- What is Price Action Trading?

- Explaining Price Action Trading

- What is Price Action in Forex?

- Who Uses Price Action Trading?

- What Tools are Used for Price Action Trading?

- What are the Price Action Trading Strategies?

- What are Drawbacks of Price Action Trading?

- How to Implement Price Action Trading?

- Education and Skill Development

- Understanding Market Context

- Charting Platforms

- Identifying Key Price Levels

- Pattern Recognition

- Risk Management

- Adaptability

- Bottom Line and Key Takeaways

Price Action Trading, How To Implement It?

Price action trading is a certain trading strategy that concentrates on analysing and interpreting price movements directly from charts. Its simplicity and effectiveness have garnered immense popularity among traders. In this article, we delve into the nature of price action trading, explore its strategies, and provide insights on how to efficiently implement this technique.

What is Price Action Trading?

Price action trading is a widely embraced approach in financial markets that focuses on analysing and making trade decisions based on actual price movements and patterns, rather than trusting indicators or external factors. It is a strategy that primarily involves the use of historical price data, chart patterns, and candlestick formations to forecast future price movements.

Explaining Price Action Trading

Price action trading emphasises the significance of understanding market psychology and the collective behaviour of traders. Traders, using this strategy, interpret the raw price data on charts, seeking meaningful patterns and trends that can grant insights into possible future market movements.

Price action trading doesn't involve complex algorithms or intricate mathematical models. Instead, it relies on the notion that historical price movements tend to repeat themselves, which allows traders to make informed decisions based on recognisable patterns.

What is Price Action in Forex?

Price action trading has received significant popularity in the Forex Market. This can be attributed to several factors that resonate with the local trade community. Novice traders appreciate its straightforward approach, while seasoned professionals find its flexibility conducive to their trade strategies.

Additionally, the Forex Market is characterised by its susceptibility to global economic events. Forex price action trading, with its emphasis on reading raw price data and chart patterns, allows traders to respond quickly to changing market conditions influenced by international economic developments. The adaptability of price action trading to various time frames also appeals to traders looking to capitalise on short-term fluctuations or long-term trends.

Traders, known for their resilience and adaptability, consider price action trading to be a valuable tool in navigating the complexities of the Forex Market, making it a widely embraced strategy across the trade community.

Who Uses Price Action Trading?

Price action trading is utilised by a diverse spectrum of market members. Individual retail traders form a substantial portion of those employing this strategy. The accessibility and ease of understanding make it an attractive choice for those entering the Forex Market for the first time. Many retail traders appreciate the empowerment that comes with making decisions based on clear, observable price action patterns.

Institutional investors and professional fund managers also incorporate price action trading into their strategies. The adaptability of this approach to various time frames allows institutions to align their trade decisions with their specific investment horizons, whether short-term or long-term.

Price action trading is not confined to a particular trade style. Its versatility and ability to cater to different preferences contribute to its widespread adoption across various segments of the financial market.

What Tools are Used for Price Action Trading?

Traders using price action trading utilise some tools to analyse and interpret market movements. These tools are chosen for their efficiency in understanding raw price data and determining possible trading opportunities. Some key tools comprise:

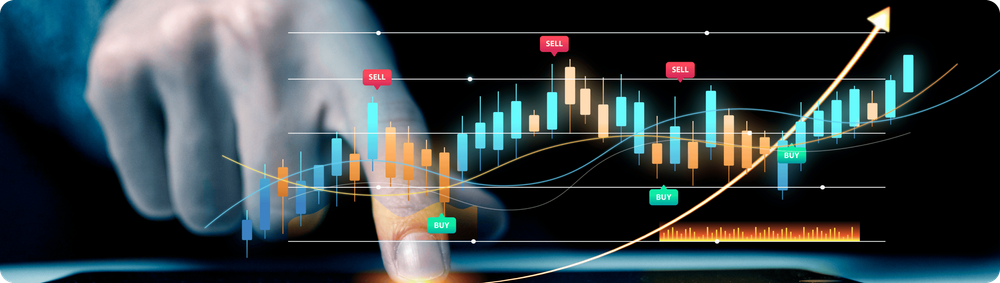

- Candlestick Patterns: Traders extensively use candlestick patterns to discern market sentiment. Patterns such as Doji, Hammer, and Engulfing Patterns grant valuable insights into possible trend reversals or continuations.

- Support and Resistance Levels: Determining key support and resistance levels is important in price action trading. Traders rely on these levels to anticipate possible price movements and determine strategic entry and exit points.

- Trendlines: Drawing trendlines on price charts is a common practice. Trendlines aid traders in visualising the general direction of the market, helping to identify trend reversals or confirming existing trends.

What are the Price Action Trading Strategies?

Traders implement different price action trading strategies tailored to their preferences and risk tolerance. Some notable strategies include:

- Pin Bar Strategy: Traders look for pin bars, which are candlestick patterns with a small body and a long wick, to identify potential reversals in the market.

- Inside Bar Strategy: This price action strategy involves identifying an "inside bar" pattern, where the current candlestick's range is within the previous candle's range. Traders use this pattern to anticipate potential breakout or reversal opportunities.

- Engulfing Candle Strategy: Traders look for engulfing candle patterns, where one candle completely engulfs the previous one, signalling a potential shift in market sentiment.

- Trendline Strategy: Traders draw trendlines and look for significant breakouts, using the breach of these lines as a signal for potential trend reversals or continuations.

What are Drawbacks of Price Action Trading?

While price action trading is widely embraced, it is essential to acknowledge its drawbacks:

- Subjectivity: One of the main drawbacks is the subjectivity of interpreting price action. Traders may perceive chart patterns differently, leading to varied analyses and potential trading decisions.

- Lack of Quantitative Metrics: Price action trading relies heavily on qualitative analysis, which can be a drawback for traders who prefer quantitative metrics and precise indicators.

- Market Noise: Price action can be influenced by market noise, leading to false signals. Traders need to distinguish between genuine price movements and random fluctuations, which can pose challenges, especially in volatile markets.

- Emotional Decision-Making: Traders, like anywhere else, may fall prey to emotional decision-making when relying solely on price action trading. The absence of concrete indicators may lead to impulsive reactions to market fluctuations.

Despite these drawbacks, many traders successfully navigate the market by combining price action trading with risk management strategies and other technical analysis tools.

How to Implement Price Action Trading?

Implementing price action trading involves a structured approach:

Education and Skill Development

Traders should learn the principles of trading price action. Numerous online resources, courses, and local workshops cater to traders at various skill levels.

Understanding Market Context

Traders must consider the broader economic and geopolitical context affecting the market. Awareness of local and global events enhances the ability to interpret price action accurately.

Charting Platforms

Utilise charting platforms that provide clear and customisable visuals. Traders often use popular platforms compatible with various devices for convenient and efficient chart analysis.

Identifying Key Price Levels

Determine significant support and resistance levels on the charts. These levels can act as potential entry or exit points and aid in setting stop-loss orders.

Pattern Recognition

Master the identification of key candlestick formations. Traders often focus on common formations like Doji, Hammer, Engulfing Patterns etc.

Risk Management

Develop a robust risk management strategy. Determine position sizes based on risk tolerance and set stop-loss orders to protect capital.

Adaptability

Price action trading requires adaptability. Traders should be ready to adjust price action strategies based on changing market conditions and emerging patterns.

Bottom Line and Key Takeaways

Price action trading is a powerful strategy that resonates well with the diverse and dynamic financial markets of South Africa. Traders who master the art of interpreting price movements gain a valuable edge in navigating the intricacies of the local and international markets.

Lloyd has been trading, investing and teaching about financial markets for over a decade. He has a thorough understanding of financial services provider legislation as well as investment asset classes and categories. Lloyd is a certified RE5 representative and holds a COB Investment certificate from the Moonstone Business School of Excellence.

Yes, price action trading is accessible to beginners due to its simplicity.

Absolutely, price action trading principles can be applied to stocks, commodities, and other financial instruments.

Numerous online courses and educational platforms offer comprehensive guides to mastering price action trading, catering to both novice and experienced traders.

Read also

BCS Markets SA (Pty) Ltd. is an authorized Financial Service Provider and is regulated by the South African Financial Sector Conduct Authority (FSP No.51404). BCS Markets SA Proprietary Limited trading as BROKSTOCK.

The materials on this website (the “Site”) are intended for informational purposes only. Use of and access to the Site and the information, materials, services, and other content available on or through the Site (“Content”) are subject to the laws of South Africa.

Risk notice Margin trading in financial instruments carries a high level of risk, and may not be suitable for all users. It is essential to understand that investing in financial instruments requires extensive knowledge and significant experience in the investment field, as well as an understanding of the nature and complexity of financial instruments, and the ability to determine the volume of investment and assess the associated risks. BCS Markets SA (Pty) Ltd pays attention to the fact that quotes, charts and conversion rates, prices, analytic indicators and other data presented on this website may not correspond to quotes on trading platforms and are not necessarily real-time nor accurate. The delay of the data in relation to real-time is equal to 15 minutes but is not limited. This indicates that prices may differ from actual prices in the relevant market, and are not suitable for trading purposes. Before deciding to trade the products offered by BCS Markets SA (Pty) Ltd., a user should carefully consider his objectives, financial position, needs and level of experience. The Content is for informational purposes only and it should not construe any such information or other material as legal, tax, investment, financial, or other advice. BCS Markets SA (Pty) Ltd will not accept any liability for loss or damage as a result of reliance on the information contained within this Site including data, quotes, conversion rates, etc.

Third party content BCS Markets SA (Pty) Ltd. may provide materials produced by third parties or links to other websites. Such materials and websites are provided by third parties and are not under BCS Markets SA (Pty) Ltd.'s direct control. In exchange for using the Site, the user agrees not to hold BCS Markets SA (Pty) Ltd., its affiliates or any third party service provider liable for any possible claim for damages arising from any decision user makes based on information or other Content made available to the user through the Site.

Limitation of liability The user’s exclusive remedy for dissatisfaction with the Site and Content is to discontinue using the Site and Content. BCS Markets SA (Pty) Ltd. is not liable for any direct, indirect, incidental, consequential, special or punitive damages. Working with BCS Markets SA you are trading share CFDs. When trading CFDs on shares you do not own the underlying asset. Share CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail traders accounts lose money when trading CFDs with their provider. All rights reserved. Any use of Site materials without permission is prohibited.