE serves as a primary platform for companies to raise capital by issuing shares to the public. This capital is essential for business expansion, research and development, and infrastructure projects, contributing to economic growth.

- Liquidity: The JSE provides a liquid market for investors to buy and sell shares, enhancing the market's efficiency. This liquidity enables investors to easily enter and exit positions, making the JSE an attractive destination for both institutional and retail investors.

- Information Dissemination: The JSE disseminates vital financial information and company disclosures, ensuring investors have access to the latest data to make informed decisions. This transparency is crucial for maintaining market confidence.

- Benchmarking: The JSE offers various indices, such as the FTSE/JSE All Share Index, which serve as benchmarks to gauge the overall performance of equities. These indices are widely used by investors and analysts.

The History of the JSE

The JSE has a rich and storied history, dating back to its establishment in 1887. Here are some key historical milestones:

- Formation: The JSE was originally established as a result of the Witwatersrand gold rush, which led to the need for a formal marketplace for trading gold mining shares.

- Evolution: Over the decades, the JSE expanded its offerings to include a wide range of companies from various sectors, making it the primary stock exchange in South Africa.

- Electronic Trading: The JSE embraced electronic trading in the late 1990s, modernising its operations and allowing for more efficient and transparent trading.

- Demutualisation: In 2005, the JSE underwent a significant transformation by demutualisation and becoming a public company, contributing to its global recognition and competitiveness.

- Indices and Innovations: The JSE introduced various stock market indices to measure the performance of different sectors, and it has continued to innovate, launching new products and services to cater to the evolving needs of investors.

The JSE Index

The Johannesburg Stock Exchange hosts several indices, with the FTSE/JSE All Share Index being the most widely followed. This index reflects the performance of the entire South African equity market and shows JSE listed companies by sector, such as financials, resources, industrials, and more. The constituents of the JSE index include a diverse range of companies, such as large-cap, mid-cap, and small-cap stocks, representing the breadth of the economic landscape.

What Are the Types of Shares Traded on the JSE?

On the Johannesburg Stock Exchange, various types of shares are traded, each with its unique characteristics:

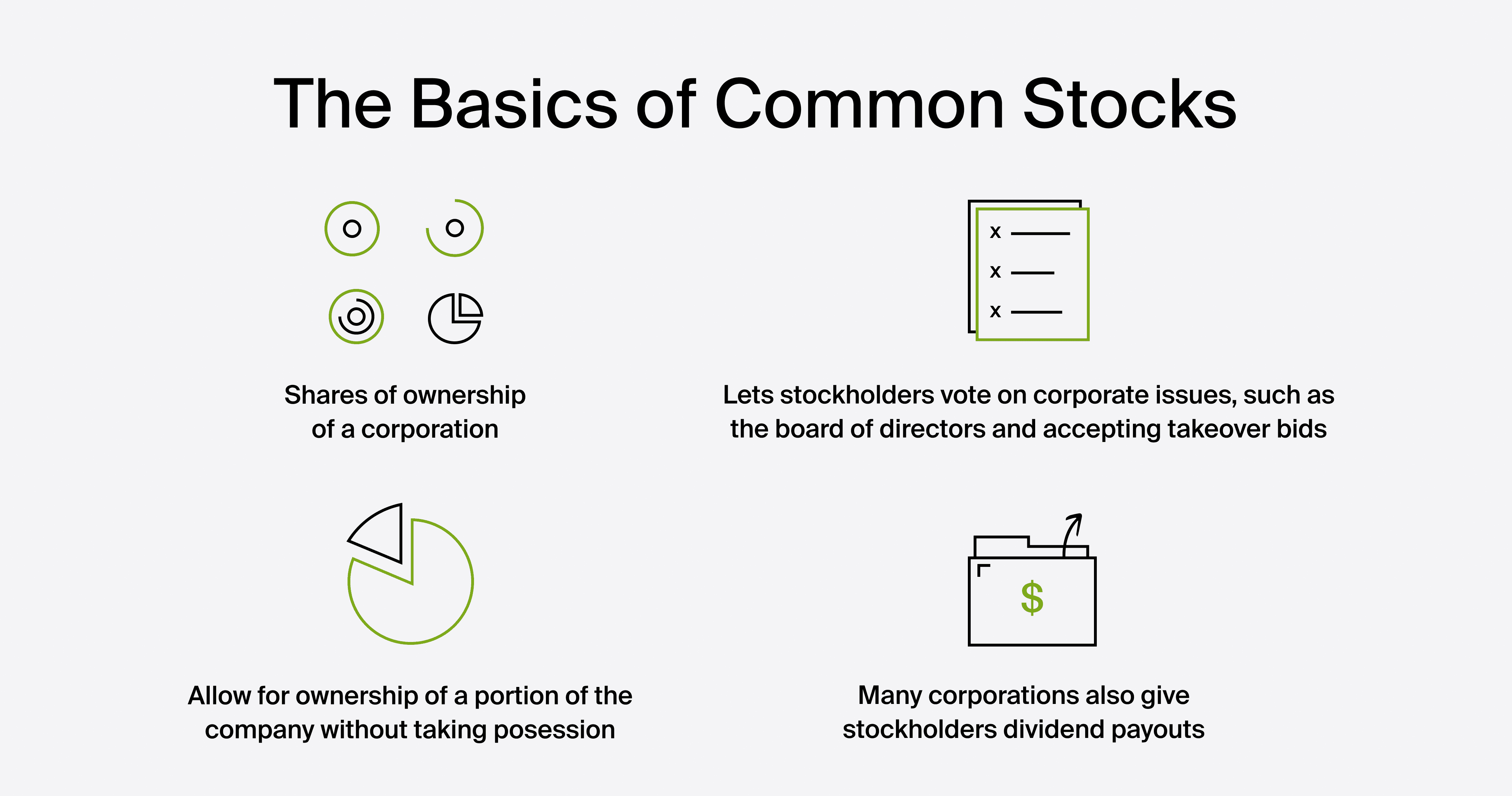

Common Shares: Common shares, also known as ordinary shares, represent ownership in a company. Shareholders have voting rights and may receive dividends, though they are not guaranteed.

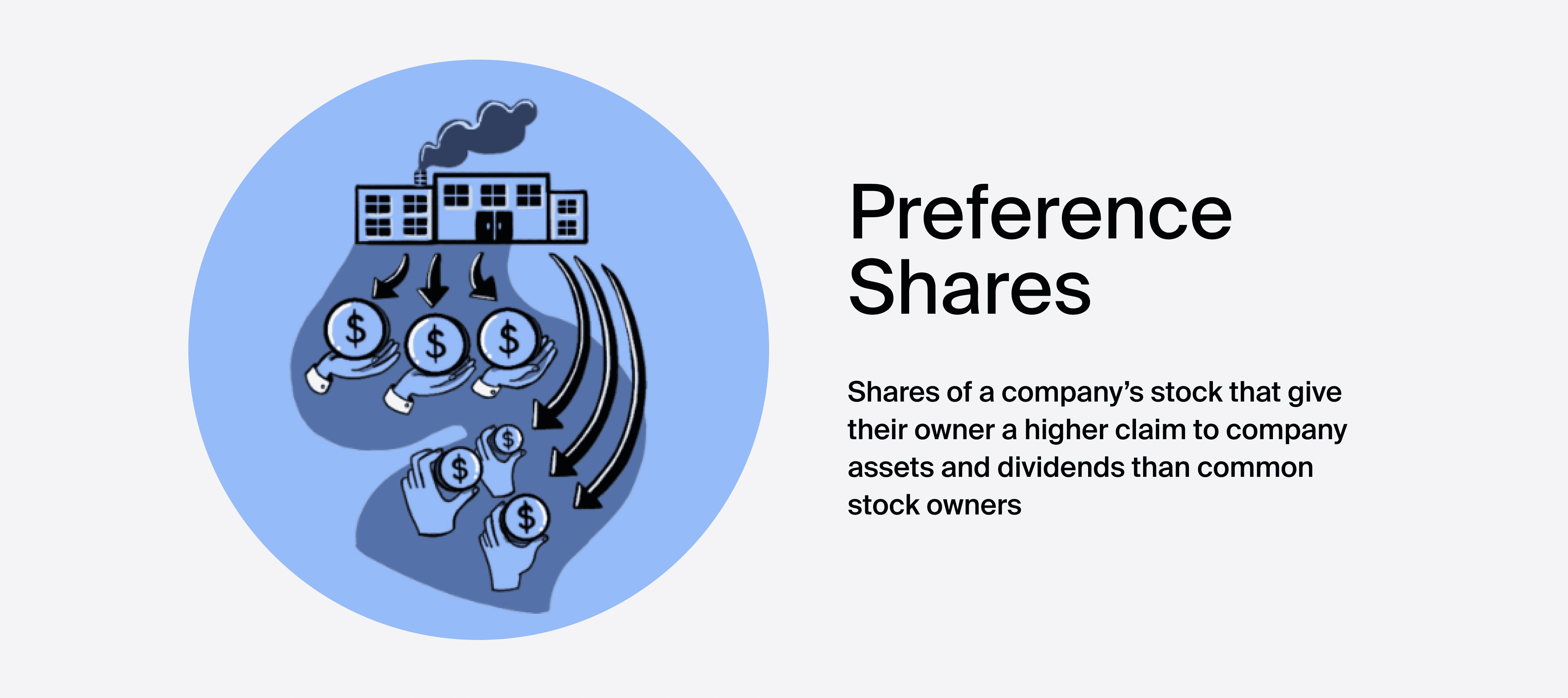

Preference Shares: Preference shares provide shareholders with a fixed dividend before common shareholders receive any dividends. However, preference shareholders typically do not have voting rights.

Debentures: Debentures are debt instruments issued by companies to raise capital. Holders of debentures receive regular interest payments and the return of the principal amount at maturity.

Exchange-Traded Funds (ETFs): ETFs are investment funds that trade on the JSE like common shares. They offer diversified exposure to various assets, such as equities, bonds, or commodities.

Warrants: Warrants are derivative securities that give the holder the right to buy or sell an underlying asset, such as shares, at a specific price on or before a particular date.

Preference Depository Receipts (PDRs): PDRs represent ownership in foreign-listed companies and allow South African investors to access international stocks.

Real Estate Investment Trusts (REITs): REITs are investment vehicles that own and manage income-producing real estate properties, offering a way for investors to access real estate assets.

Investors can choose from these various types of shares and securities to diversify their portfolios and pursue their financial objectives on the JSE.

Starting JSE Stock Trading

How to Open a Brokerage Account?

To start trading the stocks of companies listed on the JSE, you'll need to open a brokerage account. Here's how to do it:

- Research and Choose a Broker: Begin by researching reputable brokerage firms that offer JSE trading services. Consider factors like trading fees, research tools, and customer support. Popular brokers in South Africa include BROKSTOCK, Standard Bank Online Share Trading and Absa Stockbrokers.

- Complete the Application: Once you've chosen a broker, complete their account application process. This typically involves providing personal information.

- Fund Your Account: After your application is approved, you'll need to deposit funds into your brokerage account. This can usually be done through various methods, including bank transfers or Electronic Funds Transfers (EFT).

- Select Your Trading Platform: Brokers often provide online trading platforms. Familiarise yourself with the platform's features and user interface, as this is where you will execute your trades.

- Start Trading: With your account funded, you can start buying and selling JSE-listed stocks. Ensure you understand how to place orders, as discussed below.

Using Market Orders and Limit Ones

When trading on the JSE, you can use two primary order types:

- Market Orders: These are orders to buy or sell a stock at the current market price. Market orders are executed quickly, but the exact price at which your order is filled may vary due to market fluctuations.

- Limit Orders: Limit orders allow you to specify the price at which you want to buy or sell a stock. Your order will only be executed if the market reaches or surpasses the limit price you've set. This provides more control over the price you pay or receive, but there's no guarantee your order will be executed if the market doesn't reach your specified price.

Using a Virtual Account

Some brokers offer virtual or demo trading accounts, allowing you to practise trading without using real money. This is a valuable tool for beginners to become familiar with the trading platform and test trading strategies before risking real capital.

How to Efficiently Measure Your Profits?

To assess your profits when trading on the JSE, consider the following:

- Tracking Investments: Keep a record of your trades, including entry and exit prices, the number of shares bought or sold, and trade dates. This will help you monitor your investments.

- Calculating Profits: To calculate your profits, subtract the total cost of purchasing shares (including brokerage fees) from the total proceeds received when selling shares. Be sure to account for taxes and transaction costs.

When and How Will You Get the Dividends?

Receiving dividends from your investments in JSE listed companies is contingent on the company's dividend policy and performance. Here's when and how you can expect to receive dividends:

- Frequency: Companies generally declare dividends on a bi-annual or annual basis. The timing of these declarations often coincides with the company's financial reporting, with interim dividends being declared during the fiscal year and final dividends at year-end.

- Payment Dates: The payment dates for dividends are determined by the company's board of directors and are usually communicated in advance to shareholders. These dates can vary, but they are typically within a few months after the dividend declaration.

- Payment Methods: Dividends can be paid in various ways. The most common method is a cash dividend, where you receive the dividend amount in your trading account or via a check sent to your registered address. Some listed companies on JSE also offer Dividend Reinvestment Plans (DRIPs), which allow you to use your dividends to purchase additional shares at a discounted price.

- Taxation: It's essential to be aware of the tax implications of dividend income. South Africa has specific tax laws related to dividends, including the Dividend Withholding Tax (DWT) that companies deduct before distributing dividends. Shareholders may be eligible for a tax credit on this withholding tax.

What Impacts the Prices on JSE Shares?

The prices of shares on the Johannesburg Stock Exchange are influenced by a variety of factors, both domestic and global. Here are some key factors that impact share prices on the JSE:

- Economic Conditions: The overall health of the economy plays a significant role. Factors such as GDP growth, inflation, and employment rates can affect investor sentiment and, consequently, share prices.

- Company Performance: The financial performance and prospects of individual companies have a direct impact on their share prices. Positive earnings reports, revenue growth, and expansion plans tend to drive share prices higher.

- Market Sentiment: Investor sentiment, often driven by news, events, and market rumours, can cause share prices to fluctuate. Positive sentiment can lead to buying pressure, while negative sentiment can result in selling.

- Global Events: International economic and geopolitical events can have a spill-over effect on the JSE. Events such as changes in global commodity prices, currency exchange rates, and trade policies can impact share prices.

- Regulatory Changes: Changes in regulations and government policies can significantly influence share prices. This includes changes in taxation, industry-specific regulations, and government stability.

How to Manage Risks?

Managing risks when investing in JSE stocks is crucial to protect your capital and achieve long-term financial goals. Here are some strategies to consider:

Diversification

Spread your investments across different sectors and asset classes to reduce exposure to the risks associated with a single investment.

Research

Conduct thorough research on the companies you invest in. Analyse their financial health, management team, competitive position, and growth prospects.

Risk Tolerance

Assess your risk tolerance and invest accordingly. Be honest with yourself about how much risk you can comfortably handle and adjust your portfolio to match your risk profile.

Regular Monitoring

Stay informed about your investments and regularly review your portfolio to ensure it remains aligned with your financial objectives. Be prepared to adjust your investments as circumstances change.

Bottom Line and Key Takeaways

Investing in JSE listed companies in South Africa offers opportunities for growth and income, but it's essential to be well-informed and make informed decisions. The JSE plays a pivotal role in South Africa's economy, offering a diverse range of investment options. Understanding the dynamics of the stock market, staying informed about market trends, and managing risks are crucial for successful investing in JSE-listed stocks. Ensure you follow a sound investment strategy tailored to your financial goals and risk tolerance.

Maboko holds a BTech in Metallurgical Engineering and has been in the financial market for over 6 years. He has experience in market analysis and systematic trading strategies.

The JSE Top 100 is a list of top 100 companies listed on the Johannesburg Stock Exchange.

JSE companies can be found on the JSE's official website, financial news websites, and through brokerage firms.

Top 40 companies on JSE shares refer to the 40 largest companies on the Johannesburg Stock Exchange, often represented by the FTSE/JSE Top 40 Index.

Anyone with access to a brokerage account can buy shares of companies listed on the JSE, including those in the JSE Top 100.

The Johannesburg Stock Exchange is one of the largest stock exchanges in the world, ranking among the top 20 by market capitalisation.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.